ASEAN in the Aftermath of Brexit

Asia remains largely unscathed by the Brexit vote. However, the worst case scenario of a break-up of the EU could have serious repercussions for the global economy, including AsiaWe have identified five major impacts on Asia/ASEAN stemming from Brexit: i) Financial services remains the most affected, with exposure in terms of real assets, bond/equity holdings in the UK in their investment portfolio and currency risks. ii) FMCG companies are forced to reassess their business models, in terms of them looking at the UK as a separate market rather than as part of the EU. iii) Property investors who are heavily invested in commercial and residential properties in the UK are likely to suffer losses if demand for office headquarters decline and the residential market is affected by strict immigration rules. iv) The transitional phase after Brexit would lead to a prolonged period of political and economic uncertainty in EU countries, which will in turn affect the Asian countries/companies/investors that have relationships with these countries. v) Finally, on the positive side, with a shift in the equation of trade and other relationships with EU countries, Asian countries may be able to capitalize on the gaps created by Brexit. What’s the current situation? The sterling, global equity market and the UK property market have all lost value following the UK’s decision to leave the EU. The flight to quality has increased demand for safe haven government bonds, gold and USD. The 10-YR Treasury yield — a benchmark for global interest rates — has declined 40bps since the UK voted to leave the EU, and has fallen for the past seven consecutive weeks. Meanwhile, the Reserve Bank of Australia kept benchmark interest rates on hold as expected on Tuesday, although the market is expecting a 25bps rate cut in August. The yield on 20-YR Japan government bonds has fallen to 0%. Given the sterling depreciation and reduced growth outlook in the UK and EU, central banks around the globe are looking at QE to stimulate growth. The BoE has already announced accommodative monetary policy to relax regulations for banks and insurance companies in the financial sector. What to expect going forward?? The one-off downward adjustment in asset prices that has already taken place will now be followed by a protracted period of uncertainty as Britain and the EU negotiate their split. This implies prolonged risk-off sentiment and continued flight to safe haven assets such as JPY, USD, Japanese and Swiss bonds. Central banks across the globe will likely cut interest rates to ease liquidity and thus ward off any crisis similar to that of 2007. In Asia, Malaysia and Indonesia are the most likely to cut interest rates to defend their currency given the higher level of debt holding by foreigners. The GBP and global markets are going to be volatile until there is clarity on the UK-EU trade terms post-Brexit, which could take several months to two years or even longer given that both parties could mutually extend the grace period. As of now, we still don’t know what Brexit will actually mean and as such heightened uncertainty is going to be the theme in the near-term. Direct impact on Asia from Brexit remains limited; however, break-up of EU could be detrimental The immediate impact from Brexit can be felt in the currency and financial markets, where volatility has gone up drastically amid uncertainty surrounding the relationship between the UK and EU in the post Brexit era. The direct impact on Asia would be dictated by currency and equity markets as Asian markets and currencies react to sterling and UK markets. Japan remains more vulnerable given its safe haven status and the effect of JPY appreciation on local markets. Following Japan, Hong Kong and Singapore have comparatively more links to the UK in terms of FDI, which could shave off some growth in these two countries. However, the direct impact remains limited as trade links via exports are not hugely significant (0.7% of GDP on average). Further, large foreign currency buffers and current account surpluses should help weather any economic stress. However, in the worst case scenario of an EU break-up, Asia could face a severe crisis like that of 2007 as a recession in the entire EU would slow down global growth in its entirety. However, we believe this is highly unlikely as fears for the future of the EU have prompted German authorities to consider offering Britain “constructive exit negotiations” and making it an “associate partner country” of the EU. Whatever the implications may be, it is too early to comment on the full extent of the impact of Brexit so long as the future of the relationship between the UK and the EU remains ambiguous. Article 50 of the Lisbon Treaty allows the withdrawal talks to take up to two years, with a possible extension if needed. Moreover, there is no precedent for an EU split as the UK will be the first member to break away from the EU. As of now, sterling and equity markets are going to be quite volatile until there is some clarity on the roadmap, whilst a flight to safety would boost assets such as gold, USD, and US/Swiss/Japanese government bonds. Helicopter money could be used to help stimulate growth. For Asia, reduced risk appetite among investors could prove to be the most challenging as currency and equity markets would be responding to the risk-off sentiment. However, the direct impact on economic growth remains limited as the key growth drivers for Asian countries likely would be Chinese growth and Fed action. Japan could be an exception due to its currency’s safe haven status, which could dampen its export income. |

