Impact of Brexit on ASEAN

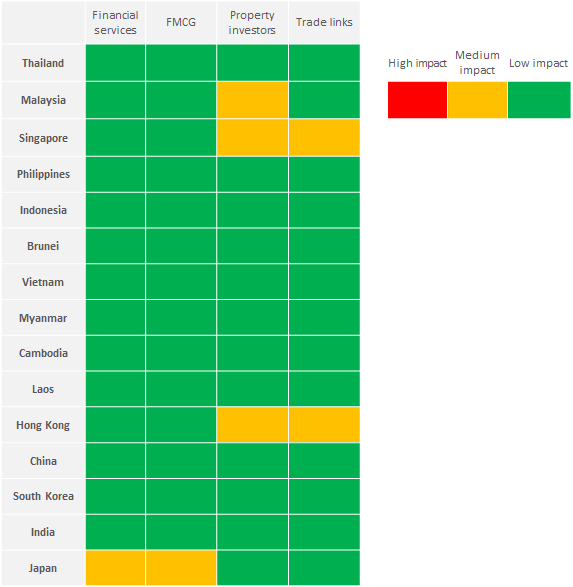

Brexit and Asia: No real concerns as suchThe key downside risk identified by various policy institutions and governments, in particular the IMF, remains Brexit, the fate of which will be determined on June 23 when the UK holds the referendum on whether it should leave or remain in the EU. As of now, it is hard to assure a certain outcome, given the outcome of recent survey polls, which suggest that people are divided. Obviously, leaving the EU would likely have serious implications for the UK ─ the worst positioned in this scenario. The main stumbling block here is the future of the relationship between the UK and the EU. Heightened uncertainty and a lack of clarity over how the relationship would be re-established with the EU, is the one reason that the transition process appears to be a painful and protracted one. The impact of Brexit could be measured in terms of i) trade relationships, ii) foreign trade investment, iii) regulation, iv) competition, v) immigration, vi) financial services and vii) trade policy. When we assess the impact of Brexit based on these key economic parameters, we can conclude that the UK and some of the EU countries, namely the Netherlands, Ireland, Cyprus, Portugal and Greece, are the most affected by Brexit, given the closer ties within the economic union. Outside the EU, the direct implications remain limited due to the relatively low significance of trade and other relationships. That being said, the mere uncertainty and dent on sentiment would pose downside risks to the broader global economy. In the context of ASEAN/Asia, the overall impact of Brexit, in our view, remains limited as both the EU and the UK are considered to be attractive markets from the perspective of these economies. So what that implies for Brexit is that it won’t be business as usual even though the negative impact is unlikely to be material. Brexit could potentially change the business rationale for basing their operations in some of the EU countries, and as such affecting valuations of these businesses. Moreover, it would indeed impact the way business is done with EU and the UK on the regulatory, FTA and political fronts. We identify five sources of impact on Asia/ASEAN stemming from Brexit: i) Financial services remains the most affected by Brexit, with exposure in terms of real assets, bond/equity holdings in the UK in their investment portfolio and currency risks. ii) FMCG companies have to reassess their business model enabling them to look at the UK as a separate market rather than part of the EU. iii) Property investors who are heavily invested in commercial and residential properties in the UK are likely to suffer losses if demand for office headquarters decline and the residential market is affected by strict immigration rules. iv) The transitional phase after Brexit would lead to a prolonged period of political and economic uncertainty in the EU countries, which will in turn affect the Asian countries/companies/investors that have relationships with these EU countries. v) Finally, on the positive side, with a change in equation of the trading and other relationships with the EU countries, Asian countries may be able to capitalize on the gaps created by Brexit. Summary of Impact on Asian Countries from Brexit – Minimal

In sum, the impact of Brexit has far reaching implications on the UK and the EU countries rather than outside the economic zone. The UK’s importance in trade to the Asian countries is quite low at less than 1% of GDP. However, given the fragile nature of the recovery of global growth, any uncertainty is just going to add to the global woes and further prolong the recovery period, including for Asia. Further, Brexit could have serious repercussions for property and capital market investors due to the negative impact on financial markets, currency and asset valuations in the UK. These risks, though not significant, appear to be higher than the trading related risks. To the contrary, Asia could also benefit from an exodus of financial business from London if the UK votes to leave the EU, with Singapore and Hong Kong seen as strong candidates given their already robust infrastructure and skill set. |

