India: Financial Inclusion and Seamless Payments through Development of Financial Infrastructure

|

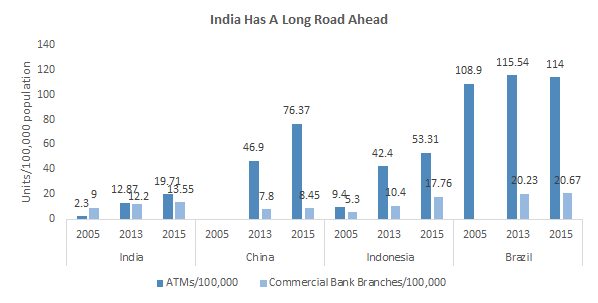

“We have the internet of everything but not the inclusion of everyone”Ajaypal Singh Banga, CEO MasterCard Compulsion for Financial Inclusion in IndiaIn India, the Gini coefficient in rural areas rose to 0.28 in 2011-12 from 0.26 in 2004-05 and rose during the same period to an all-time high of 0.37 from 0.35 in urban areas. Thus putting India at the bottom of the table in Asia, just above Papua New Guinea and China. The household debt-GDP ratio of 8.9% is among the lowest in the region contrasted to China (36.8%) and Thailand (83%). The absence of inclusion is especially revealing in rural areas, home to 60% of the population, where average deposits per head in 2013-14 were only INR 9,244 (USD 138) and credit about INR 6,000 (USD 90). This highlights the social risk arising from growing inequality and brings to the fore the pressing need for financial inclusion, among other factors. Financial inclusion broadens the resource base of the financial system by developing a culture of savings among large segments of the rural population and plays its own role in the process of economic development. Financial inclusion also mitigates the exploitation of vulnerable sections by the usurious money lenders by facilitating easy access to formal credit. India remains one of the most cash-intensive economies in the world, with a cash-GDP ratio of about 12% in 2013 which is about 3.5x-5x that of other emerging economies such as Brazil (2.7%) and South Africa (3.3%). The repercussion of this is the leakage of money.  Source: IMF, Financial Access Survey 2016, compiled by Uzabase

This is best described by the 2010 example of an exercise undertaken by the Indonesian government to use WorldBank funds to build infrastructure in villages. Even before the project had begun, leaders and bureaucrats from the centre to the community level had skimmed more than 47% of the funds allocated. In terms of inclusion, the country still lags behind most other emerging economies and thus it is imperative that the new schemes be rolled out soon and their results monitored diligently. Spurring financial inclusion in India would require an overhaul of the financial architecture. Bank account creation is an integral part of this agenda and the Pradhan Mantri Jan Dhan Yojana (PMJDY) ensures that banks are more directly involved. But their efforts need to be supplemented with solid infrastructure in the form of payment networks which warrants the entry of specialist payment banks. There are a number of models, regulations and committee findings highlighting the plight of inclusion in India and the ways to alleviate the issue. But in this report, we will highlight the components of the J-A-M trinity and the role that each scheme will play in linking the last-mile of financial inclusion. We will also highlight the growing importance of payment banks in bridging the gap. |

J-A-M holds the key to a Financial RevolutionThe ultimate purpose of the JAM trinity is to deliver direct benefits to India’s poor. The JAM trinity, which comprises Jan Dhan, Aadhaar and mobile technology is believed to hold the key to a financial services revolution in India. The introduction of each component will have a multiplier effect across different sectors and will be the backbone for the NDA (National Democratic Alliance) government’s financial inclusion initiatives. Until now, successive governments have operated a multitude of subsidy schemes to ensure a minimum standard of living. But such schemes are heavy on the exchequer’s pocket as they are riddled with corruption and inefficiencies. The JAM trinity, as a whole, is one of the key reforms introduced to ensure the success of the Direct Benefit Transfer (DBT) scheme which was introduced in 2013 by the UPA (United Progressive Alliance). |

