Country Report 2016 – India

November 14, 2016

by Senith Pathirane, Nuzran Sahib, Kanchana Nirupamala (Research and Analysis Team)

Executive SummaryIndia’s ascent in the global economy has been one impressive story and has commanded the attention of many. The Indian economy continued to demonstrate resilience and strength in terms of economic growth, making it the fastest growing economy during 2016. The economy is on a recovery path, largely aided by trade gains, positive policy actions by the government, improved business confidence and reduced external vulnerabilities. Growth in the economy has largely been driven by strong domestic consumer demand. Moreover, the fall of global oil prices underpinned further improvement in the current account and fiscal conditions, while simultaneously bringing about a sharp decline in inflation, which created space for nominal policy rate cuts. Finally, reduced external vulnerabilities have made India a safe haven for foreign investment, thereby strengthening continuous inflows into the country. Our analysis suggests that the Indian economy will continue to remain on a positive growth trajectory with investment growth likely to pick up and finally surpass consumption growth over the next several years. This is consistent with a stable political economy, backed by conclusive policy actions set forward by the new government in play, where Prime Minister Narendra Modi has made important strides towards economic growth and development. Furthermore, if the US remains strong, capital inflows especially in India are likely to increase, with further support of liberalisation for FDI in many key sectors. On a different note, global deflation, which is a concern, need not lead to depression in India on account of the fact that causes of deflation are not debt- induced as in the case of the United States. The outlook for inflation remains consistently low, which is largely conditional on volatile global prices and the state of consumer demand. In addition, a stable financial system and stable economic conditions lowers uncertainty and reduces India’s exposure to emerging risks in the global and financial markets. Most risks relate to the impact of global market volatility, including unexpected developments in terms of the US monetary policy normalisation. Domestic risks include weakness in corporate financial positions and banking system asset quality, which could severely weigh on growth, accelerate inflation or even undermine sentiment. Our study aims to bring these changing dynamics and highlight India’s global image in several dimensions. This report is composed of four different sections, each discussing key areas of concern on a demographic, economic, political and financial front. It is expected that India is likely to play a vital role in the international economy. With India growing much faster relative to many regional peers across the globe, we project that the country is on track to becoming one of the most lucrative investment destinations in the world within the next few years. |

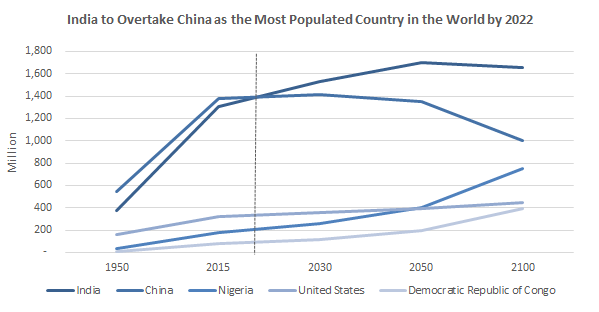

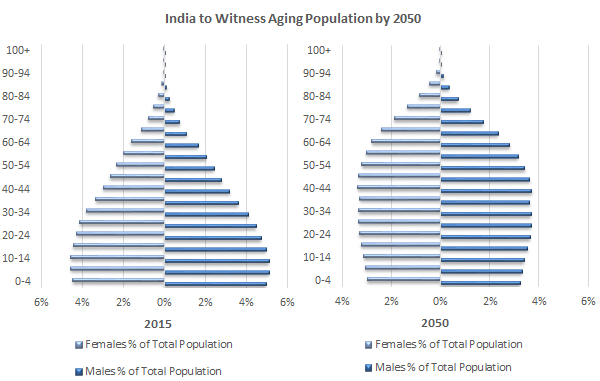

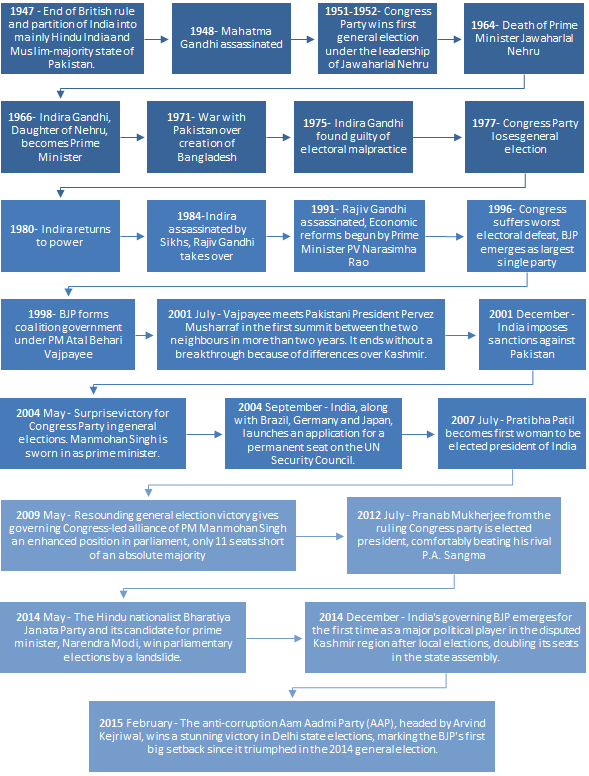

Country OverviewFormer British Colony Thrives Post Independence Situated in the South Asian sub-continent, India shares a common history of dynastic rules with its neighbouring countries. While a lot of dynasties played a major role in the development of Indian history, the arrival of the British East India Company during the 18th century changed the dynamics, while playing a decisive role in India’s economic and political life. Their main aim was to engage in trade and gain political control of the country by exploiting the weaker divisions of several hundreds of minor kingdoms in the country. Eventually dethroning the last Mughal ruler, India was colonised by the British in the year of 1858. This led to the formation of the Indian empire, which then consisted of today’s India, Pakistan and Bangladesh. Their stay lasted up until the 20th century. However, the British rule left the Indian economy completely devastated. During this time, India experienced frequent famines, persuasive malnutrition, was largely illiterate and recorded one of the lowest life expectancies in the world. India’s share of world income, which was recorded at 27% in 1700 (against 23% for Europe) saw a sharp decline to 3% in 1950, indicating that the country suffered immensely from over-exploitation by the British. However, the colonial rule ended in 1947, with India gaining independence from British rule. This put India back on track for development. India went for centralised planning and introduced the Five-Year Plan for economic development in 1952. Initially, the country experienced large investments from the agrarian sector, before moving on to other areas such as industry development and scientific research and programmes. Today, not only is the country one of the fastest-growing nations in the world but has also gained popularity in many of the major sectors such as services and other innovative technologies. The country is expected to become a world superpower in the near future, with growth based on untapped potential in many of the sectors in the country. This is bolstered by a favourable macroeconomic environment in terms of rising investments, savings, and consumption. India to Have World’s Largest Population Earlier than Expected As of 2015, India was the second most populated country in the world with a population of 1.3 billion (17.9% of world population), trailing after China (1.4 billion and 18.7% of world population). In 2015, India grew at an average annual population growth of 1.2%, ranking 98th in terms of the fastest growing nations in the world, while China grew at 0.5%, occupying the 162nd place in the list. The United Nations predicts that India will become the most populated country in the world, overtaking China by 2022 – ahead of the previous estimated year of 2028. This phenomenon is explained by the rapid decelerating population growth in China against that of India. The UN further goes on to state that India is likely to retain the top spot up to 2100, with a cumulative global share of 14.8% followed by China (9%), Nigeria (6.7%), the United States (4%) and the Democratic Republic of Congo (3.5%). As of 2015, India was more densely populated (441 people per sq. km in 2015) than China (146 people per sq. km) and is expected to continue to be so for the next several years. Despite this phenomena, India is likely to experience a condition of aging population. In 2015, up to 62.3% of the population fell under the category of 15-59 year olds, with 8.9% of the population above the age of 60. However, by 2050, it is expected that up to 19.4% of the total population will be above the age of 60. The changing dynamics of the population story is often looked at more closely with the two world giants, India and China. Based on the latest UN assessment, the total fertility rate in China was estimated at 1.6 children per woman in 2010-2015 (6.1 in 1951), while India recorded a higher fertility rate of 2.5 children per woman (5.9 in 1951) for the same period. However, fertility rates for China are expected to further decline much faster than that for India. Despite the relaxation of its one-child policy, China has not been able to slow down its decline in population growth. This was associated on the back of many families, especially those in urban areas, who were reluctant to have large families (A trend seen in most developed nations).The continuously higher fertility rate in India was thus the driver towards the relatively higher population growth. This was further seen clearly with India who recorded a higher average crude birth rate of 20 in 2014 (26.5 in 2000) against China recorded an average crude birth rate of 12 for the same year (14 in 2000).  Source: United Nations, UZABASE

Note 1 -Figures beyond 2015 are expected values

Note 2- Line drawn at 2022.

Source: United Nations, UZABASE

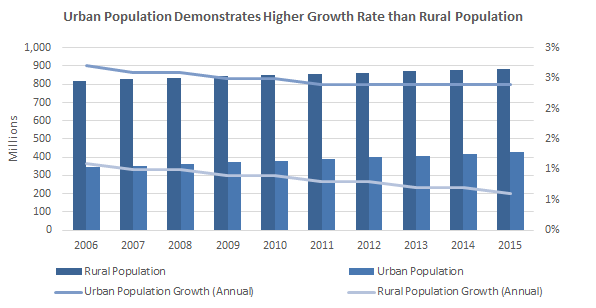

Growing Urbanisation in India: A Messy and Hidden Phenomenon? As of 2015, India recorded an average urban population of 429 million (32.7% of total population). On a comparative note, India ranks low in terms of the share of urban population in contrast to other major countries such as the United States (82%), Malaysia (75%) and China (56%). However, the level of urbanisation has shown improvement over the years compared to 27.8% in 2001. In spite of this, one of the most notable discrepancies in the level of urbanisation is that it is often considered to be an understatement. According to World Bank, it was found that the total urban sprawl accounts for nearly 55.3%, based on the agglomeration index, which is in contrast to the overall census figure of 2011, indicating the existence of hidden urbanisation. The concept of “messy urbanisation” is thus associated with India, where nearly 65.5 million Indians lived in urban slums (5.5% of total population) as well as the 13.7% of the urban population that lived below the national poverty line in 2011. Yet despite an understatement, it is believed that the urban population in India is likely to show further growth over the next several years. The United Nations predicts that by 2050, India, China and Nigeria will account for an approximate cumulative share of 37% in terms of the projected growth in the global urban population. Over the period of 2014-2050, India is expected to add 404 million urban dwellers (16% of total addition), followed by China (11.9%) and Nigeria (8.6%). This growth in urban population will be stimulated by several factors, some of which will include population growth, rural-urban migration, and development of large towns and cities in the country. During 1990-2001, the natural growth of population drove the share of urban population upwards, while based on recent trends, the contribution from it was observed to have declined. Today, nearly one-fifth of the total urban population growth is attributed mainly towards rural-urban migration in the country. As a whole, all these factors have affected growth positively, although stronger policy interventions are likely to be needed to bring about further development in urbanisation.  Source: World Bank Development Indicators, UZABASE

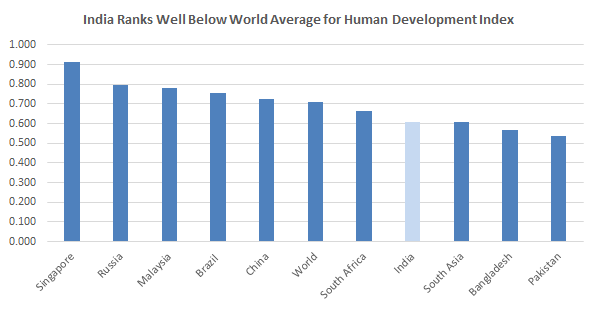

India Moves up the Ranks for HDI despite Ranking Low Amongst Regional Peers India has continued to rank low as per the Human Development Index (HDI), measured on the basis of health, education, standard of living and gender equality. However, it climbed five notches to the 130th rank among 188 countries in 2014 against its 135th rank in 2013 on account of rise in life expectancy and rise in per capita income. The HDI stood at 0.609 in 2014, demonstrating an increase of 68.1% against a value of 0.362 in 1980. Despite a rise in ranks, India continued to position itself quite low among regional peers and recorded the lowest rank amongst the BRIC countries, with Russia at 50, Brazil at 75 and China at 90 and South Africa at 116.  Source: UNDP, UZABASE

Note-HDI is expressed to 3 decimal places

Based on the findings of the report released by the UNDP in 2015, it was observed that life expectancy at birth rose to 68 years in 2014 from 53.9 years in 1980, thereby reporting an increase of up to 14.1 years. In addition to this, the Gross national Income (GNI) per capita rose to USD 5,497 in 2014 recording an astounding threefold increase in value from USD 1,255 in 1980. However as per the report, the expected years of schooling is stagnant at 11.7 since 2011. In addition to this, the mean years of schooling at 5.4 has not changed since 2010. As compared to the BRICS and some other neighbouring countries, India, reports the least mean years of schooling and a life expectancy that is just above that of South Africa. Bangladesh, with less GNI per capita than India has a much higher life expectancy and mean year of schooling. China, who ranked higher than India for HDI, has widened the margin for many of the indicators, compared to India. This indicates that a lot remains to bridge the gap between India and the rest of the world. HDI Component Indices of Selected Countries for 2014

Source: UNDP, UZABASE

Note- GNI (gross national income) is based on 2011 dollar purchasing power parity (PPP).

