Will the New Era of Trade Protectionism Under the Trump Regime Make America Great Again?

|

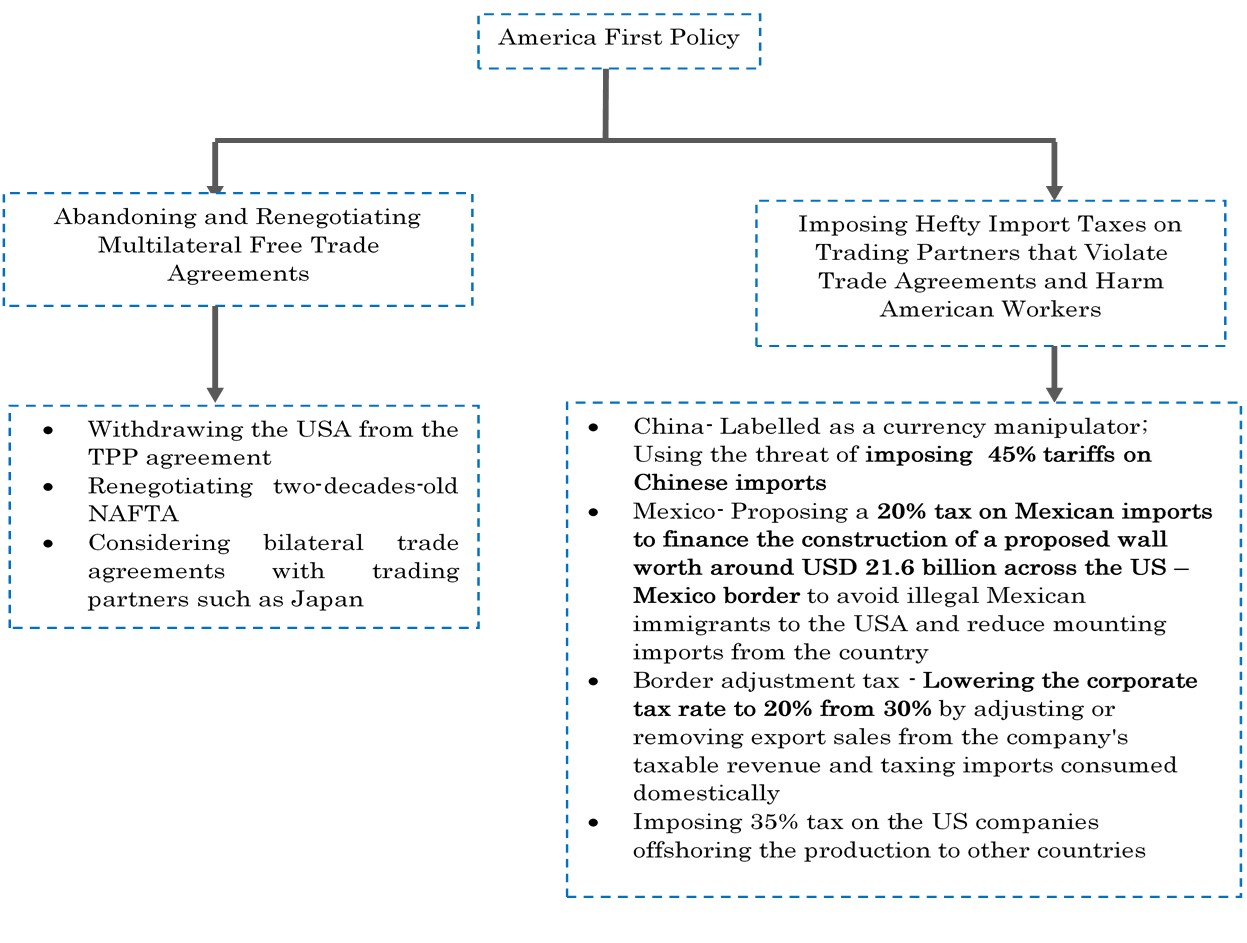

The election of Republican candidate, Donald Trump, as the 45th President of the USA in November 2016 marked a new era of trade protectionism. In his inaugural address, President Trump announced his “America First,” policy, effectively advocating a retreat from its traditional global leadership role in promoting more open trade. These sentiments mirror a global movement towards protectionism as evidenced by the British referendum to leave the EU (Brexit) and the wave of nationalism and anti-immigration sweeping across Europe. President Trump’s economic agenda to make America Great Again included several restrictive trade measures ranging from abandoning (TPP) and renegotiating multilateral free trade agreements (NAFTA), to imposing hefty import taxes on errant trading partners whose actions harm American jobs. In our view, the net impact of these restrictive trade measures are likely to be positive on the US economy as the benefits to domestic manufacturers and American workers via import substitution and reshoring outweigh the costs of protectionism, such as higher prices for consumers and slowdown in trade activity. However, from an Asia-Pacific Economic Corporation (APEC) perspective, which has been repeatedly accused of unfair trade practices, US trade protectionism poses significant downside risks, with major ramifications for Mexico, Canada and China due to their high exposure to the US market. While economic growth of these countries would be in jeopardy due to the slowdown in trade and remittances inflows, possible trade wars between China and the USA would have knock-on effects for other countries that export heavily to China such as Taiwan and Malaysia. |

|

Trump’s America First Policy: A Move Towards Trade Protectionism

In his inaugural address after the election as the 45th US President, Donald Trump announced his foreign policy, “America First,” emphasising American nationalism in international relations, which effectively withdraws the nation from its global leadership role. This includes several trade protectionist measures which are anticipated to be implemented during his tenure over 2017-21 with the aim of ending an era of unfavourable trade balances and manufacturing job losses.  Source: by UZABASE based on various materials

These sentiments mirror a global movement from liberalisation towards protectionism, which turned into a dominant trend all over the world, post the 2008 global financial crisis with governments taking steps to recover from the liquidity glut and financial weakness. The British referendum to leave the EU (Brexit) and nationalist and anti-immigration movements across Europe are the most recent instances of the world’s movement towards protectionism. |

|

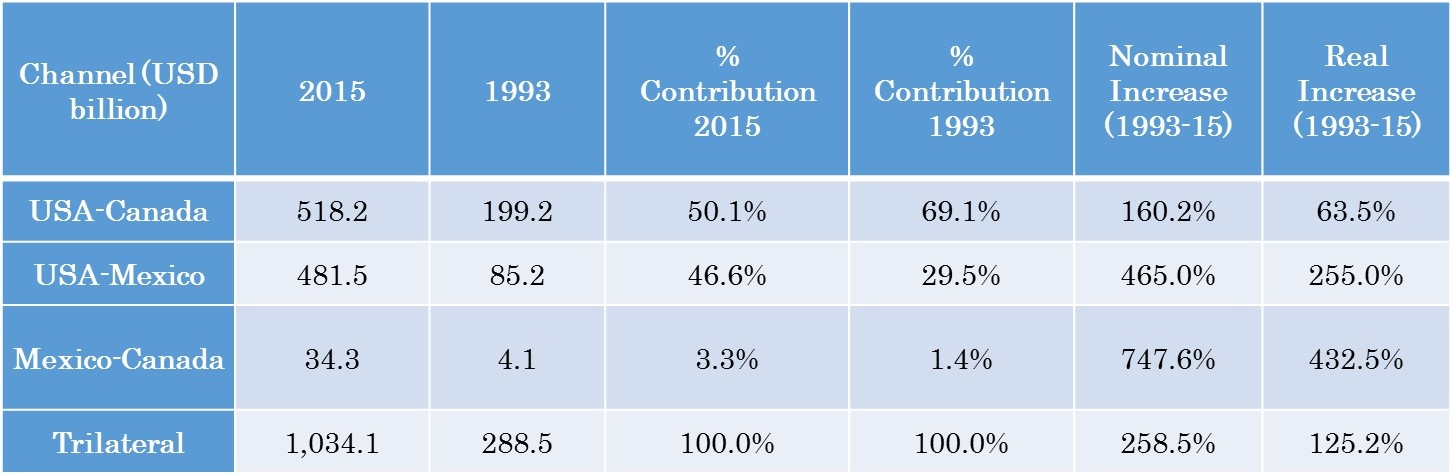

NAFTA: The Classic Free-Trade Quandary Yielding More Pain than Gain to the USA The Largest Free Trade Agreement in the World, with Members Contributing to One-Fourth of Global GDP NAFTA, a free trade agreement between three economic powers in the North American region-Canada, Mexico, and the USA- came into force on 01 January 1994. It is the world’s largest free trade agreement with its members contributing more than USD 20 trillion or 25% of the global GDP as of 2014. NAFTA’s purpose was to encourage economic activity in the North American region by reducing numerous tariffs and non-tariff trade barriers with a particular focus on those related to agriculture, textiles and automobiles. Cross Border Trade Flourished After NAFTA Implementation While Benefiting the US Auto Industry Through Value Chain Integration The NAFTA’s immediate aim to increase cross-border commerce in the North American region through lowering or eliminating tariffs and reducing some non-tariff barriers, such as Mexican local-content requirements was undoubtedly successful. Over 1993-15, the trade between these three countries almost grew four-fold to USD 1,034 billion in 2015. NAFTA Makes Significant Contribution to Growth in Cross-Border Trade