|

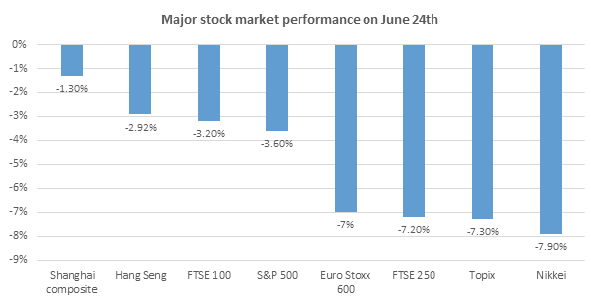

Short-term effects of Brexit ─ immediate impact of surprise “NO” vote harsher than expected, whilst recovery surprisingly quicker The immediate impact of Brexit ─ on the day after the UK surprisingly voted to leave the EU ─ was by and large worse than expected, as the “Leave” vote caught the markets off guard. In line with our earlier argument, the financial and currency markets were the first to react, but the immediate magnitude of the losses was much higher than expected. We present below the immediate impact on the key areas forecast in our previous Brexit report. ・Pre-Brexit Forecast: The first and foremost to react will be the financial markets ─ not just the UK or European but the global markets ─ as any sort of uncertainty derails recovery, given the fragile nature of the recovery so far. Even though the markets are pricing in the uncertainty, a no-vote will definitely dampen investor confidence across the globe. Post-Brexit: The global equity markets lost a massive USD 3trn during the first two days of trading following the referendum, with USD 2.8trn lost in the developed markets and USD 179bn in emerging markets. The left-hand chart below illustrates how much each of the major global markets lost on the first day of post-Brexit trade. Interestingly, the worst decline was seen in Japan with a fall of -7.9%, followed by FTSE 250 at -7.20% on June 24th. We would attribute this to the time factor ─ Japanese markets opened immediately after the results came out ─ and JPY appreciation to Japan’s worse than expected performance. Increased risk aversion amid heightened uncertainty resulted in a flight to quality, boosting safe haven assets such as gold, USD, US treasuries and other sovereign bonds considered safe such as Swiss and Japanese bonds. Meanwhile, commodity prices were under pressure on growth concerns. Brexit has started a bond rally which is likely to continue until there is clarity on the UK trade deal with EU.  Source: FT