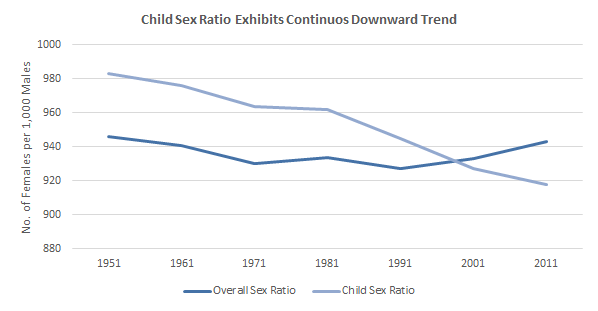

The Daughter Deficit on the Rise- Long Term Consequences on Sex Ratio Expected While being a country with a large number of female deities, who are worshiped for strength, courage and for general wellbeing, India continues to follow its traditional preference for the male child/son. Contrary to this, the overall sex ratio, increased to 940 females per 1,000 males in 2011 from 933 in 2001. This was supported greatly by higher life expectancy of women as against men in India, indicating older women in the population. However, the recent census noted that the child sex ratio, sex ratio in the age group 0-6 year olds, declined to 918 females per 1,000 males in 2011 from 962 in 1981, the worst since post-independence. This clearly indicates that a child’s chance at life greatly improves once she crosses the age of six. This further goes on to indicate that only fewer girls were born in comparison to boys and has highlighted gender discrimination, which has become one of the most pressing issues in the country. The dwindling child sex ratio has been attributed to several factors such as high maternal mortality, female infanticide, and female foeticide. This is mainly because of the high preference for a male son as most girls and women are looked down upon as a burden in a patriarchal society. Most women, especially young girls, are not seen as beneficial investments for many families, with the concerns of dowry and family lineage been brought about. Thus, the problem was identified to be more socio-cultural, which is believed to have dangerous impacts on the overall sex ratio in the country, which could decline in the future. As a part of combatting the issue of the declining child sex ratio, awareness campaigns were raised in the country. Religious and spiritual leaders have been asked to speak against sex selection. In more recent news, the Prime Minister Narendra Modi launched the “Beti Bachao- Beti Padhao” campaign to generate awareness and improve efficiency in terms of welfare services meant for girls and women. The campaign aims to ensure that girls are born and well looked after and given the right to proper education. Although such intervention could prove beneficial to the declining numbers, the general perception of a girl child and outdated beliefs are yet to be addressed.  Source: Indian Census Data 1951-2011, UZABASE

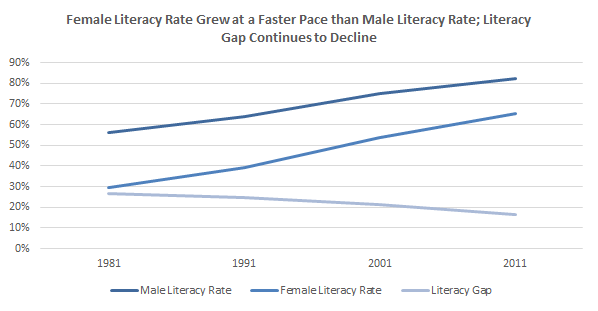

Rising Literacy Rate Hints Growing Importance of Education; India Boasts of Extensive Higher Education Market Based on the last census conducted in 2011, the literacy rate of India rose to 74.0% from 12.0% in 1947. The improvement was mainly attributed to the country’s development on an economic and social front. However, India ranks low in terms of the literacy rate, compared to other peers such as China (95.1%), Malaysia (93.1%) and Indonesia (92.8%), indicating that the country faces severe issues in terms of its literate population. On a state-wise analysis, it was noted that Kerala occupied the highest literacy rate at 94.0% while Bihar recorded the lowest literacy rate in the country at 61.8%. On further analysis, the male literacy rate for 2011 stood at over 80%, while female literacy levels were recorded at 65.5%. In spite of this, the female literacy rate in India has increased at a faster rate than male literacy rate during the period of 1981-2011 reducing the gender gap literacy to 16.6% in 2011 from 26.6% in 1981. This was attributed strongly with government measures undertaken to create awareness of literacy while also enforcing stricter rules to achieve female equality towards education.  Source: Open Governmnet Data Paltform India, UZABASE

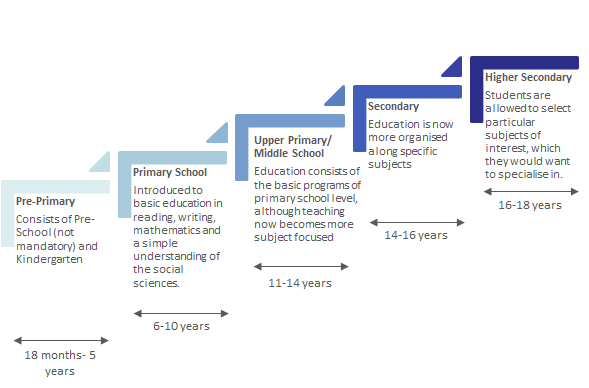

In line with the growing literacy rate, the emphasis to read and write has become a key area af concern, with importance placed on schooling institutions. In 2015, the education market was worth about USD 100 billion and is expected to reach USD 144 billion by 2020. Currently, higher education contributes 59.7% of the market size followed by school education (38.1%), pre-school segment (1.6%). Schools in India are owned either by the government (Central/State) or by the private sector (individuals, societies or trusts). The government occupies 77% of the total mix, while the rest is accounted for by the private sector. Despite the lower share, the private sector has continued to witness increasing corporate investments over the years, which has contributed significantly towards its rising share of schools. Segmentation of Indian Education by Level of Education

Source: British Council India, UZABASE

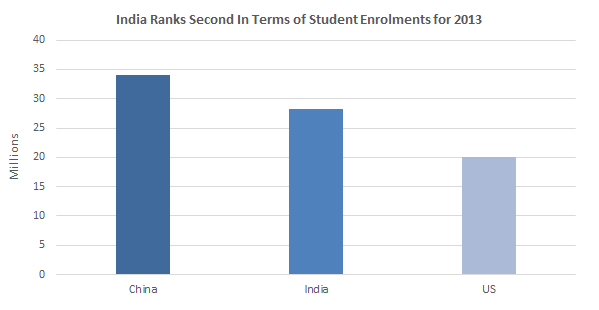

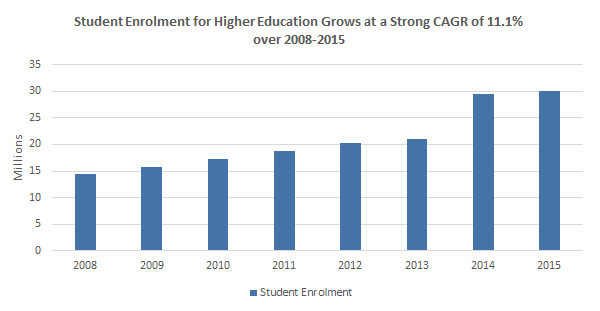

Once done with secondary schooling, a student progresses on to tertiary education. In India, the higher education system has been growing rapidly driven by a growing number of student enrolments, increased spending on education by the country’s middle-class population and greater participation from the private sector. In 2013, India was ranked the largest higher education market (in terms of the number of institutions) followed by the US and China respectively, while India ranked second in terms of the number of student enrolments in higher education institutions , following China with the US occupying third place . As of 2015, the higher education market in India comprised of 760 universities, 38,498 colleges and 12,276 standalone institutions. Furthermore, India has 14 open universities and 150 distance education centres, which account for 20% of the higher education system. In terms of Gross enrolment ratio (GER) in higher education, India witnessed an improvement in the ratio to 23.6% in 2015 from 21.5% in 2013, signifying easing access to higher education in the country. Over the next decade, the higher education system in India is likely to be affected by several socio-economic factors that make it imperative for the country to have a robust higher education system. By 2030, India is likely to have 142 million students aged 18–23, potential aspirants for higher education. According to projections, India would be the third-largest economy worldwide by 2030, creating an underlying requirement for an estimated 250 million workers in the local industry and service sectors. This is likely to further spur demand for institutes offering vocational education in the country. Other factors influencing the country’s higher education market include the growing capacity to cater to the incremental demand for higher education (to achieve a gross enrolment ratio (GER) of 50% by 2030), increasing access to affordable education for underprivileged/low-income sections and greater availability of vocational training to facilitate the creation of a skilled, competent workforce.  Source: UNESCO, IBEF, UZABASE

Source: UNESCO, IBEF, UZABASE

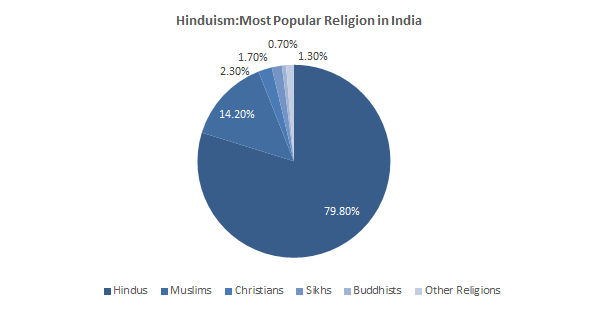

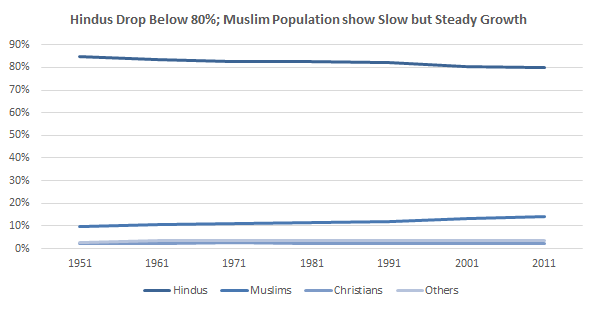

Religion in India: A Context for Diversity India is home to one of the world’s most diversified group of religious beliefs and practices. As per the religious census for 2011(released in 2015), 79.8% of the population was found to practice Hinduism, followed by Islam (14.3%), Christianity (2.3%) and other religions (3.6%). Compared against the last census carried out in 2001, the number of followers for Hinduism dropped to 79.8% in 2011 from 80% in 2001, continuing to show a declining trend. On a related note, the number of Muslims in the country has continued to show an upward trend, with the total share rising to 14.3% in 2011 from 13.4% in 2001. Despite India being the origin of many other religions such as Buddhism, Jainism, and Sikhism, the total share for these religions remains below 2%.  Source: Wall Street Journal, Aljazeera, UZABASE

Source: Wall Street Journal, UZABASE

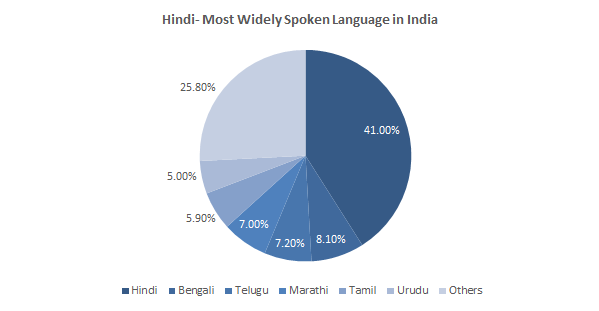

Diverse Indian Ethnicity Makes Knowing Cultural Norms a Necessity India is often recognised as a country with a rich history of a diversified range of different languages. As per recent available data (Census 2001), India recorded a total of 1365 rationalised mother tongues. This was further subdivided to arrive at 234 identifiable mother tongues, out of which 22 languages (9.4%) were classified as major languages in India. The enumeration data points out that the most widely spoken language in the country was Hindi, with a total of 422 million people (41.0% of total population), followed by Bengali (8.1%), Telugu (7.2%), Marathi (7%), Tamil (5.9%) and others (30.8%). Most states, including Uttar Pradesh, Madhya Pradesh, Bihar, Chhattisgarh, Rajasthan, Uttarakhand, Himachal Pradesh, Haryana, Delhi, and Jharkhand recorded Hindi as their respective mother tongue. Based on further analysis, it was observed that Hindi has shown steady growth since 1971, with an overall increase to 41.0% in 2001 from 37.0% in 1971. However, most other major languages have continued to show a marginal decline in their speakers as a percentage of the total population.  Source: India Census Data 2001, UZABASE

