Indonesia Continues to Lower Interest Rates; Vietnam Records Over 7% GDP Growth for First Time in Seven Years

|

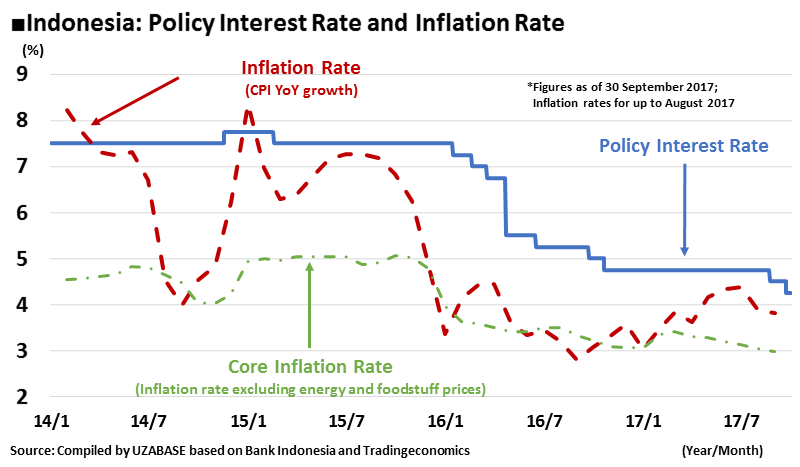

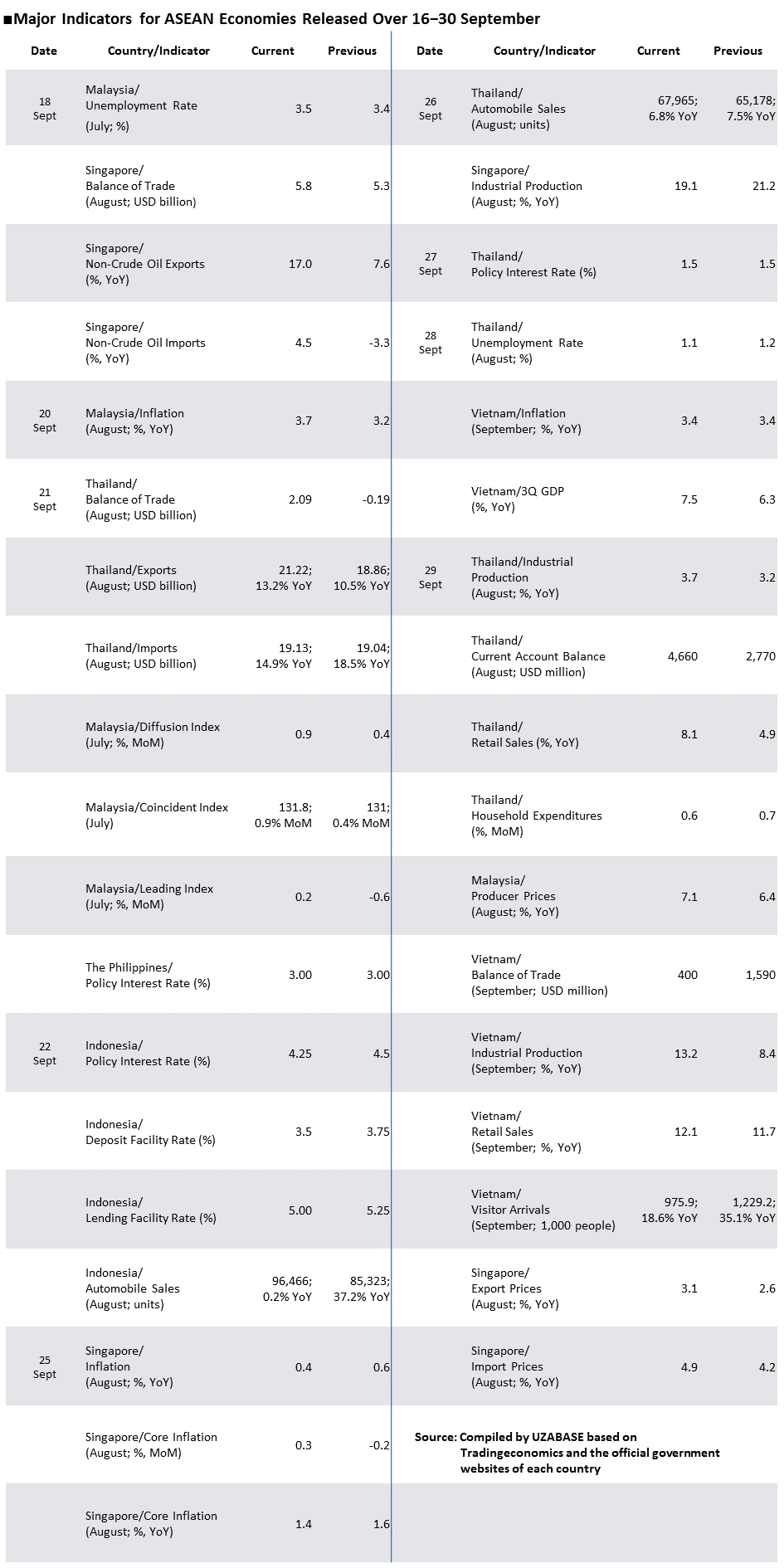

Indonesia: Central Bank Lowered Interest Rates for the Second Consecutive Board of Governor’s Meeting Indonesia’s central bank, Bank Indonesia, held its regular Board of Governor’s Meeting on 22 September, where it was decided to lower the policy interest rate by 25 basis points (bps) to 4.25%. The deposit and lending facility rates were also lowered by 25 bps each in tandem to 3.50% and 5.00%, respectively.

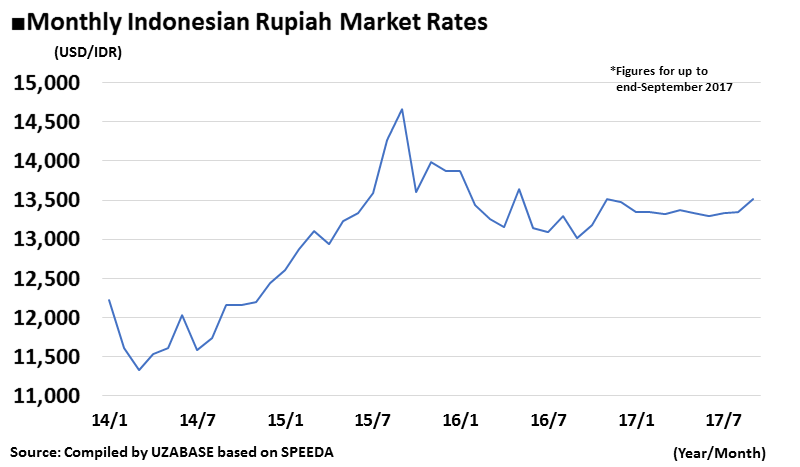

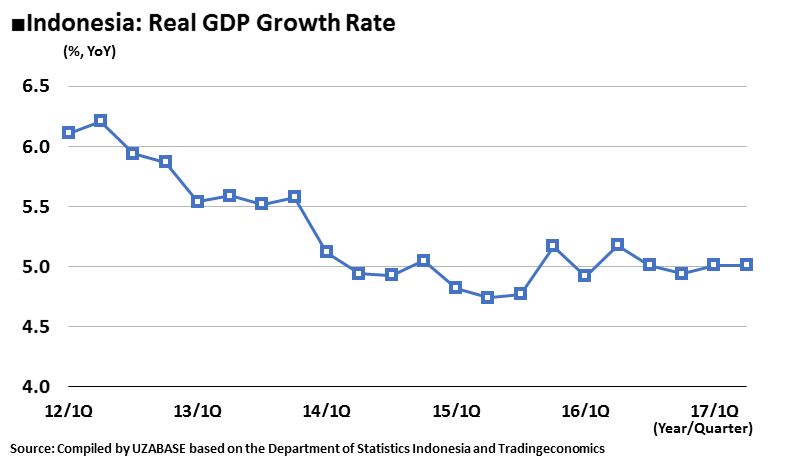

Bank Indonesia issued statements outlining the background behind the decision, with summaries provided below: - The country’s inflation rate is expected to remain low through to end-2017, with estimates that it will be below the mid-range inflation targets for both 2018 and 2019. The inflation targets are +4.0±1% for 2017, and +3.5±1% for 2018 and 2019. - Lowering interest rates can further promote lending amongst banks, as well as economic recovery. - External risks such as the raising of interest rates by the US Federal Reserve Board were also taken into consideration. Bank Indonesia noted that it is seeing a decline in financial risk as the global economy continues to improve driven by advanced economies, with the USA showing signs of higher-than-expected growth supported by domestic demand, and consumption improving in Europe. Amongst emerging economies, it noted that while India’s economy is expected to slow down, both consumption and lending are on the rise in China, which may lead to the realisation of even stronger economic growth. The domestic economy in Indonesia is estimated to grow by 5.0–5.4% in 2017 compared to the previous year, and grow further by 5.1–5.5% in 2018. In 3Q 2017, household spending improved centred on retail and durable consumer goods, with construction investment remaining steady together with a rise in government expenditures. Exports are also anticipated to improve alongside a rise in international commodity prices. In addition, with the 0.02% rise in its market rate, the Indonesian rupiah is anticipated to remain stable, and the accelerated inflation in August that was brought upon by an increase in demand before the Lebaran holiday has slowed down and returned to normal. Indonesia’s economic growth rate continued on a flattened trend over 1Q and 2Q at +5.0% YoY. The consecutive lowering of interest rates reveals the hopes that Bank Indonesia has for stimulating domestic economic growth prior to any increase in risks of change in the global economy.

