A Cashless South East Asia: A Future Reality or a Dream?

|

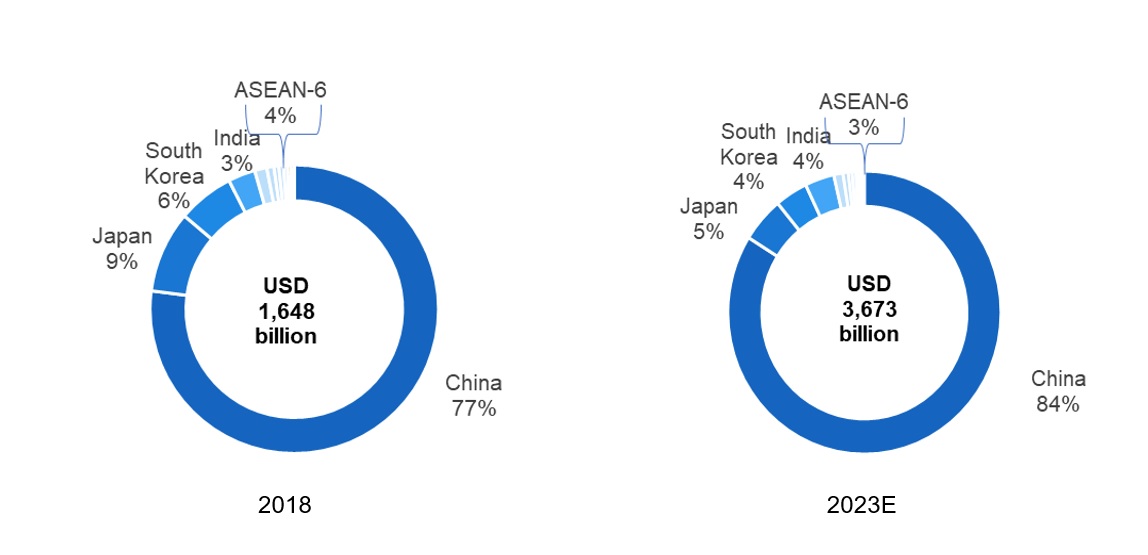

The digital payment market in South East Asia remains at a nascent stage (~2% contribution to the global digital payment market in 2018) with cash dominating day-to-day-transactions. This is primarily owing to security concerns over e-payments and low financial inclusion (~70% of the region’s population remains unbanked, higher than the global average of ~30%). |

|

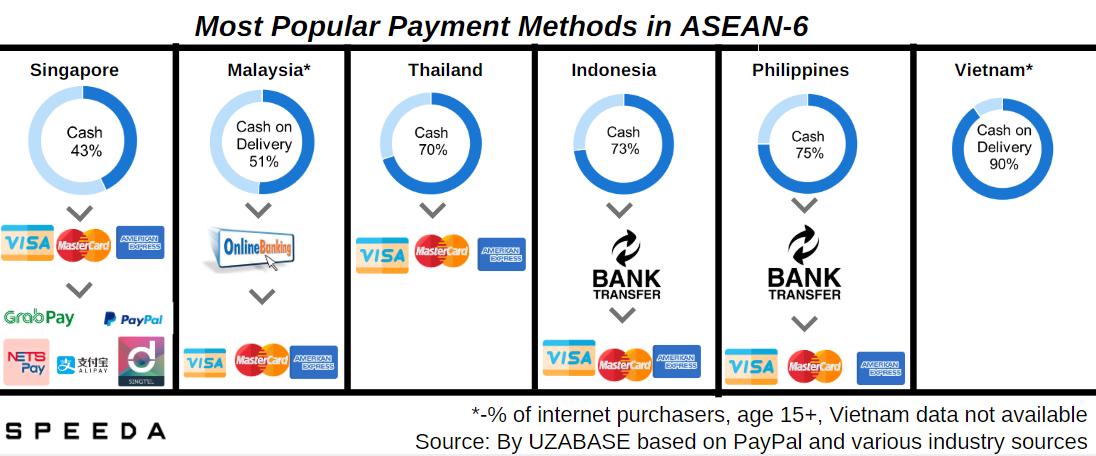

Within South East Asia, countries vary in terms of exposure to e-payments as a result of heterogeneity in economic development and infrastructure provision in the region. While credit card remains the most popular digital payment option in Singapore followed by in-app payments, ATMs/bank transfers and online banking are more popular among most of its ASEAN peers. Malaysia will see faster progression towards a cashless society among other ASEAN countries due to the regulatory push to enhance user confidence, yet might still fail to catch up Singapore’s current status even in the medium term. Despite this, Malaysia ranked fourth largest on digital payment transaction value among the ASEAN-6 (~12% in 2018) and accounted for almost 80% of Singapore’s. |

|

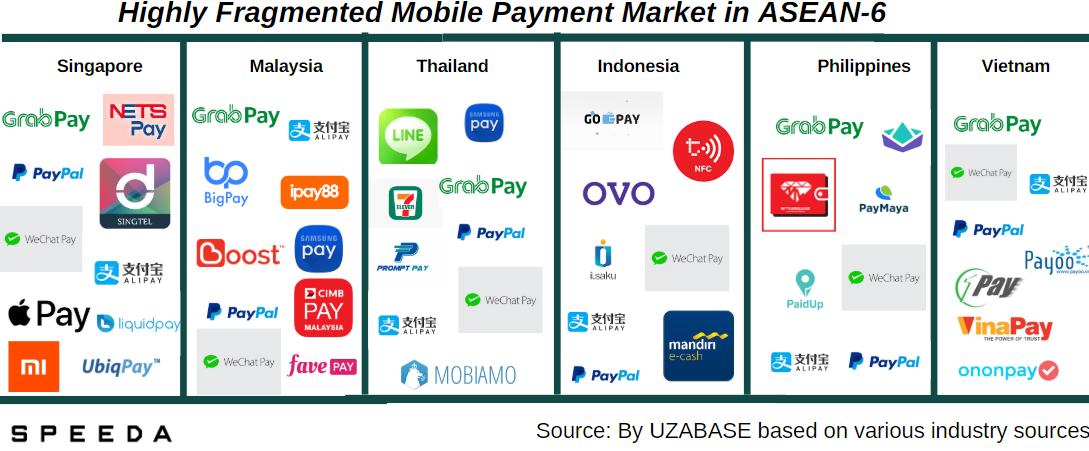

While the mobile payments market in the region currently remains underpenetrated due to its fragmented nature, resulting in low merchant acceptance, South East Asia is expected to see faster adoption of mobile wallets than the rest of Asia. Rising smartphone adoption (with ~90% of internet users in the region using mobile phones for internet access), and increased government efforts to enhance collaboration between mobile payment operators should support growth. In addition, the availability of offline-to-online mobile wallet top-ups should also favourably impact adoption. |