Despite Hindi being the official national language of the country, most business transactions are conducted in English. While it is considered very difficult to generalise Indian culture, a few of the common features can be identified. These are discussed below: India: Multi-culturally Diverse- Identifying Key Cultural Traits

Source: UZABASE |

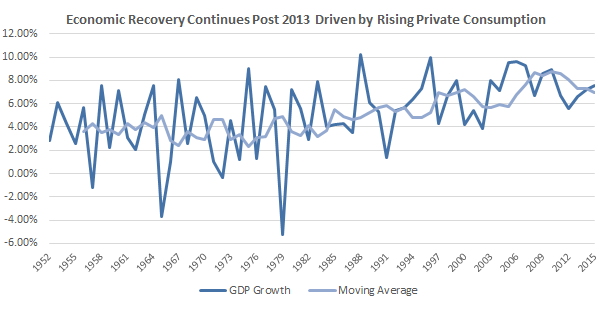

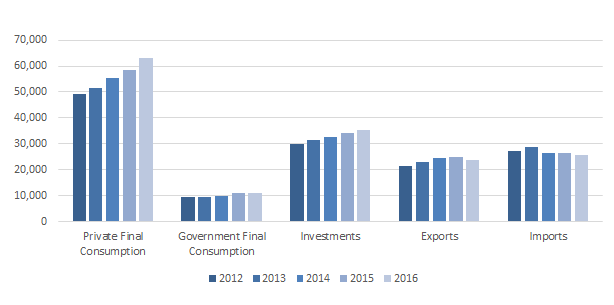

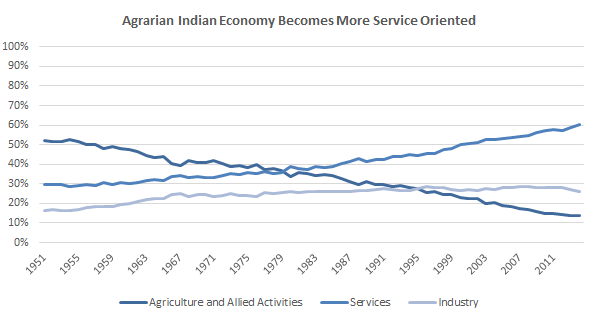

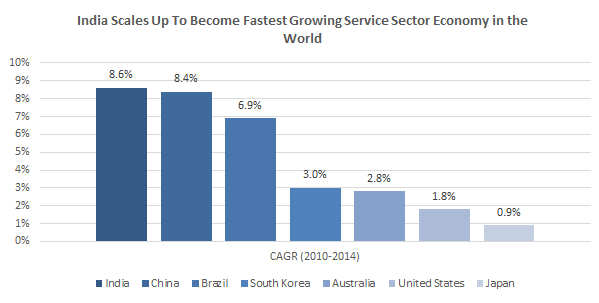

Economic OverviewGrowth Outlook Remains Positive Amidst a Favourable Macro-Economic Landscape India, with a USD 2.1 trillion economy ranking seventh largest in the world, accounted for approximately 3.0% of the total global nominal GDP in 2015. However, given that India has the second largest population in the world, its GDP per capita stands at only USD 1,581. This is comparatively lower than the United States (USD 55,837), China (USD 7,925) and the World Average (USD 10,000). As of 2016, services contributed up to 53.5% of total GDP up from 30.9% in 1962 followed by the Industrial Sector (31.2%) (20.1% in 1962) and others. One of the most notable trends in the composition change over the years was that the contribution from the Agricultural sector declined steadily to 15.3% in 2016 from 46.3% in 1962. This was attributed to the shift from a traditional agrarian economy to a more industrialised and service sector oriented country. In the past, the Indian economy continued to display variable growth at different points of time. Over the period of 2000-2011, the growth of GDP remained positive, within the range of 3.9%-9.6%.However, in January 2015, the Central Statistics Office (CSO) updated the base year and introduced a new series for GDP. Based on this, India recorded a real GDP growth rate of 5.6% in 2013, which was recorded as one of the lowest the country had faced in a decade. This was on the back of poor performance in different sectors of the economy, such as the manufacturing, agriculture and services sectors. However, the economy has since been on a gradual cyclical recovery reaching 7.2% growth in 2015 followed by 7.6% growth in 2016, and is now classed as the fastest growing economy in the world. The upward trend observed in the recent past was underpinned by rising private consumption (benefitting from lower energy prices and higher real wages) which grew at 7.6% during 2016 as against 6.2% in 2015, indicating a trend of increasing demand. In addition to this, strengthening policy credibility coupled with rising industrial activity is expected to aid recovery. Bearing this in mind, India is expected to witness a further rise in growth rates to 7.8% by 2019 and its GDP is projected to more than double to USD 5 trillion by 2025, backed by strong monetary and fiscal consolidations.   Source: Statistic Times, Reserve Bank of India (RBI), Central Statistics Office (CSO), UZABASE

Source: Planning Commission India, UZABASE

Note- Graph records % contribution of each sector to GDP

Source: Central Statistics Office (CSO), Union Budget 2015-2016-Government of India UZABASE

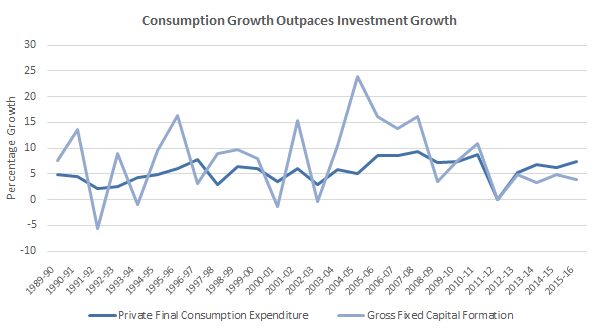

Make in India Restores Business Confidence for Volatile Investment Growth in India- Investments Likely to Pick up One of the most notable highlights on the demand side is the volatile growth of Gross Fixed Capital Formation (GFCF) at constant prices. Despite improvements in the absolute value of capital formation, the contribution of GFCF to GDP (investment rate) for 2016 stands at 29.3%, in contrast to 30.8% in 2015. The year 2015-2016 marks the third consecutive year of decline in the investment rate, with the trend commencing at an investment rate of 34.1% in 2012-2013. The declines in the investment rate in 2013 and 2014 were largely reflecting the stagnant contribution from non-financial corporations to the GFCF, which improved marginally to approximately 47% in 2014 from 44% in 2013. However, other problems such as a weak domestic and external environment coupled with structural factors such as delays in land acquisitions, environmental clearances, weak business confidence and policy uncertainties, contributed to the overall decline the investment rate for the country. In 2015, business confidence improved in response to many government initiatives such as the ‘Make in India” campaign and faster clearances of stalled projects with respect to non-environmental permissions. Despite the fact that private investment remained muted and higher risk aversion tightened financial conditions, favourable drivers are expected to come around to provide for a turnaround in the capex cycle for the country.  Source: Reserve Bank of India, Central Statistics Office, UZABASE

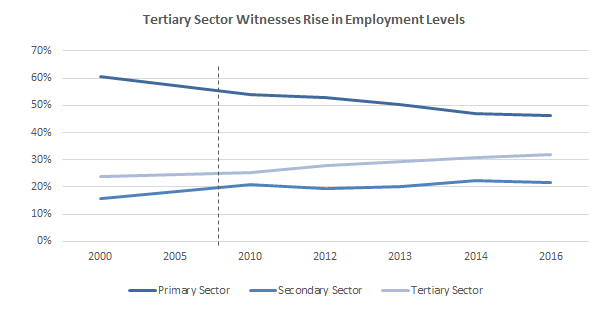

Growing Disconnect Between Economic Growth, Education and Job Creation- High Unemployment despite Positive Economic Growth The primary sector (agriculture, forestry & fishing and mining & quarrying) – the largest employment generator in India, followed by the tertiary sector (service sector) and secondary sector (industry sector) witnessed a gradual decline in employment generation during the last few years. While the employment in the primary sector has declined to 46.1% in 2016 from 52.9% in 2012, that of the tertiary sector increased to 32.0% in 2016 from 27.8% in 2012. The secondary sector (industry sector), saw its employment decline marginally to 21.8% in 2016 from 22.2% in 2014 subsequent to a continuous uptrend witnessed during the previous years. This is mainly on account of the shift of the country from a traditional agrarian economy to a more industrialised and service sector oriented country.  Source: Labour Bureau, UZABASE

Note: The figures for 2010 and beyond are from UPS Approach

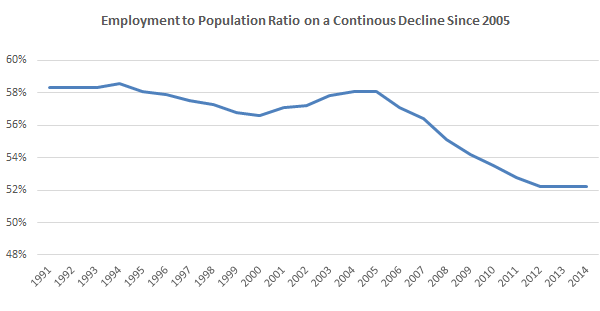

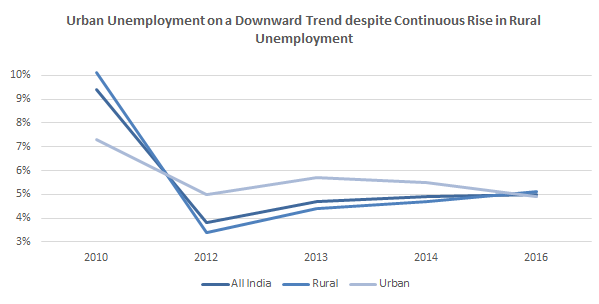

The unemployment rate in India shot up to a five-year high in 2016, despite all the government initiatives and measures such as Make in India, Start-up India and Digital India to promote domestic manufacturing and employment. Explosive rate of population growth compared to the job creation in the country has been a primary reason for such high rate of unemployment. This is reflected through the continuous deterioration of the employment to population ratio (ratio of the labour force currently employed to the total working-age population) to 52.2% in 2014 from 58.1% in 2005. Accordingly, the unemployment rate, which stood at a high of 9.3% in 2010 fell to 3.8% in 2012 and continued to rise thereafter to reach 5.0% in 2016. A paradigm shift in urban unemployment was recorded in 2016 with the rate falling behind the rural unemployment rate for the first time in the last 6 years. This is mainly on account of the decline in the urban unemployment rate since 2013 to 4.9% in 2015-16 from 5.7% in 2013, despite the continuous rise in the rural sector unemployment to 5.1% in 2016 from 4.4% in 2013.  Source: World Bank

Source: Labour Bureau, UZABASENote: The figures are based on UPS Approach

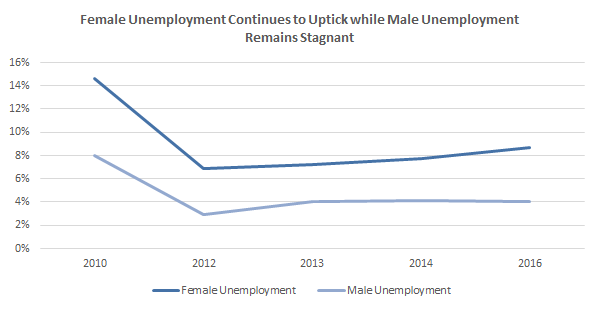

In terms of gender wise unemployment, female unemployment in India is almost double that of males and is the highest in both rural and urban areas compared to males. Occupational segregation appears to play an important role in this scenario as Indian women tend to be grouped in certain industries and occupations, such as basic agriculture, sales and elementary services and handicraft manufacturing. Overall, the rate of unemployment for females was 8.7% against 4.0% male unemployment in 2015-16. While female unemployment witnessed a continuous uptrend during 2011-15, male unemployment remained stagnant at 4.0% during 2012-15, subsequent to an increase from 2.9% in 2011-12. Notably, female unemployment in 2016, was higher in urban areas (12.1%) than in rural areas (7.8%).  Source: Labour Bureau, UZABASENote: The figures are based on UPS Approach

