Electric Vehicles and the Next Oil Crisis — Is the Threat Real?

|

Supported by revolutionary technology and information, the world’s major economies are moving towards lower dependence on fossil fuels. Concerns about climate change, the globalisation of the natural gas market, and affordable renewable energy make way for competition between conventional and non-conventional energy sources. |

|

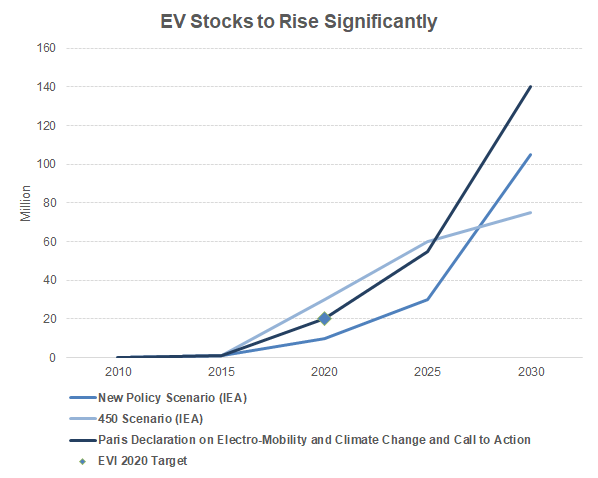

In addition, new and more efficient modes of transportation such as electric vehicles (EVs) are expected to gain significant popularity over the next few years. In line with this, industry expert predictions indicate that the total global stock of EVs will rise to approximately 150 million vehicles (8.3% of the global car fleet) from approximately 2 million vehicles in 2016 (0.1% of the global car fleet). In light of this, the common belief about the electrified powertrain is that it will revise oil demand downwards. Will this really be the case? According to the International Energy Agency (IEA), oil demand is expected to continue its slow and steady growth over the next several years, in line with its historical growth trend. This is despite new and upcoming trends in the market gaining traction as we speak. In our view, electric vehicles will continue its uptrend over the next few decades, but without leading to a collapse in oil demand, at least not any time soon. While it is true that there is potential for rapid growth in the market for EVs, bolstered strongly by a range of macroeconomic factors, its adoption at present is tepid. Based on our analysis, we believe that EVs will need to account for more than 22% of the total global car fleet by 2035E in order to pose a threat of a level that would cripple the oil industry. |