|

Malaysia and Indonesia are seen to be among the high potential markets in the region along with Singapore, which has led to the entrance of global giants such as Tencent and Ant Financial to capitalise on the strong growth opportunities. Malaysia is expected to remain the largest mobile payment market by Statista, while Indonesia is projected to overtake Singapore by 2022E. |

|

Cash-Dominant South East Asia Lags in E-Payment Adoption Triggered by Security Concerns Over Online Payments |

|

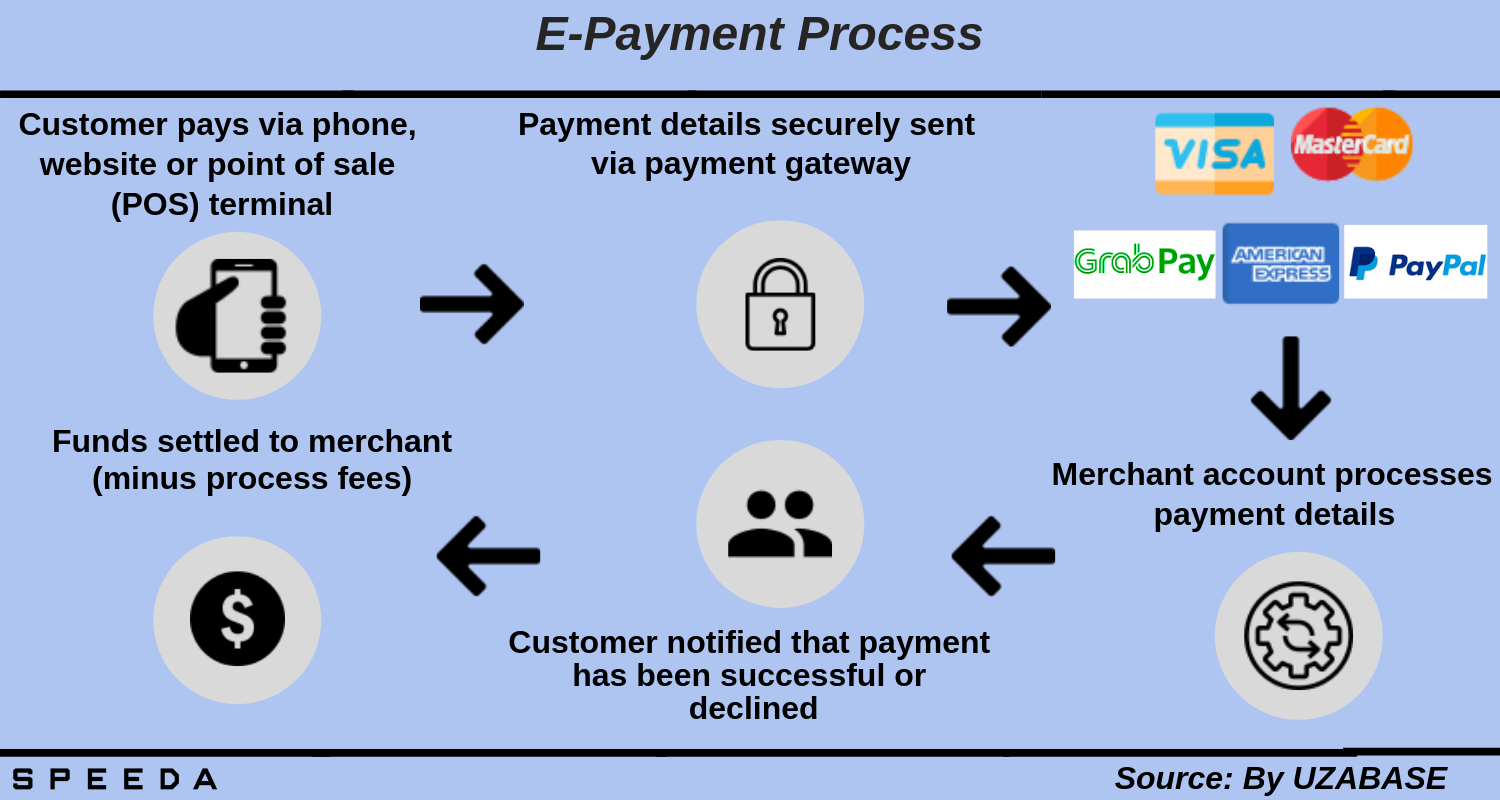

An electronic payment (also known as e-payment or digital payment) system allows transactions through an electronic medium without the use of cheques or cash, and includes use of credit cards, debit cards and mobile wallets (an application storing digitised version of credit/debit cards and/or is linked to a bank account for payment). The South East Asian mobile wallet market remains unique with users given the opportunity to top-up mobile wallet balance (called e-money balance) through physical stores by paying hard currency (known as offline-to-online mobile wallet top-ups) in addition to the payment via credit/debit cards. |