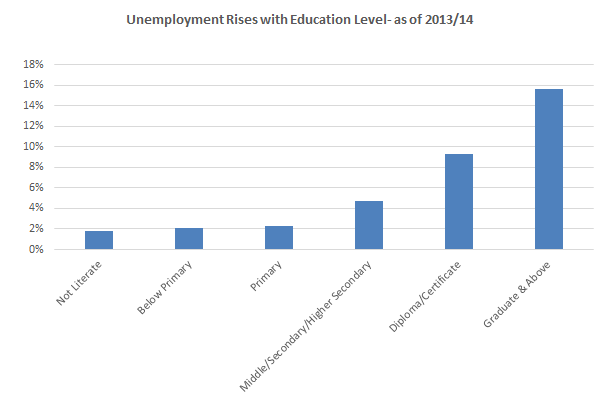

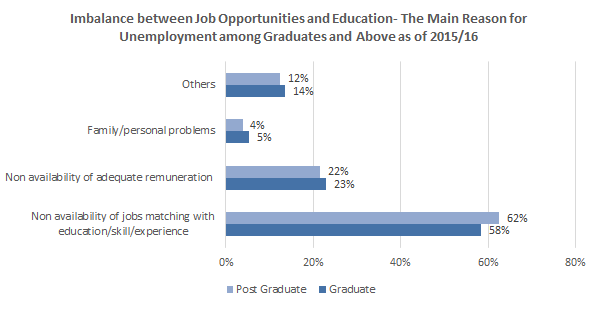

In India, the high unemployment rate among graduates and post graduates is visible implying an imbalance between employment opportunities and education, skill and experience. The unemployment rate for persons aged 18-29 years among graduates and post graduates and above was the highest at 15.6% in 2014. However, for less educated persons like the illiterate, below primary and primary persons aged 18-29 years, the unemployment rate was estimated at less than 4.0%. In 2015-16, 58.3% of unemployed graduates and 62.4% of unemployed postgraduates cited non-availability of jobs matching their education/skill and experience as the main reason for unemployment followed by non-availability of adequate remuneration cited by 22.8% of graduates and 21.5% of postgraduates.  Source: Labour Bureau UZABSENote: The figures are based on UPS Approach and related to the age group of 18-29 years

Source: Labour Bureau, UZABASE

Note: The figures are based on UPS Approach and related to the age group of 15 and above

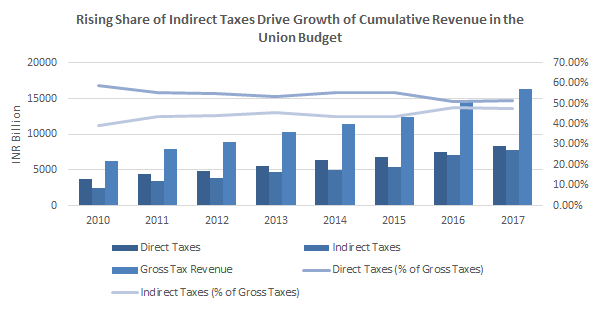

Central Government Revenue Projected to Pick Up Moderately on Back of Robust Indirect Tax Receipts In terms of India’s Union Budget, the total revenue receipts (tax and non-tax revenue) grew at a CAGR of 17.1% to register a compound value of INR 12,060 billion in 2016 from INR 7,514 billion in 2012. For 2016, India witnessed a rise of total revenue receipts by 5.6% over budgeted estimates (INR 11,416 billion), on the back of an enhanced share of net tax revenues on account of better budgeted performance and a higher component of cess receipts. In addition to this, there were substantial increases in non- tax revenue over the year, with total non-tax revenue rising by approximately 30.7% YoY to INR 2,586 billion in 2016 from INR 1,978 billion in 2015. This was mainly supported by higher dividend receipts received over the year, which account for a major component of non-tax revenue. Out of the total composition of revenue receipts, tax revenue accounted for 82.3% in 2016, while non-tax revenue accounted for 17.7% of the mix. Out of gross tax revenue, the share of direct taxes declined to 51.8% of the total in 2016 from 59% in 2010 while the share of indirect taxes rose to 48.2% in 2016 from 39% in 2010. On further analysis, the centre’s gross tax to GDP ratio for 2016, increased marginally to 10.8% from 9.9% in 2015, due to marginal increases in gross tax revenue given higher indirect taxes and lower nominal GDP for the year. Given the upside and downside of tax potential, various policy measures and additional resource mobilization measures that had been taken to augment direct and indirect taxes, the gross tax to GDP ratio was estimated to remain on the conservative side of 10.8% for 2017. Direct taxes are estimated to grow by 12.7% to INR 8,397 billion in 2017 from INR 7,446 billion in 2016, with the total income tax rising to INR 3,457 billion (21.2% of gross taxes) in 2017 from INR 2,917 billion in 2016 (20% of gross taxes). On the other hand, Corporation Tax, which showed a deceleration of positive growth in the past, is now estimated to see a rise of 9% to INR 4,939 billion (30.2% of gross taxes) in 2017 from INR 4,530 billion in 2016. This expected growth is on the back of policy measures for additional resource mobilisation. In terms of India’s indirect taxes, service tax grew at a CAGR of 23.7% to INR 2,100 billion in 2016 from INR 584 billion in 2010. In line with this positive growth trend, service tax is expected to further grow by 10% YoY to INR 2,310 billion in 2017, partly on account of policy measures undertaken to reduce the list of exemptions under the service tax act and improved coverage and compliance. On a different note, excise and customs taxes have both shown a declining trend as a percentage of gross tax revenue in recent years, despite rises in absolute values. The share of customs revenue declined to 14.3% of gross taxes (INR 2,095 billion) in 2016 from15.1% of gross taxes (INR 1,880 billion) in 2015, with further declines expected to account for 14.1% of gross taxes in 2017. In terms of absolute value, 2016 witnessed higher excise duty collections largely on the back of leveraging falling oil prices globally.  Source: Ministry of Finance; Government of India, UZABASE

Note- Direct Taxes (Corporation Tax and Income Tax)Indirect Taxes (Customs, Excise Duties, Service Taxes)

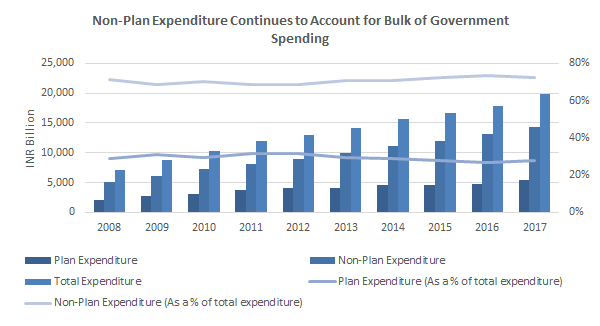

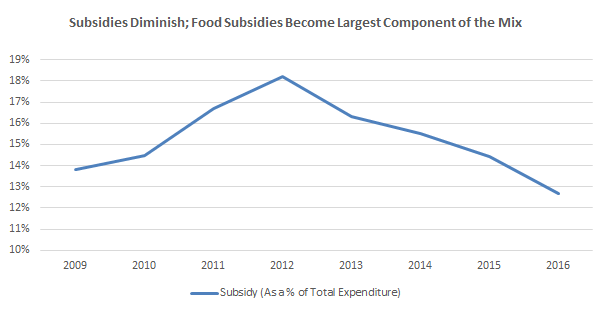

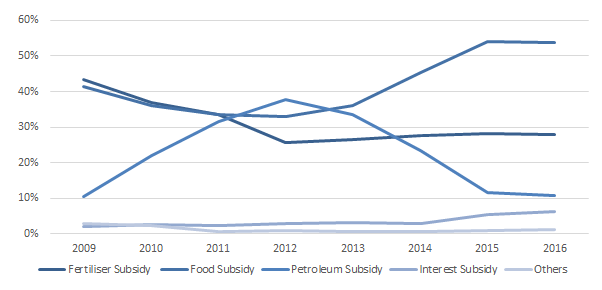

Where Does All The Tax Money Go? – An Insight into India’s Expenditure Budget The Central Government of India has witnessed a rise in total expenditure (Revenue and Capital), which grew at a CAGR of 12.1% to INR 17,583 billion (13.2% of GDP) in 2016 from INR 7,127 billion in 2008 (15.7% of GDP). The higher expenditure to GDP ratio, which was observed during 2008-2010 was due to the impact of the implementation of the Sixth Pay Commission, debt waiver scheme on farmers’ loans, expansion of flagship social schemes and increase in subsidies particularly on account of fuel costs. However, over recent years the total expenditure to GDP ratio has continued to decline, particularly on the back of higher growth in GDP. Despite this, the total budgeted expenditure for 2017 is expected to overshoot due to the implementation of the Seventh Pay Commission and the One Rank One Pension scheme for defence services. Revenue expenditure is often classified as Plan Revenue Expenditure and Non-Plan Revenue Expenditure. In 2016, Non-Plan Expenditure accounted for up-to 75.6% of total revenue expenditure, while Plan expenditure accounted for the rest. Plan Expenditure refers to productive expenditure which helps increase the productive capacity of the economy. Out of Plan Expenditure, the revenue component stood at 70.2% of the total, which was brought down in the recent budget planning after identifying fiscal constraints caused by shortcomings against total estimated tax revenues and disinvestment receipts. Further discussions are in place to bring down the share of revenue expenditure to 66% or even lower by 2019. On the other hand, Non-Plan Expenditure refers to expenditure made by the central government which are of a committed nature and with limited space for manoeuvrability. This includes provisions relating to establishment expenditures such as salaries and pensions, interest payments, defence service expenditure, subsidies etc. Some of the major trends that were observed were for interest payments, pensions and subsidies. Interest payments accounted for 33.8% of total non-plan expenditure in 2016 as against 29.6% in 2010, and were classed as the largest component of expenditure. The ratio of interest payment to net tax revenue rose to 46.7% in 2016 from 38.9% in 2008, mainly due to the reduced share of gross tax revenue due to enhanced tax devolutions to States and rising interest rates in the past. Comparing budgeted data for 2016, it was observed that the estimated figure of 49.6% was revised and brought down to the revised estimate above. This was on the back of easing interest rates over the previous year and a reduction in market borrowings. However, estimates note that the ratio is expected to be brought down further to 44.7% by 2019, owing to projected fiscal consolidation and easing inflation, which is expected to bring about a further decline in interest rates. On a different note, the Central Government also makes provisions for both Civil and Defence pensioners. Based on statistical data, it was observed that total pension payments grew at a CAGR of 18.7% to INR 1,224 billion in 2016 (7.2% of non-plan expenditure) from INR 243 billion in 2008 (4.8% of non-plan expenditure). The revised estimate for 2016 increased by 8.1% against the budgeted estimate of INR 8,852 billion and is further estimated to rise by 28.9% YoY to INR 12,337 billion in 2017 on the back of provisions made for the implementation of the Seventh Pay Commission as well as provisions made towards the One Rank One Pension (OROP) scheme. However, the expenditure on major subsidies has substantial influence on total expenditure as well the efforts of the Central Government made towards fiscal consolidation. With respect to this, the share of subsidies in terms of total expenditure decreased to 14.4% in 2016 (INR 2,582 billion) from 18.2% in 2013 (INR 2,571 billion) on account of active policy reforms with better managing of expenses. Based on further analysis, it was observed that the share of food subsides surpassed all other subsidies in 2013 (36.1% of total subsidies) and continued to show increasing growth of total share thereafter. As of 2016, the total percentage of food subsides out of total subsidies stood at 53.8%, indicating that food eats up the bulk of subsidy expenditure.  Source: Ministry of Finance; Government of India, UZABASE

Source: Ministry of Finance; Government of India, the Hindu, UZABASE

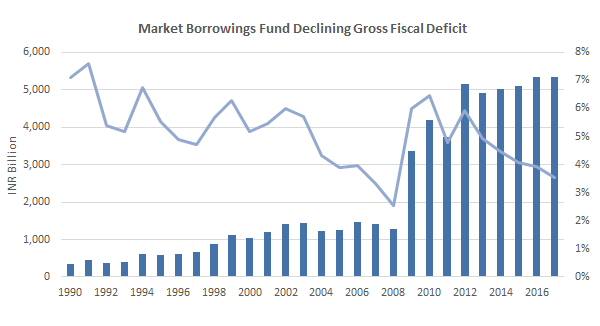

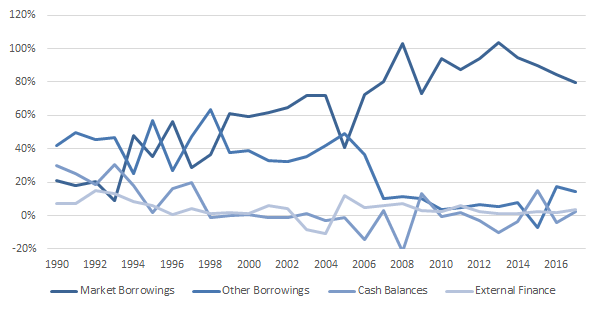

Financing the Fiscal-Target Fiscal Deficit Met with Continued Support from Internal Finances India continued to occupy a bright spot in terms of public finance, by recording another successful year of lowering its total fiscal deficit as a percentage of GDP. Based on data from the Controller General of Accounts (CGA), it was noted that the country met the budgeted fiscal deficit of 3.9% of GDP in 2016 (INR 5,351 billion), against the fiscal deficit of 4.1% of GDP (INR 5,107 billion) in 2015. In 2015, the achievement of the fiscal deficit target was largely because of drastic reduction made to budgeted expenditure. However, the situation was different for 2016, where in fact the total as well as the planned expenditure were higher than that their respective budgeted estimates. In addition to this the fiscal deficit target was met despite the implementation of the Fourteenth Finance Commission (FFC) recommendations relating to higher tax devolution to individual States, recommended grants to States and a huge shortfall in projected disinvestment receipts for the fiscal year of 2016. Furthermore, 2016 witnessed a reduction of the fiscal deficit in absolute value by 3.7% against the budgeted estimate of INR 5,556 billion, which was attributed to the lower than estimated growth of nominal GDP, and higher than budgeted tax and non-tax revenue receipts. In line with a declining fiscal deficit trend, the Government of India projects a fiscal deficit of 3.5% of GDP (INR 5,339 billion) in line with accelerated fiscal consolidation. Unlike most other countries, the financing of the fiscal deficit is often met through domestic sources and continued to be predominantly met by internal finance, which accounted for 97.8% of total funding. Out of this, net market borrowings through dated securities stood at INR 4,514 billion, which financed 86.2% of the gross fiscal deficit. This was slightly higher than that of the budgeted estimate of funding, which was projected at 82.1% of the total fiscal deficit. For 2017, the total borrowing requirement was budgeted at INR 6,000 billion, out of which INR 4,267 billion of net market borrowings were projected to finance approximately 80% of the target gross fiscal deficit. Hence, the Union Budget for 2017 continues to rely on market oriented domestic sources, with external sources projected to finance 3.7% of the fiscal deficit.   Source: Reserve Bank of India, UZABASE

