Vietnam’s Budget Puzzle

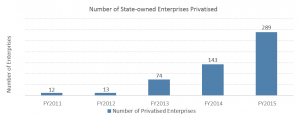

Government Must Privatise and Restructure, or Increase BorrowingAmid shrinking income from several sectors, the Vietnamese government is faced with the increasingly challenging task of balancing the state budget within the constraints of fast rising public debt and slowing economic growth. Without significant expenditure cuts, the government needs to look toward other measures to increase its revenue. Besides conventional means such as increased borrowing, higher taxes and foreign aid, the government may need to increase its efforts in privatising and restructuring the massive state-owned enterprise sector in order to free up more capital needed elsewhere. However, this has thus far been a slow and painful process, with the state reluctant to relinquish its ownership in lucrative businesses such as telecommunication, transport, civil engineering, and oil and gas. Unless there is more effective management of public funds and investments, the country may witness stagnant growth amidst high levels of taxes and public borrowing.  Source: Ministry of Finance

Note: 2015 figure is the total number of planned enterprises to be privatised

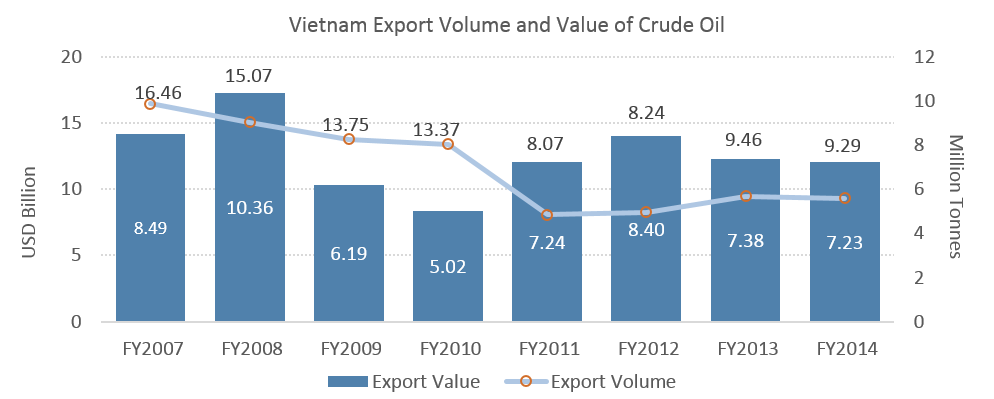

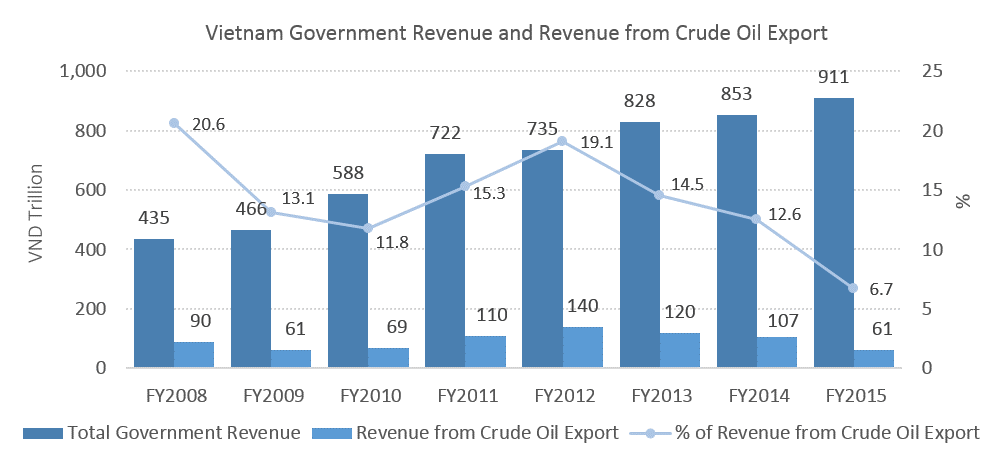

Falling Crude Stifles Government Oil Revenue Vietnam’s crude oil exports entered a downtrend following the global financial crisis, with total export volume declining to 9.29 million tonnes in 2014 from 16.5 million tonnes in 2007. Total export value also declined to USD 7.23 billion from its peak of USD 10.4 billion in 2008. Revenue from crude oil exports contributed 30.0% of total government revenue in 2005, but declined to 20.8% in 2008 and further to 12.6% in 2014. According to the Ministry of Finance (MOF), government revenue will suffer a VND 60.0 trillion shortfall if the low crude oil prices persist. Additionally, tariff income from imported crude oil and oil products is also expected to decline.  Source: UN Comtrade

