Malaysia’s GST Effect: Catalyst or Deterrent?

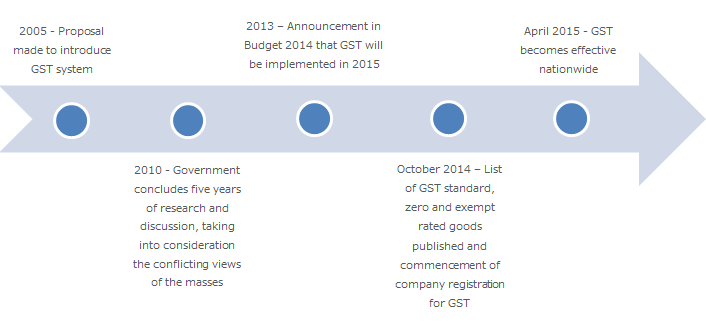

Revenue from GST More Short Term Benefit than Long Term StrategyMalaysia’s new Goods and Service Tax (GST) regime (replacing the SST system) is the government’s attempt to create an additional revenue stream (around MYR 30 billion estimated revenue in 2015 and MYR 39 billion in 2016) for the country, in order to reduce the fiscal deficit and debt levels. However, the drastic drop in oil revenue since early 2014 has resulted in a MYR 30 billion loss in revenue for 2015. The additional GST revenue, therefore, simply makes up for the loss in revenue and does not help reduce the fiscal deficit in the short term at least. To encourage the adoption of and compliance with the GST system, the government is providing a number of incentives in the form of financial assistance, grants, reduced corporate tax rates and tax allowances for the purchase of GST software, training of employees and SMEs. However, despite its advantages, GST also demands government time and money in processing claims and monitoring of the system. There are also concerns that this is just a short term strategy to maintain government revenue and therefore not a long-term benefit to the country. Property, Healthcare, Telecommunications and Tourism were Main Sectors Affected by GST The manufacturing sector has been the main beneficiary of GST, with manufacturers being able to claim GST for tax paid on inputs and therefore not having to increase the prices of goods offered to customers. However, within the property sector, developers are affected as they cannot charge GST on sales of residential properties despite having to pay GST at each stage of the construction phase. This has caused residential prices to rise and sales numbers to decline since 2Q 2015. From among the service sectors, healthcare has had the biggest impact as a result of the government exempting only public healthcare from GST. Further, only 25% of the medication on the National Drugs List had initially been exempt rated, excluding many drugs used for long-term illnesses. This increased the cost of private healthcare, drugs for lifelong illness such as diabetes, heart disease and cancer and medical insurance as well. The domestic tourism sector was also negatively impacted, as domestic flights were charged with GST. This put an undue burden on many residents in east Eastern states such as Sabah, for whom air transport is the only mode of transportation to Kuala Lumpur. Although tourists can re-claim GST charged on goods and services they spend on while in Malaysia, many are still unaware of the process to do this and therefore are choosing other travel destinations instead. In 4Q the government addressed these concerns by increasing the number of exempt drugs, providing rebates within the telecom sector and making local travel GST exempt. These initiatives provide citizens with the reassurance that the government is willing to accommodate their concerns and adjust policies accordingly to benefit the public as well. Price Increases and Failure to Comply with GST are Main Concerns for Government Since the implementation of GST in April 2015, the prices of nearly 70% of goods and services in the consumer price index basket have risen by as much as 30%. With household debt levels already at 88% (the highest in the ASEAN region), domestic consumption could fall as high value goods become more expensive. This could reduce the projected GST revenue numbers and even force smaller SMEs to close down as raw materials and costs increase. Further, reduced demand could decrease total revenue and profitability generated by SMEs, resulting in lower corporate and income tax paid to the government. This could negatively impact the government’s expected outcome from GST implementation. The main concern is the failure of companies to register and comply with GST. As of May 2015, only 75% of all businesses had registered for GST. Contractors and e-commerce merchants made up the largest proportion of companies failing to comply with GST requirements. The government has enforced fines on non-compliant companies and is also planning to provide awareness programs and training for businesses regarding GST to boost the number of registered companies to a least 400,000 by early 2016. Taking the above arguments into consideration, only time will tell whether the GST regime will have a positive or negative effect on Malaysia in the long-term. At present, it seems to be just a short term solution to the government’s deficit and loss of revenue in key industries. As the full impact of GST sets in only during 2016, it will be a critical year for the government to prove to citizens the benefits of the new regime in improving productivity and boosting the economy in the long run. GST Regime Vs Previous SST System Since the 1970s, Malaysia has had the Sales (5%-10%) and Service Tax (6%) systems in place on goods sold and services offered. However, over time, this system experienced a number of problems such as being non-transparent (where different rates were being applied to different goods and services), red tape and multiple taxation. In an attempt to overcome these issues, the GST system was announced in the Budget 2005 to be implemented in 2007. However, public resistance, conflicting opinions and concerns raised caused the government to delay the implementation of GST. From then until 2011, the government conducted in-depth studies on the implementation of GST, to identify the social and economic impact on the country and in particular, on the Rakyat. Finally, after continuous discussion and evaluation, the proposed implementation of GST was announced in the Budget 2014. However, since its implementation in April 2015, a number of concerns and drawbacks have arisen, thereby affecting the local economy. As is the case with new tax regimes, it is likely to take a year or two for the dust to settle. In the meantime, there have already been some effects of GST on the economy this year, with other short-term implications and benefits on the Malaysian economy. GST Timeline in Malaysia