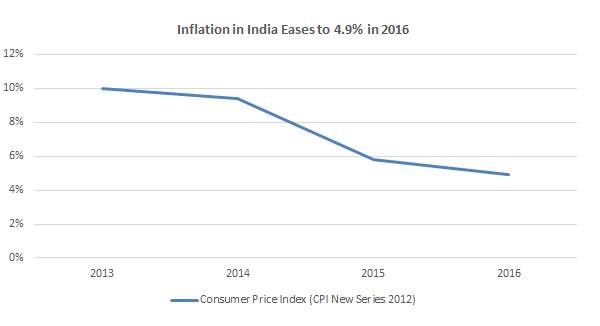

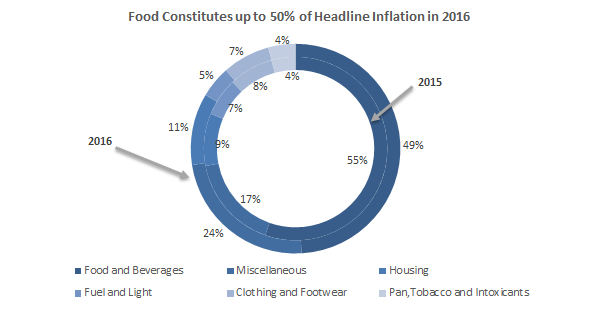

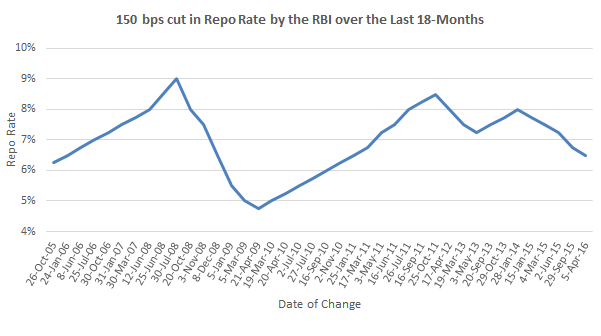

Indian Inflation Cools to All Time Low Supported by Lower Global Commodity Prices Persistent and elevated levels of inflation in India were a major concern of the government in the past. Headline inflation, as measured by the Consumer Price Index (CSI New Series 2012), declined to an average of 4.9% in 2016 from 10% in 2013, with a relatively sticky decline observed since 2015. However, the overall decline was attributed to several macroeconomic factors such as the decline in global commodity prices, with further support from various supply-side factors. In spite of the recent 150 basis points cut in the nominal policy rate, monetary conditions remains consistent with the country achieving a 4% CPI Inflation target over the next 5 years up to 2021. During the fiscal year 2016, inflation evolved over three different phases. During the early months of the year, food price pressure as a result of unseasonal rain and delays of the southwest monsoon were muted by strong favourable base effects. Hence, by July 2015. Inflation reached an intra-year low of 3.7%, the lowest recorded since November 2014 (5.4%). During the second phase from September 2015, the base effect thinned out and inflation rose steadily to hit 5.7% in January 2016 from 4.4% in September 2015. The main driver of this upsurge was attributed to rising prices of pulses, which subsequently meant that India met the 6% target which was set for January 2016. During the third and final phase, which commenced in February 2016, vegetable prices declined and downward adjustments were made to fuel prices, which pulled down headline inflation to 4.8% in March 2016. In terms of the constituents of inflation, volatility was observed across the major sub-groups. Food and beverages, which account for 45.9% of the CPI Index, contributed 50% to overall inflation in 2016 as against 47.9% in 2014. Within this category, pulses and products were the main contributors of food inflation, and contributed for up to 15% of headline inflation in 2016 (1.3% of headline inflation in 2014), despite a lower weightage of 2.4% in the CPI. In addition to the shortfall in production during 2015, sensitivity to pests and natural calamities elevated the contribution of pulses towards headline inflation. Furthermore, unseasonal rainfall as well as temporary demand-supply mismatches supported rising vegetable prices during the period of July-September 2015. On a different note, the fuel component of the CPI, which accounts for up to 6.8% of the CPI, accounted for 7.1% of total inflation during the year (5.0% in 2014). Inflation in this category generally reflects price changes with respect to coal, electricity, LPG and other household fuels, of which most prices remained relatively sticky during the year.  Source: Reserve Bank of India (RBI), UZABASE

Note- Data is only available from 2013 onwards due to revision made to headline inflation calculation and measures.

Source: Ministry of Statistics and Programme Implementation- Government of India, UZABASE

Note- All figures used have been computed using index figures for March and not average.

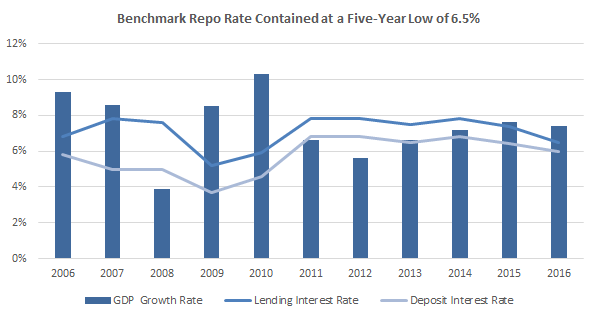

Reserve Bank of India in an Accommodative Policy Phase; More Room for Further Rate Cuts Since 2013, The Reserve Bank of India (RBI) has adopted an accommodative monetary policy stance, with the RBI easing or delaying tightening. The agreement on the monetary policy framework signed between the RBI and the Central Government in February 2015 has shaped the monetary policy stance for 2016. Since January 2013, the RBI has cut interest rates by 150 basis points (bps) to 6.5% in 2016 from 8.0% in 2013. The monetary easing came with a deceleration of inflation on the back of a sharp drop in oil prices and softening commodity prices, strong economic growth and an improved fiscal situation. The debt fuelled stimulus was aimed at accelerating a trickle-down effect through the Indian economy by making more cash available at a lower interest rate. Based on the bank’s latest monetary policy review held on 9th July 2016, the policy repo rate remained unchanged.  Source: World Bank national accounts data, and OECD National Accounts data files, RBI, UZABASE

Note: 2016 (E) GDP growth rate is based on the IMF forecast; however, the lending interest rate and deposit interest rate are actual figures

Source: Reserve Bank of India (RBI), UZABASE

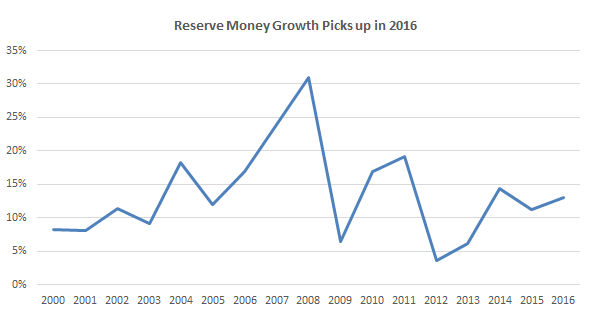

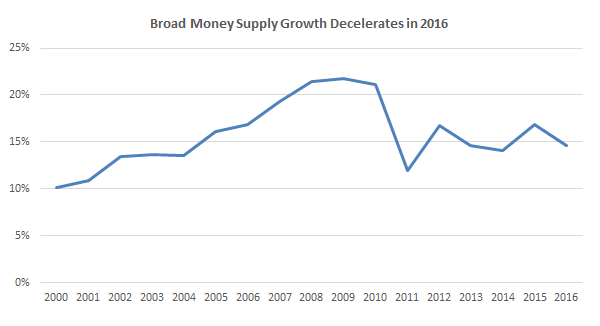

The easing of the policy repo rate was accompanied by the pick-up in growth rates of reserve money (M0) and narrow money (M1) during 2016. Reserve Money increased by 13.1% on a YoY basis to a record INR 21,807 billion in 2016 from INR 19,284 billion in 2015. The expansion in the M0 primarily took the form of currency in circulation, which continued to grow at a CAGR of 9.8% to INR 16,643 billion in 2016 from INR 9,497 billion in 2010. The YoY growth for 2016 stood at 14.3%, which was significantly higher than the 11.3% for 2015. This was attributed to several factors such as the jewellers’ strike, festival related demand and elections which increased the normal requirement for money in the system. On a related note, the growth in narrow money supply (13.5% YoY growth in 2016 from 11.3% YoY growth in 2015) was associated with higher growth in demand deposits with banks. (11% YoY growth in 2016 against 0.7% YoY growth in 2011). Furthermore, the growth in time deposits continued to decline for another year, with the total growth rate standing at 9.2% YoY for 2016 against 18.3% YoY growth for 2011. Despite the real rate of interest on deposits turning positive after inflation dropped to 5.8% in 2013 from 9.4% in 2012, time deposits have failed to pick up on the back of household savings being diverted to other channels such as gold and real estate. This slowdown in time deposits has slowed down the growth in the broad money supply (M3), which declined to 10.1% YoY growth in 2016 from 16.1% in 2011.   Source: Reserve Bank of India (RBI), UZABASE

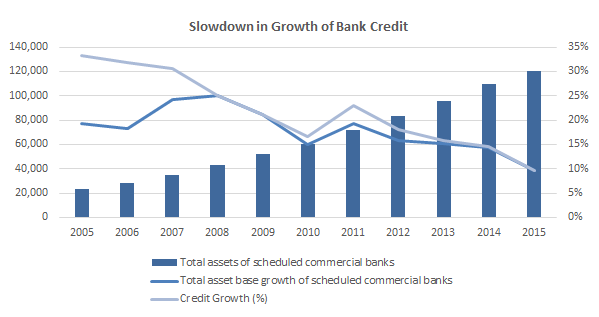

Non-Performing Loans and Other Market Factors Curtail Bank Credit Growth The bank credit of scheduled commercial banks grew at a healthy CAGR of 17.7% during 2005-2015, contributing to a total asset base of INR 120.3 trillion in 2015 from INR 23.5 trillion in 2005. Credit growth was largely driven by all major sectors- led by infrastructure, metals and engineering. Meanwhile, the rising GDP per capita (PPP) – that reached USD 6,746 in 2016 from USD 3,747 in 2008 at a CAGR of 7.6%– spurred demand for retail credit, especially for housing. However, credit growth slowed on the back of several factors such as incomplete transmission of monetary policy as banks have not passed on the entire benefit to borrowers, unwillingness of banks to lend credit on account of rising Non-Performing Assets (NPA), the worsening of corporate balance sheets and more attractive interest rates for borrowers in the bond market.  Source: Reserve Bank of India (RBI), UZABASE

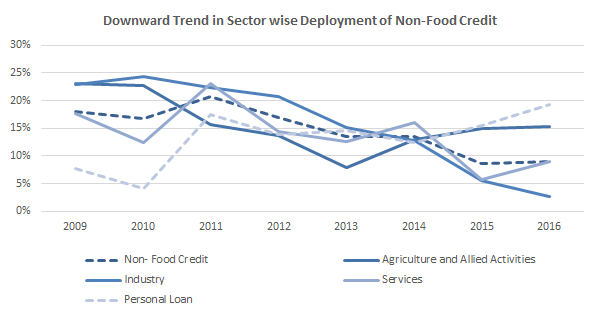

The trend in deployment of gross bank non-food credit (NFC) by major sectors indicates that credit off take by the industry has been declining. The deployment of gross bank credit of the total industry grew to 9.1% YoY in 2016 from 8.6% YoY in 2015. Personal Loans, which accounted for 34.2% of total non-food credit in 2016 (15.3% in 2011), witnessed a rise in total credit growth to 19.4% in 2016 against 15.5% in 2015. This was partially attributed to the policy repo rate cut. On a similar note, the service sector, which accounted for 22.8% of total non-food credit in 2016 (23.8% in 2011), saw a rise in credit growth to 9.1% in 2016 against 5.7% in 2015. However, the share of industry to total NFC declined to 25.4% in 2015 from 52.6% in 2011 on the back of muted market sentiment leading to a slowdown in private investment demand and industrial growth and poor earnings growth of the corporate sector.  Source: Reserve Bank of India (RBI), UZABASE