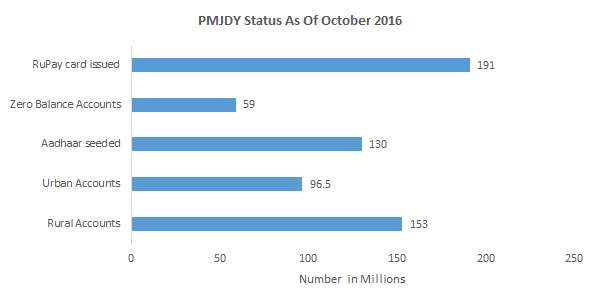

Breaking Down The TrinityPrime Minister Jan Dhan Yojana (PMJDY) This scheme aims to extend banking services to the unbanked population of the country by providing universal and clear access to banking facilities with basic banking accounts that have an overdraft facility of INR 5,000 after six months, RuPay debit card inclusive of accident insurance cover up to INR 100,000 and RuPay Kisan card. The scheme functions in two ways: - Opening a bank account and linking it to RuPay card and pension and insurance schemes to cover all forms of payments and receipts of the under-privileged. - Automation of subsidies and other government payments to plug the leaks that lead to millions of rupees being squandered.  Source: http://pmjdy.gov.in/statewise-statistics

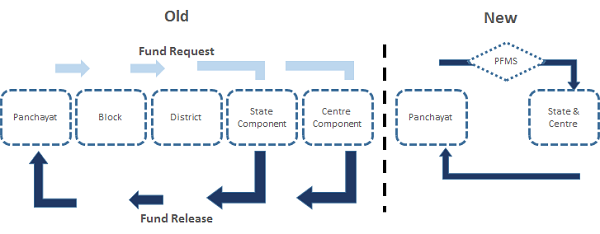

The number of accounts opened as of 5th October, 2016 was 249 million, 61.4% (153 million) of which were in rural areas. The total deposits from this scheme stood at INR 442.2 billion. As of 24th February 2016, 7 out of every 10 accounts opened under the scheme remained active. This parameter was seen as a success of the scheme. Another important feature of this scheme is the way it has made payments real-time. Using the example of MGNREGS Mahatma Gandhi National Rural Employment Guarantee) we can show you how funds can now be transferred when the cost is incurred instead of the old method of estimating the cost and transferring funds even before the cost has occurred. New System Ensures Minimum Steps to Transfer Funds for Government Schemes

Source: Economic Survey 2015-16, compiled by Uzabase |

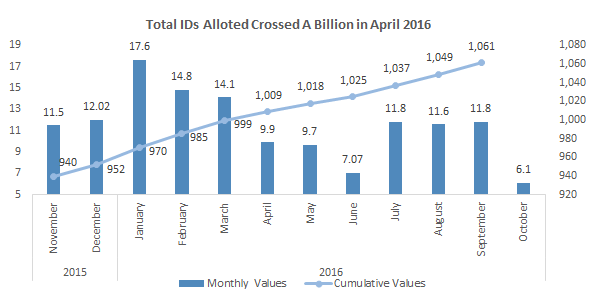

Aadhaar – Unique Identification Authority of India (UIDAI)Aadhaar refers to the bio-metric identification which is linked to individual bank accounts to aide the unique identification of beneficiaries and address the issue of information and monetary leakage. Aadhaar has already been used to deliver the LPG (Liquefied Petroleum Gas) subsidy benefits to millions, helping the government save more than INR 150 billion in FY2014-15 by weeding out black markets because the subsidy on LPG cylinders will be credited directly to consumers’ Aadhaar linked bank accounts. In the next phase the government plans to use Aadhaar for distributing DBT for kerosene and fertilizers.  Source: https://portal.uidai.gov.in/uidwebportal/dashboard.do

According to Nandan Nilekani, former Chairman of UIDAI, in February 2016 there were more than 250 million Aadhaar based payment accounts making 1.2 billion transactions a year. |

|

Mobile The last and most critical component of the trinity is mobile, or the medium of delivery of services. With a tele-density of 81.4% and over 933 million mobile subscribers, mobile money is seen as the best mode to deliver DBT benefits to the rural population. The digital infrastructure has been covered in detail in our second series. |