Source: Mexican Embassy in Canada

Note: Adjusted for inflation using Bureau of Statistics’ (BLS) core CPI

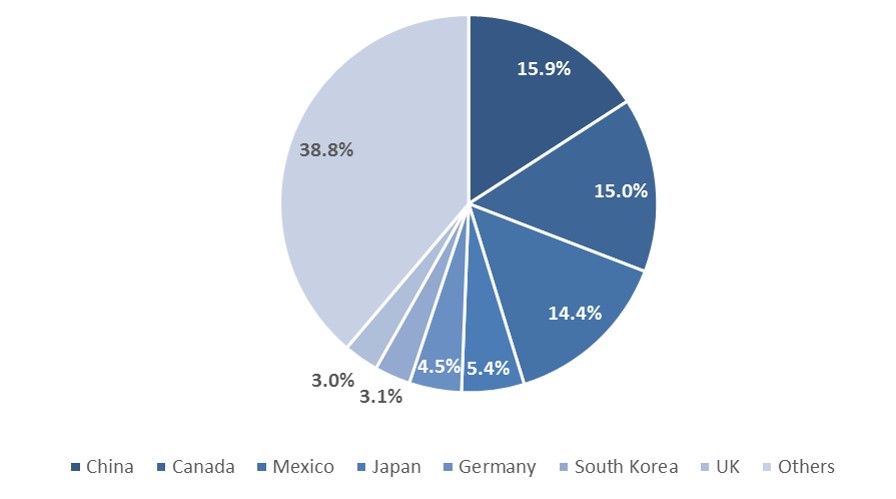

Furthermore, the NAFTA implementation benefited specific sectors such as the US automotive industry as it enabled the integration of supply chains across North America. A 2011 working paper by the Hong Kong Institute for Monetary Research estimated that an automobile imported from Mexico contains 40% US content compared to 25% US content from Canada, 4% from China, and 2% from Japan giving an option for US automobile makers to retain a significant share of production domestically. Furthermore, offshoring to low-wage countries like Mexico enabled the industry to compete with Asian rivals. The US Economy Experienced Profound Disruption with Mounting Trade Deficits, Manufacturing Job Losses and Illegal Immigration • Staggering Trade Deficit with Mexico and Canada since NAFTA Implementation Nevertheless, since the NAFTA implementation, the USA registered trade deficits with Canada and Mexico, the second-and third-largest trading partners after China. The USA continues to import more than it exports from NAFTA partners, resulting in widening trade deficits thereby exerting growing pressure on the balance of payment (BOP). Canada and Mexico: The Second-and Third-Largest Trade Partners of the USA, 2016

Source: US Census Bureau

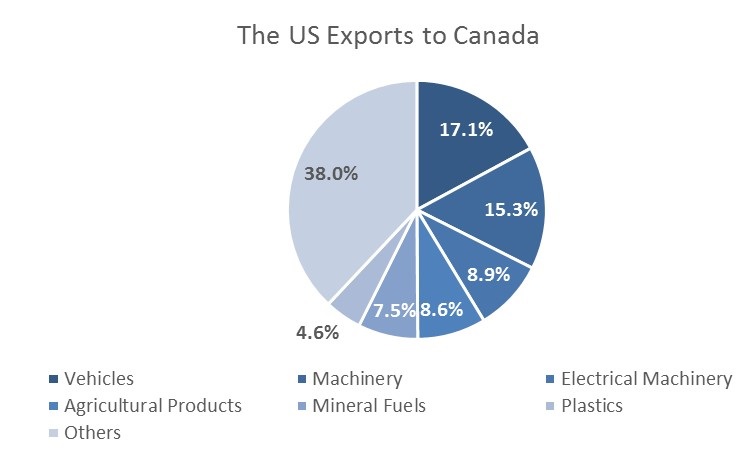

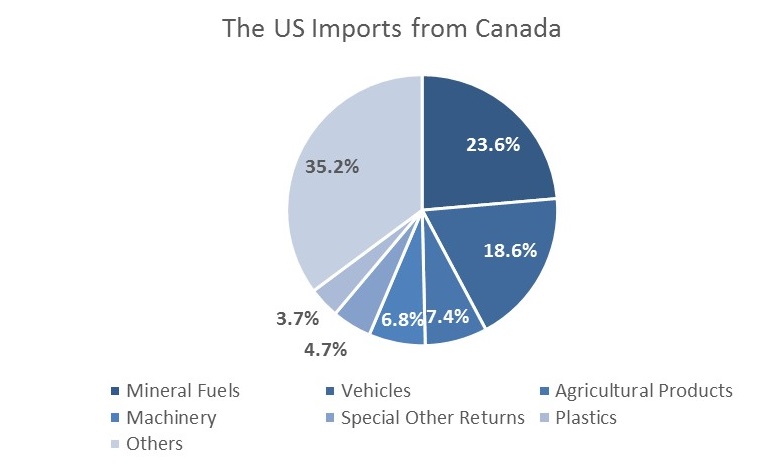

The Top Trade Commodities of the USA with NAFTA Partners, 2015

Source: Office of the United States Trade Representatives

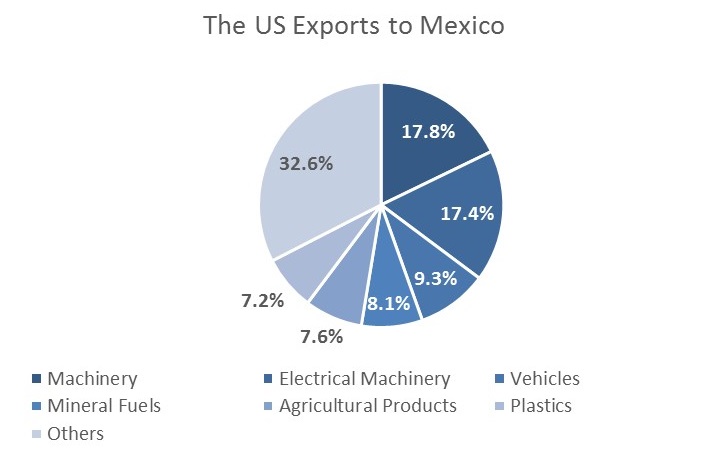

Source: Office of the United States Trade Representatives

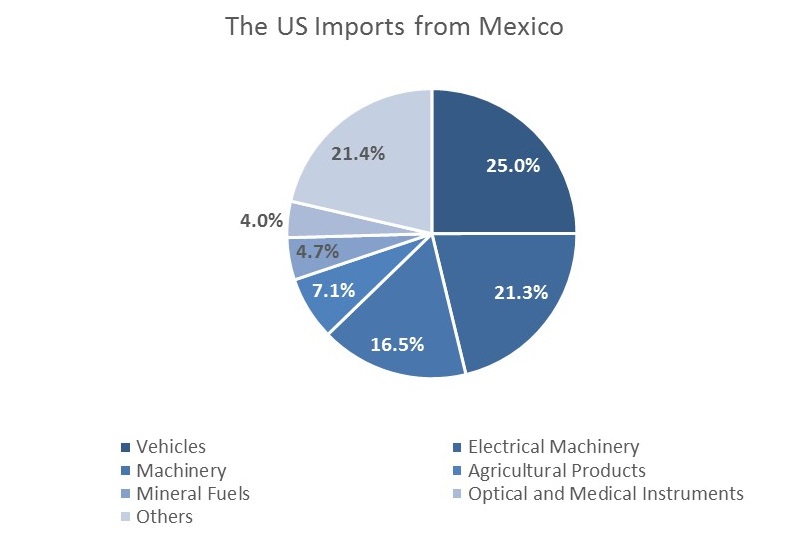

Source: Office of the United States Trade Representatives

Source: Office of the United States Trade Representatives

US-Canada Trade Slowed Down in 2009 Due to the Recession Resulting in a Four-Fold Reduction in the Trade Deficit