|

|

|

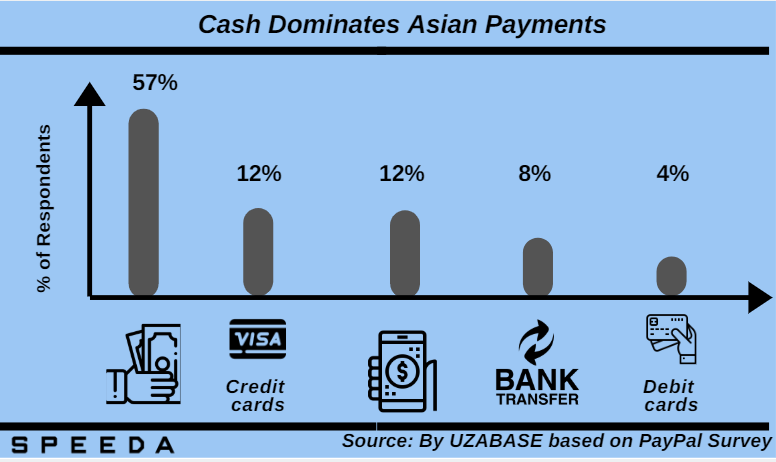

The South East Asian digital payment market, which stood at USD 59.9 billion in 2018 in terms of transaction value (as per Statista) remains at a nascent stage with only a ~4% to the Asian digital payment market in the same year (~2% contribution to global digital payments). This could be primarily attributable to low awareness on credit card usage, the risk-averse nature of the population, and a lack of trust in plastic money due to several incidents of scams and frauds. |

|

As per “Shopper Trends Report” by Nielsen in 2014 (latest available), credit card security remains a key concern for consumers across the region with five of the six Southeast Asian countries except Singapore ranking above the global average (~49% consumers) with respect to their concern around providing credit card information online. |

|

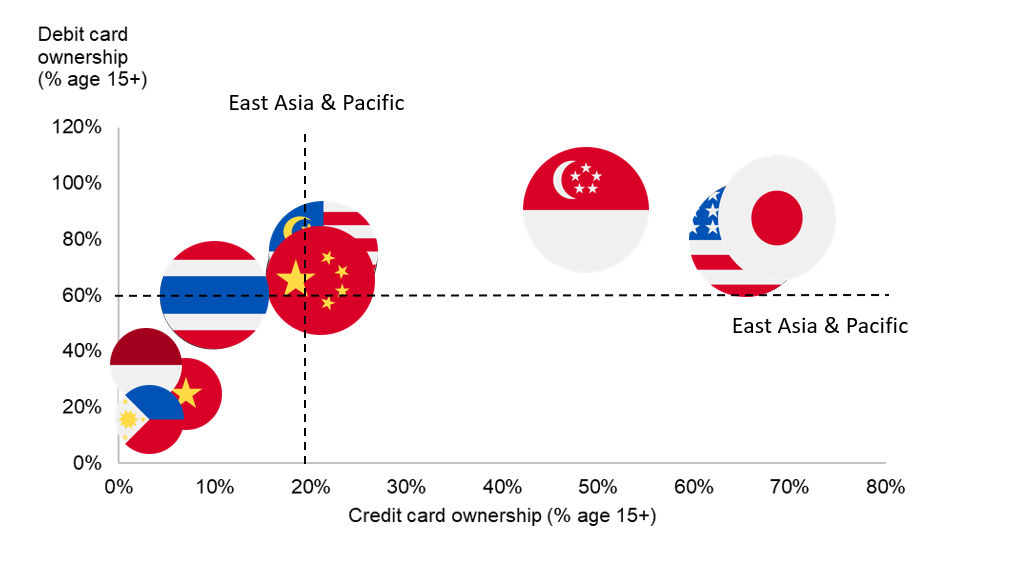

Further, low financial inclusion (with more than ~70% of the region’s population remaining unbanked, significantly higher than the global average of ~30%) has deterred credit and debit card ownership in the region. As of 2017, less than ~25% of the population above 15 owned a credit card in ASEAN-6 except Singapore (~49%) while less than ~60% of the population above 15 owned a debit card in the region except Singapore (~92%) and Malaysia (~74%). |

|

Thus, cash remains king in South East Asia with hard currency paid on delivery, accounting for 44% of the region’s e-commerce transactions in 2017 according to data by US-based research firm IDC, and will continue to remain the popular payment method over the next three years. Thus, the digital payment market in ASEAN-6 will continue to remain small capturing only ~3% of the Asian digital payment market by 2023E with the region recording digital payment transactions growth at a CAGR of ~12% less than the rest of Asia (~18%), as per Statista. China is expected to continue to take the lead, capturing 84% of the Asian market in 2023E vs. 77% in 2018. |

|

Singapore in Line with Developed Peers on Debit and Credit Card Ownership, While Rest of ASEAN-6 Trail Behind, 2017 |

|

|

|

Source: Created by UZABASE based on Global Findex Database of World Bank |

|

Note: Bubble size represents ownership of financial institution account (% age 15+) |

|

Note: Latest data available is for 2017 |

|

|

|

China Commands Strong Lead in Asian Digital Payment Market; South East Asian Contribution to Continue to Remain Minimal |

|

|

|

Source: Created by UZABASE based on Statista |

|

Note: Shares calculated in terms of transaction value |

|

Malaysia to Witness Faster Progression Towards Cashless Society, Supported by Regulatory Push; However, Would Still Lag Behind Singapore |