|

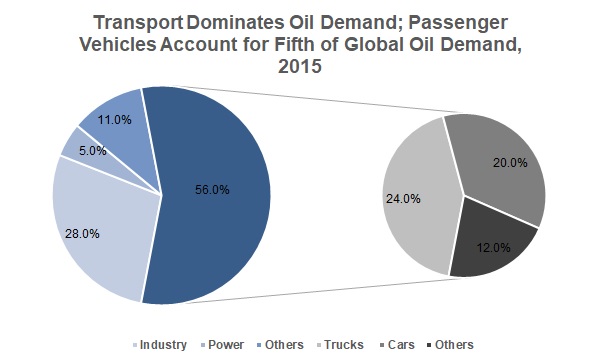

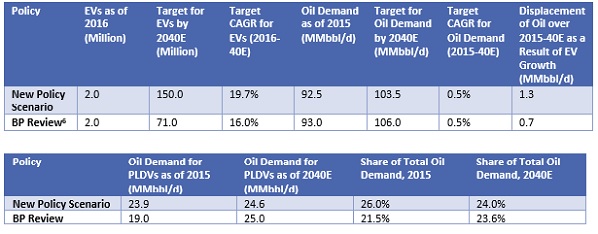

Electric Vehicle Evolution Expected to Cause Displacement in Oil Demand The 21st century marks the dawn of a new era for the electrification of the automotive powertrain, as the electric motor replaces the conventional internal combustion engine (ICE). The electric vehicle (EV) market has evolved from an unfamiliar concept into the next generation of transportation, with many positive macroeconomic factors arising from private and public sector, which drive growth.(1)The International Energy Agency’s (IEA’s) New Policies Scenario (2) projects an increase in the global EV stock to 150 million vehicles (8.3% of the total global passenger light-duty vehicle [PLDV] fleet (3)) in 2040E from 2 million vehicles (0.1% of the total (4)) in 2016. In line with the New Policies Scenario, global oil demand is expected to grow at a CAGR of 0.5% over 2015-40E (compared with a 1.3% CAGR over 2000-15) to peak at 103.5 million barrels per day (MMbbl/d) in 2040E from 92.5 MMbbl/d in 2015. Furthermore, in 2015, out of total oil demand, the transport sector accounted for a share of 56.0%. As of 2015, PLDVs consumed approximately 24.0 MMbbl/d of oil (26.0% of total oil demand). (5) These estimates were also similar for BP, as illustrated in the tables below, where we show different policy expectations for EVs and their impact on oil demand. Major Policy Forecasts as of 2016

Source: International Energy Agency (IEA), “World Energy Outlook 2016”; BP, “Energy Outlook-2017”

Source: International Energy Agency (IEA), “Global EV outlook 2017”, “World Energy Outlook 2016”; BP, “Energy Outlook-2017”

With the increasing popularity of EV technology, the emergence of EVs raises two important questions, each of which will be answered in this report: 1. How fast can EVs penetrate the global market? 2. What implications do EVs have on the global energy system (specifically with respect to global oil)? Note 1 :The report focuses heavily on electric cars, as they are the front runner in the EV market

Note 2 :The New Policies Scenario is referred to as the IEA’s baseline scenario (which accounts for policy commitments and other plans announced by countries) that includes the reduction of greenhouse-gas emissions and the phasing out of fossil fuels