Source: FT

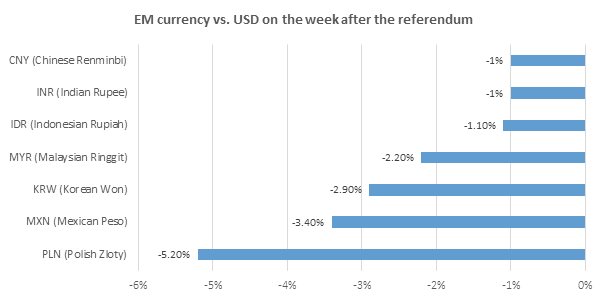

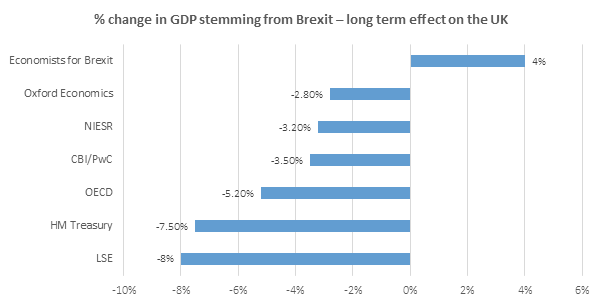

・Pre-Brexit Forecast: GBP will lose its value following the heightened uncertainty in the local and global markets, despite the depreciation of GBP since the Brexit topic came to the limelight. Post-Brexit: The GBP decline was the worst of all with GBP hitting USD 1.3229, declining by 11.1% during the day, although it recovered to USD 1.37 by end of trade that day. The GBP has been hit hard by Brexit and has been the main source of volatility, even affecting the financial markets. The limited fall of the FTSE 100 is largely attributable to the currency impact. The GBP depreciation propped up UK exporter companies, which helped the performance of the FTSE 100. Moreover, about 50% of the UK stock market is owned by foreigners, with FTSE 100’s foreign ownership at 60%. Hence, currency has had a pronounced immediate impact rather than long-run concerns, which explains the quicker than expected recovery as well.In addition to the GBP depreciation, emerging market currencies declined as well with markets entering risk-off mode. Consequently, emerging market currencies reacted negatively. However, decline in Asian currencies was limited. ・Pre-Brexit Forecast: Even though we mention the financial/currency markets as the first to react, political uncertainty is the critical problem. We simply do not know what sort of an agreement the UK government will be able to seal with the EU and how long it will take. Most economic think tanks estimate a transition period of at least 10 years, which does not bode well for the UK and the EU. Post-Brexit:Even though political uncertainty in the UK is the key problem, it is a longer term issue than the abovementioned currency and financial markets. We find the quick replacement of David Cameron a positive development, the new leadership’s stance on the EU relationship is yet to be seen. As a result, there is a delay in triggering the Article 50 even after the appointment of a new PM, still leaving a lot of uncertainty. The second source of uncertainty is the status of Ireland and Scotland, which could go for a second referendum to stay in the UK or be part of the EU. ・Pre-Brexit Forecast: For the EU, we can expect the same level of uncertainty given the UK remains a powerful member. Post-Brexit: Brexit will have a long-lasting impact on the EU depending on the direction of negotiations, but the immediate impact has been the loss of confidence in the system and could prompt other countries to follow the footsteps of the UK. In the 2 days since the vote, the Italian equity market fell 16%, Spain 14% and Greece 16% compared with FTSE 100’s 5.6%. ・Pre-Brexit Forecast: The IMF expects the long-run effects on UK output and income to be negative and substantial underpinned by increased barriers, which likely would reduce trade, investment and productivity. There is a wide disparity among economists about the negative impact of Brexit on the UK’s GDP growth starting from -2.8% to -8.0% of GDP. This itself exhibits the underlying issue of uncertainty about the relationships with the EU and the rest of the world post Brexit. Post-Brexit: It is too early to comment on this, but investments are on hold until the UK-EU relationship is sorted out, which reinforces lower growth during the transition period for the UK and EU.  Source: FT

Source: FT

Put together, the biggest immediate impact from Brexit was felt in the GBP depreciation, which was steeper than expected given the surprise vote. The equity markets reacted negatively as well and safe haven bond markets, gold and the USD performed strongly as investors flew to quality. As for growth prospects, we need to wait until the Q3 economic indicators are published. Quicker than expected recovery in markets suggests fear of Brexit overdone in the rest of the world The financial markets have recovered since then and ended last week with gains, erasing most of the losses with FTSE 100 gaining 7.2% on the week, the S&P 500 +3.2% and the volatility index down 4.8%, whilst oil has recovered to USD 50 levels. Based on performance of these markets, including the GBP which has since regained value, we can conclude that the initial stock market reaction may have been overdone. It appears that Brexit is not as bad for the rest of the world as it could be to the UK. Perhaps the biggest surprise from the post-Brexit market action was the rapid rebound in global equity prices following the initial sell-off. |