A Quick Look at Brexit: What Happens After a “No-vote”?If the UK votes to leave the EU, the key question that cannot be answered is what access Britain will have to the EU market, regulatory regime and migration rules or how long any of these conditions may take to negotiate. Hence, the underlying issue is the uncertainty surrounding the relationship between Britain and the EU, post Brexit. • The first and foremost to react should be the financial markets ─ not just the UK or European but the global markets ─ as any sort of uncertainty derails the recovery, given the fragile nature of the recovery so far. Even though the markets are pricing in the uncertainty, a no-vote will almost certainly dampen investor confidence across the globe. • GBP may lose its value following the heightened uncertainty in the local and global markets, despite the depreciation of GBP since the Brexit topic came to the limelight. • Even though we mention the financial/currency markets as the first to react, political uncertainty is the critical problem. We simply do not know what sort of an agreement the UK government will be able to seal with the EU and how long it will take. Most economic think tanks estimate a transition period of at least 10 years, which does not bode well for the UK and the EU. • For the EU, we can expect the same level of uncertainty given that the UK remains a powerful member. • The IMF expects the long-run effects on UK output and income to be negative and substantial underpinning increased barriers, which likely would reduce trade, investment and productivity. There is a wide disparity among economists about the negative impact of Brexit on UK’s GDP growth starting from -1.5% to -9.5% of GDP. This itself emphasises the underlining issue of uncertainty about the relationships with the EU and the rest of the world post the Brexit. |

Potential models being discussed post Brexit1. Norwegian ─ based on membership of the European Economic Area, where the UK will have full access to the single market and free labour movement but no say in regulation 2. Swiss ─ based on bilateral accords which narrows down the above option to selected sectors 3. Canadian ─ based on FTA, which introduces non-tariff barriers and regulatory divergence Regardless of the model adapted by the UK, we can see that the UK will not have the same favourable terms of trade under its EU membership, whilst increasing the downside risks to economic growth. |

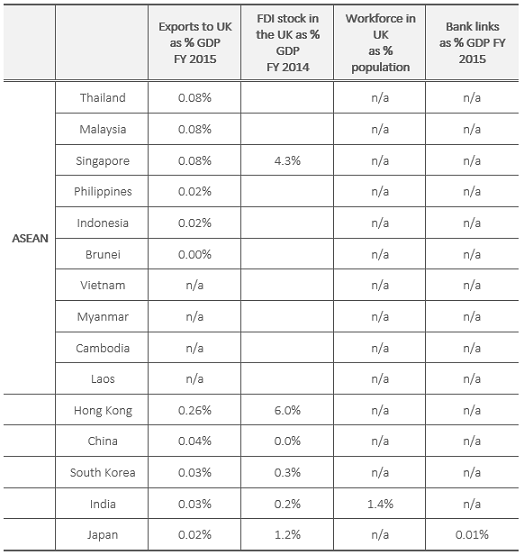

Exposure via Exports: Minimal for AsiaThe main tangible impact comes in the form of trading relationships due to reduced growth in the UK post Brexit and some EU countries with sizable exposure to the UK. In order to gauge the impact on Asian countries, we compare the exports to the UK from these countries with their GDP. Our analysis reveals that there is actually minimal impact on trading revenues stemming from Brexit. Hong Kong has the highest exposure at 0.26% of GDP based on 2015 data. We present below a matrix that helps identify the risks for Asian countries stemming from Brexit based on exports, FDI stock, workforce and bank links. Matrix of impact of Brexit on Asian countries