Note 3 : Calculated based on BP estimates for the global car fleet for 2035

Note 4 :Calculated based on BP estimates for the global car fleet for 2015

Note 5 : This is for IEA’s New Policies Scenario

Note 6 :Expectations in BP review are stated up to 2035. |

|

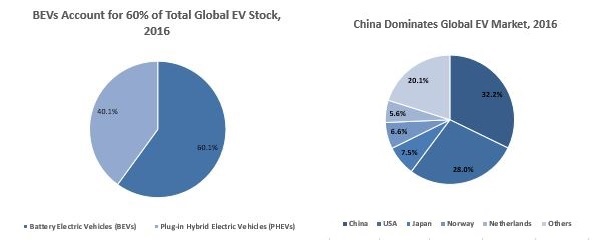

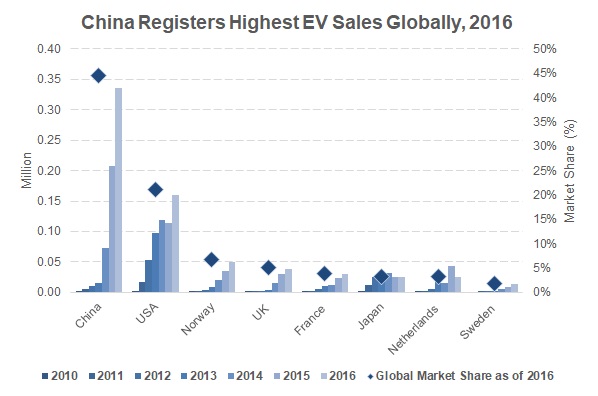

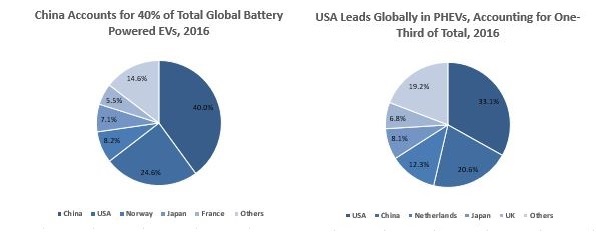

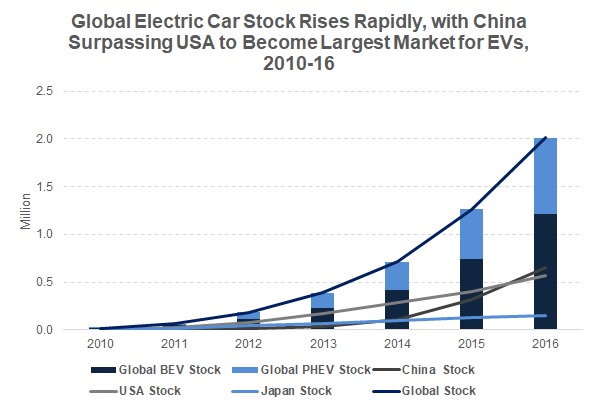

China: The Leading Electric Vehicle Market The EV market comprises two sub-segments: battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). The total global stock of EVs grew significantly to 2.0 million vehicles over 2006-16 (0.1% of PLDVs) from just 1,700 vehicles (less than 0.01%) in 2006. China dominated the global EV market in 2016 with a share of 32.2% of the total global electric car stock (BEVs and PHEVs), followed by the USA (28.0%) and Japan (7.5%). Although the global electric car stock is currently on a growth trend, annual growth rates have been declining. As of 2016, growth in the total global electric car stock decelerated to approximately 60% YoY from about 85% YoY in 2014, primarily reflecting changes to policy support from the private and public sectors. Despite the slowdown in the annual growth rates, the IEA expects a significant rise in the absolute global stock on the back of a favourable economic environment. Source: International Energy Agency (IEA), “Global EV outlook 2017”

Source: International Energy Agency (IEA), “Global EV outlook 2017” |

|

|

Source: International Energy Agency (IEA), “Global EV outlook 2017”

Note: The chart analyses the top three players in terms of global stock for 2016 |

|

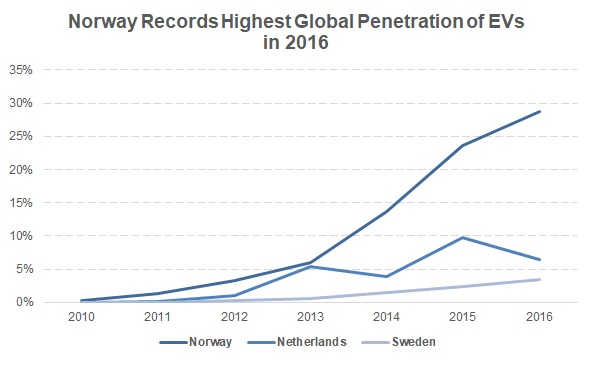

Outlook for EVs Positive, Supported Strongly by Falling Battery Prices, Increasing Vehicle Range, and Policy As of 2016, China leads the market in terms of annual new EV registrations, with a global share of 44.6%, followed by the USA (21.2%) and Norway (6.7%). However, not all global leaders in EVs saw high penetration; for some, this was in spite of higher shares of global sales. In 2016, only six countries achieved an electric car penetration of above 1.0% of total domestic passenger vehicles sales. Among these, Norway registered the most significant EV penetration rate (29.0%) in 2016, followed by the Netherlands (6.4%) and Sweden (3.4%). This was not the case for the three global EV market leaders (China, USA, and Japan), who averaged less than 1.0% of the total deployment of vehicles in 2016. The drivers of growth and year-on-year development in the global EV market are discussed in detail below. Source: International Energy Agency (IEA), “Global EV outlook 2017”

Source: International Energy Agency (IEA), “Global EV outlook 2017”

Note: The RHS chart shows only the global top three players’ penetration in 2016. Other players recorded considerably low penetration rates (less than or equal to 1%) through 2010-16. |

