November 2023:

The “Belt and Road” Initiative - A 10-Year Review and Outlook

The Hot Topic of This Month:

The "Belt and Road" Initiative Celebrates Its 10th Anniversary

The Third International Cooperation Summit on the “Belt and Road” was held in Beijing from October 17th to 18th. Representatives from more than 130 countries and over 30 international organizations were confirmed to attend. This summit is an important event to commemorate the 10th anniversary of the “Belt and Road” Initiative. The “Belt and Road” Initiative, commonly abbreviated as BRI (Belt and Road Initiative) or OBOR (One Belt One Road), is a cooperative initiative aimed at building the New Silk Road Economic Belt and the 21st Century Maritime Silk Road.

From 2013 to the first half of this year, China's cumulative investment and construction projects along the “Belt and Road” Initiative reached nearly $1 trillion (965.95 billion). What achievements has China made and what difficulties has it faced during the past decade of the “Belt and Road” Initiative, from initially focusing on foreign construction projects to now leading investments in new energy industries, and from having annual investment exceeding $100 billion to slowing down after the impact of the pandemic?

How will China plan for the next decade?

This report will answer these questions.

Chart 1.1 Main Achievements of the "Belt and Road" Initiative

Source: The official website of the Third International Cooperation Summit on the "Belt and Road" Initiative, China's the "Belt and Road" Initiative Network, AEI, "Building a Community with a Shared Future for Mankind: Major Practices in the Construction of the "Belt and Road" Initiative " white paper, etc.

Speeda Analysis

(1) Over the past decade, what directions has China focused on investing through the "Belt and Road" Initiative?

Key Findings:

1.Energy, transportation, and metals are the three major areas of investment for China's the "Belt and Road" Initiative. The energy sector focuses on the oil and gas industry, locking in overseas oil and gas resources for China.

2.In recent years, the proportion of projects in the transportation and metals sectors has significantly increased. The former is an important direction for China's export of production capacity, while the latter has been driven by the rapid development of China's new energy industry, with more and more companies accelerating their overseas investment in lithium ore and other new energy-related resources.

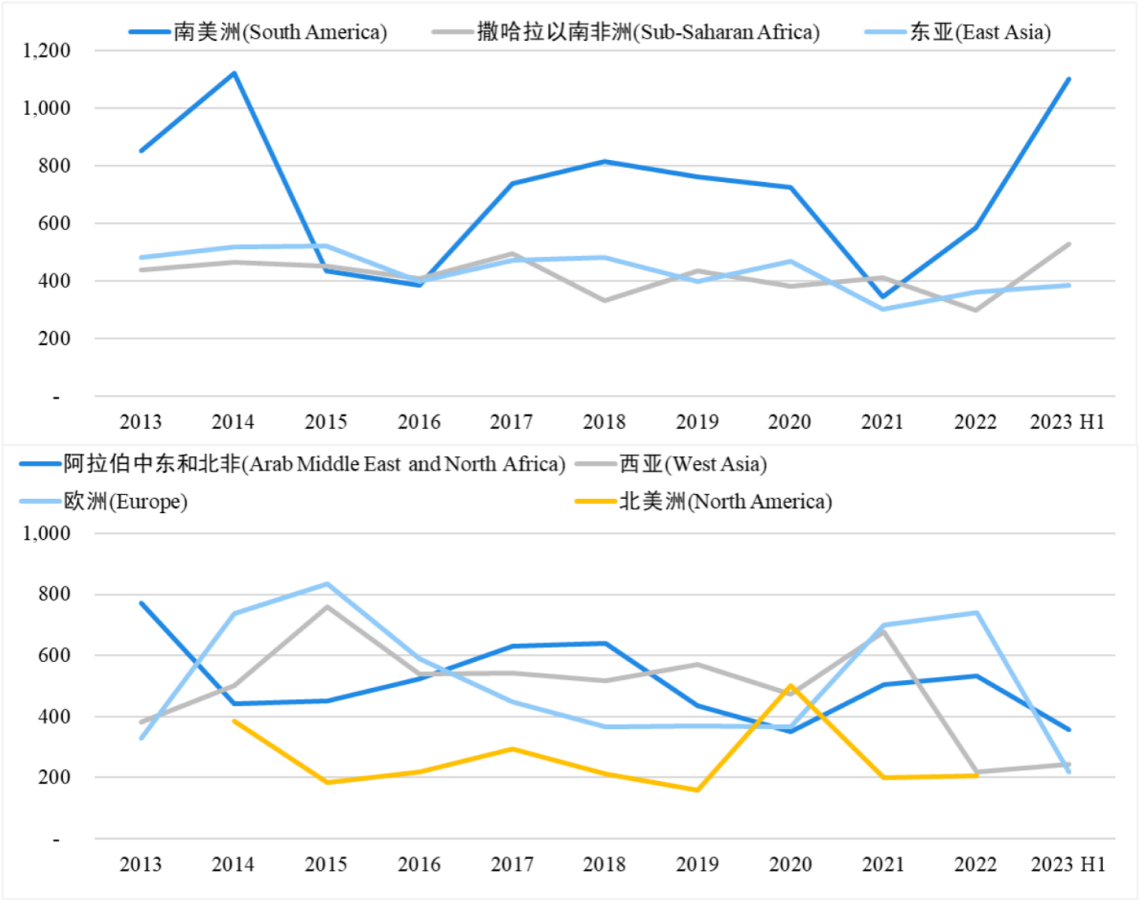

3.East Asia is the major destination for China's investment and construction of the "Belt and Road" Initiative projects, followed by Sub-Saharan Africa and West Asia, while Europe and America have relatively fewer projects. Investment in South America has significantly increased in the first half of 2023.