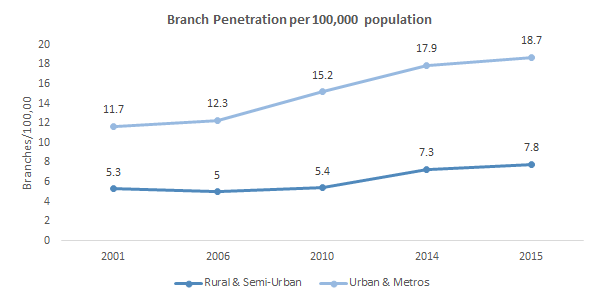

Critical Dimensions to Measure InclusionCRISIL, an S&P company, undertook the task of creating a tool that would help measure the tangible aspects of financial inclusion. The CRISIL Inclusix is a relative index and a robust analytical tool that measures financial inclusion based on the below dimensions: – Branch Penetration This parameter measures the number of bank branches per hundred thousand people. As of 2015, this number stood at 9.7 branches, a YoY increase of 5.43%. It was adequate for the Reserve Bank of India (RBI) to state that the banking penetration among rural and semi-urban areas had increased significantly since the introduction of the PMJDY scheme. The slew of measures introduced by the RBI as well as the government ensured the deregulation of the opening of ATMs and branches while ensuring sufficient coverage was provided to unbanked areas. This accelerated the pace of branch opening in both rural and urban areas. Despite this surge, the number of branches per 100,000 in rural areas remains less than half of that in urban areas.  Source: RBI, compiled by Uzabase

– Credit Penetration This dimension measures the number of loan accounts, small borrower loan accounts and agriculture advances per one hundred thousand people. During 2006-2015, the number of credit accounts reported by commercial banks increased at a CAGR of 6%. The rate of growth was higher for rural and semi-urban areas. Individual and small accounts dominate the banks’ credit portfolio in terms of numbers, making it compliant with the Aadhaar linkage to manage credit risk and avoid multiple lending. At the country level, individual accounts dominate the total number at 94%. Small size loans contributed to over 96% of the total number of loan accounts. Given the predominance of individual account holdings, the RBI has recommended the extended use of Aadhaar to mitigate overall indebtedness of individuals who are lured into multiple borrowings.  Source: rbi.org.in, compiled by Uzabase

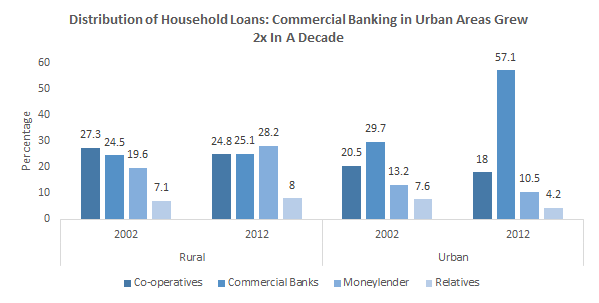

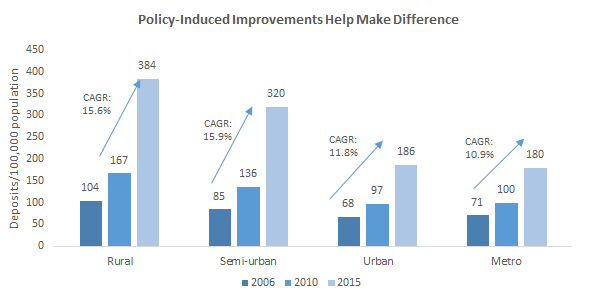

Though this data covers the period before the new schemes, it portrays how branch penetration has been able to lure customers to commercial banks in urban areas. It maybe unnerving to see that there has hardly been any noticeable change in rural areas. But considering branch penetration has increased 44.5% to 7.8 per 100,000 in 2015 from 2010 it is highly likely that the number has changed in favour of commercial banks in rural areas. – Deposit Penetration With the help of this measure, the usage of a formal credit system can be analysed. Deposit penetration is measured as the number of saving deposit accounts per hundred thousand population. Concurrent with higher branch expansion in semi-urban and rural areas the CAGR for both, number of individual saving bank deposits as well as deposit amounts was highest for semi-urban regions followed by rural, urban and metros.  Source: RBI |