Source: US Census Bureau

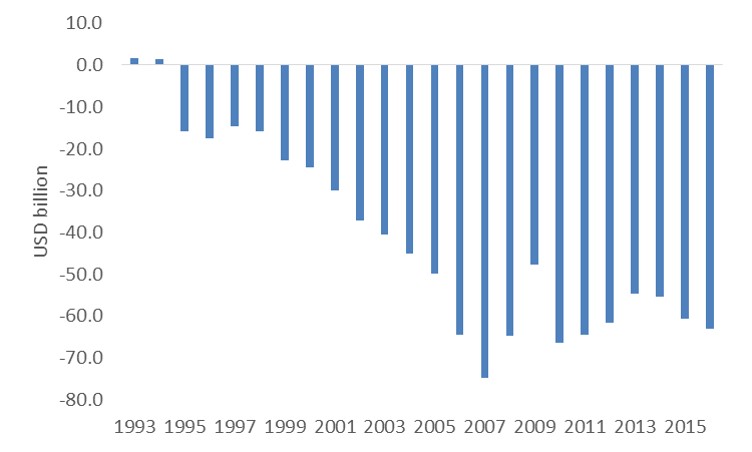

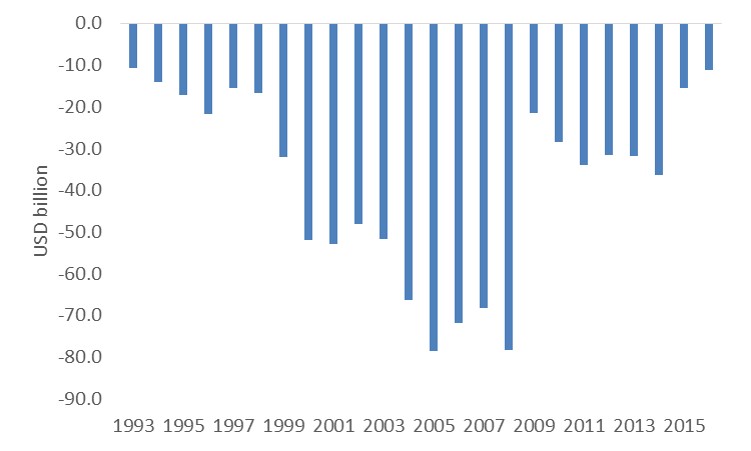

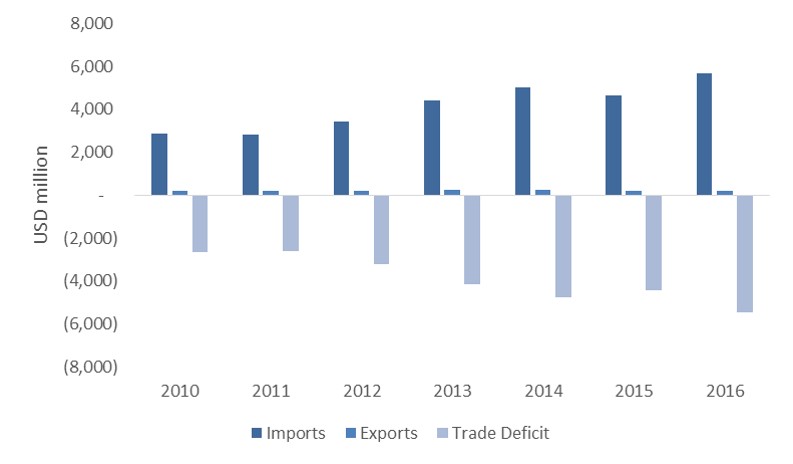

The US Trade Deficit with Mexico Quadrupled Over 1995-16

Source: US Census Bureau

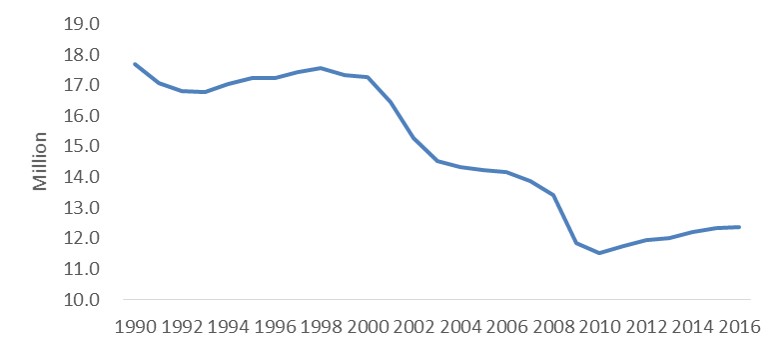

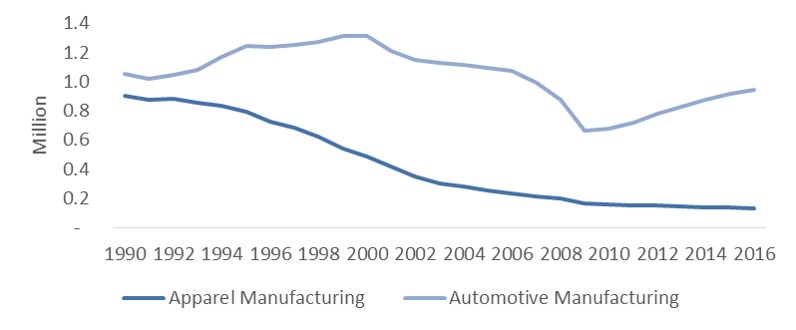

• Around 30% Manufacturing Job Losses with Profound Disruptions in Textile and Automobile Industries When former President, Bill Clinton signed the bill authorising the NAFTA in 1993, he said the trade deal means “jobs, American jobs, and good-paying American jobs”. Contrary to his expectations, the USA witnessed around 30% drop in manufacturing employment to 12.3 million jobs at the end of 2016 from a high of 16.8 million jobs at the end of 1993. Whether the NAFTA is directly responsible for this decline is difficult to say, (automation is also a key reason for the manufacturing job losses). Nevertheless, industries, which were more exposed to the removal of tariff and non-tariff trade barriers such as textile, apparel and automotive are usually considered to be the hardest-hit by the agreement. This is due to the low wages prevalent in the NAFTA partners (the average wage of a Mexican factory worker is around USD 4 per day compared to around USD 70 for a US factory worker as of 2016) making imports and offshoring relatively cheaper to the USA in a free trade environment, thus translating into both domestic production and job losses. Mexico is currently the top offshoring destination for US companies followed by China owing to the low wage rates and fewer government regulations. All major American car makers including Ford and General Motors have factories in Mexico and prior to Trump’s twitter campaign against offshoring, a few auto companies were openly planning to ship more jobs abroad. The US Manufacturing Jobs Remain Well Below Pre-NAFTA Levels Despite Slowly Rising Over 2010-16

Source: The US Department of Labour

Automotive Manufacturing Jobs on a Recovery Path, Yet Below Pre-NAFTA Levels

Source: The US Department of Labour

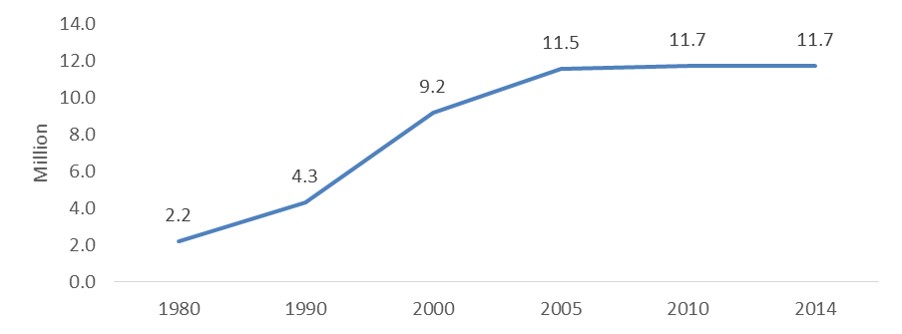

• Illegal Immigrants Resulted in Massive Wealth Transfer Out of the USA by Means of Remittances Part of the justification for the NAFTA was that it would reduce illegal immigration from Mexico to the USA through the gradual convergence in wages and living standards in Mexico via uniting the US and Mexican markets. Yet the implementation didn’t results in the expected reductions. Mexico is the origin of the largest immigrant group in the USA, accounting for 27.6% of the foreign-born population, which was 42.4 million in 2014. Over half of all Mexican immigrants reside in the USA illegally and constitute nearly 60% of the unauthorised immigrants in the country. Mexican Immigrants to the USA Slowed Down Over 2005-14 Subsequent to a Rapid Rise Since 1980