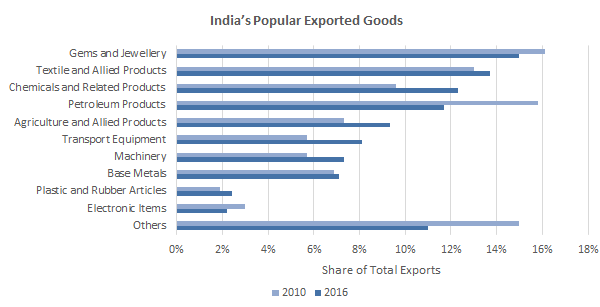

Who Trades What?-A Closer Look at India’s Merchandise International Trade Based on the new classification of trade that was introduced in 2010, Gems and Jewellery were classed as the most popular exports in 2016 with a total share of 15%, followed by Textiles (13.7%), Chemicals (12.3%), and Petroleum products (11.7%). Non-Oil Exports have shown volatility over the last six years, with recent trends showing a total contraction of 8.7% to USD 298 billion in 2016 from USD 310 billion in 2014. On the other hand, total Oil Exports declined at a CAGR of 30.6% for a second consecutive year to USD 30 billion in 2016 from USD 63 billion in 2014. Despite this, the leading export items continued to retain their respective top spots in the total share, with slight variations amongst them.  Source: Ministry of Commerce and Industry-Government of India, UZABASE

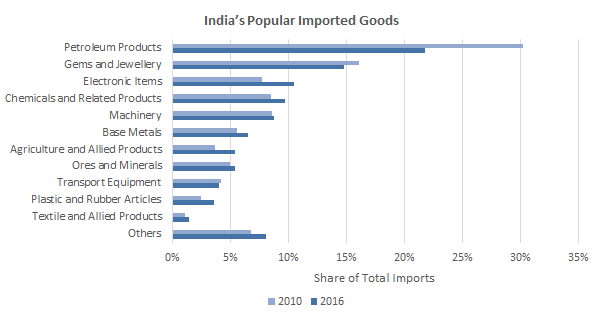

In terms of imports, Petroleum Crude and other products were classed as the most popular form of imported goods in India, with a total share of 21.8%, followed by Gems and Jewellery (14.8%), Electronic Items (10.5%) and Chemicals (9.7%). In terms of Oil Imports, India recorded a second consecutive fall at a CARC of 29.1% to USD 82.9 billion in 2016 from USD 164.8 billion in 2014. This fall was mainly attributed to falling oil prices on the back of the supply glut that the global economy faced. On the other hand, Non-Oil Imports continued to show a volatile trend, with recent statistics showing a YoY marginal contraction of 3.9% to USD 297 billion in 2016 from USD 310 billion in 2015. This was attributed to a decline in growth seen by several principal commodities such as plantation goods, ores and minerals, office and project goods.  Source: Ministry of Commerce and Industry-Government of India, UZABASE

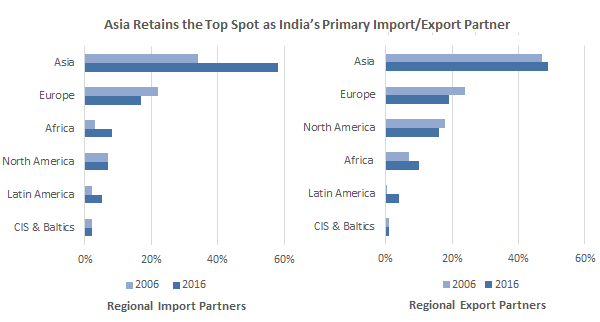

In terms of the direction of trade, the fall in global demand was clearly seen in trade figures. Region-wise, India’s largest export market in 2016 continued to be Asia, with a share of 49% of India’s total exports. The Asian market exhibited negative growth of 16.7% YoY in 2016 as against negative growth of 1.0% YoY in 2015. Within Asia, the largest share of exports was recorded by West Asia GCC (32.6% of total Asian Exports). However, despite this, the West Asian GCC market demonstrated a decline in total exports, with a total contraction of 15.45% YoY in 2016 against positive growth of 2.3% YoY in 2015. In addition to this, India’s next largest export market, Europe, shrank 10.6% YoY in 2016 against 3.5% YoY in 2015. Country-wise, the USA ranked top as India’s main export partner, occupying 15.1% of total exports, followed by the UAE (11.6%), Hong Kong (4.6%), China (3.4%) and the UK (3.4%). However, each of these economies witnessed broad based decline in export growth, with China registering the highest decline of 24.6% for the fiscal year. On the import front, most regional markets, including Asia, witnessed a decline in total imports for 2016. Asia is the largest source of imported goods for India, and accounts for up to 58% of total imports. However, the largest YoY decline in imports was witnessed by the Americas, with a total decline of 17.7% in 2016. Country-wise, the largest import partner of India in 2016 was recorded as China, with a total share of 16.2% of total imports. This was followed by the US (5.7%), Saudi Arabia (5.3%), UAE (5.1%) and Switzerland (5.1%). Despite most economies facing negative growth in imports for the fiscal year, China witnessed positive YoY growth of 2.4% in imports.  Source: Ministry of Commerce and Industry-Government of India, UZABASE

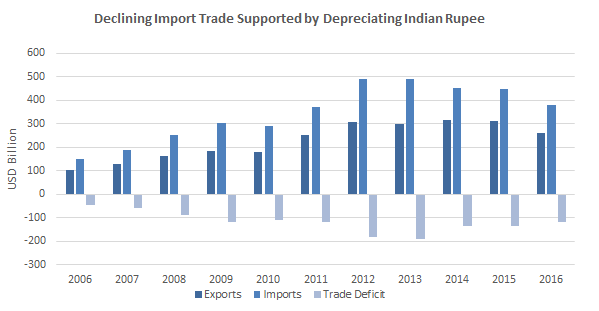

Trade Deficit Declines as Import Slide Outpaces Export Fall; Competitiveness of Exports Questioned? International trade in India has constantly been affected by macroeconomic variables such as the global economic slowdown, with the International Monetary Fund (IMF) revising global growth estimates down from 3.4% to 3.2% in 2016. Furthermore, by the second half of 2014-2015, the decline in global commodity prices in value terms had a significant impact on global trade as well. As of 2015, India accounted for approximately 1.6% of total global exports, as opposed to other global peers such as China (13.8%) and the USA (9.1%). In terms of merchandise exports, the country experienced volatile rises in total export revenue. Initially, revenue rose at a CAGR of 30.8% to USD 306 billion in 2012 from USD 179 billion in 2010. With respect to this observed trend, exports reached an all-time high of USD 314 billion in 2014. Despite this, India witnessed a decline in exports thereafter at a CARC of 8.7% to USD 262 billion in 2016, on account of subdued global demand and falling crude oil prices. On the other hand, imports demonstrated a decline at a CARC of 6.1% to USD 380 billion in 2016 from USD 489 billion in 2012. This trend was partly driven by rising import restrictions and the sharp depreciation of the INR. The upshot of the above developments is that the total trade deficit of the country declined to USD 118 billion (5.7% of GDP) in 2016 from USD 190 billion (10.4% of GDP) in 2013, recording an all-time low in five years. This further concludes that the decline in growth for imports was much faster than that for exports.   Source: Export-Import Bank of India, Reserve Bank of India, UZABASENote-Average Annual Exchange Rates were used.

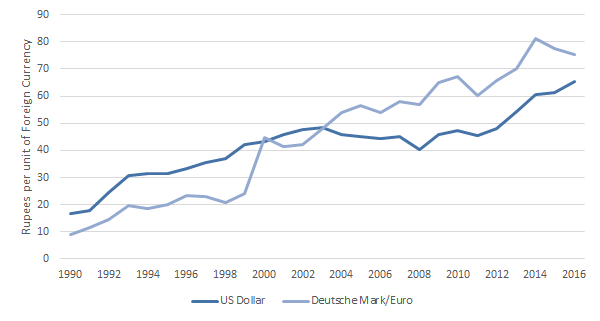

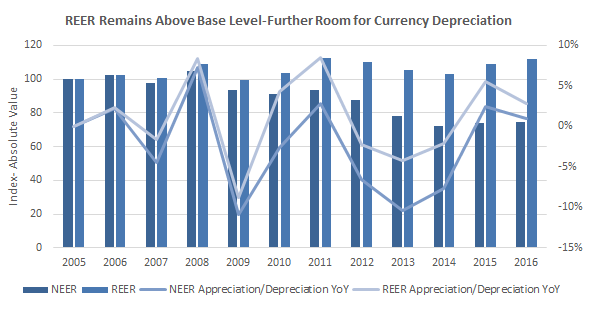

In terms of currency depreciation, the Indian rupee depreciated against the US dollar by 7.1% YoY during 2016, which was greater than that for 2015 (1.1% YoY). This was mainly backed by declining global crude oil prices and the collapse of the Chinese stock market. According to the Indian Express, the Indian Rupee has remained one of the stronger currencies, compared to the Brazilian Real, Russian Rouble and the Euro, all of which witnessed significant depreciation of their currencies. This has significantly affected Indian competitiveness on the export front, as witnessed by its pattern of export trade. To account for the effects of inflation and the relative depreciation faced by other peers, we further examine the Real Effective Exchange Rate (REER), which better reflects competitiveness of the economy. The Nominal Effective Exchange Rate (NEER) showed signs of appreciation YoY post 2014, after continuous depreciation since 2009. In 2016, the NEER depreciated by 23.3% over the base year, standing at 74.8 while on real effective terms, it appreciated by 12.07% over the base year, standing at 112.07. Based on analysis, the REER continues to remain above the base year value of 100, indicating that the domestic currency was overvalued. This further indicates that domestic prices in the country are high and most producers are likely to lose out on competitiveness. This further explains how India witnessed a decline in exports over the fiscal year of 2016, indicating that further depreciation of the rupee is likely necessary in order to better establish India’s competitiveness on the trade front, although other structural factors need to be taken into account to make it an effective policy.  Source: Reserve Bank of India (RBI), UZABASE

Note- Base Year 2005=100 for both indices.