|

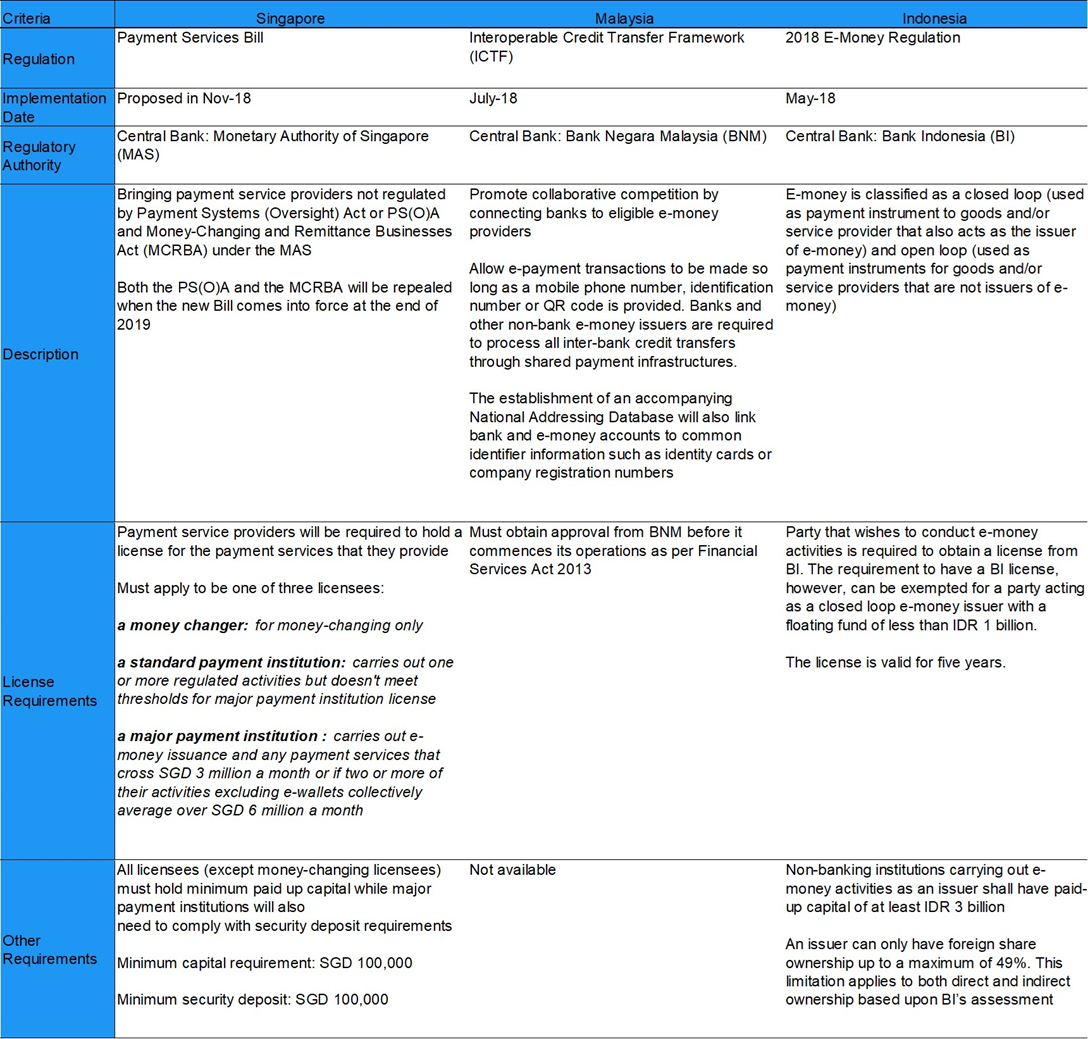

Within South East Asia, countries vary in terms of exposure to e-payment which is a result of heterogeneity in economic development and infrastructure provision in the region, resulting in different levels of readiness to embrace digital payments. Singapore is the pioneer in this matter, with only ~9% of internet purchasers above 15 years of age using the cash paid on delivery option in 2017 as per the Global Findex Database. Credit cards remain a frequently used digital payment option in Singapore (~49% of respondents as per Paypal), followed by in-app payment systems at 19%. |

|

However, the reliance on cash is still high compared to other global leaders such as China and the USA; ~43% of respondents preferring cash as per Paypal vs ~25% in China and ~30% in the USA. This could be attributed to the higher transaction cost in the country despite high ownership of debit or credit cards and quality of infrastructure to support such payments (transaction fee for merchants accepting Visa and Mastercard payments in Singapore is around 3% compared to 0.45% in China and 2% in the USA). |

|

In contrast, more than 70% of respondents in the Philippines, Indonesia and Thailand preferred cash for day-to-day transactions as per PayPal indicating low digital payment penetration in these countries. According to industry sources, cash on delivery accounted for ~69% of the order share of online payments in Thailand in 2017, and ~50% each in Indonesia and the Philippines. While credit cards remain second most preferred online payment option (~31%) in Thailand, ATMs/bank transfers came in second in Indonesia and the Philippines (~40%). As per iPay88 Holding Sdn Bhd (Malaysian-based leading provider of online payment services), online banking is clearly the preferred choice of e-payment in Malaysia over credit cards with online banking payments of 2.5-4.4 million per month in 2017, almost twice that of credit cards (1.3-2.4 million). |