Source: US Census Bureau

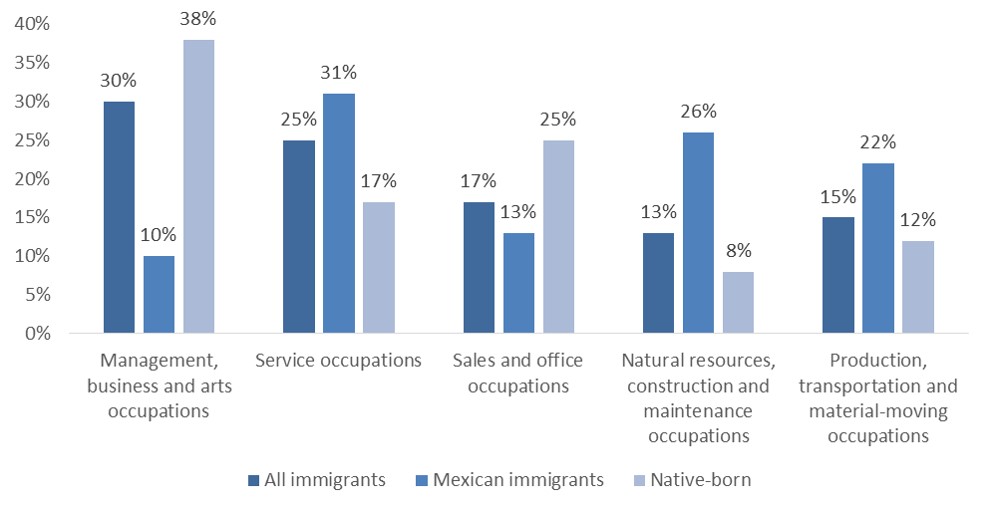

Mexican Immigrants Typically Tend to Work in Unskilled Occupations, 2014

Source: US Census Bureau

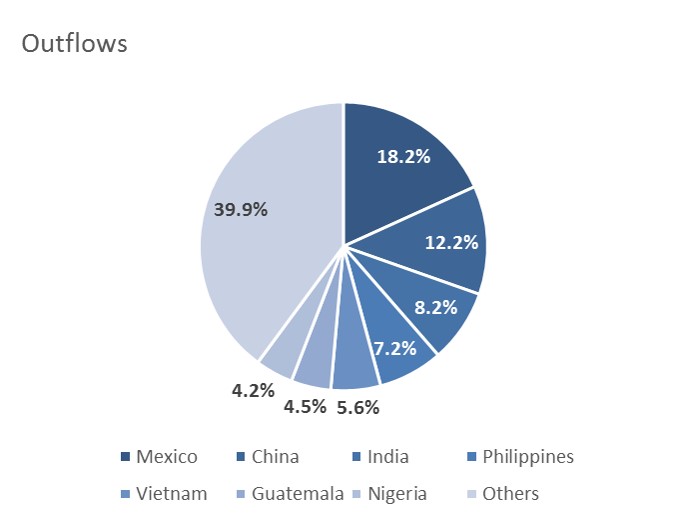

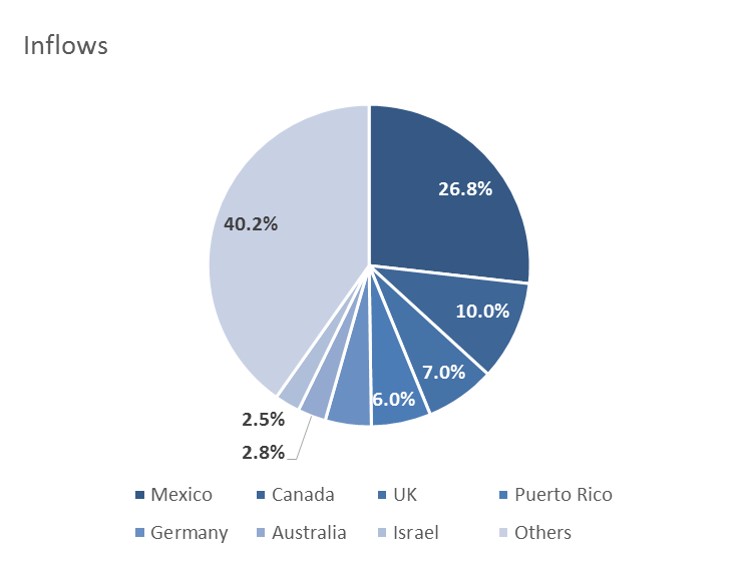

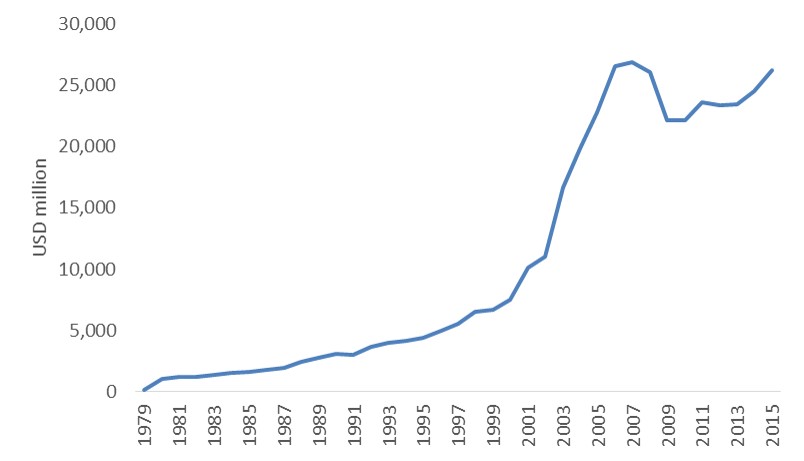

Furthermore, a significant transfer of wealth has occurred out of the USA to Mexico by means of remittances from both legal and illegal immigrants. Mexico is the top partner of the USA in terms of both remittance inflows and outflows. Yet, the outflows from the USA surpass inflows by a huge margin with the gap increasing over time. Total remittances sent to Mexico from the USA via formal channels amounted to USD 24.3 billion in 2015, representing 18.2% of the total remittances outflows. In contrast, the USA only received 1.9 billion remittances inflows from Mexico, forming 26.8% of total remittances inflows. Remittances outflows can be viewed as a leakage from the circular flow of income that reduces the amount of money that is available for economic activity, thus hampering economic growth. Mexico: The Top US Partner for Remittances Inflows and Outflows, 2015

Source: Pew Research Centre

Source: Pew Research Centre

Remittance Inflows to Mexico on a Recovery Path after Deterioration During Global Financial Crisis

Source: World Bank

Note: Around 98% of the remittances inflows to Mexico occurs from the USA

In conclusion, while the economy as a whole saw a slight boost after the NAFTA implementation, certain sectors and communities experienced profound disruption. As a result, the overall positive impact of the NAFTA is barely perceptible, thus renegotiating the pact is quite essential from an economic point of view. |

|

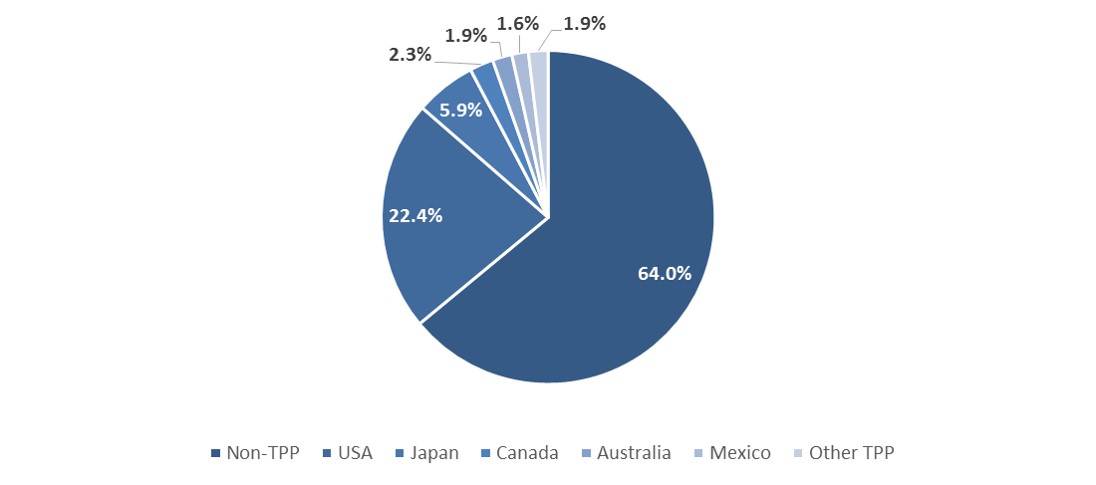

Trans-Pacific Partnership (TPP) is Unfavourable on Economic Grounds, but Strategically Crucial to Counter China’s Regional Influence TPP Binds 12 Nations Across the Pacific Rim Contributing to 36% of Global GDP The TPP is a free trade agreement signed in February 2016 during former president Obama’s tenure binding 12 nations bordering the Pacific Ocean namely; Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, the USA and Vietnam, but notably excluding China. The pact aimed to remove most tariffs, some tariff-rate quotas (TRQs) and many nontariff barriers to goods and services, and trade and investment between the 12 parties. Furthermore, the TPP covers a broad range of goods and services including financial services and telecommunication and includes broader provisions on state-owned enterprises (SOEs), labour protection standards and the protection of IP rights. The TPP region is significant to the world economy in terms of GDP and trade. Countries involved produced combined GDP of USD 28 trillion forming 36.0% of the global GDP as of 2014 outpacing the North American region’s contribution of 25%. Top five signatory countries namely, the USA, Japan, Canada, Australia and Mexico represented nearly 95% of the TPP region’s collective GDP in 2014 of which the USA accounted for the largest share (62.2%) followed by Japan (16.4%) and Canada (6.4%). Furthermore, TPP countries accounted for 28% of world merchandise imports and 24% of world merchandise exports in 2014. TPP Countries Represent Nearly 36% of World’s GDP, 2014

Source: International Trade Commission, USA

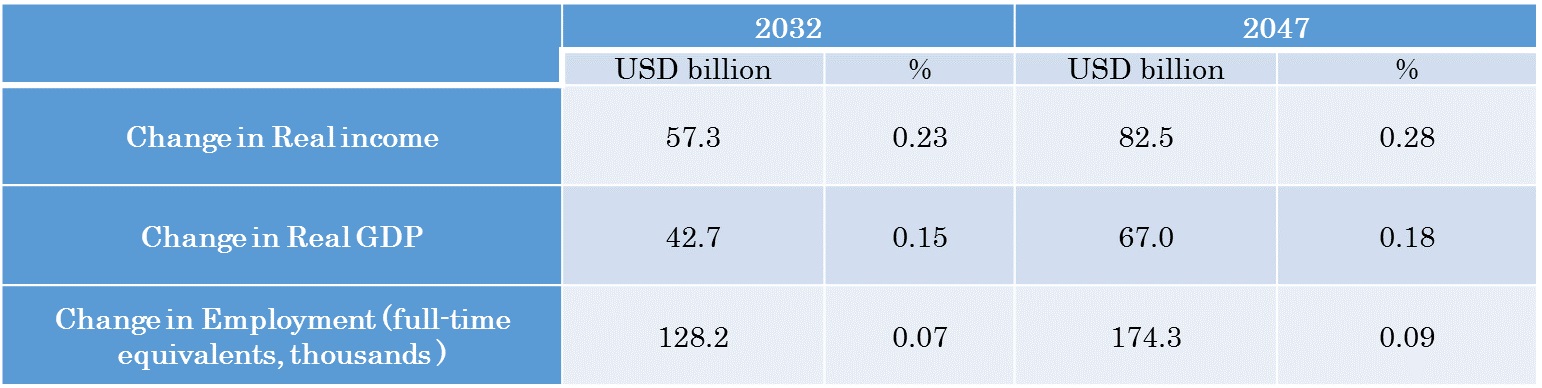

TPP: Strategically Crucial With Limited Economic Benefit From a strategic point of view, the TPP is crucial to the USA since this enables the nation to build its power in East Asia by creating an economic bulwark against the growing Chinese regional influence. For instance, TPP would give the USA an excuse to intervene in trade disputes in the oil and natural gas-rich South China Sea, where China has been piling up its military to back its incursions in that area. According to a report by the US Defence Department in 2015, about 30% of global maritime trade passes through the South China Sea each year, worth USD 5.3 trillion. Furthermore, the South China Sea is estimated to contain 17.7 billion tonnes of crude oil compared to 13 billion tonnes in Kuwait as per the Ministry of Geological Resources and Mining of the People’s Republic of China. • China Steps in to Fill the Void Left by US Withdrawal from TPP The withdrawal of the USA out of the TPP indirectly handed China an opportunity to step in with a different regional free trade deal, known as Regional Comprehensive Economic Partnership (RCEP) to expand its influence in the region. The proposed RECP, includes 16 Asia-Pacific states, including China, Japan, India, and the member states of the Association of South-east Asian Nations (ASEAN) but notably excluding the USA. However, RECP currently includes fewer disciplines and lower standards, with the economic benefits to the member nations projected to be less than those from the TPP. • Japan Pushes Ahead with TPP Japan, which had been cautious about moving ahead with the TPP without the USA changed its position and showed its keenness implement the TPP with the remaining 11 signatories. The shift to prioritising implementation of the multilateral deal can also be seen as a pushback against the US pressure to negotiate a bilateral trade pact with Japan. According to a study conducted by the US International Trade Commission in 2015, the TPP would result in positive effects, albeit small, as a percentage of the overall size of the US economy. As a result, abandoning the TPP is the right thing to do in terms of economic point of view. Thus, while the TPP abandonment is strategically unwise for the USA, from an economic standpoint was likely to add little value to enhancing American prosperity. Economy-Wide Effects of TPP

Source: US International Trade Commission

Note: For the analysis, 2017 has been assumed as the year of TPP implementation. 2032 would be year 15 of the agreement, at which time most TPP provisions would have been implemented. The changes are relative to baseline in 2032 and 2047, which assume no TPP scenario. Dollar values are in 2017 prices.