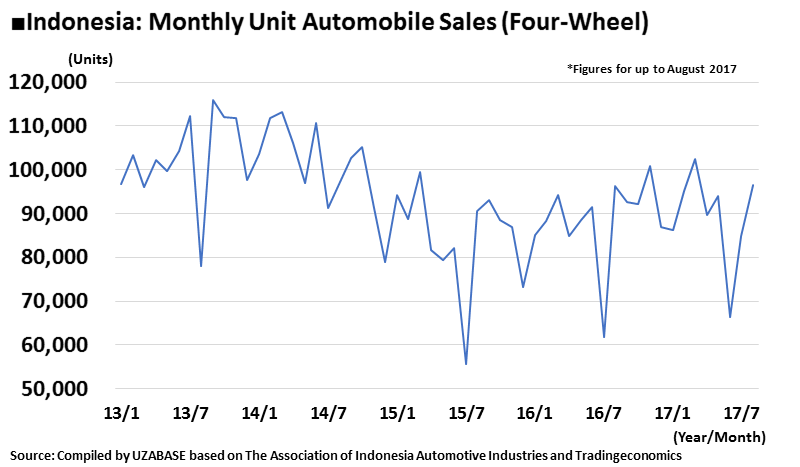

Indonesia’s unit automobile sales amounted to 96,466 units in August, the second best performing month in 2017 after March, which recorded 102,336 units. This figure also implies that the rebound drop from the increased consumption activity prior to the Lebaran holiday has ended (refer to the report covering 16–31 August, “Malaysia and the Philippines Undergoing Rapid Growth; Indonesia Lowered Interest Rate”, for more information on the increase in consumption before the Lebaran holiday).

The below news topics were also highlighted over 16–30 September: - In the high-speed rail project led by China for connecting the capital city of Jakarta and Bandung, West Java, local newspapers have released outlooks on the expropriation of land. Although the use of existing lines was under discussion, new lines may indeed be constructed, and if affiliated parties are able to attain sites for construction with no issue, the high-speed rail line may be able to launch operations in 2020. - Indonesia’s government-owned power company, PLN, is faced with a considerable amount of debt. - The Palu Special Economic Zone in Central Sulawesi becomes the third area out of 11 designated areas to launch operations. - The Indonesian government formulated a policy for establishing an institution for selecting fin-tech companies for business operation. - Penal regulations regarding those who do not participate in tax amnesty are to be strengthened. |

|

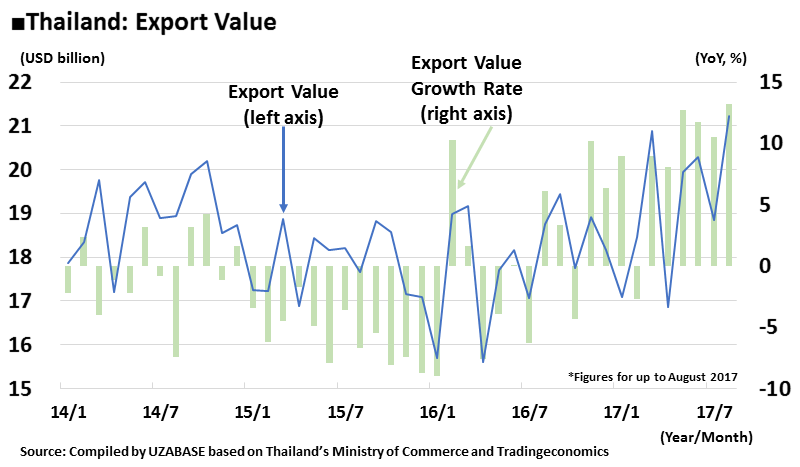

Thailand: Economic Recovery Led by Foreign Demand; Individual Consumption Still at Midway Point Thailand’s total export value for August totalled to USD 21.22 billion, rising favourably by 13.2% YoY. Exports for PCs, machinery, and components to the USA and Japan were favourable, increasing by 16.8% YoY and driving overall exports. Electronic products and components followed thereafter, rising by 13.5% YoY. By country, China accounted for the largest portion of the export value with USD 2.69 billion, exhibiting high growth at 25.5% YoY.