|

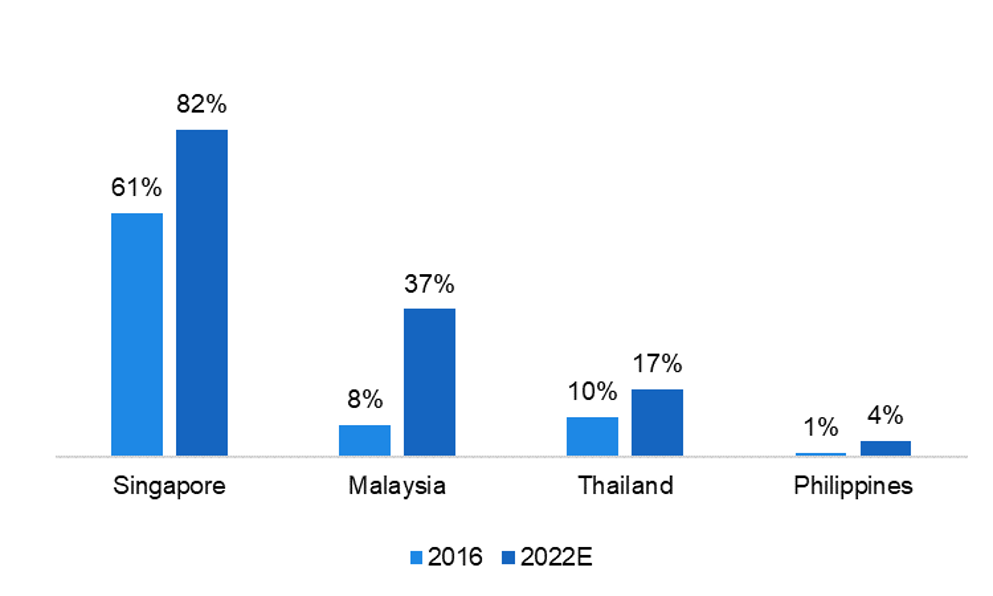

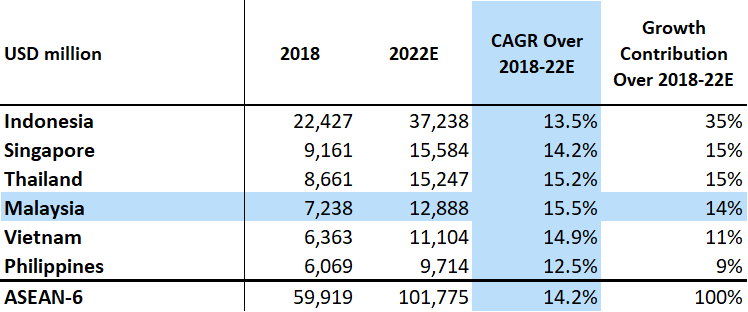

As per the report” Future of Cashless Payments in Singapore” by Frost & Sullivan released in 2018, Malaysia is seen as the most prospective country among the ASEAN-5 that would move faster towards cashless payments (~37% cashless in terms of transaction volume by 2022E up from ~8% in 2016). However, it would still fall significantly behind Singapore’s current status (~61% in 2016 and expected to increase to ~82% in 2022E). However, despite this, Malaysia ranked fourth largest on digital payment transaction value among ASEAN-6 (~12% in 2018), and accounted for 79% of Singapore’s. In addition, Malaysia will witness the fastest growth in digital payment transactions value among the ASEAN-6 over 2018–22E (15.5% CAGR vs 14.2% for ASEAN-6 average) as per Statista. It should also be noted that, while Indonesia’s digital payment penetration is relatively much lower, it is the largest market within the ASEAN-6 as of 2018, more than twice that of Singapore. |

|

Policy moves by the Central Bank, Bank Negara Malaysia (BNM), such as E-Payment Roadmap (halving cheque usage to 100 million by 2019E, from 205 million in 2011) and Interoperable Credit Transfer Framework (ICTF; facilitating funds transfer across banks and non-banks by just referring to the mobile phone number, identification number or QR code) would facilitate increased transition to e-payments. According to BNM, the total cheque volume in Malaysia dropped at a CARC of 9% to 120 million in 2017 from 2011, while electronic fund transfers have increased at a CAGR of 31% to an estimated 329 million during the same period. |

|

|

|

ASEAN 5 Fail to Catch-Up to Singapore’s Current Cashless Status Even by 2022E |

|

|

|

Source: Created by UZABASE based on Frost & Sullivan “Future of Cashless Payments in Singapore” |

|

Note: Share represents % of cashless transactions out of total transaction volume |

|

Note: Data for Indonesia and Vietnam not available |

|

Malaysia to Witness Fastest Growth in Digital Payment Transactions |

|

|

|

Source: By UZABASE based on Statista |

|

Mobile Payments Catching Strong in the Region with Rising Smartphone Adoption; Malaysia and Indonesia Among High Potential Markets |

|

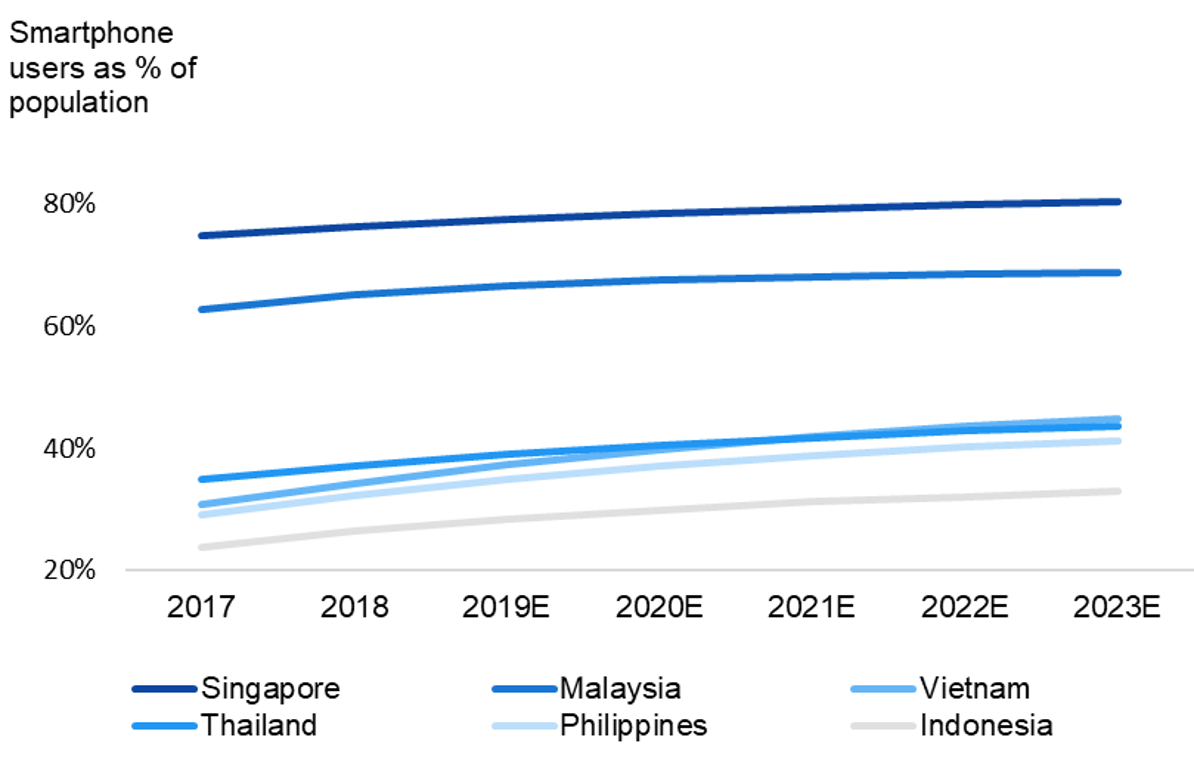

Southeast Asia is witnessing a high rate of smartphone adoption, providing immense potential for mobile payment system providers despite the current nascent stage (less than 1% of Asian mobile payment market as of 2018). |