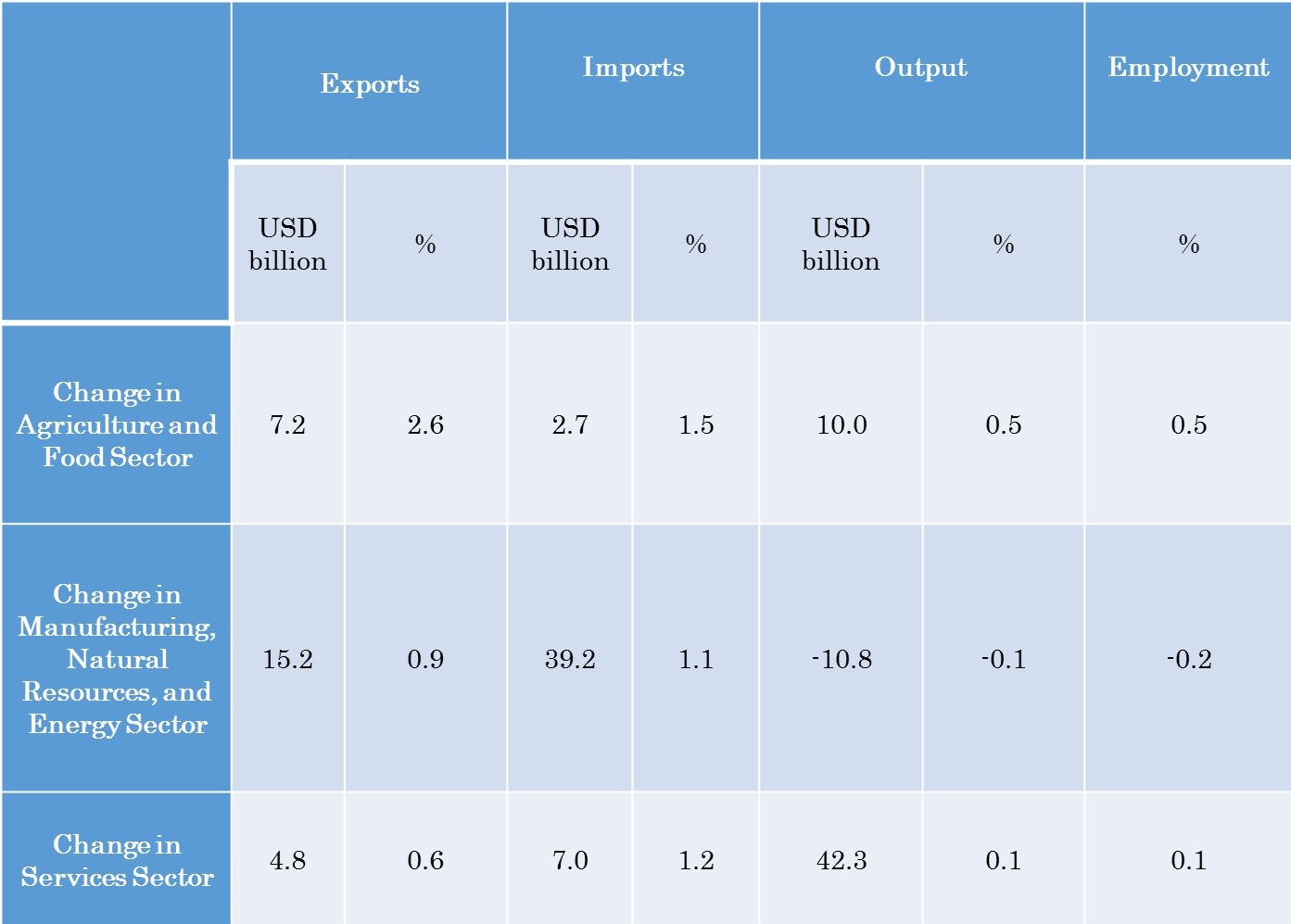

Broad Sector Level Effects of the TPP by 2032

Source: US International Trade Commission

Note: For the analysis, 2017 has been assumed as the year of TPP implementation. 2032 would be year 15 of the agreement, at which time most TPP provisions would have been implemented. The changes are relative to baseline in 2032, which assume no TPP scenario. Dollar values are in 2017 prices.

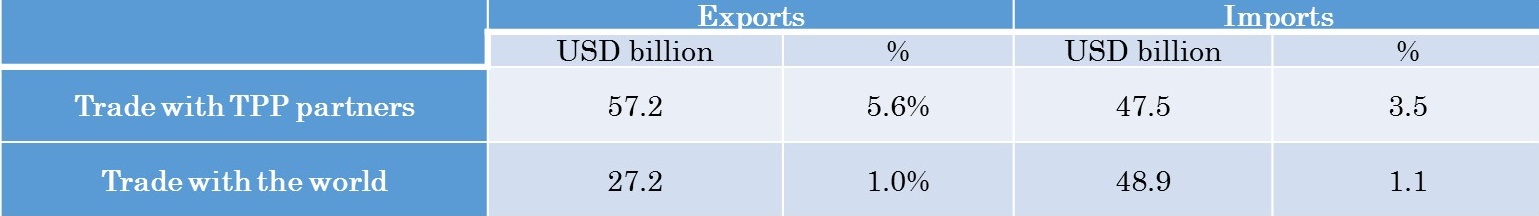

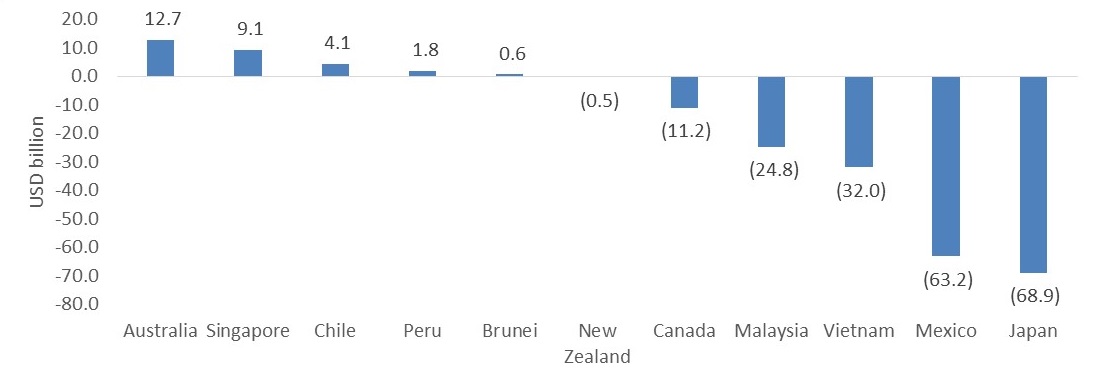

The USA already runs trade deficits with most TPP partners. The TPP implementation would simply give partners tariff-free access, further widening already large trade deficits. A report by the Roosevelt Institute, an American think-tank also questions the economic benefit of the TPP. The report points out that since 2011 the US dollar is up 26%, making the US products 26% more expensive on foreign markets and making foreign imports cheaper at home and abroad. Removing tariffs on imports would further depress the local industries and force them to offshore or move out of the business, thus leading to losses in jobs and domestic production. Effects of the TPP on US Trade by 2032

Source: US International Trade Commission

Note: For the analysis, 2017 has been assumed as the year of TPP implementation. 2032 would be year 15 of the agreement, at which time most TPP provisions would have been implemented. The changes are relative to baseline in 2032, which assume no TPP scenario. Dollar values are in 2017 prices.