Source: Uzabase research

Source: Uzabase Research

GST is implemented under three categories: Standard-Rated GST, Zero-Rated GST and Exempt-Rated GST. This eases the burden on lower income households as basic items (eg. rice, flour, sugar etc.) and essential goods and services (eg. education and healthcare) are either zero rated or exempt from GST.

Source: Uzabase research

Despite being slightly complex to understand at first and requiring a one-off investment to set up, the GST system overall is a more transparent, smooth and effective system than SST, which had higher taxation levels and different thresholds. Under the GST tax system, businesses with a minimum annual revenue of MYR 500,000 are legally required to register. For businesses with revenue below this threshold, registration is voluntary. Pros and Cons of GST System Although the main drawback of GST relates to the increase in the price of goods and services, there is a greater awareness regarding the system and its benefits among taxpayers and businesses alike. In the long run, the additional revenue should boost the Malaysian economy by enabling the government to spend this extra revenue to overcome the fiscal deficit and improve the productivity of the manufacturing and service industries.

Source: Uzabase Research

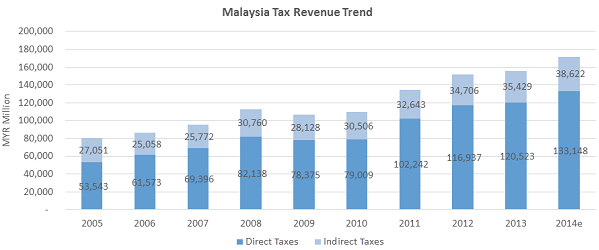

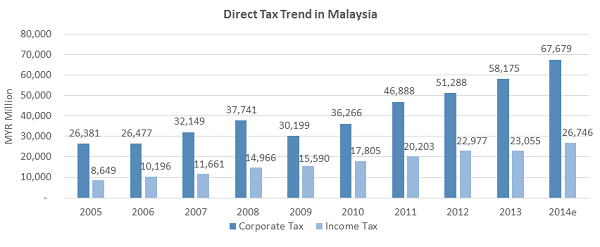

To help businesses and consumers ease into the GST system, the government is reducing some taxes and providing a number of incentives such as: 1) Reduction in corporate tax rate to 24% from 25% and decrease in income tax rates for small and medium enterprises to 19% from 20%. These will take effect in tax assessment year 2016. 2) Co-operative income tax rate to be reduced to 2% from 3% in the tax assessment year 2015. 3) From assessment year 2015, secretarial and tax filing fees will be tax deductible 4) Accelerated capital allowances on the cost of ICT equipment and software extended to assessment year 2016. 5) Expenditure on accounting and ICT training relating to GST will be given further tax deductions for assessment years 2014 and 2015. 6) Grants for training employees regarding GST have been provided for 2013 and 2014. 7) Financial assistance provided to Small and Medium Enterprises (SMEs) for the purchase of accounting software in 2014 and 2015. GST to Increase Total Tax Revenue Base and Even Out Income Distribution Since 2005, the government’s earnings from direct taxes has steadily increased. Direct taxes accounted for 78% of total tax revenue in 2014, up from 74% in 2009. During 2009-2014, total revenue from direct tax grew at a CAGR of 11.2%. Revenue contribution from indirect taxes (which included SST under the previous regime), on the other hand, declined to 22% of total government revenue in 2014, from 26% in 2009. However, total indirect tax revenue actually grew by a CAGR of 6.5% over the same period. From 2009-2014, total tax revenue grew at CAGR of 10.0%, reaching MYR 171.8 billion in 2014. With the introduction of GST, the government’s total tax base is expected to increase by 6.8% yoy to MYR 183.4 billion in 2015, with indirect taxes driving growth, thereby enhancing fiscal resilience. As commodity prices decline, the government has been trying to boost its income from indirect tax revenue since 2011. Revenue from the SST in 2011 totalled MYR 13.6 billion amounting to 7.3% of total revenue. However, GST revenue in 2015 is expected to exceed MYR 30 billion and for 2016, GST revenue is estimated to contribute almost MYR 39 billion, accounting for around 17.5% of total government revenue. Most developed nations that have already implemented GST, did so to shift the tax burden from high income earners to the middle class in order to balance tax distribution, but not with the aim of increasing total tax revenue. GST does this by increasing the proportion of indirect taxes to total tax revenue. The corresponding reductions in corporate and income tax rates also spread the tax burden more evenly among the population. The Malaysian government, however, intended to create an additional revenue stream with GST to help reduce the fiscal deficit and national debt. This raises the question of whether GST will actually help improve the economy or if it is a long term strategy to cover government spending.  Source: Department of Statistics Malaysia