Detailed Analysis:

China implements the "Belt and Road" Initiative project overseas through two approaches: investment and construction. Investment refers that Chinese domestic enterprises obtain the ownership, control, management rights, or other interests in overseas enterprises through new establishment, mergers and acquisitions, or other means. Construction usually refers to Chinese enterprises contracting overseas construction projects. The participation amount mentioned in the following report refers to the sum of investment project scale and construction project scale. The project scale data used in the following analysis are mainly sourced from the China Global Investment Tracker database from the US think tank AEI.

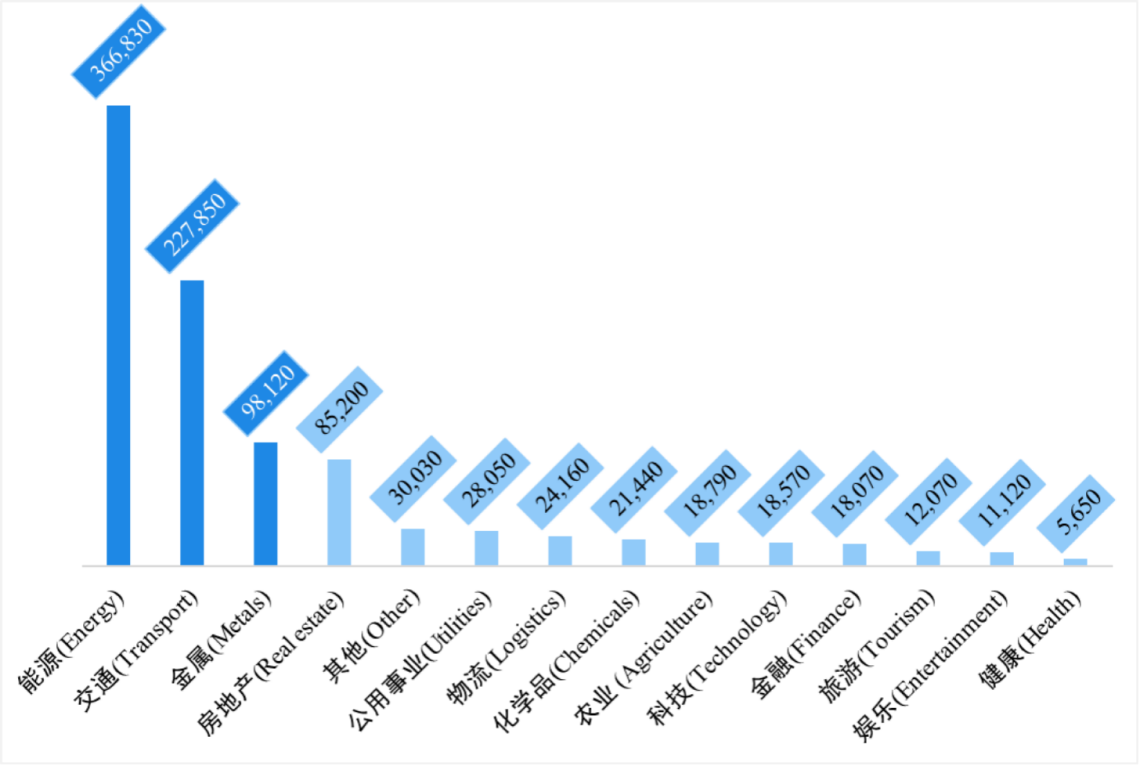

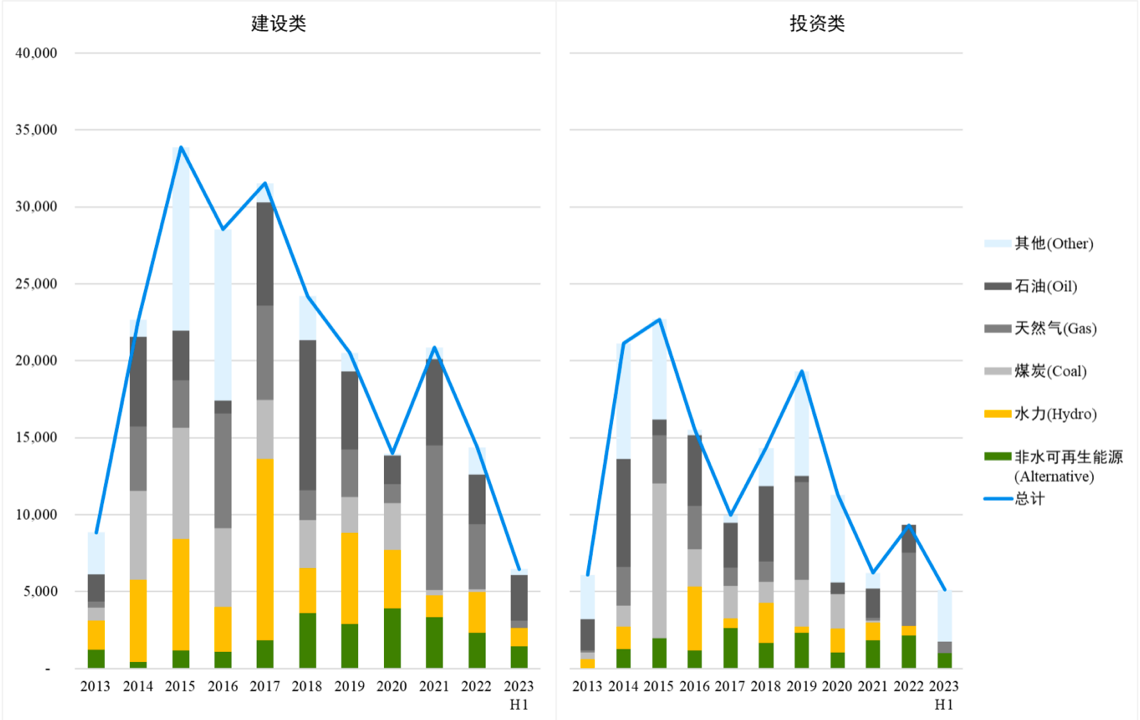

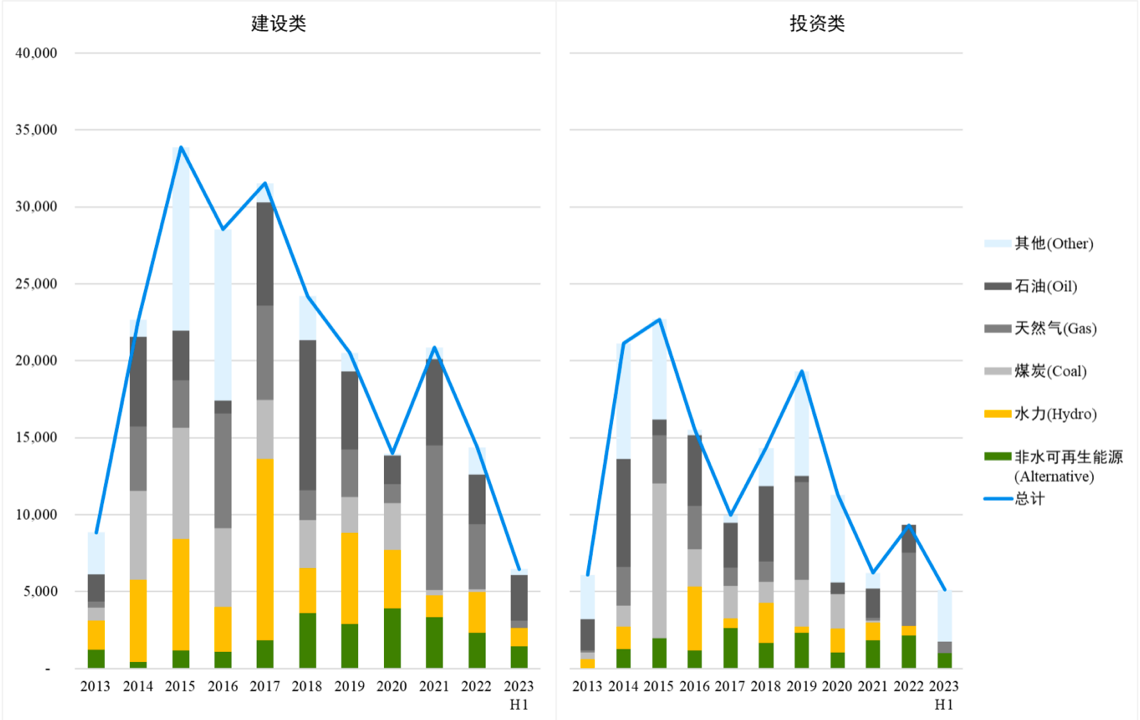

Chart 2.1: Total Participation Amount of China's "Belt and Road" Projects by Sector (in millions of US dollars) from 2013 to the first half of 2023

Source: Data compiled by Uzabase based on AEI

As shown in Chart 2.1 (China's cumulative participation amount from 2013 to the first half of 2023), the energy industry, transportation industry, and metal industry are the three key investment areas, among which energy projects leads by a large margin. The cumulative scale of investment and construction projects in the energy sector in the past decade is approximately $366.8 billion. In the energy sector, oil and gas projects dominate, accounting for nearly 40% of the total scale. Due to China's resource characteristic, which is "more coal, less oil, less gas", such investment and construction projects are mainly aimed at helping China secure external oil and gas resource supply. For example, in 2021, China National Petroleum Corporation (CNPC) invested $7 billion to build three new natural gas wells in Turkmenistan, by a payment made through Turkmenistan exporting natural gas to China.