Source: Ministry of Finance

Note: 2015 and 2014 figures are from Planned Government Budget; Oil Revenue is projected from actual 1H 2015

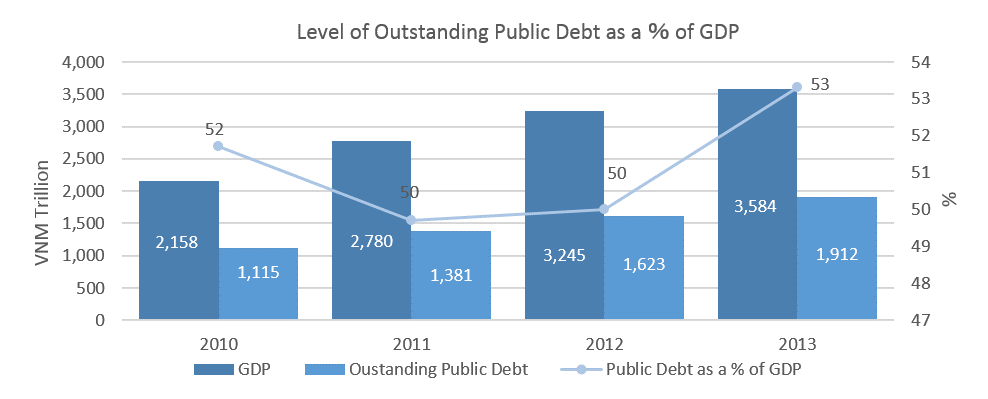

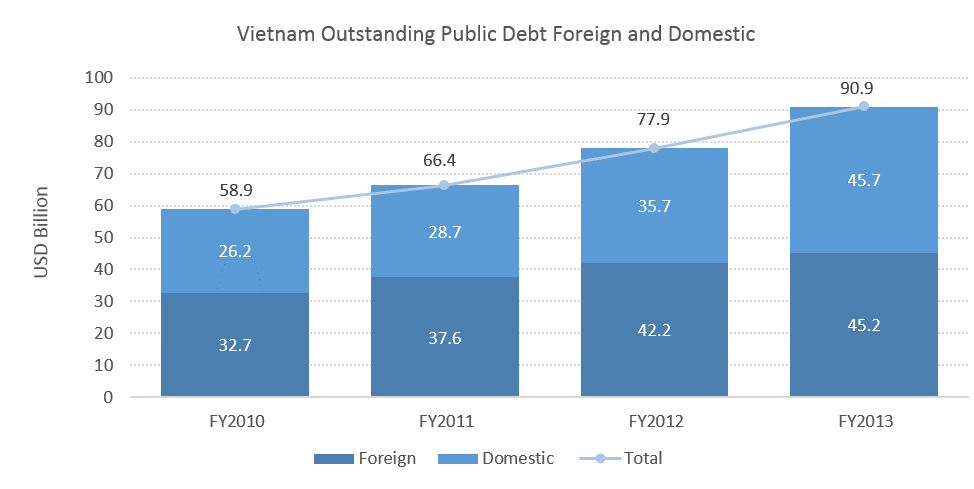

Sub $50 Crude Causes 61% Oil Revenue Shortfall According to the mid-August 2015 data released by the Vietnam Customs Office (VCO), the total volume of crude oil exports reached 5.71 million tonnes for the first 7.5 months of 2015, which was 150 thousand tonnes lower than the same period in the previous year. Total export value for the first 7.5 months of 2015 was USD 2.56 billion, which was just 50.7% of the total value for the same period in the previous year. In the 1H2015 budget meeting in June, the MOF warned that, should the sub $50 oil price situation persist, the gap between actual and budgeted oil revenue may reach VND 32 trillion by the end of the year. 1H oil revenues recorded an achievement rate of only 38.6% relative to the budgeted full year figures. Budget Deficits Cause Public Debt to Balloon Amid the diminishing contribution from crude oil revenue, the government has continued to run a budget deficit, with an increasing