Source: ONS, IMF, Labour Force Survey, Bank of England

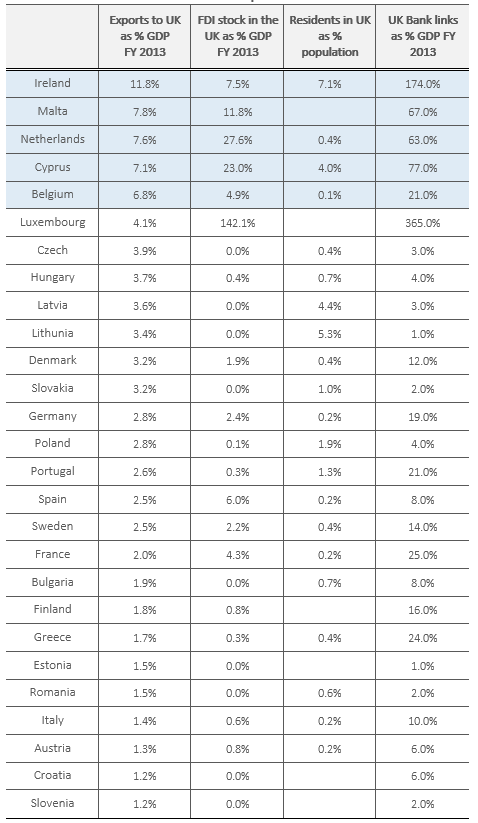

We also present the same for the EU countries for comparison purposes. Of the EU countries, we identify Belgium, Cyprus, Ireland, Malta and Netherlands as the worst positioned due to their dependence on the UK. Following on from this, we need to be wary of the exposure of Asian countries to these EU countries that have been flagged as risky in the below matrix. However, we can comfortably conclude that the exposure to these countries remain negligible, alleviating any concerns, based on recent available data. Total exports from ASEAN to the EU have risen from EUR 70bn (USD 76bn) in 2004 to EUR 100bn (USD 109bn) in 2014. |

|

Matrix of impact of Brexit on EU countries

Source: ONS, Bank of England, IMF, European Commission

On the positive side, if the UK decides to leave the EU, Britain most likely would focus on the ASEAN countries to sign trade deals to make up for the loss stemming from disruption in the EU relationship. This could increase trade with the UK for ASEAN countries. However, we think it is better to leave the blue sky scenarios out at this juncture, given no one knows what the post Brexit UK relationship with the rest of the world is going to look like. |

Exposure via FDI: Singapore has the Highest Exposure Among ASEAN Countries, Though Hong Kong the Most Exposed in AsiaAs shown in Exhibit 1, Singapore has the highest exposure to FDI stock in the UK at 4.3% of GDP among the ASEAN countries. However, when we look at Asia, Hong Kong tops the list with 6.0% followed by Japan at 1.2%. Even though the exposure in terms of FDI is higher than the export exposure discussed above, we do not see any reason for concern but rather, some transitional challenges. Some of these operations may have to be relocated to a EU country, having some interim impact on earnings. Nonetheless, the magnitude of loss is quite significant for the UK rather than the countries that are considering relocation. Singaporean companies in Britain are largely service firms that typically do not rely on their presence there to service their European operations, according to the Singapore Business FederationCEO. It is estimated that circa 55% of Singapore’s investment in the EU is in the UK and concentrated in the property, transport and tourism sectors. In absolute terms, Japan is the most exposed with investments totaling GBP 38bn at the end of FY 2014 ─ equating to 1.2% of Japanese GDP, mainly in the car industry which accounts for 1,000 Japanese companies and a workforce of 140,000 people (0.1% of Japan’s population). However, the countries may decide to continue to be based out of the UK rather than move to a EU country, similar to Toyota which has already announced that it would stay given the magnitude of the investment. So the implications are not serious given the UK has its own currency unlike Greece as Grexit would have resulted in a vacuum until a new currency is created. |

Exposure via Workforce and Banking Presence: A Non-issueThe EU remains the key migrant workforce in the UK with Africa, Australia, the USA and New Zealand making up the higher shares in the non-EU category. Data is only available for India, Pakistan and Bangladesh separately implying that most of the Asian countries have a negligible workforce presence in the UK and as such minimal disruption. Another source of risk is banking presence and the available dataset only provides a breakdown of Japanese exposure among the Asian countries. Against the backdrop of unavailability of separate data, we believe that banking assets/liabilities of the other countries remain limited. Even the Japanese exposure, as measured by liabilities, remains small at 1.4% of GDP. |