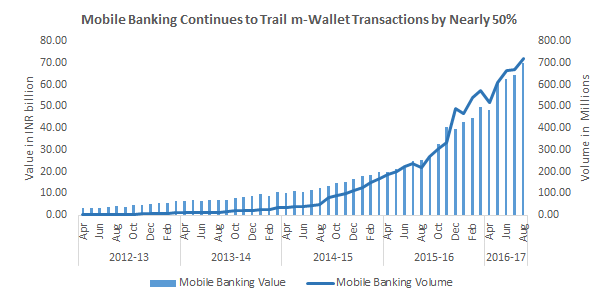

Mobile Technology Paves The Way For Financial Inclusion in India; Excerpts From The International ContextOnly 50% of Indians hold a savings account and just one in seven individuals have access to banking credit. It should also be noted that barely 0.3% of the adult population were using mobile money in 2014. But on the on other hand, 74% of households in the country possess a mobile phone and out of the total subscription base of 933 million, rural areas account for 40.5%. We have discussed in detail in Series II the spread of smartphones in India that allows for internet enabled transactions and communication. Mobile banking technologies can also be used for government-to-person (G2P) payments. Digitising G2P can improve efficiency and transparenfcy. Through the regular flow of money, previously unbanked beneficiaries can now be brought into the financial services domain. In South Africa, over 80% of beneficiaries receive government transfers into an account and in Brazil that figure is as high as 88%. In India, G2P payments comprised less than 10% of the total transfers in the country. Even India’s neighbour, Pakistan, launched an online G2P program (Benazir Income Support Program) in 2008 that accounted for 85% of overall G2P payments. The scheme experimented with several instruments such as smart cards, magnetic strip debit cards and mobile wallets. Though m-wallets are limited functionality bank accounts, they alleviate the need for a debit card as all transactions are carried out virtually. Kenya launched the M-Pesa in 2007 to enable microfinance re-payments using mobile phones. This service caught on for its safety and convenience and as of 2013 the volume of mobile transactions amounted to 25% of Kenya’s GDP, with nearly 70% of the adult population using it. Though India has covered substantial ground by following a bank-led model for financial inclusion, the enormous population and demographic and geographical diversity leaves more to be done. Banks have been leveraging on the improving tele-density in the country to offer basic banking services and entrepreneurs have been dishing out mobile based prepaid instruments to ease accessibility. It is now up to the government to decide on the channels through which mobile technology can further economic growth. Another advantage that mobile technology holds is the savings to the exchequer. In 2012, 87% of all transactions were in cash and barely 0.3% of adults were using mobile money. The infatuation for physical money comes at a cost. The median lifespan of a currency note is 3.6 years. In 2014-15 the Reserve Bank of India spent INR 38.6 billion to print 23 billion pieces of notes, costing INR 1.7 per note. It is also estimated that each transaction from an ATM costs INR18-20. From this standpoint there is a need to generate greater awareness and spur the use of electronic money across the whole society. According to the RBI, out of the mobile banking transactions worth INR 270 billion in September 2015, the share of public sector banks was 14% while private banks (84%) and co-operatives accounted for the remainder. The market is quite concentrated with the top three banks accounting for three-fourths of the total value of mobile banking transactions and the share of the top 5 at more than 90%. This suggests that there is significant room for market players to grow, both in terms of public sector banks to seize a sizeable share of the market and for individual entities to expand their business. Some of the most common channels for mobile banking are as follows: Short message service (SMS): Though there is no end to end data security it is available on all handsets and is easy to execute. Interactive Voice Response System (IVRS): This system is highly interactive and easily available in different languages. Again, this is available on most handsets as well. But like SMS, IVRS also faces the issue of security and it is often a time consuming process. Unstructured Supplementary Service Data (USSD): Using this system the user only has to provide basic account information to facilitate the transaction. But since the medium of instruction is text based it involves multiple steps to complete. General Packet Radio Service (GPRS): Once internet connectivity issues are resolved in rural areas this system with its end to end security will provide transactions that use images and voice rather than texts like the other services. |