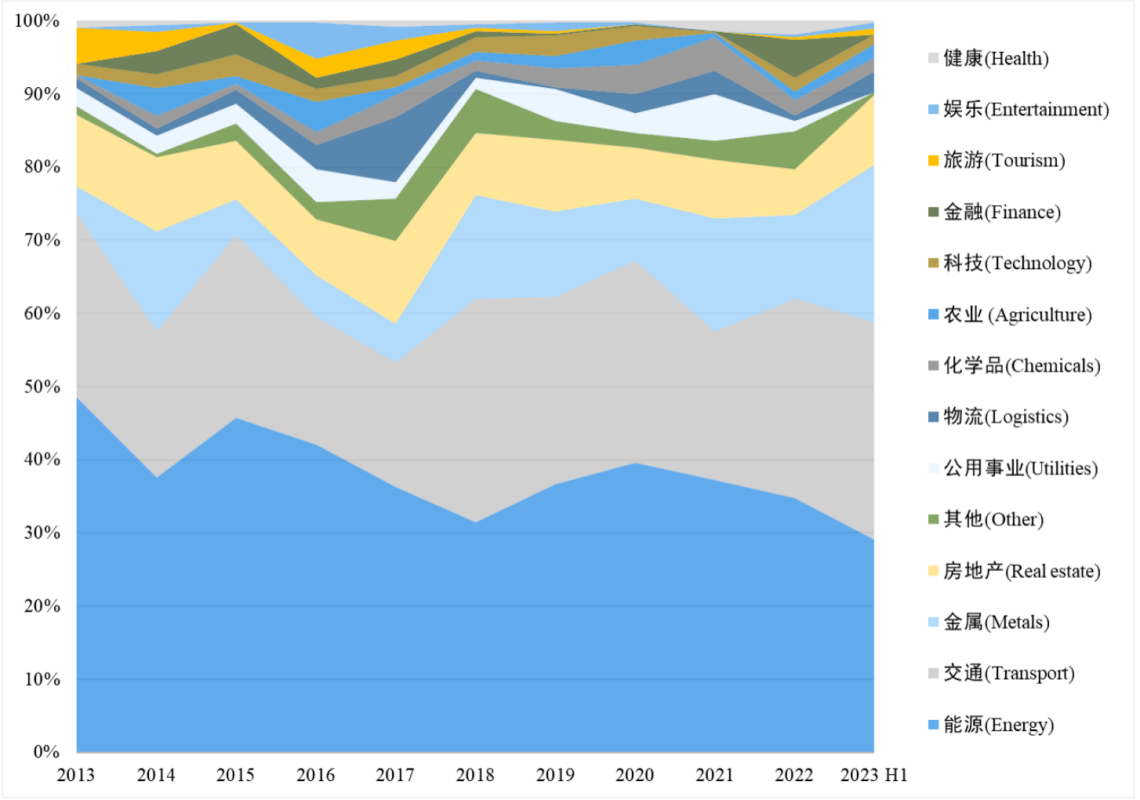

As shown in Chart 2.2 (the participation amount ratio of various fields over the years), although energy projects have the largest scale, the proportion of energy projects has decreased, falling from a peak of 49% in 2013 to 29% in the first half of 2023, while the proportion of transportation and metal projects has increased. Especially, the proportion of transportation projects reached 30% in the first half of 2023, which exceeded that of energy projects.

Chart 2.2: Proportion of China's "Belt and Road" Project Participation Amount by Sector

Source: Data compiled by Uzabase based on AEI

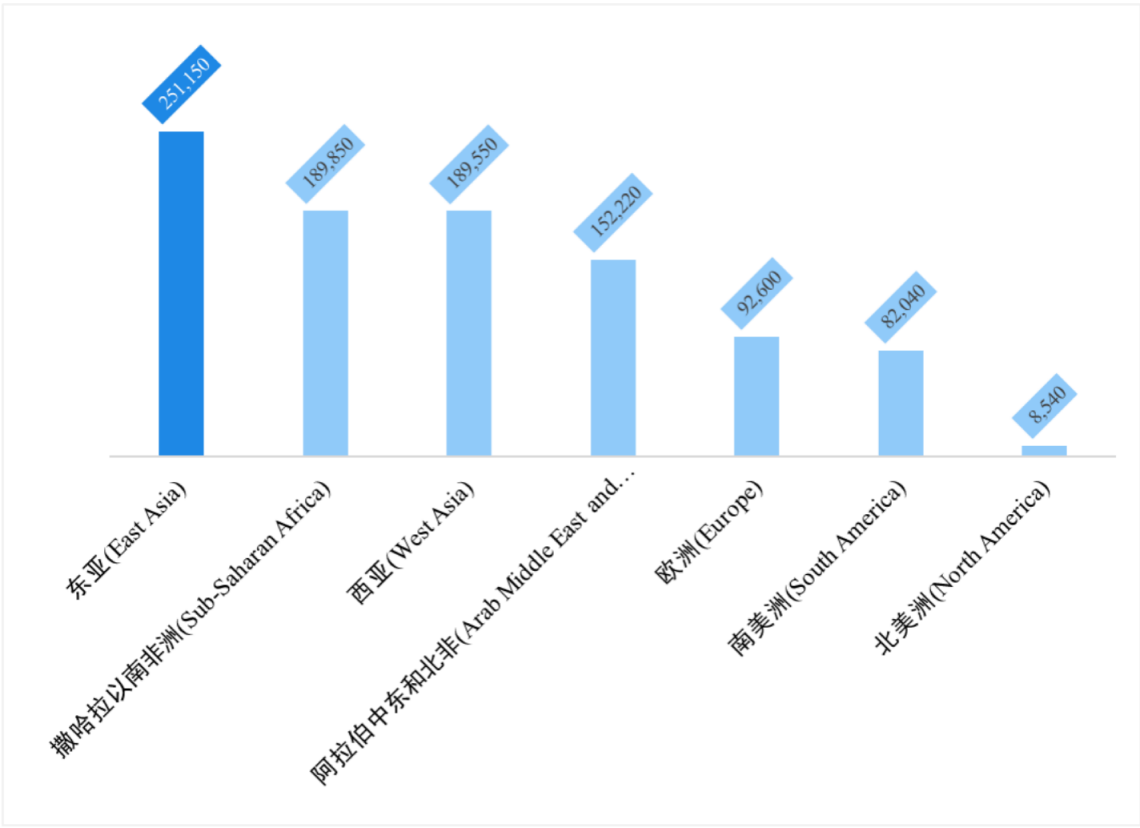

Chart 2.3: Total Participation Amount of China's "Belt and Road" Projects by Sector (in millions of US dollars) from 2013 to the first half of 2023