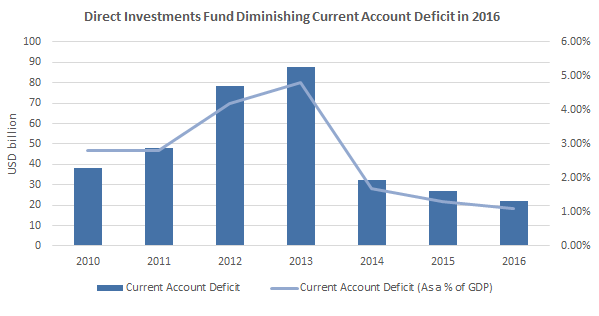

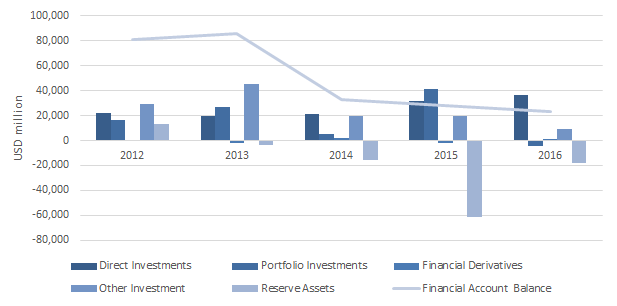

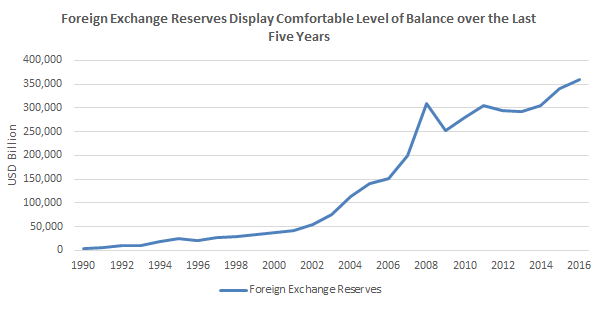

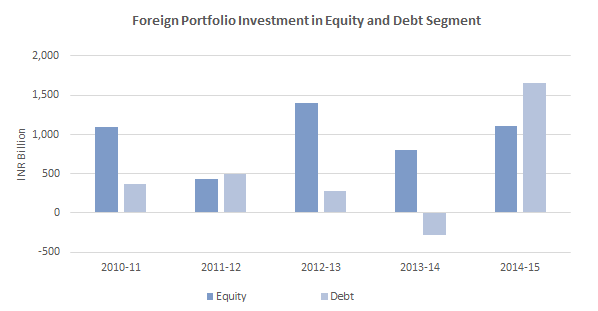

Narrowing Current Account Deficit Financed by Rising Foreign Direct Investments (FDI’s); External Sector Provides Favourable Outlook After recording a high and unsustainable USD 87.8 billion current account deficit (CAD) (4.8% of GDP) in 2013, India’s Balance of Payments situation has been benign and comfortable. The CAD contracted by approximately 63.4% YoY to register a total deficit of USD 32.4 billion (1.7% of GDP) in 2014. This was supported by stringent policies placed on restricting imports, which subsequently aided in achieving a lower trade deficit. The CAD remained subdued in 2015, despite restrictions being lifted over the course of the year. In 2016, the CAD stood at an all-time low figure of USD 22.1 billion (1.1% of GDP), primarily on the back of a stronger invisibles surplus and a lower trade deficit that was recorded. The stress on the Balance of Payments arises in emerging economies when these economies try to maintain a CAD, even where there are inadequate levels of financing. However, over the recent past India has witnessed sufficient capital flows to balance the CAD, reducing its vulnerability in the economic environment. Foreign investment is considered an important component in the capital account of India’s BOP and is typically preferred over debt flows. India’s net foreign direct investments recorded an all-time high net inflow of USD 36.0 billion in 2016 against a net inflow of USD 21.6 billion in 2014. The changing dynamics were driven primarily by rising FDI inflows which rose at a CAGR of 24.1% to USD 56 billion in 2016 from USD 36 billion in 2014. The rise in FDI flows was attributed to the launch of the ‘Make in India’ initiative, which came into effect in 2014. Despite the rising importance of FDI flows, portfolio investments continued to show volatility in 2016. Net Foreign Portfolio Investments (FPI’s) recorded an alarming outflow of USD 4.1 billion in 2016 after recording an all-time high figure of USD 42.2 billion in 2015. This was mainly on the back of a substantial sell off in the debt market that was made by foreign investors. Hence, the capital account is now driven mainly by rising FDI’s, which were sufficient enough to finance the CAD, with a substantial accretion in foreign exchange reserves at USD 18.6 billion over 2015-2016.   Source: Export-Import Bank of India, Economic Survey, Various issues; Union Budget, Reserve Bank of India (RBI), Annual Report & Weekly Statistical Supplement; Ministry of Finance; CSO; EIU; NASSCOM; Ministry of Commerce and Industry; Institute of International Finance (IIF); WEO, IMF, UZABASE.

Note-Only recent relevant data have been included.

Source: Reserve Bank of India (RBI), UZABASE |

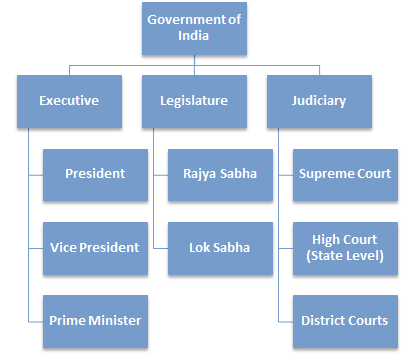

Political and Legal OverviewIndia: A Democratic Political System With the leadership of Mahatma Gandhi and his unique non-violent campaign, India achieved its independence from the British Rule on 15 August 1947. Following this, the Constitution of India came into effect in 1950, making India a secular and democratic republic. Under this constitution, the union government came into effect and comprised of a union of 28 states and 7 union territories. This arrangement was officially called the Republic of India, where the seat of authority of the central government was based in the capital city of India, New Delhi. Today, the Indian Constitution provides for three closely linked entities to carry out the effective functioning of the government, namely the executive, the legislature and the judiciary. The titular head of the executive branch is the President of India, who is formally known as the head of state and exercises his authority via his cabinet of ministers. This role is primarily ceremonial in nature and is elected for a period of five years by an electoral college which consists of members from all houses of parliament and the state legislature. However, the real executive power of running governmental affairs is headed by the Prime Minister, who heads the Union Cabinet. The Prime Minister is appointed by the President after the Lok Sabha elections, held every five years. The legislative arm compromises of India’s bicameral Parliament, which is made up of the Rajya Sabha (Council of States) and the Lok Sabha (People’s Assembly). The main function of the Parliament is to pass laws on matters specified in the constitution. On the other hand, at the state level, some states operate via a single legislative assembly while others choose to operate under a bicameral structure. However, the judiciary arm is independent of the executive and is divided into three tiers with the Supreme Court as its apex. This is followed by high courts at the state level and district courts at the district level, which are the first level for seeking justice and maintaining law and order. Basic Structure of the Indian Government

Source: Ernst & Young (EY) Indian Politics Post Independence: An Overview

Source: BBC News, UZABASE

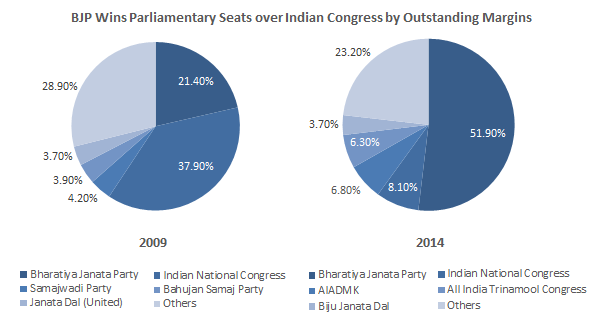

A Tale of Two Parties – The Congress Suffers Humiliating Defeat Founded in 1885 during the British Raj, the Indian National Congress (INC) led the country to freedom from British colonial rule. Ever since then, it was recognised as one of India’s major political parties, where it ruled the country for 54 out of the past 69 years, either on its own or as the leader of coalition governments. However, in 1977, the Congress saw its first ever defeat in the national elections, where the voters punished the party for harmful actions committed during the Emergency Rule in India (1975-1977). Voters were so angry that a political comeback at that time was deemed impossible. However, the party returned back to power in 1980 and until the 1990’s formed governments without the support of other parties. Between 2004 and 2014, the United Progressive Alliance (UPA) (Congress led coalition) ruled India for two consecutive five year terms, out of which the latter was marked by poor governance and high levels of corruption. However, while defeat was expected in the 2014 election, even its worst critics did not anticipate it to be defeated as severely as it was. The National Democratic Alliance (NDA), led by the Bharatiya Janata Party (BJP), won a sweeping victory accumulating 336 seats out of a grand total of 543 seats (61.9%) in the Lok Sabha. However, the United Progressive Alliance, led by the Indian National Congress (INC), won a total of only 55 seats, 44 of which were won by the Congress itself (8.1% of the total). This was the first time ever since the 1984 elections that the BJP and its allies were able to form the largest majority government, as it was the first time in elections that a party had won enough seats to govern without the support of other political parties. The ability of the Congress to revive itself depends immensely on how it chooses to address the issue of credibility, encourage state leaders and act as a strong Opposition Party in parliament and outside too. The threat to the Congress from the Hindu nationalists was never greater until the BJP came to power under the leadership of Narendra Modi, whose sharp edged political vision of India won him majority of the votes. One way for the Congress to revive depends on just how long the Modi effect on India lasts. The perceived failures of his government in terms on how they chose to handle inflation and the rising communal polarisation in the country makes way for the Congress to compete against the BJP, thereby creating unity against those who oppose the ruling political party. Hence, judging by its past history and series of victories, it would be unfair to write off the Congress so quickly. However, it would be unwise to underestimate the seriousness of the political challenges that the party faces today in the course of India’s democracy. Furthermore, it is understood that the Congress has a long way to go in order to rebuild and reposition itself as a credible alternative to the BJP, which will widely depend on the kind of platform it adopts rather than leadership by a famous political party. India’s Top Five Popular Political Parties

Source: UZABASE

Source: Elections Commission of India, UZABASE

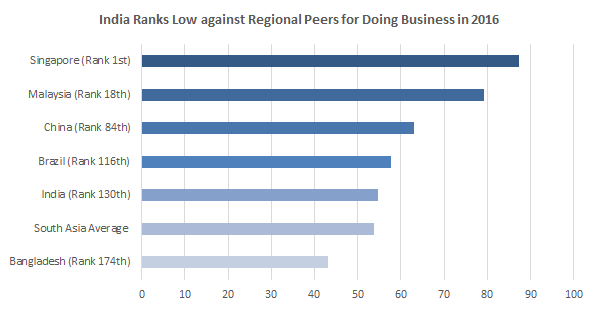

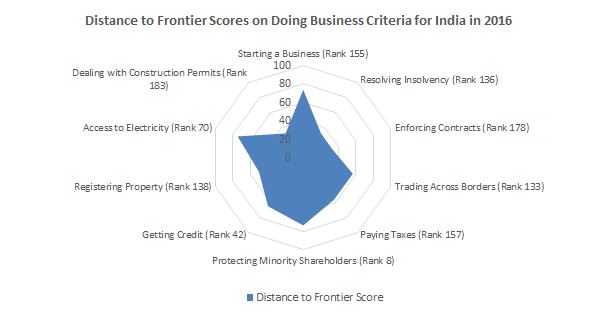

India Improves In Ranks for Doing Business in 2016 Ease of doing business in India is one important initiative that is run by the Government and is considered crucial to the success of various other initiatives such as Make in India, Start-up India and Digital India, all of which were launched by Prime Minister Narendra Modi. According to the “Doing Business 2016” report published by the World Bank, India ranked 130th in terms of the ease of doing business index, which was an improvement against its 134th rank for 2015. For 2016, India improved in terms of the protection of the minority shareholders, its ease of access to electricity, access to construction permits and starting a new business as against in 2015. On the downside, paying taxes and accessing credit was found to be a challenge for most business start-ups. In line with this, two areas that India will need to work on include enforcing contracts and resolving insolvency issues, both of which have been seen as a hindrance in conducting business in India. Given this, the new government aims to make India an investor friendly destination, which has involved successive developments post-election.   Source: Doing Business Database- World Bank, UZABASE

Note 1- The rankings based on the average of each economy’s distance to frontier (DTF) scores for the 10 criteria included in this year’s aggregate ranking. The distance to frontier score benchmarks economies with respect to regulatory practice, showing the absolute distance to the best performance in each Doing Business indicator. An economy’s distance to frontier score is indicated on a scale from 0 to 100, where 0 represents the worst performance and 100 the frontier

Note 2- Radar Chart Scale- 0 Centre, 100 Outer Edge

New Government Restores Investor Confidence -Make in India Promotes Entrepreneurship Foreign investment in an Indian business is subject to India’s FDI policy. The government of India through the Department of Industrial Policy and Promotion (DIPP) formulates a consolidated policy on a yearly basis, which is updated from time to time via press notes. Foreign investors can invest directly in India, either directly or via joint ventures in almost all sectors, except for a few sectors which do not allow for any form of foreign investment. FDI in a majority of the sectors is under the automatic route (allowed without any regulatory approval prior to such investment). Under the new government, many changes have come about in the FDI policy in different sectors such as Defence, Rail Infrastructure, Construction Development, Insurance etc. followed by investment made by Non-Resident Indians (NRI’s) and introduction of composite caps for foreign investments. All these have been seen as reasons for rise in FDI. Despite this, it was noted that the country had significant potential to attract far more investments by further liberalising and bringing about further reforms in the FDI regime. Foreign Direct Investment Reforms Made In India

Source: Ernst and Young (EY), UZABASE

In addition to the Government’s commitment towards making India investor friendly, the progressive movement in FDI reforms also reflects the impact of the “Make in India” campaign on promote entrepreneurship an easing business in India. Set up in September 2014, the Make in India campaign was formed to assist investors in seeking regulatory approvals and achieve long-term growth in the manufacturing sector. It aims to achieve and build high-quality manufacturing infrastructure by enabling investments, encouraging innovation and improving intellectual property protection. Today, it has become a major point reference for many foreign investors, and hence has become an integral component of the FDI framework in the country. Achievements under the Make in India Campaign

Source: Ernst and Young (EY), UZABASE

Entry and Funding for New Indian Start-Ups Main Business Entry Options in India

Source: Ernst and Young (EY)

Popular Sources of Business Funding in India and Regulatory Notes

Source: Ernst and Young (EY), UZABASE

Direct Tax Incentives to Boost New Industrial Undertaking 1. Profit Linked Incentives New businesses formed are eligible for the following incentives:

Source: Ernst and Young (EY), UZABASE

2. Investment Linked Incentives To promote rural infrastructure and other specified industries, investment linked incentives in the form of deduction of capital expenditure incurred before starting up are allowed at 100%- 150% for businesses that engage in the fields of: ○ Laying and Operation of Oil and Gas pipeline networks ○ Beekeeping ○ Warehousing for Sugar ○ Iron Ore pipelines ○ Hotels and Hospitals ○ Fertilizer Production ○ Warehousing for agricultural products 3. Special Economic Zones (SEZs) Under the SEZ scheme, the Government of India aims to create a comfortable free environment for export trade which is duly supported by simple infrastructure and incentive packages to attract both domestic and foreign investors. Given this, the government has undertaken many measures to revive interests in SEZ’s by liberalising various norms such as the minimum land area requirements, transfer/sale of ownership etc.