amount of public debt issued to finance rising expenditures. The level of outstanding public debt rose to USD 90.9 billion in 2013 (53.3% of GDP) from USD 58.9 billion in 2010 (51.7% of GDP), growing at a CAGR of 15.6%. Meanwhile, the average growth rate of real GDP declined to 5.64% over the same period.  Source: Vietnam General Statistics Office & Ministry of Finance

Note: GDP figures at current prices

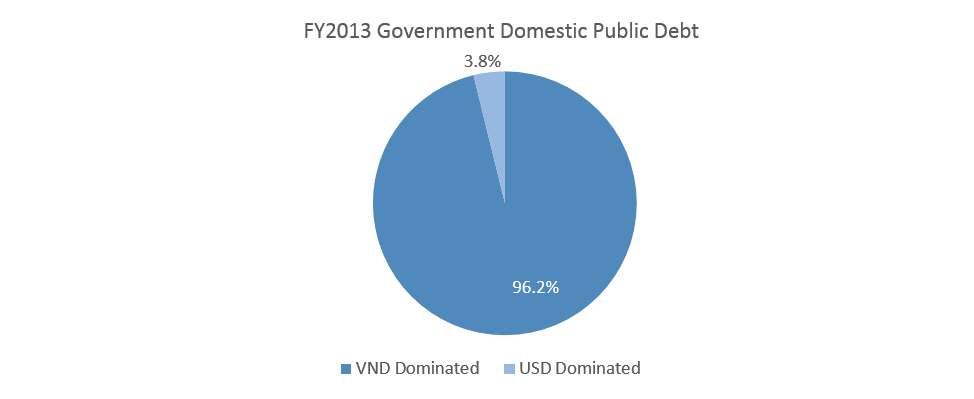

With constant depreciation of the VND, it is increasingly expensive to service debts denominated in foreign currencies. As a result, the government looks to the domestic market for budget financing. Domestic government debt increased to USD 45.7 billion in 2013 from USD 26.2 billion in 2010, growing at a CAGR of 20.4%. In 2013, domestic debt outweighed foreign debt for the first time and then reached 54.5% of total public debt in 2014. If the current situation continues, the public debt to GDP level may reach 64.0% in 2015 and rise further to 64.9% in 2016.  Source: Ministry of Finance

Source: Ministry of Finance

Note: Vietnam public debts are classified into Government debt and Government-backed debts |