|

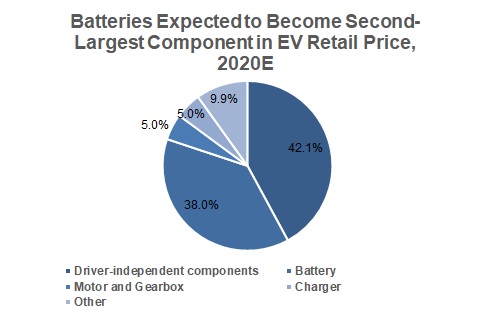

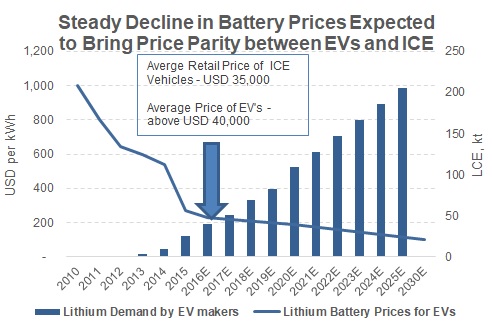

It is often understood, in line with the positive outlook for EVs, that growth in the EV market is driven largely by a favourable macroeconomic environment. As of 2016, three key support mechanisms are identified as primary drivers of the EV market: 1. Research and development (R&D) on innovative technology 2. Mandates, regulations, and financial incentives R&D embedded with key drivers/trends is discussed below. • Battery Prices Expected to Trend Down due to In-House Production and Economies of Scale One of the highlights of the R&D support mechanism is its contribution to the decrease in the cost of batteries, a major component in BEVs. According to Statista, battery cost is predicted to account for approximately 38% of the total cost of an EV by 2020E, making it the second-largest component of the total price, after driver-independent components. As per consulting firm McKinsey, average lithium-ion battery prices declined at a CARC of 23.1% over 2010-15 to USD 269.0 per kilowatt-hour (kWh) in 2015. This trend can be attributed mainly to large-scale, in-state battery production (e.g. Tesla’s new Gigafactory). Furthermore, EV automakers plan to increase their cost competitiveness by building more factories for production and thereby creating price competition. This is likely to bode well for battery prices and therefore for EV makers; McKinsey expects a tenfold decline in battery prices over 2010-20E to approximately USD 190.0/kWh by the end of 2020E, with potential to fall below USD 100.0/kWh by 2030E.

Source: Statista, “Distribution of the price of an electric car in 2020, by component”;

Source : McKinsey, “Electrifying insights: How automakers can drive electrified vehicle sales and profitability”; Deutsche Bank, “Lithium 101”

Note 1: Figures for 2016 and beyond are estimates

Note 2: The global lithium market is measured in terms of lithium carbonate equivalent (LCE), lithium carbonate being the most commonly traded product in the market |

|

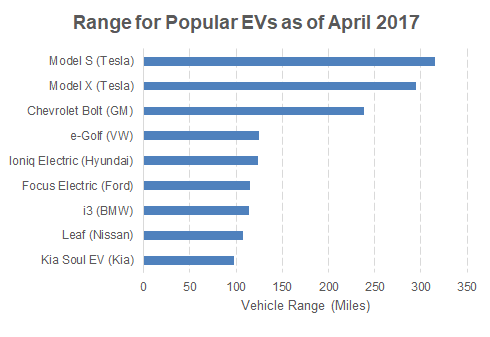

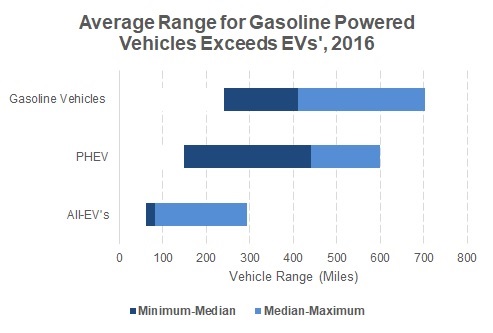

• EV Range Increases due to Improvements in Energy Density of Battery Packs The estimated range for most EVs has increased significantly over the past few years. According to McKinsey, base models such as the Nissan Leaf saw an approximately 40% rise in total range to 107.0 miles per charge over 2013-17. For most EVs, the range increase is attributed largely to increases in the energy density of battery packs. For example, for the Nissan Leaf, total energy density rose to 30.0 kWh in 2017 from 24.0 kWh in 2013. However, as of 2016, most EVs had shorter ranges than gasoline-powered vehicles. In 2016, the maximum range for an all-EV was found to be approximately 294.0 miles, while the minimum range for a gasoline model was around 240.0 miles. However, increasing range meets growing customer requirements for longer travel. Nevertheless, EVs have a long way to go before they catch up with their substitutes, which are also seeing range increases due to technological advancements in engines.