The Bank of Thailand held its Monetary Policy Committee Meeting on 27 September, where it decided to keep the policy interest rate at 1.50%. Reasons behind the decision included the following: - The country’s growth is accelerating past previous estimates due to increases in the exports of goods and services. - The prices of fresh food products have settled down, with headline inflation accelerating at a gradual rate. In addition to exports, the Bank of Thailand also forecast that the tourism industry will drive the country’s economy alongside the strong recovery of the global economy.  Thailand has numerous tourist destinations including historic Buddhist temple ruins and beautiful coastlines. The country’s tourism industry is expected to be the growth driver for its economy. Photo by GettyImages/4FR |

|

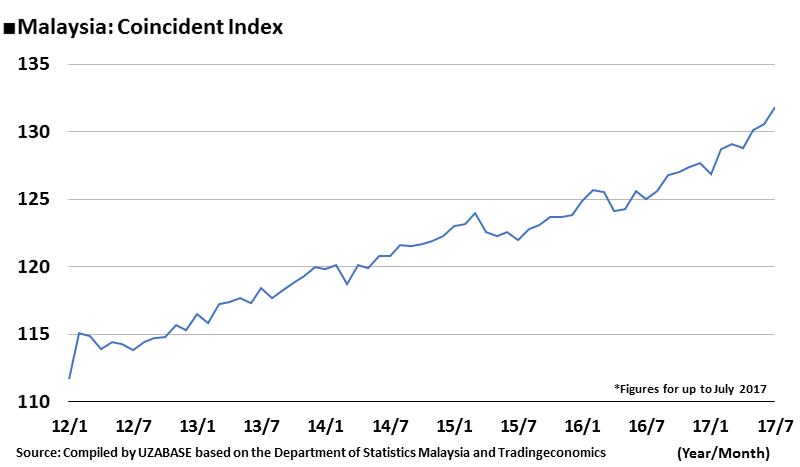

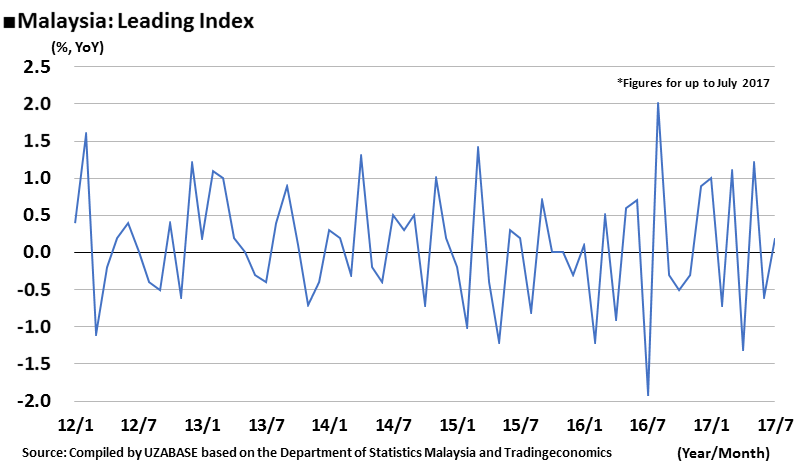

Malaysia: Coincident Index Reaches Highest Level to Date Amongst the economic indicators announced for Malaysia, the country’s coincident index rose by 0.9% in July from the previous month to reach 131.8, breaking previous records. The country’s leading index also rose by 0.2% from the previous month. While Malaysia is exhibiting favourable economic conditions, the country’s leading index has continued to increase and decrease repeatedly.