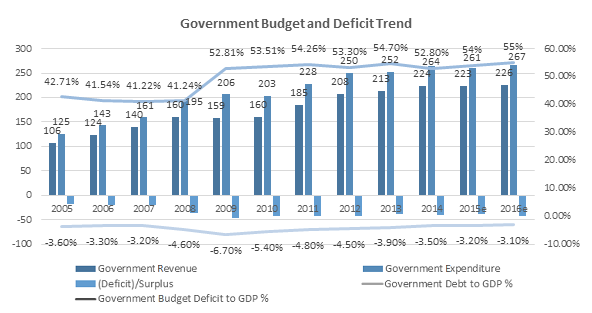

Revenue from GST Could Help Reduce Fiscal Deficit Over the last ten years, Malaysia’s fiscal deficit has been constantly mounting. However, since 2013 the country has been in the “safe zone” by maintaining debt to GDP ratios below 75% and a deficit below 4% of GDP. Compared to other neighboring ASEAN nations, this makes the Malaysian economy relatively robust. The fiscal deficit is expected to decline to 3.2% of GDP in 2015 and 3.1% in 2016, through the additional estimated revenue generated via GST. However, despite the implementation of GST and abolishment of fuel subsidies in Malaysia, Standard & Poor’s (S&P) believes that additional subsidy reforms would be crucial in order for the government to achieve its 0% deficit to GDP target by 2020.  Source: Trading Economics, Ministry of Finance