Source: Statista “EV range of selected electric vehicles as of April 2017 (in miles)”

Source: Clean Technica “Do All-Electric Vehicle Ranges Exceed Those of Some Gasoline-Powered Vehicles?” |

|

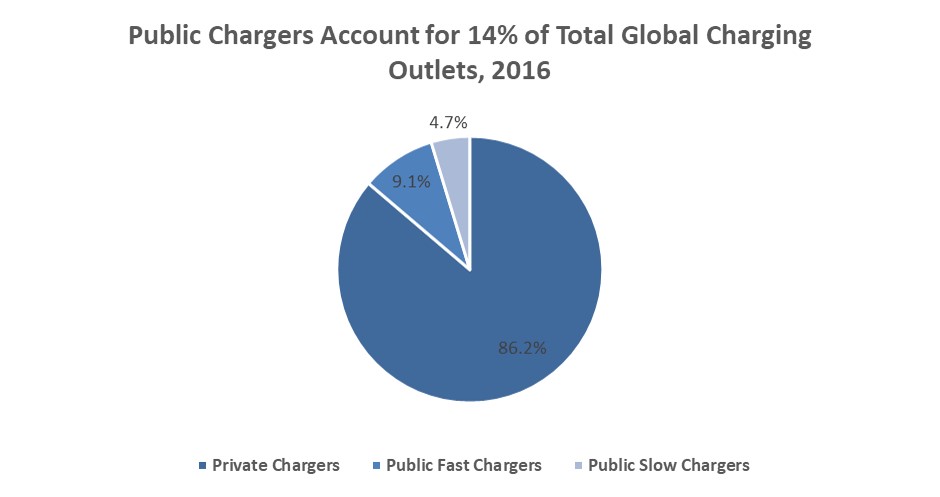

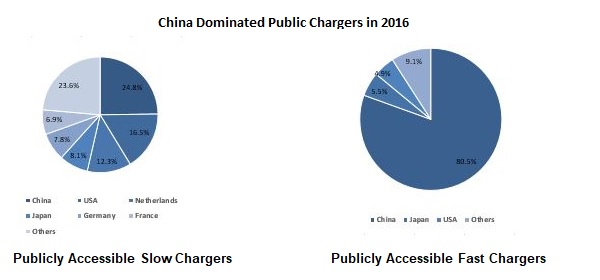

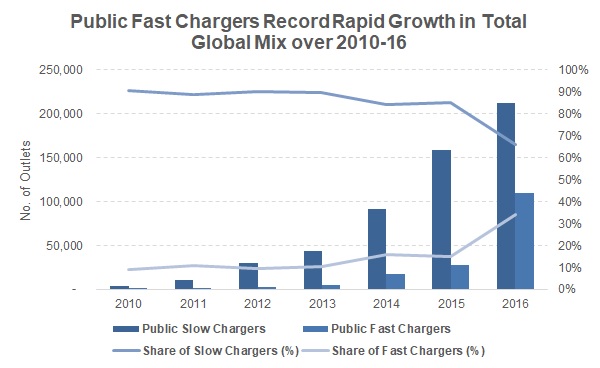

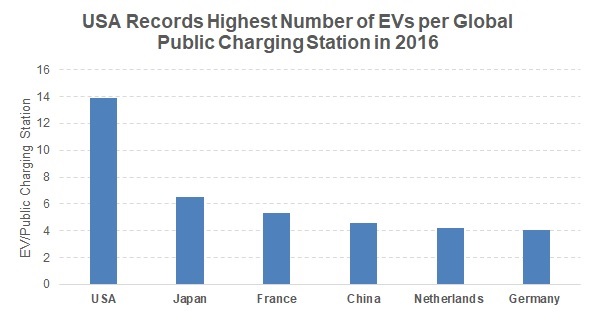

• EVSEs Increase, Supported Strongly by Rising EV Stock According to the IEA, the total number of global electric vehicle supply equipment (EVSE) outlets grew to 2.3 million in 2016 from just over 11,000 outlets in 2010. Electric cars continued to outnumber public charging stations by more than six to one in 2016, indicating that most EV users relied on private charging stations.(7) Global public EVSE outlets have grown significantly in line with growth in EVs over 2010-16, reaching 322,265 outlets in 2016 (14.0% of the total global EVSE outlets). This growth has been driven largely by a sevenfold increase in fast chargers in China over 2010-16 to 88,475 outlets (4.4% of the total) on account of rising demand for electric buses. For more about country policy/targets for EVs, please refer to the appendix at the end of this report.