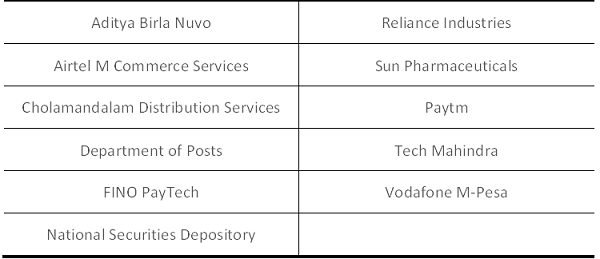

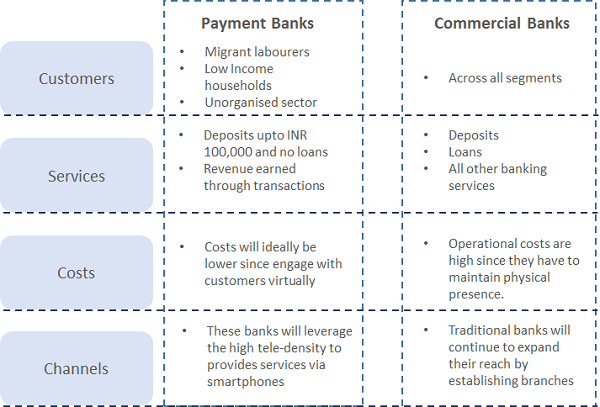

Payment Banks to Accelerate India Into A Cashless SocietyPayment banks are a new model of banks conceptualised by the Reserve Bank of India. These banks can accept deposits up to the sum of INR 100,000 per customer but are restricted from issuing loans and credit cards. They are mainly expected to reach customers through non-traditional mediums such as mobile phones. Payment banks are expected to redefine India’s banking landscape. The RBI expects payment banks to target India’s migrant labourers, low income households and small businesses by offering savings accounts and low cost remittance services. This is seen as a first step towards formal banking and to drive India’s journey into a cashless economy. Since payment banks were first introduced in August 2015, financial penetration has increased along with non-cash payments. Not only was excessive cash reliance making households vulnerable to theft but it was also eroding their cash value because of high inflation. Leading to inflation which was eroding their cash value. The RBI licensed 11 new speciality Payment Banks in 2015, which included five telecommunication ventures, a mobile payments specialist, three conglomerates, the National Security Depository and the India Post. List of 11 Entities With an “in-principle” Approval to Launch Payment Banks in 2015

Source: www.thehindu.com

Difference in Value Proposition Between Payment and Commercial Banks

Source: compiled by Uzabase

Payment banks heed the general saying that the unbanked need to be covered by any channel that provides financial services with accessibility and ease of use. In India, however even the number of customers with bank accounts that are mobile seeded are quite low. The PMJDY scheme should aim to introduce mobile banking applications along with the opening of accounts and incentivise financial literacy among the masses. An example of a simple application is the *99# NUUP (National Unified USSD Platform) channel that offers non-network, non-device-specific, mobile phone-based banking alternative for customers. This feature comes with the potential to reduce dependence on cash as well as physical bank branches.  Source: dbie.rbi.org.in, compiled by Uzabase

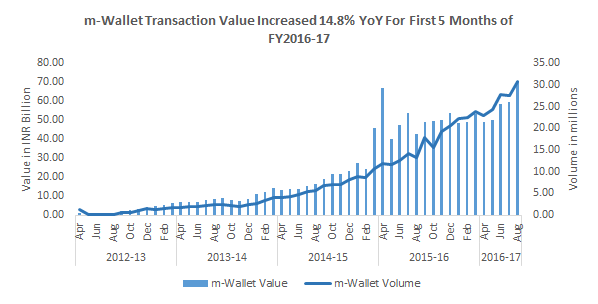

Source: dbie.rbi.org.in, compiled by Uzabase

The above charts portray the popularity of m-Wallets arising from their simplicity of use. The turnaround time for processing a payment request is about 10 seconds compared to 100-180 seconds on other payment gateways. Payment banks are expected to offer hassle free real time retail payments. According to a Morgan Stanley report, India’s e-commerce market is set to expand from USD 3 billion in 2013 to USD 100 billion by 2020. Of the 462 million internet users as of Jan 2016, over 113 million were first time users. Banks and mobile service providers have been handed this market on a silver platter to allow them to leverage their expertise and expand opportunities. Mobile payments are expected to grow from $86 million in 2011 to $1.15 billion in 2016 at a CAGR of 68%. Currently Paytm is the largest player in the market with more than 100 million users, which is double the penetration of Visa and Maestro combined. The growing popularity of m-Wallets has called for additional regulations which has allowed the government to increase the monthly cap on transactions from INR 10,000 without know your customer (KYC) to INR 100,000 with KYC verification. This change in the cap will allow users to slowly shift from smaller ticket items such as bill payments and prepaid mobile phone recharge to larger amounts for e-commerce purchase, hotels and flight bookings. With the success of the payment banks and integration of digital payment infrastructure, India’s m-Wallet companies will provide more opportunities for financial inclusion. Most importantly, the electronic nature of transactions ensures safety and confidence of benefits reaching the needy. |