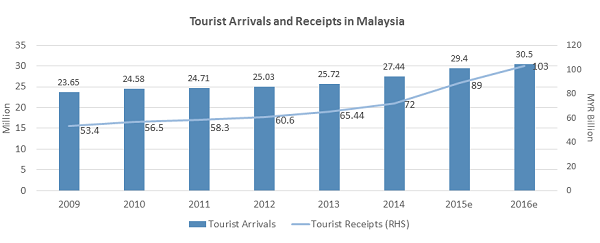

There is a concern, however, that the general public are increasingly taking on the burden of the shortfall in government revenue through this indirect tax, in order to support budget spending. Ideally, the additional revenue generated through GST should be spent by the government in improving the productivity of the economy, which would lead to economic growth. While the Budget 2016 includes generous allocations for education (MYR 41.3 billion) and developmental projects (MYR 30.1 billion), financial aid provisions have been increased to MYR 5.9 billion for low income households, raising questions about the effectiveness this would have in boosting productivity. Therefore, it appears that the actual positive impacts GST could have on the economy can only be gauged in a year or two from now. Additional Revenue from GST Helps Offset Shortfall in Oil Revenues The introduction of GST was also intended as a proactive measure to help the government cover the decrease in revenue from the oil sector, especially after oil prices fell drastically since the fracking boom and price war with the US shale industry affected the global sector in late 2014. The share of oil related revenue to total revenue is expected to fall to 20% in 2015, from around 33% in 2014, mainly due to the decrease in global oil prices (which fell from around USD 78 in November 2014 to USD 41 in November 2015). If oil prices hadn’t fallen so drastically this year, the government would have earned an additional MYR 30 billion from oil revenue in 2015. While the MYR 30 billion expected to be received from GST this year could replace this loss, this would hinder the country’s efforts in reducing the fiscal deficit. It makes more sense for the government to look at ways of increasing productivity and strengthening either the oil or other industries to replace this loss in revenue so that the additional GST revenue can be used more productively. Impact of GST and Developments in Key SectorsRise in Property Prices as a Result of GST has Negatively Impacted Property Sales Within the property sector, the new tax regime applies GST on the sales of commercial properties but not on residential properties. For sales of commercial properties, 6% GST is charged in addition to the selling price. Even if a commercial property is leased, an extra 6% GST will have to be paid by the tenant. However, when it comes to the cost of building materials, under the SST system materials such as bricks, cement and tiles were tax exempt. The GST system applies the 6% tax rate to all building materials and input services provided by contractors and engineers. In the residential property segment, developers are affected by the GST charged on the building materials used during the construction phase as they cannot get refunds on taxes paid on inputs. The weakening ringgit also increased the prices of imported building materials such as steel, elevators, escalators and air-conditioning. As total construction costs have risen by up to 11%, the profitability of many developers has been affected as they have had to absorb the cost of GST instead of passing it onto consumers. According to the Real Estate and Housing Developers’ Association Malaysia (REHDA), new property prices increased by nearly 4% since April 2015 due to higher material costs incurred by developers as a result of the additional GST during the construction phase. During the 2H 2015, property sales fell by 30% yoy, primarily due to GST and tighter loan requirements. REHDA is proposing that the government exempt the real estate sector from GST for another year to boost property sales. The government, however, appears to be supporting property price increases as in 2H 2015 it introduced a new rule enabling developers to claim a 6% rebate for GST charged on the final output, even if they are able to pass on this charge to buyers in the form of higher prices. Prepaid Mobile Users to Receive GST Rebates from January 2016 In the telecom sector, since GST was implemented, prepaid reloads became subject to the 6% tax rate. Under the previous SST system, prepaid users were relieved of tax as the 6% sales tax was absorbed by the telecom service providers themselves. Subsequently, in May 2015, the government slightly altered this ruling to the GST being deducted only when the reload is actually used for calls and text messages and not when it was purchased. Telecom operators were given until the end of October to switch to this charging system. However, many companies have been unable to meet this deadline, claiming that their existing ICT equipment and software are not equipped to handle the change. This has led to a rise in customer dissatisfaction