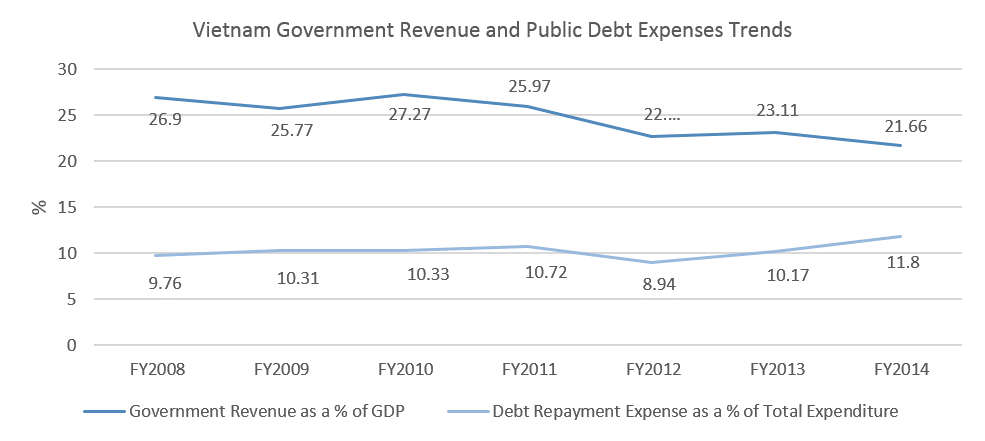

Budget Deficits Expand as Interest Expenses Grow, Tax and Tariff Revenues to TightenWith the public debt limit set at 65.0% of total GDP, it will be harder for the government to balance its budget through borrowing over the coming years. Furthermore, there is doubt over the government’s commitment to cutting back its expenditure. Government spending has continued to rise in recent years, with the budget deficit level reaching 5.30% of total GDP in 2014 from 4.90% in 2008.Debt and interest payments as a proportion of total government expenditure rose to 11.80% in 2014 (planned budget) from 9.76% in 2008. At the same time, the ratio of government revenue to total GDP declined to 21.7% in 2014 (planned budget) from 26.9% in 2008. In addition, slower economic growth will prevent the government from raising corporate income tax, and income from trade tariffs will decline with the implementation of agreements such as the ASEAN Economic Community, Trans-Pacific Partnership, and EU – Vietnam FTA. As such, it will be difficult for the government to reduce its reliance on borrowing to finance its budget.  Source: Vietnam General Statistics Office & Ministry of Finance

Note: 2014 Figures are from the planned budget

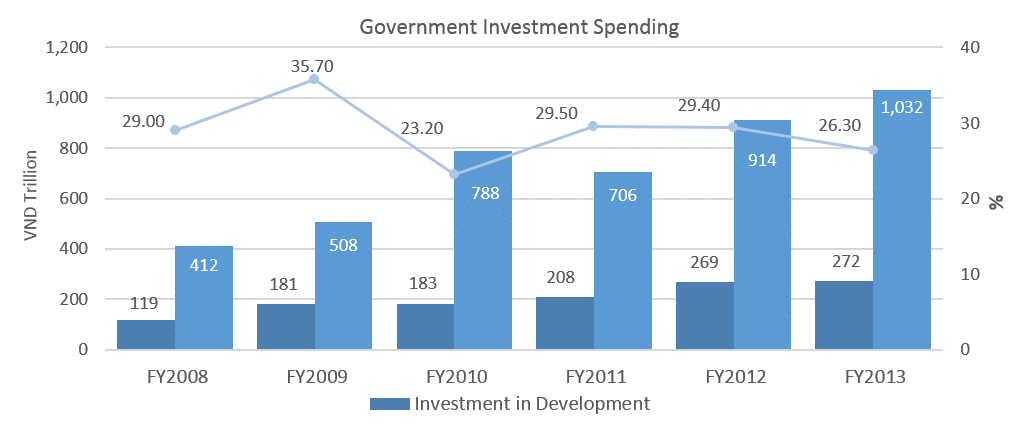

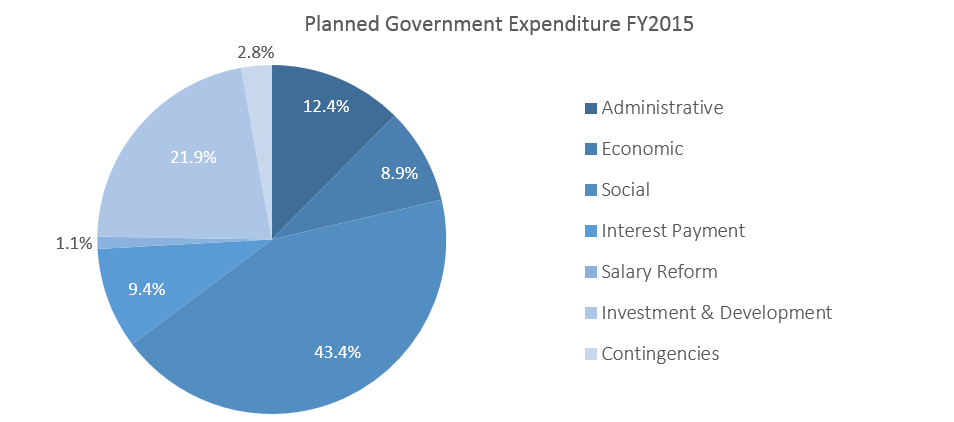

Budget Deficits Restrict Infrastructure Spending and Economic Development With an increasing proportion of government expenditure being used for debt servicing, development spending in Vietnam has been squeezed. Economic development spending increased to VND 272 trillion in 2013 from VND 119 trillion in 2008, growing at a CAGR of 18.0%, while total government spending increased at CAGR of 20.2%. However, the proportion of spending on economic development declined to 26.3% in 2013 from 35.7% in 2009. According to the 2015 state budget, this figure should decline further to 21.9%. A higher debt burden will thus further limit the government’s ability to invest in the economy.  Source: Ministry of Finance