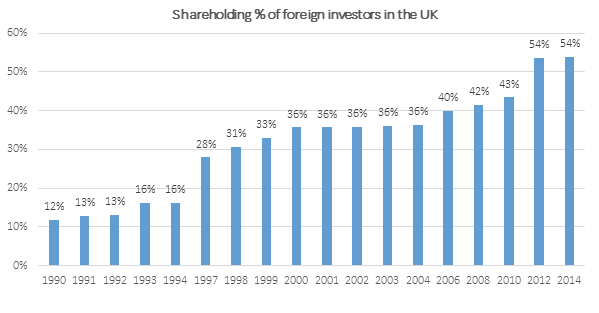

Exposure via Debt/Equity Holding: Loss in Currency Value Could Lead to Losses in Capital MarketsIf Brexit happens, GBP-denominated investments would become more volatile as investors assess the effect on the currency. Already, the GBP has been quite volatile since the Brexit topic emerged and the currency has been depreciating since the start of this year as uncertainty increases as we get close to the election day. Along the same lines, the UK stock market has been erratic. What this implies for other countries is that they are likely to incur losses on capital market investments ─ debt and equity. Based on FY 2014 data available, the rest of the world represents 53.8% of share ownership in the UK equity markets, amounting to GBP 928.6bn. In the absence of the detailed geographical breakdown, we would assume that USA and Europe would make up a bigger share compared with Asia. However, Asian investors holding equity/debt positions are likely to face the double whammy of currency losses and a market decline. In the gilt market, we estimate that about 27% of the debt is held by foreign investors with central banks of foreign countries only representing 5% of total gilts. However, we see some risks from the financial markets to Asian investors. Further, Brexit could have ripple effects in Asia by cutting off the UK’s Asian finance investors from the EU financial market. Asian fund managers working out of the London base may no longer be able to distribute funds across Europe. However, having its own currency alleviates the major concern relative to a Grexit. For Brexit, it is more about the uncertainties about the trade relationship and the consequent impact on growth and currency rather than creation of a currency.  Source: ONS, IMF, Labour Force Survey, Bank of England |

Exposure via Property: 10-18% Hit on House Prices Expected by the ChancellorThe Chancellor for the first time has estimated that UK property prices would be hurt in the region of 10-18% if the UK votes to leave the EU. Brexit could entail sharp drops in equity and house prices, increased borrowing costs for households and businesses, and even a sudden stop of investment inflows into key sectors such as commercial real estate and finance. Such concerns may have already begun to affect UK markets in recent months. In the commercial real estate market, transactions plunged about 40% in Q1 2016A. Although the residential real estate market remains buoyant, this may reflect temporary effects due to tax changes. In financial markets, GBP has depreciated by 9% in trade-weighted terms since November, the cost of insuring against a UK sovereign default has doubled (albeit from a low level), and the cost of insuring against exchange rate volatility around the time of the referendum has spiked. Asian residential property investors represented just 6% of those buyers in areas such as Kensington, Chelsea and Belgravia in Q1 2015A as opposed to 26% in Q1 2014A. Chinese buyers declined to 3% from 9% during the same period. We can see that interest in London property is waning among Asian investors. According to data from Knight Frank, Hong Kong-based buyers accounted for 3.3% of purchases of prime London homes in H1 2015A, down from 5.6% in the previous corresponding period. Singapore investors made up 1.4% compared with 3.8%, while Malaysian purchasers declined to 0.6% from 0.9%. Chinese homebuyers accounted for 9.4%, down from 10%. Even though the share has declined, the property investors will experience losses due to a hit on house prices and currency depreciation. |

Are There any Positive Implications for Asia from Brexit?In the scheme of things, however, Brexit would mean that a major powerful world economy is seeking to re-establish its trade partnerships – something that could actually benefit ASEAN and the rest of Asia. Asian countries that are currently involved in prolonged free trade talks in Brussels may be able to seal deals quite quickly with the UK. Another interesting pointer would be the relocation of financial services and other companies to Asian countries like Singapore and Hong Kong, which already have the required robust infrastructure. |