as consumers are unable to understand why telecom operators cannot absorb the 6% GST cost as they had done under the previous SST system. To resolve this issue, the Malaysian Communications and Multimedia Commission (MCMC) is currently developing a system whereby Malaysian users will receive a rebate in the form of additional airtime for the value of the GST paid on reloads. The system is expected to be ready by January 2016 and implemented throughout next year. The main operators – Celcom, Digi and Maxis – are in full support of this initiative and believe that this move would help retain customers and enable players to maintain competitive pricing as well as not worry about absorbing GST costs hitting profits or passing them onto users. Cost of Private Healthcare and Medication Increased as a Result of GST When GST was implemented in April, healthcare was stated to be exempt of GST. However, this was only applicable to the public healthcare system. Consultation fees at private hospitals are still subject to 6% GST by classifying medical specialists as outsourced service providers. Many medical supplies required for hospitals are also subject to GST, which will further increase operating costs for hospitals while they are unable to claim credit for GST paid on inputs. When it comes to medication, only 2,900 brands of medicine (about 25% of the 12,000 registered brands of medication in Malaysia) were exempt from GST in April 2015. Many expensive medicines used for critical and life-long illnesses are not exempt. Ironically, the patients needing such medication are usually unable to take up full time employment or earn full time salaries. It is estimated that post-GST, patients will be paying an additional MYR 180 million per year for medication, which would be a 0.4% increase from 2014 annual spending of MYR 42.6 billion (USD 13.0 billion). Although this figure is still lower than Singapore (USD 14.4 billion) and Thailand (USD 17.9 billion), it is higher than the Philippines (USD 12.7 billion) and Vietnam (USD 11.1 billion), which could negatively impact the medical tourism industry Taking this issue into consideration, in the announcement of the Budget 2016 in October 2015, the government zero-rated all types of medicine for non-communicable diseases, all controlled medicines and 95 over-the-counter drugs. This increased the number of exempt medicines to 8,630 brands. The list now includes medication for 30 types of long term illnesses such as cancer, diabetes, hypertension and heart disease. This will help in reducing the expected increase in healthcare expenditure as a result of GST to much less than the previously forecasted MYR 180 million per annum. Medical insurance is also subject to GST and could deter the public from obtaining insurance, particularly the elderly who need it the most and depend on fixed pensions for their livelihood. Domestic Tourism Industry Protected by GST Exemption on Local Travel In 2Q 2015, Malaysia’s local tourism industry saw a 30-40% drop in revenue, according to the Malaysian Association of Tour and Travel Agents (MATTA). Although the prices of goods and services had become cheaper as a result of the weakening ringgit, this was offset by the additional GST imposed, thereby making Malaysia dearer for tourists. The Tourist Refund Scheme allows foreign tourists to reclaim GST paid after spending MYR 300 on a single receipt. However, many tourists are still unaware as to how this process works and the red tape involved is likely to make neighbouring nations more attractive to tourists. With the advent of GST, all domestic air travel also became subject to tax in Malaysia. This raised serious concerns in East Malaysian states such as Sabah, which do not have any other mode of travel to connect residents in the area to Kuala Lumpur. Whether it is work or leisure, air travel is the only transport facility available for people living in the state of Sabah. The state therefore called on the government to consider this an essential service and thereby exempt it from GST in order to make it fair for Malaysian citizens. This would help avoid other social and work related issues that could have arisen as a result of the GST on local travel and thereby have an overall positive effect on industry revenue. Taking the above issues into consideration, the government announced in the Budget 2016 in October that all domestic economy flights will be exempt from GST. Additionally, the 100% tax exemption on statutory income for tour operators has been extended from 2016-2018. The government expects these moves to boost tourist arrivals to 30.5 million (up 3.7% yoy) and tourist receipts to MYR 103 billion (up 15.7% yoy) in 2016.  Source: Tourism Malaysia