Source: International Energy Agency (IEA), “Global EV outlook 2017”

Source: International Energy Agency (IEA), “Global EV Outlook 2017”

Source: International Energy Agency (IEA), “Global EV Outlook 2017”

Note 1: Slow chargers include AC Level 2 chargers (> 3.7 kW and ≤ 22 kW)

Note2: Fast chargers include AC 43 kW chargers, DC chargers, Tesla Superchargers, and inductive chargers

Source: International Energy Agency (IEA), “Global EV Outlook 2017”

Note 7: We assume that each electric car has its own private charger |

|

Electric Vehicles No Threat to Oil Industry, Given Negligible Oil Displacement According to BP Energy Outlook (2017), total oil consumption is expected to grow at a CAGR of 0.7% to 106.0 MMbbl/d (28.5% of the total energy mix) in 2035E from approximately 93 MMbbl/d (32.3% of the total) in 2015 (latest data available). This is consistent with the IEA’s prediction on oil consumption for 2040E. In 2015, the transport sector accounted for 56.0% of total oil demand; of this, trucks accounted for 24.0%, cars for 20.0%, and other means of transport for the remainder. According to BP, as of 2015, 0.9 billion cars consumed approximately 20 MMbbl/d of oil (21.5% of total oil demand) globally.

Source: BP, “Back to the future: electric vehicles and oil demand”

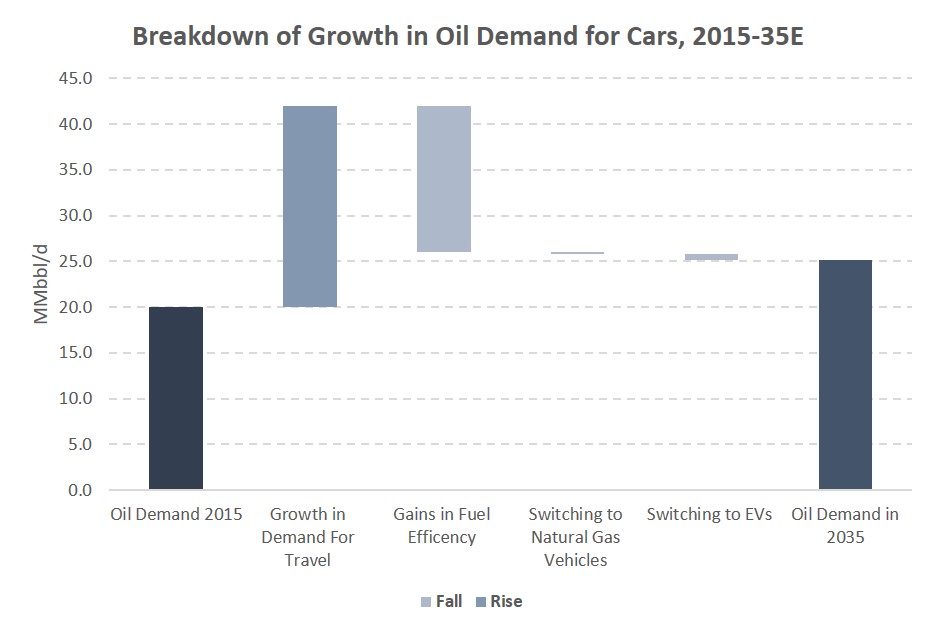

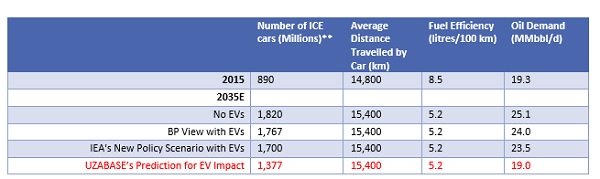

Understanding the role EVs play in oil demand requires analysing the reasons why oil demand is expected to rise. According to BP, the total global car fleet is expected to double to approximately 1.8 billion cars over 2015-35E. This is expected by BP to cause demand for oil from the passenger vehicle segment to rise to approximately 25 MMbbl/d (23.6% of expected total oil demand) in 2035E, on the back of growth in developing economies, where most families are likely to be able to afford more cars in future. However, interestingly, the expected doubling of vehicles over 2015-35 is not expected to double oil demand over the same period. This is on account of many different factors including vehicle efficiency, which is expected to increase substantially over the next 20 years (to 5.2 litres per km in 2035E from 8.5 litres per km in 2014). However, growth in EVs is not likely to have as significant an impact on oil demand as one would initially expect. EVs are expected to account for only approximately 8% of the global car fleet by 2035E despite their steady increase. According to BP Analytics, the projected drop in oil demand over 2015-35E as a consequence of growth in EVs is less than 1 MMbbl/d (5.3% of oil demand for cars in 2015). Source: BP, “Back to the future: electric vehicles and oil demand”