Source: Data compiled by Uzabase based on AEI

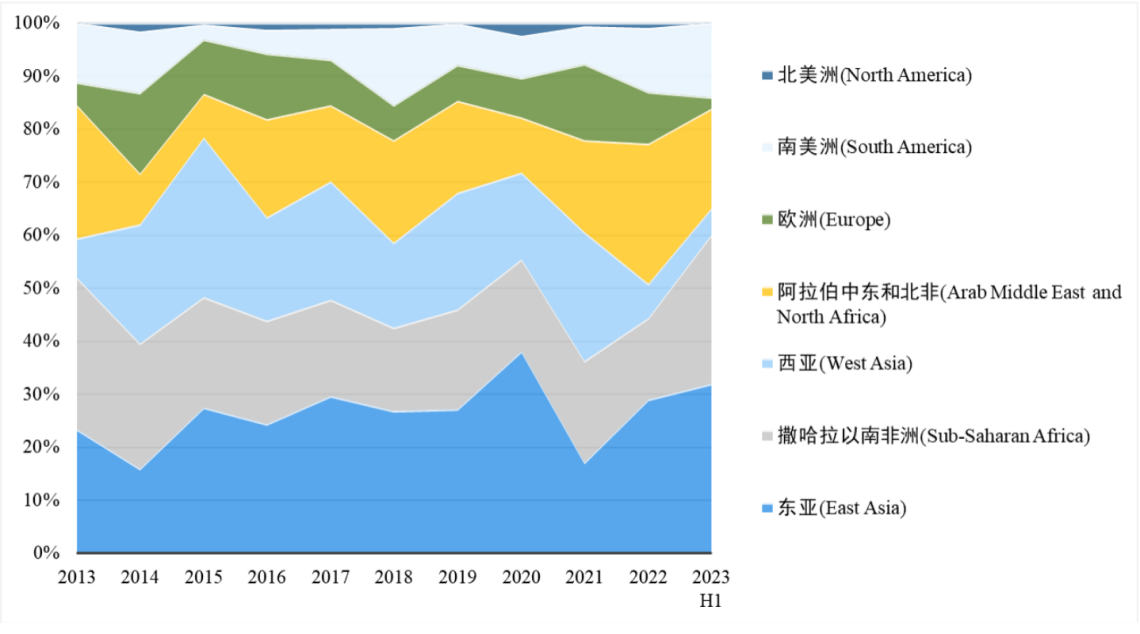

Chart 2.4: Proportion of China's "Belt and Road" Project Participation Amount by Sector

Source: Data compiled by Uzabase based on AEI

The transportation sector includes automobiles, aviation, railways, and shipping as subdivisions, with automobiles and railways holding an absolute share. The main function of these projects is to export China's excellent production capacity in these two industries abroad. The growth in metal project scale is closely related to China's green transformation of its industrial structure. With the vigorous development of new energy vehicles, the demand for lithium batteries sustained at a high level.

Therefore, China has increased its investment in overseas lithium mines. For example, in February 2023, Hainan Mining announced an investment of $118 million to acquire Bougouni lithium mine assets in Mali, an African country.

According to Chart 2.3 (investment regions), East Asia recorded the highest cumulative amount in the participation of China's the "Belt and Road" Initiative projects, which was over $250 billion invested and constructed from 2013 to the first half of 2023. Sub-Saharan Africa and West Asia followed closely, while investments in Europe and the Americas were relatively small. However, when tracking the movement in the proportion of project amounts in each region (Chart 2.4), it suggests that the proportion in South America is on the upward trend, reaching 14% of the total "Belt and Road" Initiative project scale in the first half of 2023, up from 12% in 2022.

Furthermore, when considering the average participation amount per project (Chart 2.5), South America had the highest average amount in the first half of 2023. This was mainly driven by several large investment activities, such as Southern Power Grid's acquisition of two subsidiaries of Enel Perú in Peru for $2.9 billion in April. This not only helped Enel Perú alleviate its debt problems but also allowed Southern Power Grid to further expand its overseas business. In addition, in June, Contemporary Amperex Technology Co. Limited (CATL) led an enterprise consortium to invest in direct lithium mining in Bolivia. The first-phase investment exceeded $1 billion. It is reported that Bolivia's salt lakes have the world's largest reserves of lithium resources, while they have not yet been developed and produced commercially. Therefore, this investment by CATL helps China seize the lead in lithium mining in South America.

Chart 2.5: Average Participation Amount per Project of China's "Belt and Road" Projects by Sector (in millions of US dollars)

Source: Data compiled by Uzabase based on AEI

(2) How has the China’s role in the "Belt and Road" Initiative project changed?