Corporate and Income Tax Revenue Likely to Decrease Post-GST Corporate tax revenue has grown at a CAGR of 17.5% from 2009-2014 and made up around 54% of the government’s total revenue from direct taxes in 2014. During the first year of GST implementation, many businesses are choosing or being forced to absorb the cost of GST in order to remain competitive and maintain/increase revenue. In doing so, they incur higher cost of sales and thereby lower profit margins. Thus, they would end up paying less corporate tax to the government. Many smaller businesses may also be forced to shut down, leading to further reductions in corporate tax received and unemployment. This could actually worsen the government’s fiscal deficit over the next two years. Even where sellers have passed on the GST to the final consumer in the form of increased prices, this has caused a decrease in demand/consumption. The reduction in unit sales lowered overall revenue and thereby profits. As a result, businesses once again ended up paying lower corporate and income tax.  Source: Department of Statistics, Malaysia

Rising Prices and Household Debt Could Negatively Impact Domestic Consumption Since April 2015, GST has become increasingly unpopular due to the number of basic/essential food items used by the bulk of the population, which were not on the zero rated or GST exempt list. In October 2015, the Malaysian Prime Minister addressed some of these issues by expanding the zero-rated list to include soy-based and organic milk for babies and toddlers, dhal, brown sugar, various nuts, lotus fruit water chestnuts and dried kolok noodles, among others. Prior to the implementation of GST, the government had projected a 4.1% yoy drop in the prices of 532 items out of the 944 goods and services that make up the consumer price index basket. However, since April 2015, the prices of over 70% of the goods and services in the basket have gone up by as much as 30%, leaving many people confused as to the benefits of GST implementation. Over the last ten years, Malaysia has become increasingly dependent on domestic consumption, especially since the growth rate of exports decreased after the global financial crisis in 2008. However, as most domestic consumption is fuelled by debt, it has its constraints. Malaysia also has one of ASEAN’S highest household debt levels, which is continually rising. In 2014, the household debt to GDP ratio stood at 88%, up from 62% in 2004. This has affected domestic consumption as households have less money available for discretionary spending. Since the introduction of GST, domestic consumption and private spending has eased due to the subsequent rise in the price of goods and services. In 3Q 2015, the Malaysian economy grew by 4.7% yoy, its slowest pace in two years. The increasing levels of debt combined with rising prices could result in the government not meeting its GST revenue target, which would worsen the country’s national deficit. GST – a Game Changer for SMEs In Malaysia, SMEs represent 97.3% of all businesses and are expected to contribute 35% of GDP in 2015 (from 33.1% in 2014). Within the manufacturing sector, SMEs are categorized as companies with a turnover under MYR 50 million or an employee strength of less than 200. In the service sector, SMEs are defined as companies having a turnover of less than MYR 20 million or an employee headcount not exceeding 75. In most of these businesses, accounting and invoicing is usually done in-house and manually. However since April 2015, SMEs now have to change existing procedures and systems and invest in accounting software and training for employees to automate business processes in order to be compliant with GST. They need to send tax reports on a regular basis to the Customs Department and ensure that all data is archived for inspection as well. The SME Association is emphasizing the need for the government to provide training and further educate the businessmen running SMES regarding GST, its implementation, costs and benefits to encourage maximum adoption. With many GST software programs being cloud-based or web-based, there is also the increased risk of internet hackers gaining access to valuable data and holding companies to ransom for it (i.e ransomware). This is a primary concern for SMEs, particularly those run by older people who are hardly tech savvy. As they are unaware of the consequences of cyber threats, many feel it is unnecessary to invest in data protection or security measures. Moreover, most SMEs do not have the financial resources or the manpower to make such an investment, which is between MYR 2,000 – MYR 10,000. SMEs have also been facing rising production costs and falling profits as a result of the weakening ringgit, as the bulk of raw materials are generally imported. Margins are further compressed as most SMEs sell only to the local market. The majority of SMEs don’t have access to banking facilities such as loans and thereby rely on credit terms from overseas supplies to meet their financing needs. The new GST system has resulted in SMEs facing severe cash flow constraints as they have had to wait up to three months to receive GST claims. Many companies reduced stock purchases or have written off unpaid refunds as losses, which further reduced profits. This delay occurred due to the government having to verify all GST claims to ensure they were genuine and error free. The Federation of Sabah Industries (FSI) believes the current turnover threshold and rate of GST are too oppressive on SMEs. It suggests increasing the annual turnover threshold to MYR 3 million (from the current MYR 500,000) and lowering the GST rate to 3% as the first phase of the new system. This would help ease the burden on SMEs to register and give them time to get used to GST. However, SMEs who are not registered under GST cannot claim input tax paid on production materials either, which could lower margins. Therefore, despite the obstacles present, SMEs (i.e those which are not required to register for GST) need to weigh the cost-benefit and see how best they would be able to maximize profitability, either through the GST system or without it. Failure to Comply with GST Remains Primary Concern for Government As of May 2015, 377,452 companies had registered for GST, out of a total of 500,000 companies in Malaysia. Of those registered, only 55% were mandatory, while the remainder were voluntary, indicating the growing awareness of GST and its benefits among businesses. However, from April to November 2015, the Finance Ministry had also issued 26,963 notices to companies registered for GST but which have failed to submit their GST statements and pay the required amounts. Contractors and e-commerce merchants make up the largest proportion of businesses that have not yet registered for GST although they meet the requirement. This number includes an association of 10,000 contractors – all of whom are unregistered. Based on the number of complaints received by the Finance Ministry in 3Q compared to 2Q of this year, it appears that people have begun to accept the implementation of GST and its implications. Only 572 complaints were recorded in 3Q, as opposed to 5,873 complaints in 2Q. In addition to the MYR 15,000 fine for businesses which fail to comply with GST, the Customs Department plans to introduce a GST guide specifically for the housing sector to educate developers regarding the tax regime. The aim is to increase the number of GST registered businesses to 400,000 by early 2016. Malaysia’s GST Regime in Comparison to Regional Countries China (17% GST) and ASEAN countries such as Singapore (7% GST), Thailand (7% GST) and Indonesia (10% GST) have already implemented GST systems from as far back as 1984 with rates as high as 17%. However, since implementation, all these countries have made amendments and reductions to their GST policies and rates to accommodate the consequences of GST, in order to boost their economies. Compared to these countries, Malaysia’s GST rate of 6% is currently the lowest. The main benefit of GST should be the spending of the additional revenue by the government in improving productivity, standards of living and boosting the overall economic growth in the country. Singapore has clearly detailed the offset package it has implemented to compensate for the charging of GST. In Malaysia’s case, Budget 2016 has already made amendments to GST in certain sectors and industries, taking into consideration the requests and concerns of various government authorities and businesses. At present, the government’s main focus appears to be reducing the fiscal deficit. Therefore, it will be interesting to observe if GST revenue will be continuously used to consolidate Malaysia’s fiscal position, or if the country will use this new tax regime to increase its competitiveness and shift from an income based tax system to a consumption based one. Comparison of GST in China and Other ASEAN Countries

Source: Astro Awani |