|

So what now ─ wait and watch for two years? Even 2 weeks since the UK voted to leave EU, the consequences remain ambiguous as no one knows how the trade deals will be re-negotiated and the future of the EU is uncertain as well. Below, we present the events that have happened so far, which buttresses the uncertainty around the UK-EU relationship and the consequent impact on growth prospects. 1) Political uncertainty in the UK: Even though a new Prime Minister has been elected earlier than expected, a positive development, downside risks still remain as we are yet to see the implementation and execution of the new leadership (and the cabinet), which increases uncertainty as the talks between the UK and EU will depend on the abilities of the new leadership. We are still awaiting the kind of relationship the new leadership wants with the EU, whilst the Article 50 has not been triggered as yet. 2) Future of UK-EU relationship: The UK-EU split will be governed by Article 50 of the Lisbon treaty, which takes in total a time window of 2 years for the UK to leave the EU. This itself increases the uncertainty as everyone will be waiting and watching for 2 years as to what is going to happen next? There is another catch here as the UK PM wants the article to be triggered in October when the new PM is selected, whilst the EU countries want it with immediate effect. So there is disagreement as to the timing of the UK leaving the EU as well. 3) Ireland and Scotland may demand a referendum to leave the UK: This would only further dent economic growth and investor confidence. 4) Prolonged low interest with accommodative policies from central banks: Lower economic growth has prompted central banks across the globe to cut or maintain interest rates at low levels as a policy to stimulate growth, starting with the BoE governor, who mentioned that interest rate cuts or more QE may be required. Moreover, the BoE has announced a GBP 250bn contingent facility. Following this comment, UK government yields have reached negative territory with the 2-YR bond yielding -0.003%. The Chancellor has reassured the markets that he would not inflict further austerity on the economy to achieve his 2020 target, despite his referendum campaign of imposing GBP 30bn of emergency spending cuts and/or a tax rate hike to plug the hole in public sector finances. To the contrary, the UK is considering reducing the corporate tax to 15%. The 10-YR gilt fell to 0.87% on an extended period of low interest rates and further monetary easing. The Fed will postpone its rate increase expected this June as well, which bodes well for emerging markets as a rate hike would have left no option for the EM central banks to stimulate growth. As to the central banks in Asia, it is a favourable development with Bank Indonesia referring to the Fed’s decision to postpone the June rate hike as an opportunity to cut rates. The Philippine central bank has also hinted at a shift in monetary policy after the Fed’s stance. As such, we would expect most central banks to further cut rates to stimulate growth. 5) Deflation: Consequently, we can expect deflation to dictate in the current ultra low-interest era, posing downside risks to growth. 6) UK sovereign rating downgraded: All three rating agencies have downgraded the UK’s credit rating to AA from AAA on deterioration in the UK’s economic prospects. 7) New investments on hold: Global investors and businesses will be reluctant to invest in the UK without a clear roadmap. For example, Siemens has put on hold its new wind power investment plans in the UK due to increased uncertainty after the vote. 8) Property market has been one of the worst hit as well: More than GBP 650m of commercial property deals have fallen through in London post-Brexit, including the proposed acquisition of an office block by German’s Union Investment. Property stocks have been the worst performers in the market and real estate funds are grappling with redemptions following the fall of real estate values. Standard Life has put restrictions on its GBP 2.9bn commercial property fund this week and Aviva Investments has halted redemptions from its UK Property Trust after redemptions rose sharply. In Asia, UOB in Singapore has suspended applications for UK residential properties amid uncertainty caused by the vote. Even though the fall in property prices and sterling decline offer good buying opportunities for foreign investors, rental income would decline upon translation. 9) Relocation of businesses: It is too early for businesses to start relocating, but financial firms like HSBC and manufacturing companies have announced that they will rethink their UK operations. HSBC intends to move about 1,000 jobs to Paris if the UK is not in the single market or the European Economic Area (EEA) once it finalises a deal with the EU. Japanese (Toyota, Nissan, Hitachi) and Indian companies (Tata) will face similar issues. However, this depends on the final terms of the deal. Toyota has already mentioned that Brexit could result in a 10% duty on cars manufactured in the UK and sold in the EU. Presently, Toyota exports almost 90% of the cars it manufactures in the UK, of which, 75% goes to the EU. Overall, the UK and Europe will be going through a period of uncertainty for the next two years until trade deals are completely re-negotiated. During that time, it will be a wait and watch policy for the rest of the world. However, the market response to Brexit suggests two things: (i) that investors expect the damage to the rest of the world caused by Brexit to be limited, and (ii) that the universal central bank response of low interest rates would support growth in the rest of the world. We expect central banks across the world to follow the Bank of England in stimulating growth through measures such as cutting interest rates and pumping liquidity into the system. The BoE governor has requested banks to stop building up special capital buffer, which would release as much as GBP 150bn in bank lending. We also expect most economies to adopt some form of helicopter money in the current deflationary world as QE has its own limitations.In conclusion, the rest of the world will be closely following the developments between the UK and EU before they take any drastic measures ─ wait and watch until they know the terms of the UK-EU relationship. |