The USA Ran Trade Deficit with Half of TPP Nations as of 2016

Source: US Census Bureau |

|

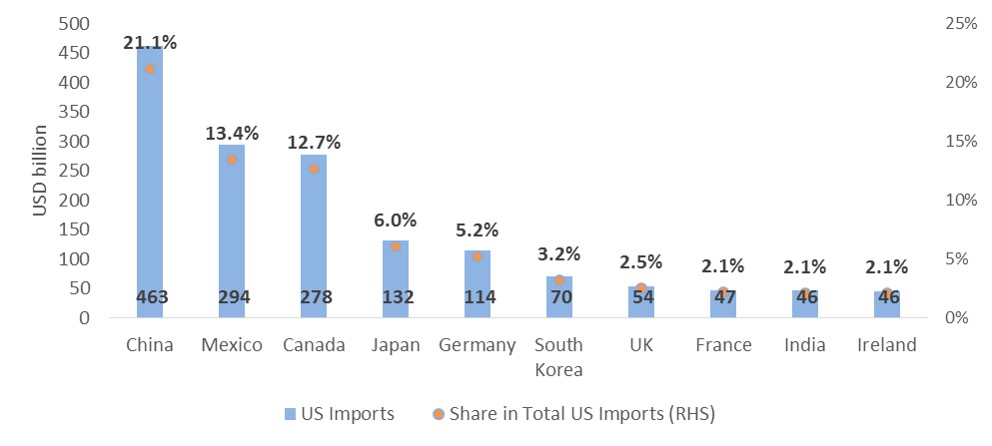

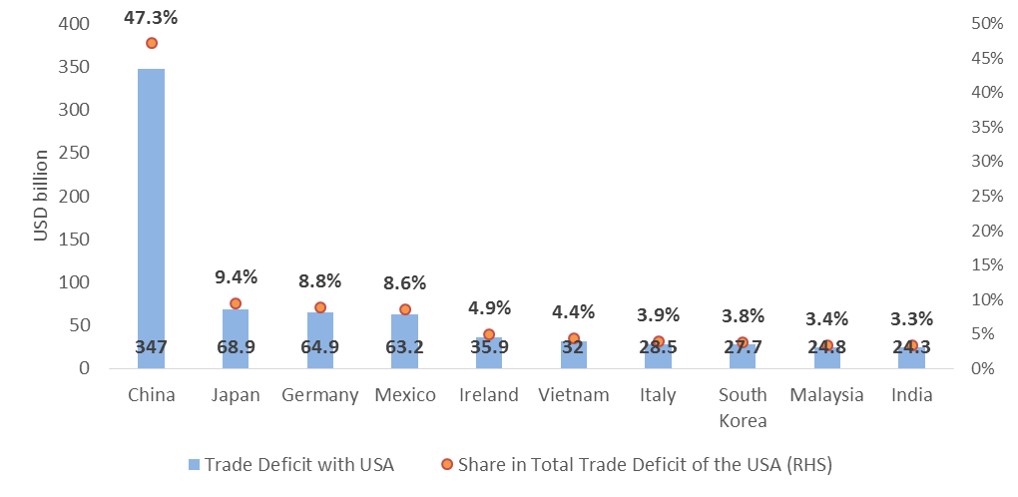

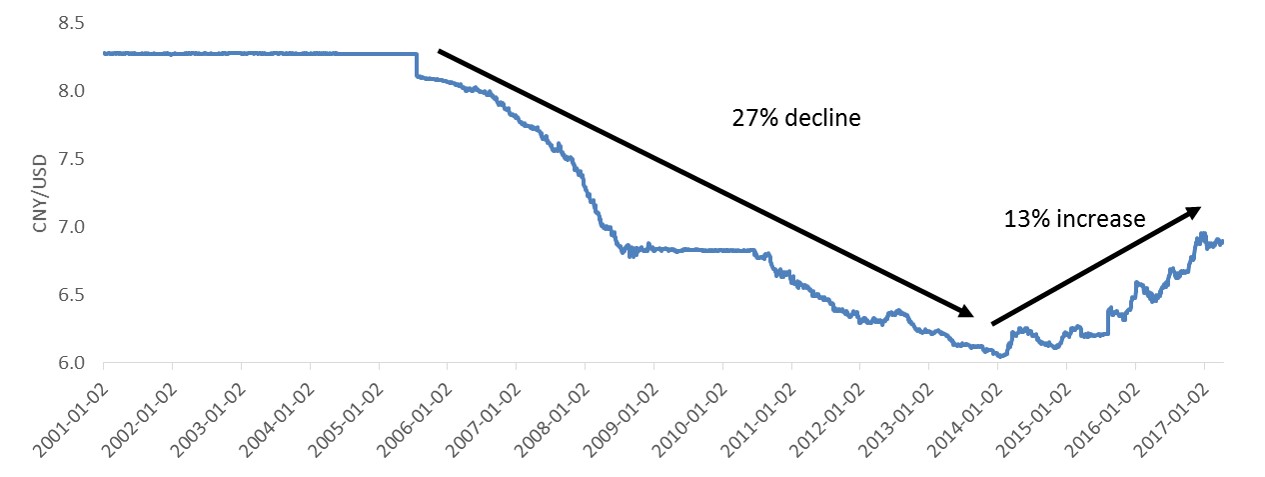

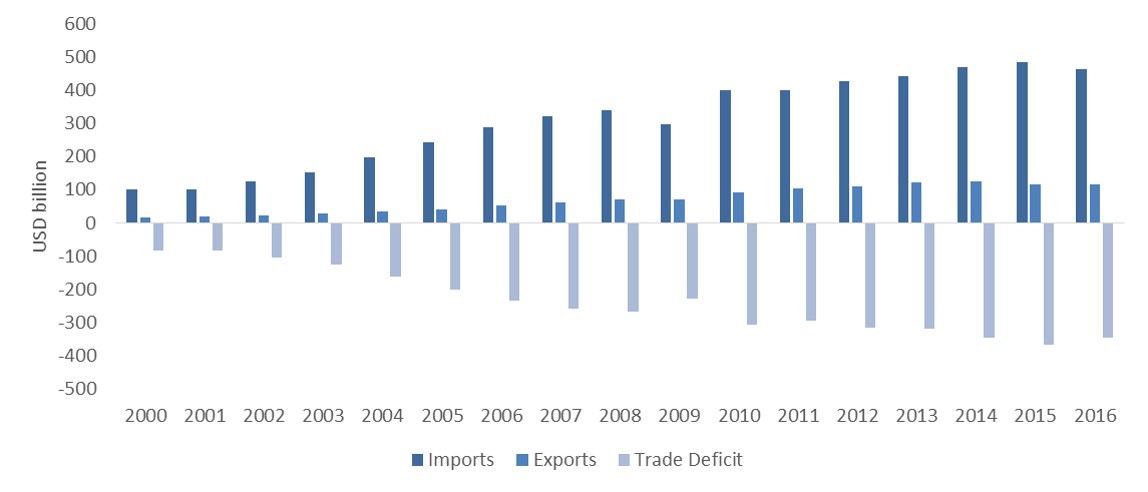

Trump’s Import Tax Reforms: Protecting American Workers at the Expense of Consumers China-Accounting for Almost Half of US Trade Deficit is Accused of Unfair Trade Practices Raising import tariffs on China, which has been accused of unfair trade practices, is also part of Trump’s protectionist economic agenda. These unfair trade practices, estimated to account for around 41% of China’s competitive advantage over the USA as per the US National Trade Council range from the theft of the business secrets and technology and currency devaluation to illegal subsidies to state-run businesses and dumping cheap imports. When analysing the bilateral trade between the two nations, the USA is undoubtedly at a disadvantage. This is reflected in the growing trade deficit with China, the top trading partner and the import partner of the USA. Over 2005-14, the People’s Bank of China, the central bank, sold its currency, Yuan and bought foreign reserves such as the US dollar to deliberately keep the Yuan artificially low (Yuan per US dollar declined by around 27% to 6.1 in January 2014 from 8.3 in July 2005), making Chinese imports relatively more attractive (and providing an unfair advantage to China over other trading partners). On the other hand, US exports to China’s export expanded at a higher CAGR compared to the imports growth over the period, yet; exports remained only one-fourth of the imports in value terms, resulting in huge trade deficits with China. However, since 2014 China abandoned its currency manipulation policy with the slowdown in economic growth and moved in the opposite direction with the central bank selling its foreign reserves with the objective of propping up Yuan to prevent a rapid decline. (Yuan per US dollar has increased by 13% to 6.9 in April 2017 from 6.1 in January 2014). Although the US trade deficit with China declined (by 5.5% YoY in 2016 after rising by 6.5% YoY in 2015) after the change in policy, China still accounts for almost half of US trade deficit. As a result, the president Trump has invoked the word “rape” in describing China’s trade policies and threatened to impose a 45% tariff on Chinese imports (current average tariff rate on Chinese imports is around of 3%). However, it should be noted that China doesn’t meet all criteria to be officially designated as a currency manipulator. Labelling a country as a currency manipulator triggers a formal process, which involves a series of negotiations between the Secretary of the US Treasury and China and fulfilment of three criteria by the target. These criteria include: • a trade surplus in excess of USD 20 billion with the USA; • a trade surplus that amounts to more than 3% of US GDP; and • repeated depreciation of its own currency by buying foreign assets equalling 2% or more of its GDP per year. If after a year, the USA continues to assess China as a currency manipulator, the USA could then impose various penalties on China, possibly limiting Chinese investment in the USA. Yet; China only fulfils the first criterion, as China’s trade surplus with the USA continued to be in excess of the requirement, (around 17 times higher than the requirement as of 2016). The second and third criteria are not relevant to China as the Chinese surplus with the USA accounted for 1.9% of the US GDP as of 2016 and China has been pushing up its currency since 2014. China Accounts for Around 21% of Total Imports to the USA, 2016