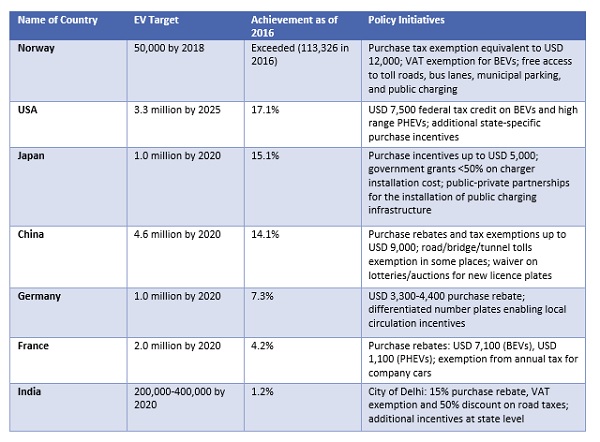

In line with BP, we predict that more than 400 million EVs (8) (22.2% of the expected global fleet) will need to be deployed by 2035E in order for demand for oil for cars to begin to decline. As of 2016, current predictions lie in the range of 100-150 million EVs (four times smaller than our estimated number required to impact oil demand), with most countries far behind achieving their EV targets as of 2016 (9). Nevertheless, rising market shares, more state support, increasing preference, and lower costs of ownership are likely to help make EVs the transportation of the future. Note 8 :Refer Annexure

Note 9 :Refer Annexure |

|

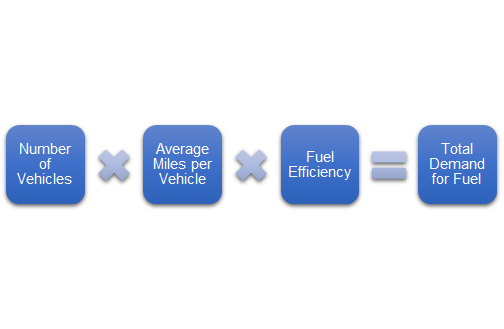

Annexure Calculation of EVs’ Impact on Oil Demand A technical analysis behind the calculation of oil displacement is given below, in order to show why we agree with BP’s view on the impact of EVs on oil demand. The following is an assumption on demand for energy for cars:

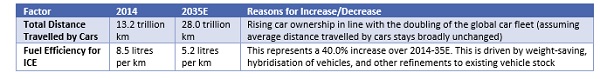

Source: BP, “Back to the future: electric vehicles and oil demand”

The following are also assumptions about the above factors, in accordance with BP’s view in 2016. Source: BP, “Back to the future: electric vehicles and oil demand”

We also assume a split between BEVs and PHEVs of 60:40 (BEVs: PHEVs), in line with 2016 numbers. We estimate the impact on oil demand in each of the following scenarios: Predictions for Oil Demand by Scenario

Source: BP, “Back to the future: electric vehicles and oil demand”; IEA, “World Energy Outlook, 2016”; Predicted EV impact calculated by UZABASE.

Note 1: **Number of ICE cars = Pure ICE cars + 0.5 * PHEV cars, based on the assumption that PHEVs drive half their miles under ICE power (BP). UZABASE also assumes that PHEVs account for 0.4 of the total EV stock

Note 2: Oil demand in Mb/d = (number of cars) * (average distance) * (fuel efficiency) * (conversion factor). The latter term converts oil demand from hundreds of millions of litres per year into million barrels of oil per day using the following formula: (1/100) * (1/159) * (1/365)

Note 3: IEA figure calculated by UZABASE

Note 4: UZABASE figure based on UZABASE analysis and BP data

Policy Support Governments Lag Far Behind Achievement of EV Targets

Source: International Energy Agency (IEA), “World Energy Outlook 2016” and “Global EV outlook 2017”

Note: Shown in descending order of “achievement as of 2016” |