Source: Ernst and Young (EY), UZABASE

Proposed Replacement of Indirect Tax Regime by GST to Create a More Efficient Tax System The Government of India has proposed to do away with the existing indirect tax regime and replace it with a comprehensive dual Goods and Services Tax Bill (GST), effective 1st April 2017. In line with the federal structure of India, it is proposed that the GST will be levied concurrently by the central government (CGST) and the states (SGST). The base and other features of the tax would then be common for the individual states. The structure for the GST is expected to follow a destination-based taxation principle, where imports will be included as part of the tax base while exports will be zero rated. The revenue neutral rate proposed is between 15%- 15.5%, where the final rate would be decided by the GST council. The constitution amendment bill that was proposed in Parliament was passed in August 2016, marking a historic step for tax reforms in the country. The GST has been seen as a more efficient tax system than the current one in India. This is because it will widen the tax base, do away with multiplicity of taxes and minimise competitive distortions. In addition to that, it also encourages better compliance and makes things much simpler. The new tax structure is expected to have a significant impact on all businesses, manufacturers and traders and affect all aspects of their business activities. While the implications of the introduction of this regime are yet to materialise, it can be said that the new system makes things less of a hassle for many traders who engage in business activities and is expected to attract investors, given that the proposed system eliminates many of the concerns voiced over the existing system. Note: PLEASE REFER APPENDIX TO POLITICAL AND LEGAL OVERVIEW FOR MORE INFORMATION |

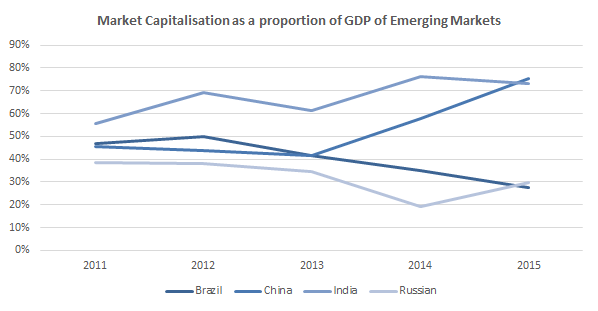

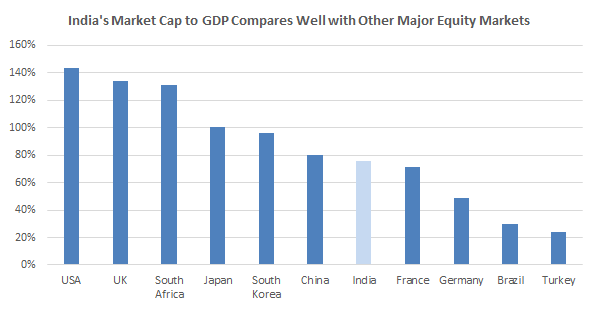

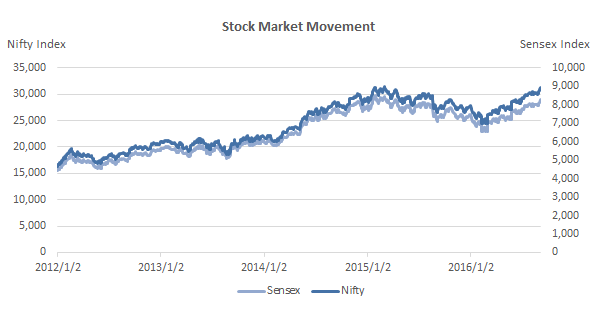

Financial OverviewStrong Links between Economic Growth and Stock Exchanges in India Stock exchanges in India have benefitted from the robust growth in the economy. The Indian economy grew at an average annual rate of 7.3% over 2010–14 and is expected to continue on this trajectory at over 7.5% during 2015–17. It is vital to promote stock exchanges in India as they contribute to the raising of capital and assist in its efficient allocation, thus reinforcing the economy. Furthermore, Indian stock exchanges have played a significant role in economic development processes by performing multiple functions such as capital mobilisation, liquidity enhancement, provision of risk pooling and sharing services, development of the corporate sector and exercising corporate control. Equity portfolio investment inflows started to slow in late 2015 after peaking at approximately USD 30.0 billion during April-May 2015. The equity market saw strong growth on the back of falling commodity prices and positive policy changes from the newly elected government of India  Source: World Bank Data

Source: Business Standard

India was ranked 41st among the best performing stock markets in the world, growing by 2.58% in 2015. India’s performance was the weakest compared to its BRICS counterparts. China (+16.73%) was ranked 8th followed by Russia (+14.19%), South Africa (+7.22%) and Brazil (+4.05%) which were ranked 13th, 28th and 34th respectively.  Source: Relevant Stock Exchanges

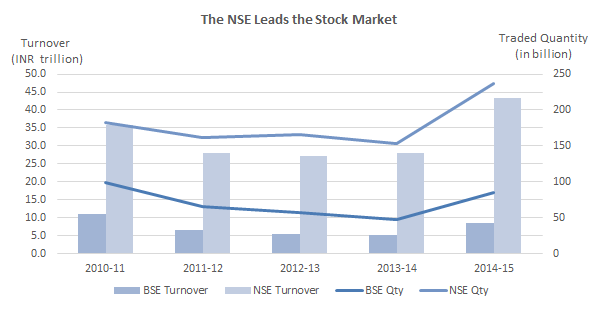

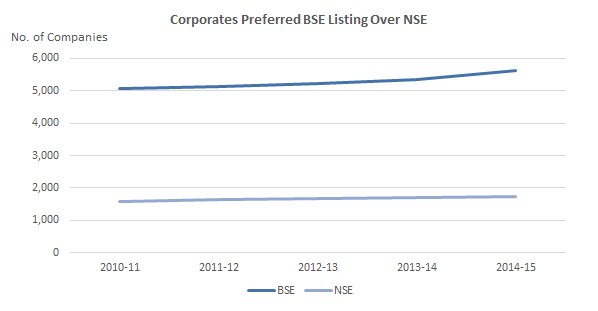

NSE and BSE Dominates the Indian Stock Market Currently, there are 23 stock exchanges operating in the country. However, the Bombay Stock Exchange (BSE; IND) and National Stock Exchange (NSE; IND) account for over 99% of the traded volumes in the securities market in India. These exchanges compete for trade, which leads to innovation, market efficiency and reduced costs. Additionally, the presence of arbitrageurs on both exchanges helps bind the prices in a tight range. Other major regional stock exchanges are: The Ahmedabad Stock Exchange (ASE; IND), the Calcutta Stock Exchange Association (CSE; IND), the Delhi Stock Exchange (DSE; IND), the Magadh Stock Exchange (IND), The Metropolitan Stock Exchange of India (MSE; IND) (formerly, MCX Stock Exchange)and the Vadodara Stock Exchange (VSE; IND) During the last five years, the NSE maintained an average market share of over 80% in the cash market, while the BSE and other regional exchanges held the remainder. The quantity and value of equity cash shares traded on both exchanges declined to 2.0 million and INR 33,302.0 billion, respectively, in 2014 from 2.8 million and INR 46,824.4 billion in 2011. The decline was attributed to the weak sentiment that prevailed in the equity market during 2012-14, engendered by global recessionary trends, the policy paralysis of the Indian government and declining retail appetite (because of corruption and high inflation) that limited the purchasing power of investors. However, in 2015 both the volume and value of equity cash shares traded on the BSE and NSE rose 20.0% and 13.5% YoY respectively, backed by a newly elected stable central government, the launch of several new IPOs (12) and offers for sale (Coal India, Rural Electrification Corporation and the Steel Authority of India Limited). Also, retail interest grew significantly in mid-cap stocks compared with large-cap stocks.  Source: SEBI

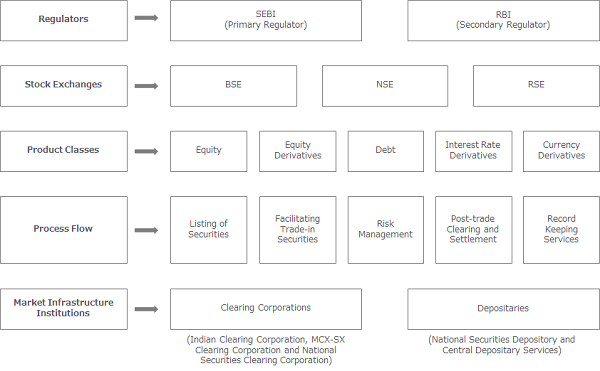

Highly Structured Industry Spans Multiple Product Classes Stock exchanges in India are highly structured and cover multiple product classes such as equity, equity derivatives (single stock and index), debt instruments, interest rate derivatives and currency derivatives. Stock exchanges in India can be classified into national and regional exchanges. The BSE, NSE and MSE are the national stock exchanges, while the other stock exchanges are regional stock exchanges (RSEs). Activities on stock exchanges include the listing of securities, trading in securities (pre-trade order management and risk management), post-trade clearing and settlement and record-keeping services. The Securities and Exchange Board of India (SEBI) is the primary regulator of stock exchanges in India. Meanwhile, the Reserve Bank of India (RBI) acts as a secondary regulator for some products. The BSE, NSE and other recognised stock exchanges facilitate trading in various instruments such as equity, debt, currency and derivatives (equity, currency and interest). Along with stock exchanges, market infrastructure institutions (MIIs) – comprising clearing corporations and depositories – play a key role in facilitating the proper functioning of the exchanges. These institutions provide clearing and settlement services and hold the traded securities in paperless form. Currently, there are three clearing corporations in the exchange-clearing domain in India. These include Indian Clearing Corporation (promoted by the BSE), National Securities Clearing Corporation (promoted by the NSE) and MCX-SX Clearing Corporation (promoted by the MSE). Structure of Stock Exchanges in India

Source: UZABASE

Source: BSE & NSE

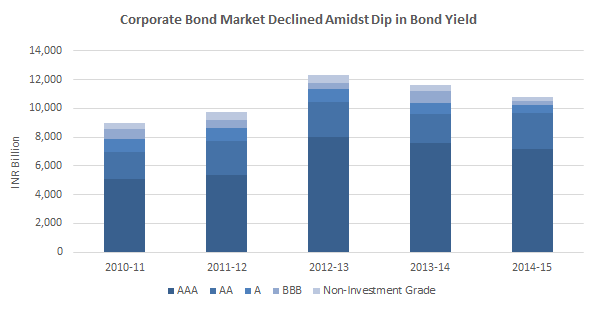

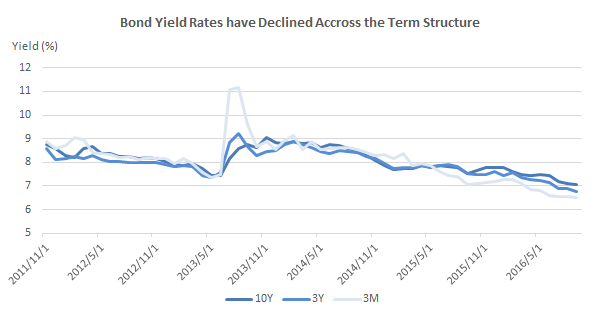

Bond Market in India Corporate bond issuance in India has long been low relative to the size of the economy, with purchases largely limited to long-term domestic investors who tend to hold the assets to maturity. The value of Indian corporate bonds outstanding was equivalent to only 9.0% of gross domestic product in 2014, according to the International Organization of Securities Commissions, compared with 46.0% in China. The bond market in India is expected to undergo a number of reforms in order to attract more foreign investment into the country. In the Indian bond market, yields witnessed a decline across term structures. Moreover, a larger portion of the corporate bonds have been rated AAA which suggests a greater chance of servicing the debt. On this ground, foreigners were keener on investing in debt instruments over equity instruments.  Source: SEBI

Source: SEBI, NSDL & CSDL

Source: NSE |

AppendixAppendix A-Key Statistical Indicators

Source: UZABASE, Reserve Bank of India, Export-Import Bank of India, IMF

Note: Asterik refers to use of median figures as per the RBI |

|

Appendix B- Political and Legal Overview. Other Central Government Initiatives to Promote Ease of Business in India

Source: Government of India- Make in India website, Ernst and Young (EY), UZABASE |