Main Findings:

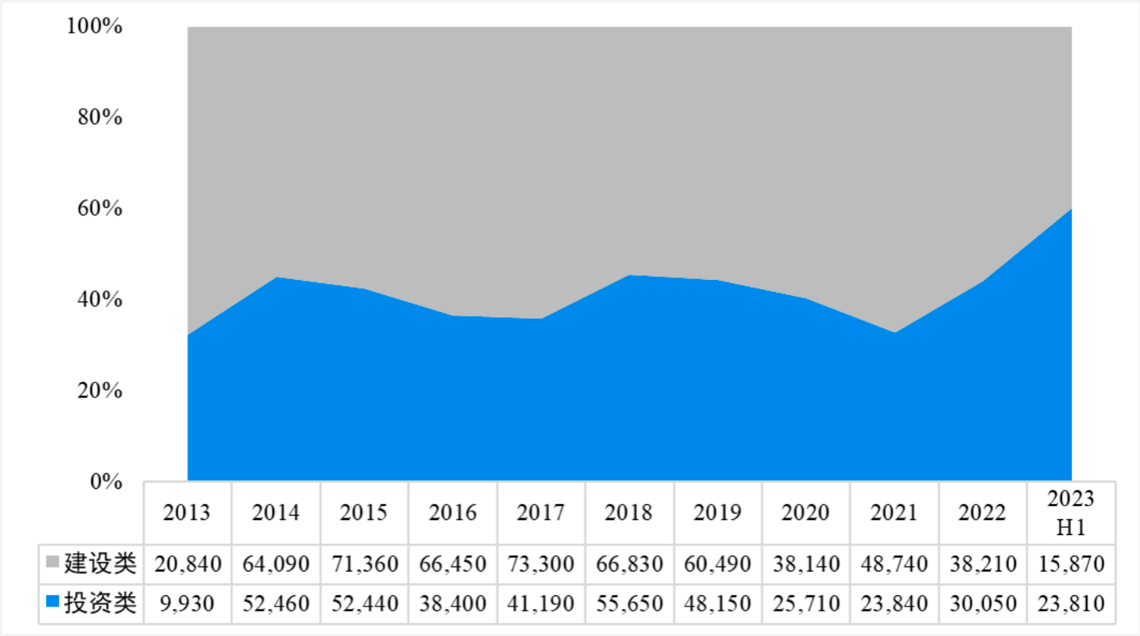

1.The investment-type projects account for a higher proportion of all the "Belt and Road" Initiative projects. The role of China as an investor becomes increasingly visible while the role as a constructor becomes less prominent.

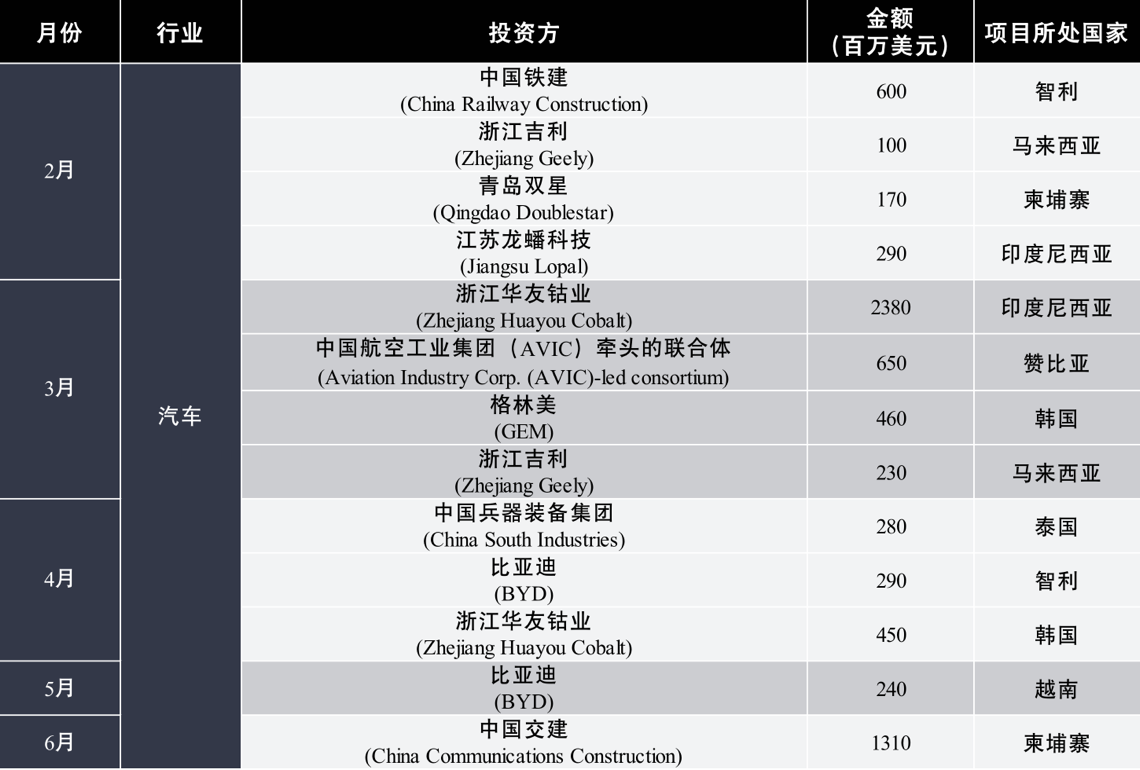

2.The investments in transportation and metal industries grow significantly. In the first half of 2023, the vast majority of investment projects were made in new energy-related industries, especially in obtaining upstream mineral resources.

Detailed Analysis:

In the early stage of the implementation of the "Belt and Road" Initiative, China's main role in foreign projects was constructor. In 2013, the construction-type project proportion was 32%, and it has stabled at around 40% for years. In the first half of 2023, this proportion suddenly reached 60%, which was a new high since the past decade, at a total investment volume of about $23.8 billion, equivalent to the total investment volume of 2020 and 2021. According to the data trend in Chart 2.7 from the three major "Belt and Road" Initiative areas, the investment-type projects in the metal and transportation industries have increased significantly. Specifically, the investment focused on new energy-related industries. Meanwhile, investment proportions in agriculture, health and other fields showed an upward trend.