|

The outcome of UK-EU negotiations post-Brexit will determine the fate of global economy The key concern is the terms of trade between the UK and the EU after Article 50 of the Lisbon Treaty is triggered. In our view, both parties should come to an agreement some time during the two year grace period. The long-run impact of Brexit will be felt then depending on the outcome. We look at three scenarios. i) Blue sky scenario: UK adopts a EEA model like Norway ii) Base case scenario: UK and EU are unable to have an “amicable divorce” and do not sign any deal at all iii) Worst-case scenario: Spillover of UK sentiment into the rest of the EU, leading to a break-up of the EU itself Blue sky scenario: UK adopts an EEA model ─ business as usual for everyone including Asia The EEA, European Economic area, is made up of the 28 (or now 27) EU countries plus Iceland, Norway and Liechtenstein, which allows for the free movement of people, goods, services and capital within the internal market of the EU. EEA countries not part of the EU benefit from free trade with the EU.Even though there are obvious reasons for the UK to favour this model, there may be one reservation ─ free movement of people. With the next PM still a big question mark, this is largely dependent on the immigration policy of the future head. We could say that some form of EEA minus deal would be ideal for the UK. However, the UK may have to give up something in return for more control over immigration. The final answer, however, lies with the EU, which is already antagonized by the UK vote. In the scheme of things, it is beneficial for both parties to enter into an EEA or EEA minus model. However, political and other factors will finally decide how the trade deal will be sealed. What would this mean to Asia and the rest of the world? Not to Asia and the rest of the world, but even to the UK and EU, this scenario will have limited impact on economic growth as trade and other activities will continue as normal. We can only gain some insight into the foreign policy of the UK after the October election of the UK Prime Minister, with home secretary Therese May currently in the lead. If Therese May is elected, the UK will likely take a hard stance on immigration, making it hard to seal an EEA deal. Base case scenario: No trade deal between UK and EU ─ reduces growth potential of UK, but has limited impact on Asia Another scenario could be that the UK and EU are unable to reach an agreement, which would dampen the UK’s economic growth prospects. But that is not a doomsday scenario as both parties can offset this impact by entering into trade deals outside the EU ─ the US, India, Australia, New Zealand, South Korea and Mexico have already expressed interest in getting deals done quickly. In particular, it will have a very limited impact on Asia due to a low level of existing trade links with the UK (exports to the UK equate to 0.7% of GDP on average for Asian countries). It will indeed have a negative impact from an FDI perspective but this is still not significant enough to hurt the economic growth of these countries. Worst-case scenario: EU break-up ─ Slows down the entire global economy, including Asia Brexit could shatter confidence in the EU, especially amongst those countries with fragile economies and weak banking sectors. The Italian PM is holding a referendum in October on the country’s reform package, which has raised concerns of Italy following Britain’s lead. Italy’s banking system is grappling with bad debts of USD 400bn ─ one-third of the eurozone total. Economic distress could trigger a Brexit for Italy. Germany has indicated France, the Netherlands, Austria, Finland, and Hungary could also leave the EU, which poses a threat to the very existence of the Union. Marie Le Pen, leader of France’s far-right National Front party, has promised to hold a referendum if she wins the country’s presidential elections next year. The Netherlands has also opposed a Ukraine-European treaty.All this points to risks of an EU break-up, an outcome which would be extremely detrimental to the entire global economy, including Asia. The EU represents 14% of Asia’s total exports and as such, a sharp slowdown in the EU likely would have a substantial impact on Asia as well. An EU break-up will most likely trigger a global recession which could take several years to overcome. |

|

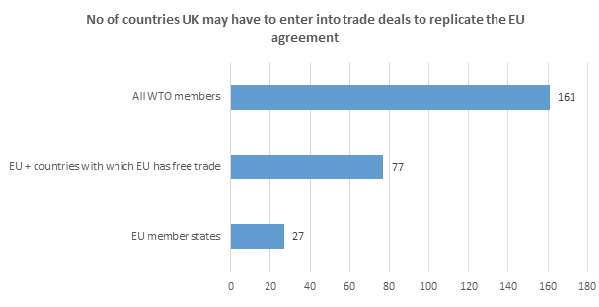

ASEAN unity remains the key to weather Brexit trauma Brexit is a test of unity of other economic blocs as it has shaken the confidence of member countries. ASEAN countries need to stick together and work to increase trade amongst each other, which should help make good any shortfall from Brexit. Brexit could also be taken as a warning for ASEAN nations to strengthen their relationships and improve economic ties within the region and with the rest of the world. Another positive step would be for ASEAN to enter into agreements with the UK as quickly as possible, given the removal of red tape from EU membership. The reason behind the previously protracted trade talks with the EU is that the terms have to be agreed and ratified by 28 (now 27) countries. The EU-Canada trade deal was held up for years by a dispute with Greece about the naming rights of a dairy product and still has not been signed. So far, the EU only has 32 trade agreements in force and that too mostly with smaller countries. The EU still does not have any trade agreement in place with Japan, the USA, India, China and Australia.Now that the UK is out of the EU, it should be easier for Asian countries to complete trade deals with the country, which would be a boon to both parties. India, too, has expressed that it would sign deals with the UK after the referendum results came out. ASEAN countries should thus work on a common platform to capitalize on this opportunity. |