|

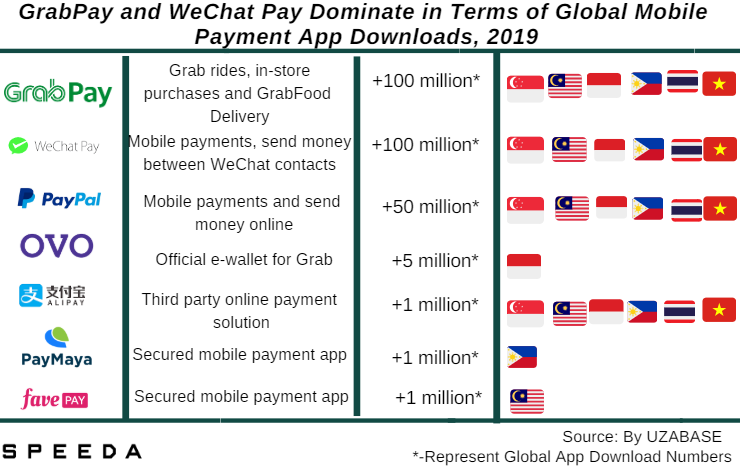

Mobile payments are more secure compared to credit cards when making an in-store payment, given that the payment via digital wallets need a PIN or fingerprint, rather than a mere swipe of the card over a terminal. Further, availability of offline-to-online mobile wallet top-ups eliminate the need for a bank account or credit card, and supports the growth of mobile payments in the region, where most of the population remains unbanked. For instance, GrabPay Credits by GrabPay is the prepaid way to pay for rides even without a credit card. The rider can pay the driver in cash for the load and credits will reflect instantly allowing for use for the next drive. Thus, despite the continued dominance of credit cards, e-wallets, which accounted for only ~9% of the region’s e-commerce transactions in 2017 is expected to reach 16% by 2021E as per IDC, witnessing strong growth. |

|

According to a report “E-Conomy SEA 2018” by Google and Temasek (global investment company headquartered in Singapore), Southeast Asian internet users grew at a CAGR of 10.4% over 2015 – 18 to ~350 million, making the region the third-largest globally in terms of internet users. Further, this number is expected to reach ~480 million by 2020E implying a CAGR of 17.1% as per TechCrunch (US online publisher of technology industry news). More than ~90% of internet users connect to the internet using mobile phones, given the accessibility to affordable smartphone technology making the region most engaged in mobile internet globally. Thus, with only ~55% of Southeast Asian consumers being active mobile internet users as of 2018, there is plenty of growth potential in terms of mobile internet usage. |