In the transportation sector, investment in "Belt and Road" Initiative projects in the first half of 2023 focused on the automotive industry, especially new energy-related businesses. Taking the largest project recorded by AEI in the first half of the year as an example, Huayou Cobalt Industry invested $2.38 billion in acquiring 50.1% of Indonesia's Andalan Metal Industry (abbreviated to "AMI Company"). AMI Company has two nickel-iron production lines with a total annual output of 150,000 tons of nickel iron. Huayou Cobalt Industry plans to renovate its production line to ensure the resources for its lithium materials business.

Chart 2.6 China's "Belt and Road" Investment Projects and Construction Project Volume (Million US Dollars)

Source: Data compiled by Uzabase based on AEI

Chart 2.7 China's "Belt and Road" Investment Projects by Sector

Source: Data compiled by Uzabase based on AEI

Chart 2.8 Investment Projects in China's "Belt and Road" Transportation Sector in the First Half of 2023

Source: Data compiled by Uzabase based on AEI

Chart 2.9 Investment Projects in China's "Belt and Road" Metal Sector in the First Half of 2023

Source: Data compiled by Uzabase based on AEI

Investment projects in the metal field are also highly related to new energy industries. In the first half of 2023, besides the lithium mining assets invested by Hainan Mining in Mali mentioned above, Feishang Industrial Group Co., Ltd, CMOC Group Limited,CATL, GEM Co., Ltd invested in lithium, copper, cobalt, nickel and other new energy metals in Africa and East Asia.

In addition, traditional metal smelting enterprises are trying to explore new energy-related emerging business overseas. For example, Hailong Group, a world leader in processing copper tube bars, invested about $860 million in building a high-performance electrolytic copper foil project in Indonesia in June 2023. Electrolytic copper foil is one of the key materials in lithium batteries negative poles. With the rapid development of new energy vehicles and energy storage industries, global demand for electrolytic copper foil is expected to continue to grow, creating development prospects for Hailong Group's project in Indonesia.

In the energy sector, one of the three major areas of the "Belt and Road" Initiative, China has sustained focusing on fossil fuels, at a main purpose of obtaining import rights for oil and natural gas or building thermal power plants locally. Therefore, construction projects always account for a large proportion. Among China's investment or construction projects in the energy sector, the motivation for "greening" is relatively low. New energy projects (especially wind, solar and other non-water renewable resource projects) have not shown a significant upward trend.

Chart 2.10 Scale of Investment and Construction Projects in China's "Belt and Road" Energy Sector

Source: Data compiled by Uzabase based on AEI

(3) How can China enhance the financial sustainability of the “Belt and Road” Initiative project?

Main Findings:

1. Bank loans are the main source of funding for the “Belt and Road” Initiative projects, which are facing increasing default risks.

2. Bond financing functions positively in risk diversification. China is gradually improving the "the “Belt and Road”" bond issuance system, leading bonds to be expected to become an important channel for capital replenishment.

3. Foreseeably, green bonds will be given priority in issuance. Given the largest number of "Belt and Road" green projects being laid out in East Asia, investment opportunities deserves close attention to this region.

Detailed Analysis:

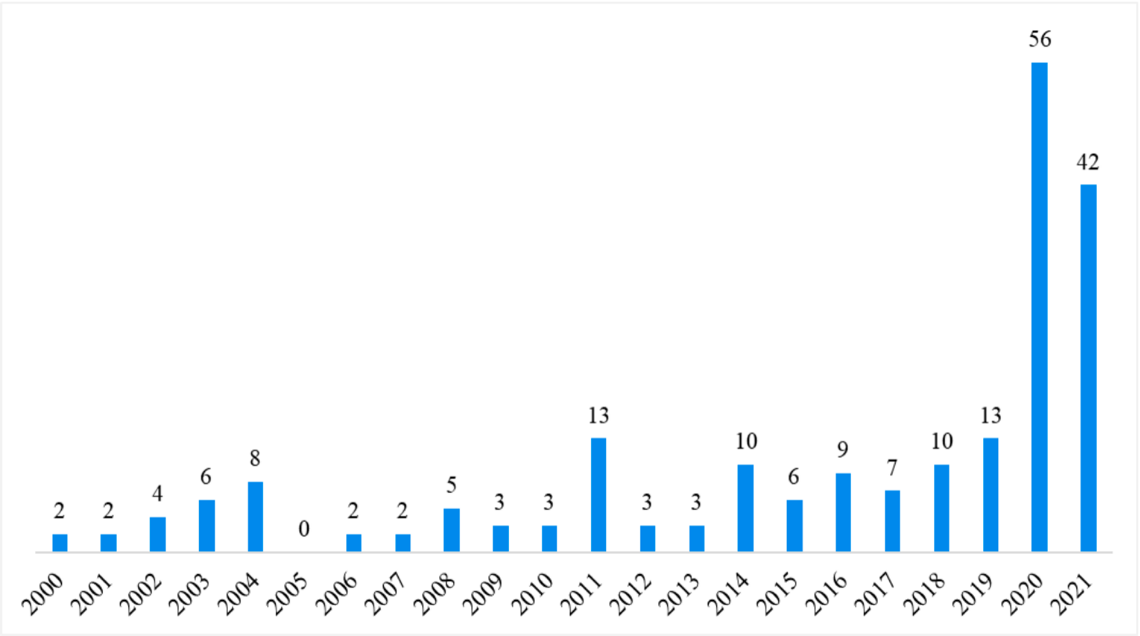

Chart 2.11 Number of China's Overseas Debt Restructuring (items)

Source: Data compiled by Uzabase based on AEI

On October 10, 2023, a report titled "Productive Finance: China's Overseas Loans and the Economic Growth of Developing Countries" was released at a conference held in Beijing. The event was jointly organized by the Institute of World Economy and Politics of the Chinese Academy of Social Sciences and the National Global Strategy Think Tank. The report, based on empirical research using data from the World Bank, suggests that receiving sovereign loans from China can increase the per capita GDP growth rate of debtor countries by 0.6 to 1%.