Source: US Census Bureau

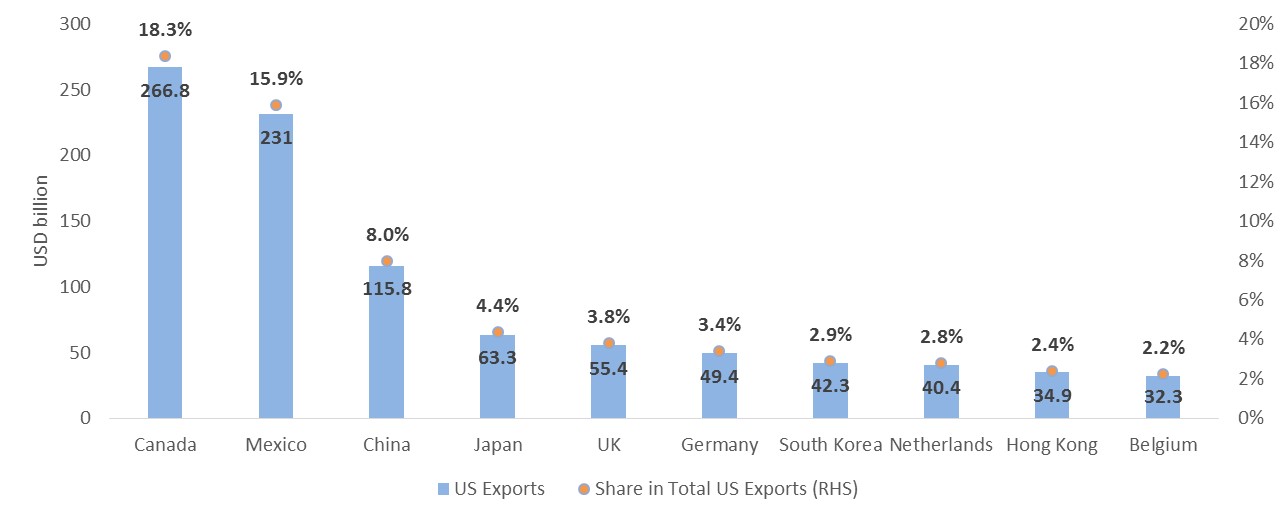

China: The Third-Largest Export Partner of the USA, 2016

Source: US Census Bureau

The USA Witnessed Nearly Half of its Trade Deficit with China as of 2016

Source: US Census Bureau

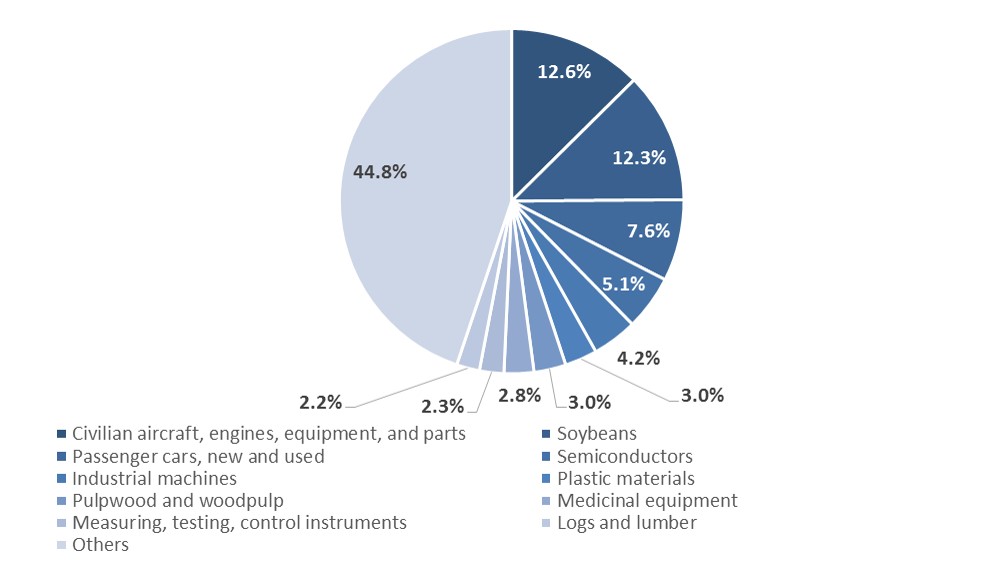

Top Export Products to China from the USA, 2016

Source: US Census Bureau

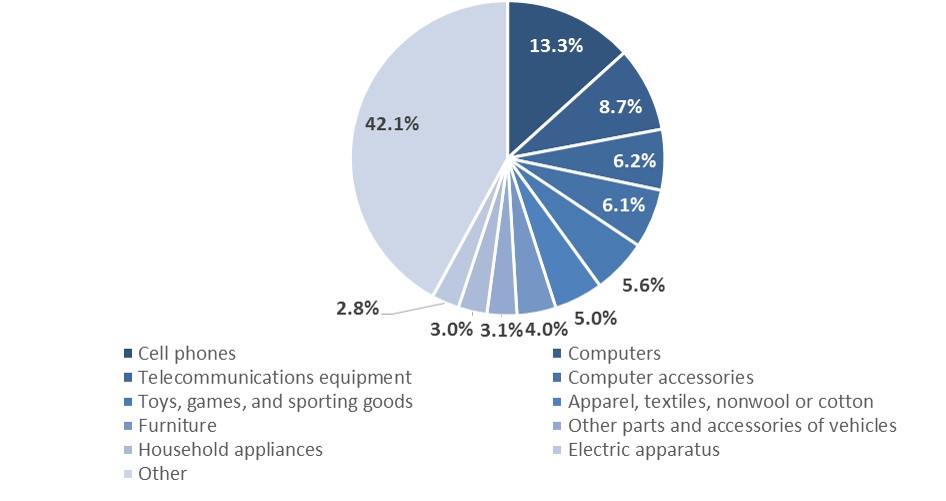

Key Products Imported to the USA from China, 2016

Source: US Census Bureau

Chinese Yuan on an Uptrend Since 2014 Post Depreciation

Source: Board of Governors of the Federal Reserve System

The USA Witnesses Mounting Trade Deficits With China Over 2005-14

Source: US Census Bureau

Canada is Blamed for Illegal Subsidising of Softwood Lumber Sales to the USA; Mexico Reprimanded for Illegal Immigrants and Offshoring Canada had been alleged for improperly subsidising the sale of softwood lumber products to the USA (Canada’s share in the US lumber market is about 31.5% as of 2016). The US Softwood Lumber Trade Deficit with Canada Grew Two-fold Over 2010-16

Source: UN Comtrade

With the objective of avoiding illegal Mexican immigrants to the USA and discouraging imports, president Trump proposed to construct a wall worth around USD 21.6 billion across the US-Mexico border, which is expected to be financed by floating a 20% tax on all Mexican imports (majority of the products are currently untaxed under NAFTA.) As per our calculation, a 20% tax on all Mexican imports (assuming all imports are currently tax-free) would yield a tax revenue of around USD 58 billion, more than enough to construct the wall. In addition, imposing 35% tax on the US companies that offshore its production to other countries is under consideration. On April 24, 2017, Trump imposed countervailing duties ranging from 3-24% on the softwood lumber imports from Canada and threatened to do the same on dairy imports. The major argument in favour of protectionism is that it encourages import substitution and reshoring, thus translating into narrowing trade deficits and manufacturing job gains over time. Given the huge trade deficits, the USA runs with Mexico and China, imposing import taxes as high as 20% to 45%, would definitely discourage imports, thus contributing to a notable reduction in trade deficits. As per Kevin Lai, research head for Asia excluding Japan of Daiwa Capital Markets, a Hong Kong-based stock brokerage firm, floating 45% tariffs on Chinese imports would lead to 87% fall in China’s exports to the USA. Similarly economists at HSBC led by Qu Hongbin predicted that the 45% tax would result in halving of Chinese shipments to the USA. Furthermore, offshoring taxes would encourage reshoring, which would result in regaining manufacturing jobs to the USA. This threat has already pushed three major automakers, namely Italian-American FCA Group, Ford and Japanese Toyota to reshore their production back to the USA, who had previously planned to move their production to Mexico. Consumer Retail Prices Likely to Increase; Estimates by Industry Experts Believe up to 10% is Possible Despite these benefits, trade protectionism is always associated with costs. The obvious danger is that if Trump’s policies are enacted in full, they will substantially increase domestic prices. Imposition of prohibitive import taxes encourages domestic manufacturing. However, these would take some time to fully substitute imports. The immediate impact would be price rises with the importing companies heaping as much of the cost as possible on their customers. As per Capital Economics, a London-based economic research consultancy firm, a 45% tariff on Chinese-made goods could drive up the US retail prices on those goods by an average of about 10%. A study of the US National Association of Home Builders found that a 15% tariff on lumber imports would result in an increase in new home prices by 4.2%. On the other hand, imports also include manufacturing inputs, which are further processed by domestic manufacturers. For example, automobile companies that assemble cars in the USA typically import many of the parts from abroad. If those parts become much more expensive after imposition of tariffs, prices would rise making the final car more expensive, less competitive with imports, and less likely to compete in export markets. In addition, imposing tariffs do not unequivocally protect American workers as the USA will be more exposed to retaliations by its trade partners, who would also increase their own import tariffs. This may put the American jobs in danger, as exporter firms could harshly suffer from the lower global demand for their products. This is highly critical to consider, as most of the countries that export to the USA also import from the USA (China, Canada, and Mexico being the top three). Consequently, the slowdown in the trade could hamper the long-term US economic growth. |

|

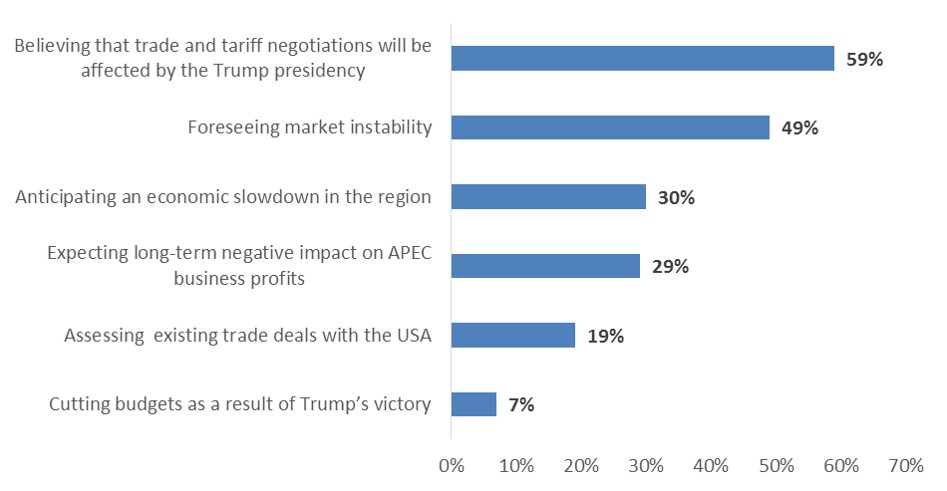

Trump’s Victory is APEC’s Loss with Major Ramifications for Mexico, Canada and China As of 2016, the Asia-Pacific Economic Cooperation (APEC) region – including Canada and Mexico as well as countries from the Asia-Pacific – accounted for 67.7% of the US imports and 62.4% of the US exports, while the USA accounted for 17.8% of the region’s total exports and 10.4% of the region’s total imports. The “Trump Effect on Asia” survey conducted between late November and December in 2016 by Harvey Nash, a global recruitment consultancy and IT outsourcing firm also concluded that the growth outlook for the region is gloomy after Trump’s victory. 30% of APEC Business Leaders Predicted an Economic Slowdown in the Region after Trump’s Victory, Dec 2016