|

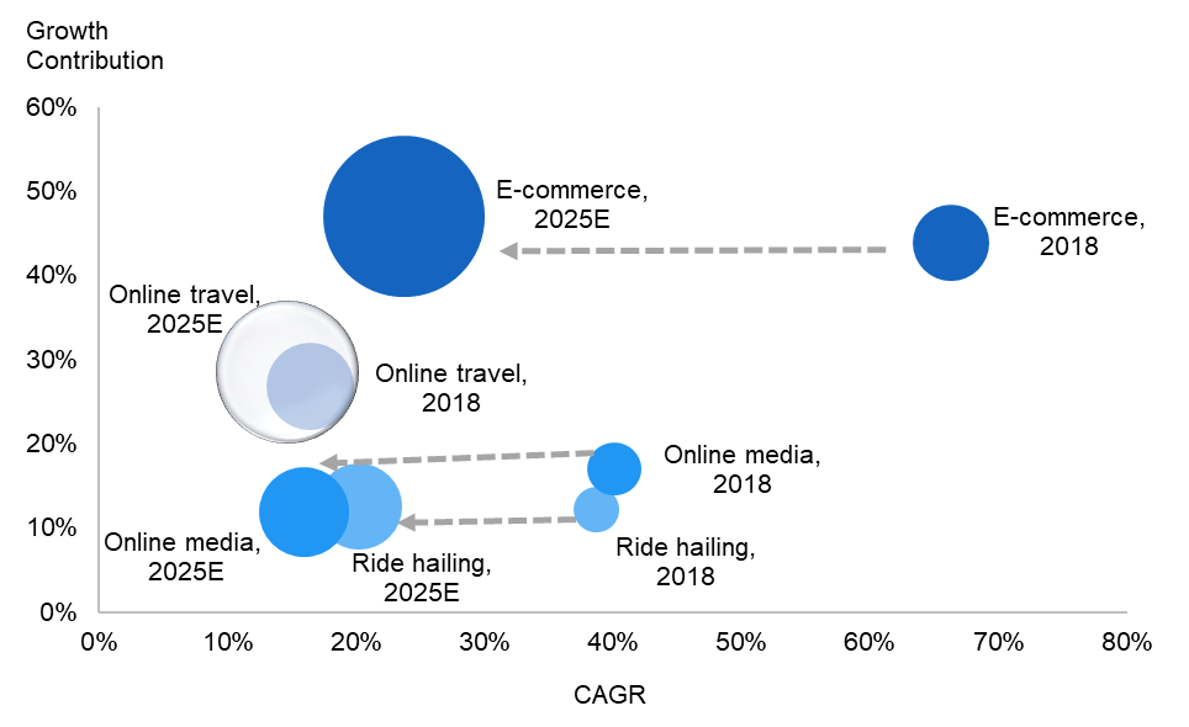

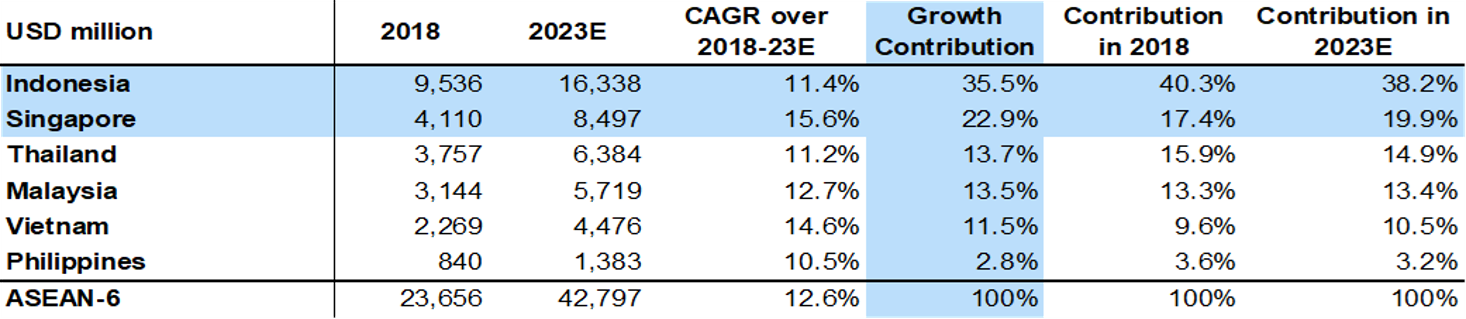

Rising mobile internet usage paves way for strong growth in internet economy (comprising e-commerce, online travel, online media and ride-hailing), providing opportunities for mobile payment system providers. Southeast Asia’s internet economy reached USD 72 billion in 2018 growing at a CAGR of 32.4% from USD 31 billion in 2015 as per a Google and Temasek report. E-commerce was the highest contributor to growth over this period (~44% contribution) and witnessed a strong CAGR of 43.9% over the period to USD 23 billion in 2018 (~32% of total internet economy). The report predicts the overall internet economy to reach USD 240 billion by 2025E (CAGR of 18.8% since 2018) with e-commerce growing at a CAGR of 23.7%, and contributing ~47% to this growth over the period. Indonesia and Singapore would contribute more than half to e-commerce revenue growth during 2018–23E as per Statista forecasts. |

|

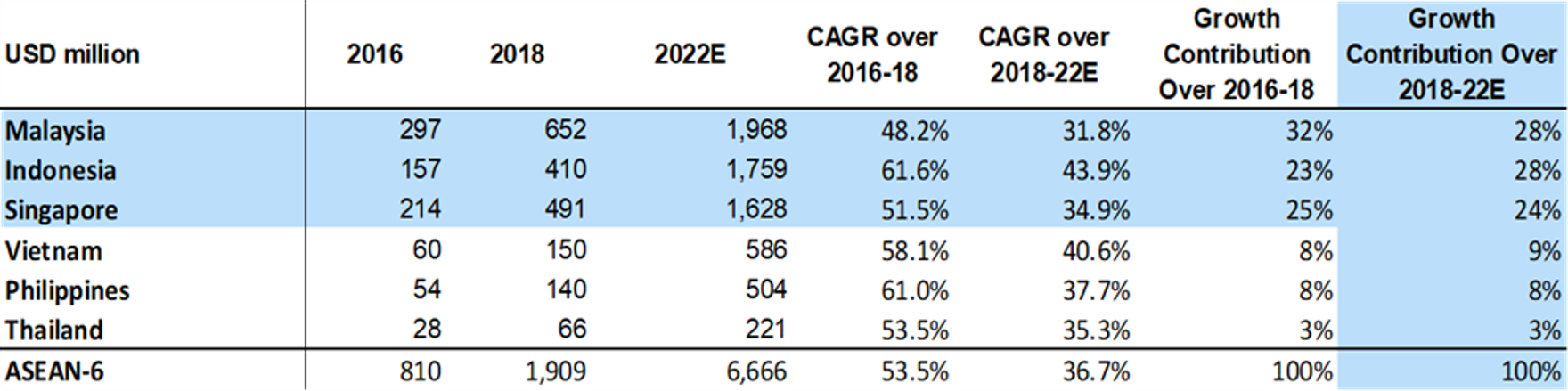

Accordingly, transaction value in the mobile payment market in ASEAN-6 is expected to reach USD 6.7 billion by 2022E, growing at a CAGR of ~37% over 2018–22E. As per Statista, the growth of ASEAN-6 is expected to be higher than the Asian region growth of ~34% CAGR. The rapid growth is due to global giants venturing into the South East Asian mobile payment markets; with Malaysia, Indonesia and Singapore expected to contribute ~80% to the growth over the period. Malaysia is expected to remain the largest mobile payment market by Statista, while Indonesia is projected to overtake Singapore by 2022E. |

|

Tencent, operator of WeChat Pay in China launched a domestic mobile wallet product in Malaysia, called WeChat Pay My in 2018 making Malaysia the first expansion in Asia outside of China and Hong Kong. Ant Financial, affiliate company of the Chinese Alibaba Group and operator of AliPay digital wallet, has entered 10 Southeast Asian and South Asian countries, including India, the Philippines, and Thailand, since 2015 by way of strategic cooperation with domestic players. |

|

Rising Smartphone Adoption Among ASEAN-6 |

|

|

|

Source: Statista |

|

E-commerce and Online Travel to Drive Internet Economy in South East Asia |

|

|

|

Source: by UZABASE based on Google and Temasek “E-Conomy SEA 2018” |

|

Note: Bubble size denotes market size in USD billion |

|

Note: CAGR and Growth Contribution over 2015-18 corresponds with 2018 bubble and 2018-25E with 2025E bubble |