Chinese overseas loans are one of the four main sources of funding for the “Belt and Road” Initiative projects (the other three are bond financing, equity financing, and other financing such as financial leasing). There is currently no official agency that collects and publishes the amount and investment direction of Chinese overseas loans. In third-party databases, the information is relatively plentiful in the Global Chinese Development Finance Dataset (GCDF database) constructed by the AidData Research Center at the College of William & Mary in the United States. This database tracks and statistics the loans provided by the Chinese government and state-owned financial institutions to low-income and middle-income countries. Currently, the V3.0 version of the database covers more than 20,000 loan information for the period from 2000 to 2021.

According to the GCDF database, China has provided a total of $1.3 trillion in financing to developing countries over the past 22 years. At the end of 2014, the first full year of the implementation of the "the “Belt and Road”" Initiative, this overseas financing data was about 745 billion US dollars. In other words, about 43% of the overseas financing provided by China occurred in 2014-2021 when the “Belt and Road” Initiative was implemented.

Due to the financial and development challenges faced by low-income and middle-income developing countries, especially after the outbreak of the COVID-19 pandemic in 2020, which had a global economic impact, China is facing an increasingly severe problem of overseas debt defaults. According to the GCDF database, a total of 98 debts were rescheduled due to overdue defaults in 2020 and 2021, which was significantly higher than the average single-digit default numbers in the previous 20 years.

The GCDF database estimates that 44% of Chinese overseas loans will face their scheduled final repayment dates in 2023, while this proportion is expected to rise to 52% in 2025 and close to 100% in 2040. This means that the number of debt defaults may continue to increase in the future, triggering difficulties for China to continue to independently bear the funding for overseas investment.

Therefore, in recent years, China has begun to expand the source of funds for the “Belt and Road” Initiative project actively. The data analysis of GCDF shows that compared to bilateral loans formed between China and debtor countries, multilateral loans and syndicated loans (also known as syndicated loans) with multiple institutions participating face significantly lower debt default risks. When more institutions are introduced, stronger comprehensive risk management standards will be formed, which build a relatively effective system of default risk management. When facing debt defaults, each financial institution bears less loss, achieving the goal of risk diversification.

From this point of view, the “Belt and Road” Initiative bond is the most ideal financing channel besides direct bank loans. The “Belt and Road” Initiative bonds include two categories. The first category refers to government or corporate bonds issued by government institutions, financial institutions and enterprises of countries along the “Belt and Road” Initiative in Chinese trading institutions. If such bonds are denominated in RMB, they are called "Panda Bonds". The second category refers to the corporate bonds issued domestically or overseas by Chinese financial institutions and enterprises to raise funds for the “Belt and Road” Initiative project.

China has preliminarily established the bond related system of the “Belt and Road” Initiative. In December 2015, the China Securities Regulatory Commission officially launched the pilot program for panda bonds. In March 2018, Shanghai Stock Exchange and Shenzhen Stock Exchange issued the Notice on the Pilot of the “Belt and Road” Initiative Bond Business respectively. According to the white paper "Jointly Building the “Belt and Road”: A Major Practice of Building a Community with a Shared Future for Humanity" issued by the State Council in October 2023, as at June 2023, 99 Panda Bonds and 46 the “Belt and Road” Initiative Bonds have been issued, reaching a cumulative issuance scale of 152.54 billion yuan and 52.72 billion yuan respectively.

Chart 2.12 By region, the scale and proportion of green projects in China's the “Belt and Road” Initiative project participation quota

Source: Data compiled by Uzabase based on AEI

Summary and Outlook

As 2023 is the first year of post-pandemic, China's participation in the “Belt and Road” Initiative project has rebounded. In the first half of the year, a total of 39.68 billion US dollars was invested and constructed, which is equivalent to 58% of the total scale of 2022. As China's economy continues to recover, it is expected that the scale of the “Belt and Road” Initiative in the second half of the year and 2024 will further expand.

As analyzed above, China's role in the “Belt and Road” Initiative will continue to change. In the future, more and more Chinese enterprises will act as investors to expand their business in the “Belt and Road” Initiative countries. New energy industry and green transformation projects should be the first investment direction. In the first half of 2023, we have seen many Chinese enterprises actively invest in new energy related projects overseas.

In consideration of the sustainability of project funds, financing is one of the key areas of the “Belt and Road” Initiative development in the next decade. On November 24, China released the "Prospects for the Development of the “Belt and Road” Initiative in the Next Decade, proposing to continue to expand new investment and financing channels, to encourage multilateral financing and to support the issuance of the “Belt and Road” Initiative bonds. We suggest that investors can focus on the “Belt and Road” Initiative green bond market. The successful issuance of the “Belt and Road” Initiative green bonds by Bank of China and Industrial and Commercial Bank of China may indicate important opportunities for development in this market.

Uzabase China Limited

Garden Square Room 770,

No.968 West Beijing Road, Jing’an District,

Shanghai, China

TEL:(86)021-52004489

Email:info.china@uzabase.com