Source: “Trump Effect on Asia” survey

Note: The survey polled 141 APAC business leaders

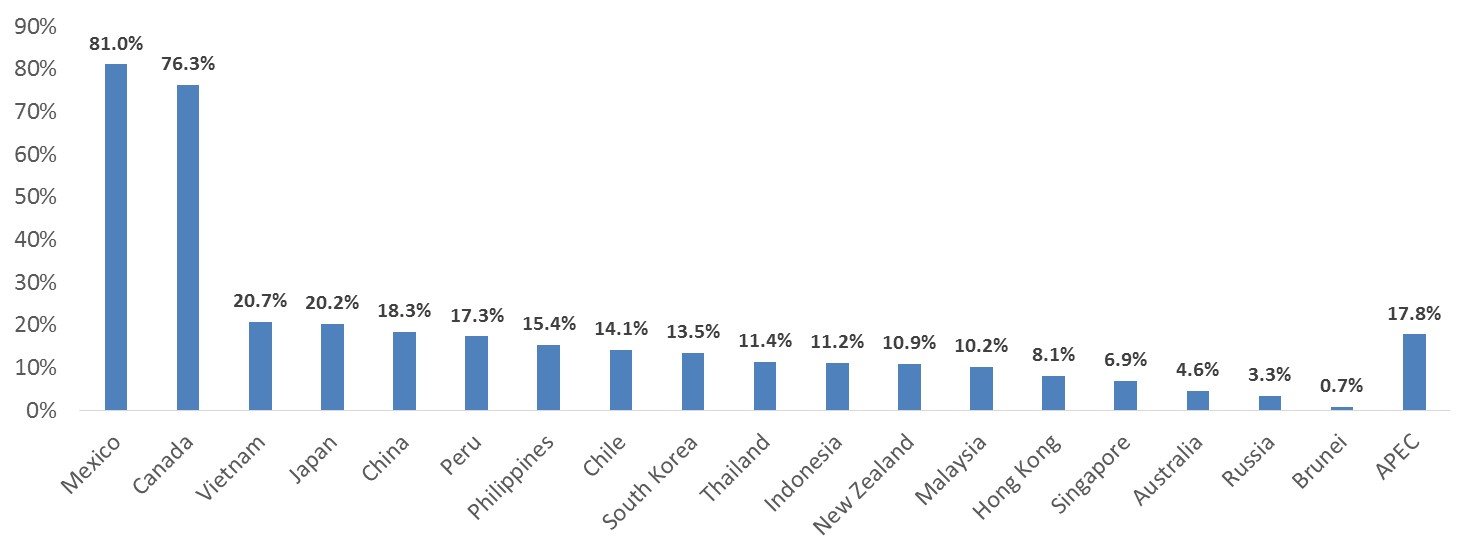

However, Trump’s impact on individual countries would differ based on the individual countries’ dependency on the USA. The US share in APEC region’s exports varies across the countries, with Mexico and Canada exporting more than 75% of their products while Vietnam, Japan and China shipping nearly 20% of their products to the USA. These countries are likely to be more vulnerable to the decrease in US demand with Trump’s move towards import barriers. Mexico and Canada Exported More than 75% of their Products to the USA as of 2016

Source: UN Comtrade

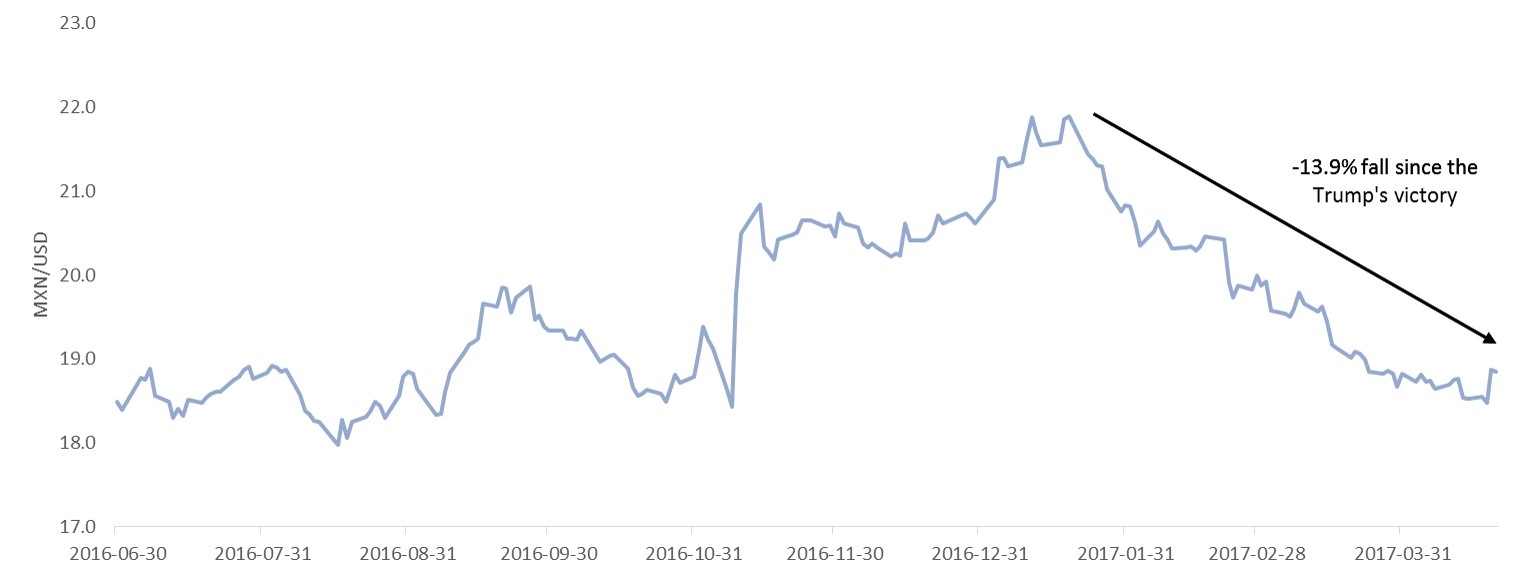

• The Mexican Economy is Likely to be the Hardest-Hit by Trump’s Policies on Trade and Immigration The USA is the largest export market for Mexico, accounting for more than 80% of total Mexican exports and contributing 38% to the Mexico’s GDP as of 2015. Thus, renegotiating NAFTA and imposing hefty import taxes on imports are likely to hamper Mexican exports to the USA, which quadrupled since NAFTA implementation, thereby hampering the nation’s economic growth. Furthermore, Trump’s rhetoric on Mexican immigrants and proposed wall across southern border put the nation’s remittances inflows, which contributed nearly 3% of Mexican GDP as of 2015 at jeopardy. Similarly, Trump’s reshoring efforts would hurt the Mexican automobile industry, the world’s fourth-largest car exporter, which directly employs almost 900,000 workers across the country (nearly 2% of the total employed person as of 2016). Owing to these downside risks, private sector specialists surveyed by the Bank of Mexico in December 2016 estimated 1.6% GDP growth for 2017, a two-fold decrease from the estimate of 3.2% made at the beginning of 2016. While Trump’s proposed policies are yet to be realised, currency markets have already reacted to the uncertainty about Mexico’s economic future. The Mexican peso tumbled by around 14% over the three months since the US presidential election in January 2017 to reach 18.8 pesos per US dollar on April 20, 2017 indicating less investment and slower economic growth prospects. Mexico’s central bank has also started to more actively intervene in order to combat rising inflation due to the low peso. It raised interest rates by 50 basis points to a nearly 8-year high of 6.25% in February 2017 to combat rising inflation (average inflation during the first three months of 2017 was around 5% above the government target of 3% and average inflation of 2.8% in 2016). Mexican Peso on a Free-Fall Since Trump’s Victory

Source: Board of Governors of the Federal Reserve System

• Canadian Economy to Suffer from Slowdown in Exports and Economic Growth Similarly, Trump’s protectionism poses risks to the Canadian economy, which is dependent on the USA for nearly 80% of its exports revenue, equivalent to 20% of Canadian GDP as of 2015. Thus any trade barrier would hamper the nation’s export growth and simultaneously economic growth. The vulnerability of the Canadian economy to the US trade protectionism was reflected through 1% drop of the Canadian dollar against US dollar after Trump’s imposition of up to 24% countervailing duties on Canadian softwood lumber imports. • At Least 9% Shrinkage of Chinese Exports with Loss of GDP by Around 5% China is also a major victim of the Trump’s trade protectionism. The USA being China’s biggest export market capturing approximately 20% of total exports (equivalent to 3.7% of the Chinese GDP). As per economists, China’s overall exports are expected to shrink at least 9% if Trump carried through with his tariff threat. Shen Jianguang, Chief Asia Economist at Mizuho Securities estimated that China’s exports had created 120 million jobs (around 16% of total employment), including 20 million (around 17%) making products for the US market. Thus, economists estimate that China’s GDP could be trimmed by 4.8% with any import barriers. On the other hand, if Trump’s actions result in protectionist retaliations, this could suppress trade and, in a bleak scenario, could even lead to a trade war between the world’s largest and second-largest economies, together accounting for around 28% of global imports. A trade war and the negative impact thereof on China’s economic growth would have knock-on effects for countries that export heavily to China such as Taiwan and Malaysia, which are relatively large suppliers of intermediate goods to China, particularly electronics (intermediate exports are about 1.5% and 1.0% of Taiwanese and Malaysian GDP’s respectively as of 2015). Furthermore, Trump’s decision to move towards isolationism and reducing external engagements will also leave a power vacuum in Southeast Asia, which an expansionist China would quickly fill through China-backed regional free trade agreements, such as RCEP. However, the Chinese dominance would not bring stability to the region as the smaller nations will lose out on their negotiating power with China. |