|

|

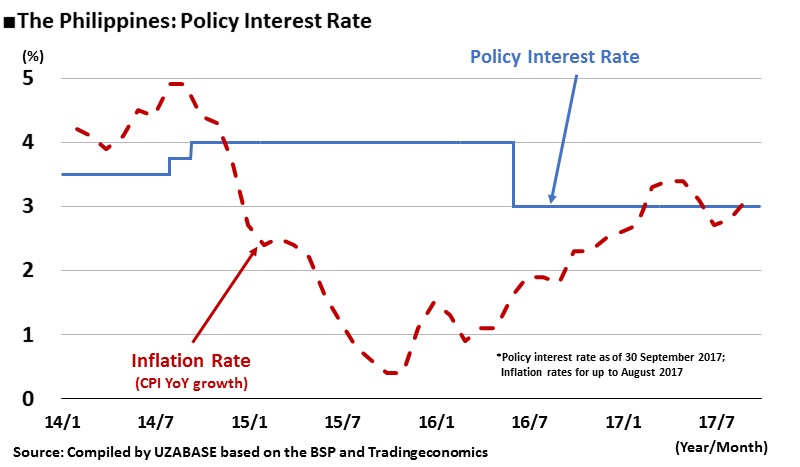

The Philippines: Maintains Current Policy Interest Rate The Central Bank of the Philippines (Bangko Sentral ng Pilipinas, BSP) held its Monetary Policy Meeting on 21 September, and decided to maintain the policy interest rate at the current 3.00%. The BSP highlighted the below two points behind its decision: - The country’s current inflation is manageable. - The current rate is at an appropriate level for achieving the 2017 inflation target of +3±1% YoY. While forecasting acceleration in inflation, the BSP also noted that while the government’s current tax reforms will put pressure on the rising commodity prices, it does not expect these measures to have a major impact in the medium term by way of enhancing productivity. In regard to the global economy, the BSP highlighted that increases in geopolitical risks and unclear macroeconomic policies in OECD countries pose risks for international demand for products and services from the Philippines, despite a general favourable trend. As for the domestic economy, consumer sentiment and business confidence are both on positive trends, with the economy supported by sufficient liquidity, and the BSP believes that it will remain strong for the time being. |

|

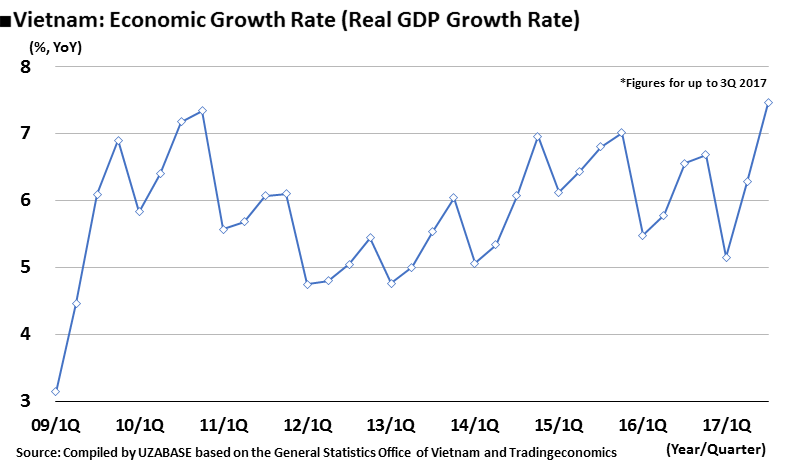

Vietnam: GDP Exhibits High Growth at 7.5% in 3Q Vietnam’s real GDP growth rate for 3Q was 7.5% YoY, marking the country’s highest growth since the collapse of Lehman Brothers. Furthermore, this is the first time that the figure has exceeded 7% since 4Q 2010. Exports are driving this growth, with smartphones and related components, which account for approximately 20% of the country’s total export value, recording remarkable growth in particular at 45.5% YoY in 3Q. Vietnam’s exports were previously centred on agricultural, forestry, and fishery products, as well as processed food items. However, Samsung opened its largest factory in the world in Vietnam in 2009 and has continued to expand it since then, which has largely contributed to the country’s exports. It should be noted that Vietnam’s macroeconomic statistics are released prior to the end of a particular month or quarter as a standard. These statistics are not treated as preliminary figures, but rather as definitive values, although there are cases where they are revised after announcement. |

|

Summary and Key Focus in the Next Report During 16–30 September, Indonesia lowered its interest rates for the second time in a row, and began endeavouring into boosting economic growth. Furthermore, Vietnam received attention for recording high economic growth. The next report will cover the period from 1–15 October and focus on the following indicators in particular (dates in the brackets are scheduled release dates). Indonesia: Inflation Rate (September; 2 October), CCI (September; 5 October), Retail Sales (August; 11 October) Thailand: Inflation Rate (September; 2 October), BCI and CCI (September; 3 October) Malaysia: Balance of Trade (August; 6 October), Industrial Production (August; 12 October), Retail Sales (August; 13 October) The Philippines: Inflation Rate (September; 5 October), Balance of Trade (August; 10 October) Singapore: Manufacturing Sector PMI (September; 3 October), Nikkei PMI (September; 3 October), Retail Sales (August; 12 October), Real GDP Growth Rate (3Q Preliminary Figure; 13 October)

|