Source: Ministry of Finance

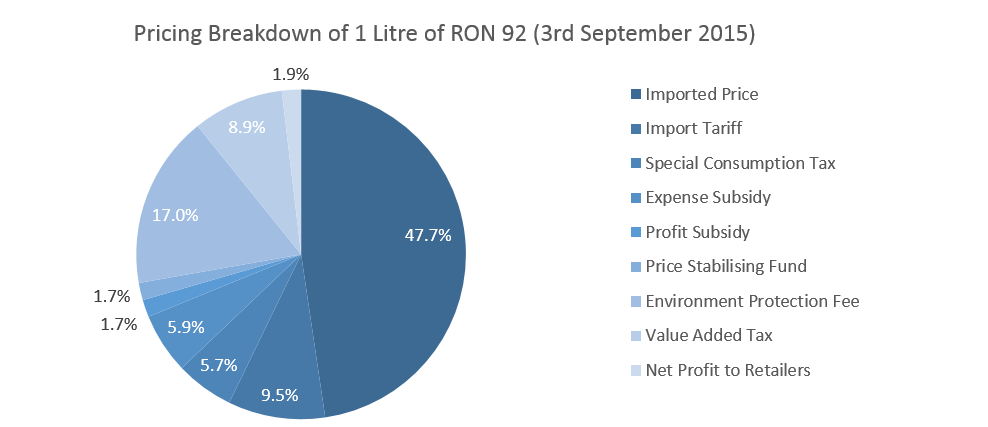

Fees and Taxes Used to Cover Budget Shortfall Contribute to 75% Rise in Petrol Retail Price Even as the price of crude oil dropped to the same level as the lows of 2008, the retail price of petrol in Vietnam remains high. In 2008, one litre of RON 92 cost VND 11,000. This figure jumped 75.7% to VND 19,300 in August 2015, before being lowered to VND 17,000 on September 3rd. The 29.0% depreciation of the VND against the USD since 2008 has not been the sole factor behind this difference. The high price of petrol in Vietnam is largely attributed to the various taxes and fees imposed, which together account for 50.4% of the end retail price. These taxes and fees are the primary means for the government to enhance their revenue, especially when the price of crude oil declines. In addition, the government has also implemented a flexible import tariff regime, which can be adjusted from 20.0% to 40.0% should crude oil prices drop further. Taxes and Fees on Retail Petroleum 2015

Source: Vietnam Petroleum Association

Source: Vietnam Petroleum Association

Government Tax Hikes Use All Possible Means To combat the increasingly challenging fiscal situation, the Vietnamese government is utilising a variety of methods to raise more revenue from taxes. In an unprecedented move, the MOF published a list of companies in July 2015 that have owed income taxes for a prolonged period. Aggressive measures such as the freezing of assets, cancellation of tax registration numbers, and capital deduction from bank accounts will be used to claim taxes owed from these companies.Special consumption taxes are also expected to be increased, which will help raise tax revenue from tobacco consumption by VND 9.00 trillion in 2015 and by VND 24.0 trillion in 2018. Similarly, special consumption taxes for alcoholic beverages were increased from 45.0% to 50.0% for beer and from 50.0% to 55.0% for wine in 2013. In 2014, the alcohol industry contributed VND 25.8 trillion to state revenue, which included over VND 20 trillion from the special consumption tax. Proposed Special Consumption Tax for Tobacco 2015

Source: Compiled by Uzabase

Finally, the new personal income tax regime will target more individual business owners. In contrast to the current tax regime, any annual revenue above VND 100 million will be taxed regardless of the amount of income tax relief a person is entitled to. |