|

Indonesia and Singapore: Major Contributors to ASEAN E-Commerce Revenue |

|

|

|

Source: By UZABASE based on Statista |

|

Malaysia, Indonesia and Singapore to Contribute 80% of Mobile Payment Transaction Growth in ASEAN-6 |

|

|

|

Source: By UZABASE based on Statista |

|

|

|

High Fragmentation, Key Hurdle for Mobile Payments Growth; Governments Progressively Taking Action to Facilitate Easy Adoption |

|

Despite the immense potential, the major hurdle in the Southeast Asian mobile payment market is its highly fragmented nature with each market in the region consisting of multiple digital wallet services from different players (compared to 90% of Chinese mobile payment market dominated by two wallets: AliPay and WeChat Pay), resulting in low merchant acceptance as transactions beyond its own network is not facilitated. This is in contrast to the ASEAN credit cards market controlled by the duopoly of Visa and MasterCard, which allow vendors to switch among credit card networks. |

|

Governments are taking actions to solve this issue. The Malaysian central bank signalled implementation of real-time retail payment platform (RPP) in 2017, in which all bank and non-bank entities operating any kind of digital payment platform will be obliged to participate. In 2019, Payments Network Malaysia Sdn Bhd (PayNet) has launched RPP in Malaysia through a partnership with United States-based ACI Worldwide. The platform called DuitNow is an instant credit transfer with a national addressing database linking mobile numbers and national identity numbers to account numbers. |

|

In September 2018, in Singapore NETS was appointed as master acquirer to unify the e-payment landscape at hawker centres, coffee shops and industrial canteens. NETS will reconcile accounts and earnings of stall holders who accept payment via the various cashless systems, eliminating the need for multiple terminals or quick response (QR) code. By the end of 2018, 10 payment schemes – including Mastercard, Visa and NETS – will go live, with the remaining 10 to be implemented by August 2019. |

|

|

|

Appendix |

|

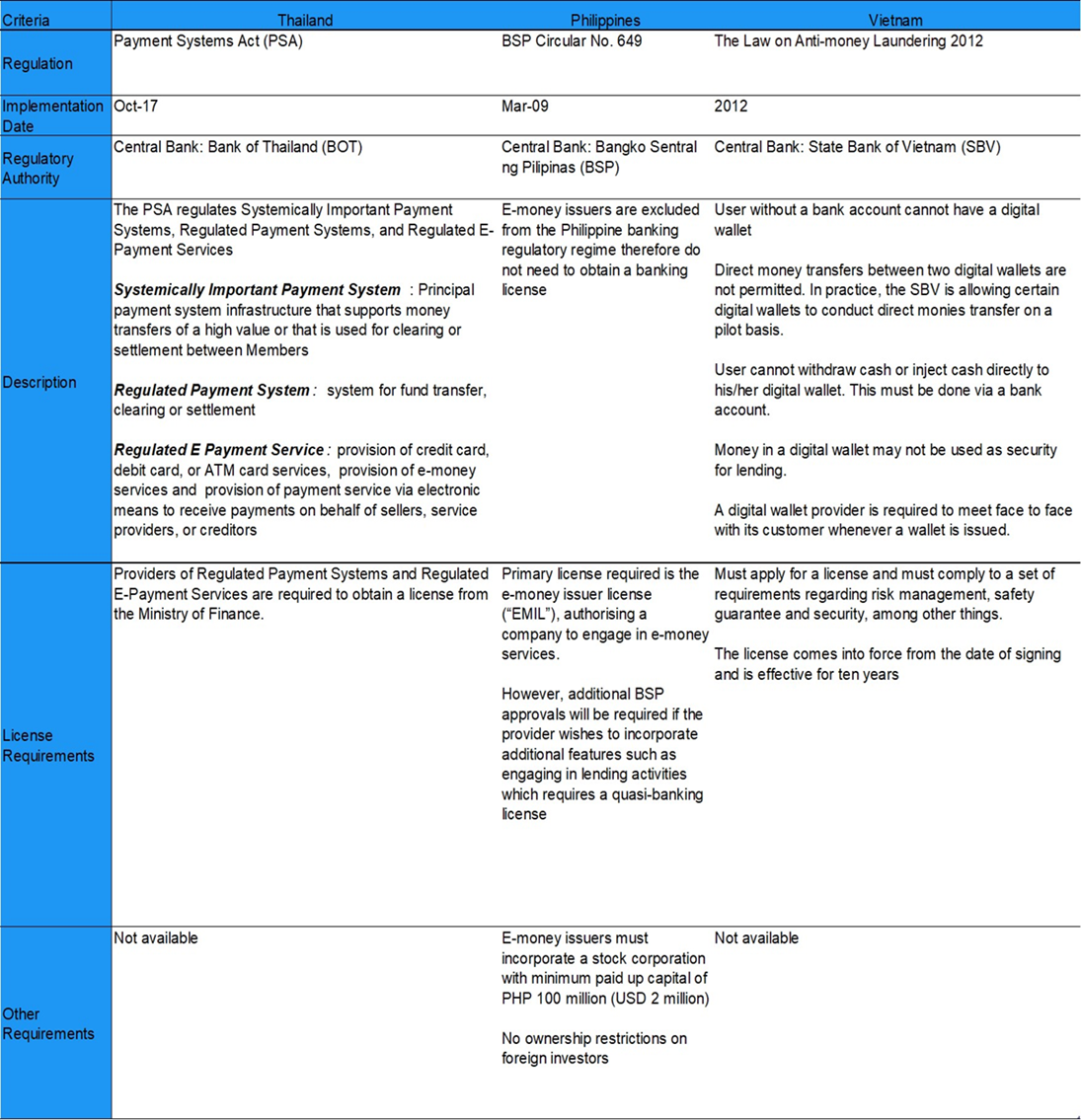

Regulatory Landscape in ASEAN Digital Payment Market |

|

|

|

|

|

Source: By UZABASE based on multiple sources |