Indonesian Data Centres: Could Stronger Privacy Regulations Raise Foreign Interest?

|

Indonesia’s commercial data centre (DC) market is highly underpenetrated and has significant potential for growth, given the large enterprises in the country and their ever-increasing number. Current trends show that a growing number of companies use the services of commercial DCs to retain the high capital expenditure necessary for developing in-house DCs for operating expenses instead. Moreover, commercial DCs give enterprises more flexibility to adjust their capacity requirements, and also allow them to use their services immediately without having to wait for construction to be completed. |

|

The financial sector has been the main driver for commercial DC services in recent years, due to banking regulations that require banks and other non-banking financial institutions to locate their data centres and disaster recovery data centres within Indonesia by October 2017 (PwC). In spite of the strong growth, rapid adoption of commercial DCs might happen only in the medium to long term, in line with improvements in power supply and fixed broadband penetration across the country. |

|

While the domestic DC market has so far been characterised by leading local telecommunication operators, an increasing number of foreign players have established their presence in Indonesia in order to accommodate growing demand due to low latency requirements and data localisation regulations. Over the next several years, we expect to see increasing investments by foreign players through various arrangements (e.g. greenfield investments, joint ventures, partnerships and acquisitions). This increase should be driven by clearer guidance on the implementation of data protection regulations (which require electronic service operators to store their data locally by December 2018) and by subsequent enforcement of the law. |

|

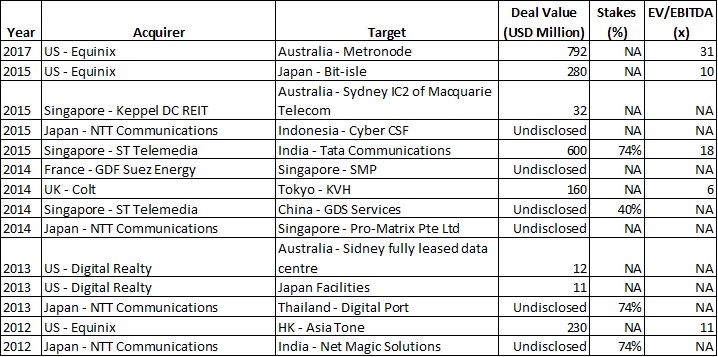

Currently, most commercial DC facilities in Indonesia are carrier-neutral, with direct connections to the Indonesian Internet Exchange (IIX). Historically, major DC providers have expanded into the Asia-Pacific (APAC) region by either developing new DCs or acquiring existing ones. Based on past transactions in the APAC region, we estimate that current colocation businesses in Indonesia should be valued at EV/EBITDA multiples in the range of 12x-18x, depending on their size. At valuations above 18x EV/EBITDA, foreign players might prefer to develop their own DCs, as construction can be completed at lower costs and reasonably fast (taking less than a year). Hence, the chances of high valuation resulting from fierce competition for the same DC asset might be low in Indonesia. |

|

Penetration of Commercial Data Centres Remains Low Amid Infrastructure Challenges |

|

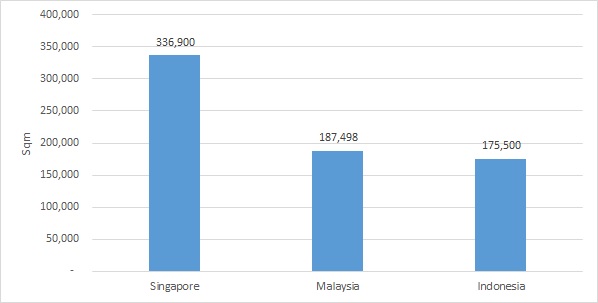

Commercial data centre operators in Indonesia generally offer a variety of services to both small and medium-sized enterprises (SMEs) and big corporations, ranging from colocation services to managed hosting and cloud services. Basic colocation services are currently the most sought-after by Indonesian enterprises. The domestic commercial DC market currently has 15 operators controlling around 175,500 square metres (sqm) of DC space across ten major cities in Indonesia (most of them Tier III DCs), i.e. around half of Singapore’s (336,900 sqm), but comparable to Malaysia’s (187,498 sqm; BroadGroup data [2015] published by Building Industry Consulting Services International [Bicsi]). The power capacity for both commercial and in-house DCs in the country (285 megawatts [MW]) is also half of Singapore’s (620 MW) and 14.9% below Malaysia’s (335 MW), as per Data Centre Dynamics (a global B2B events and media company). Although the size of Indonesia’s commercial DC market is almost equivalent to that of Malaysia, Indonesia’s economic demographic is around eight times Malaysia’s, indicating that the domestic DC market is highly underpenetrated relative to neighbouring countries’. |

|

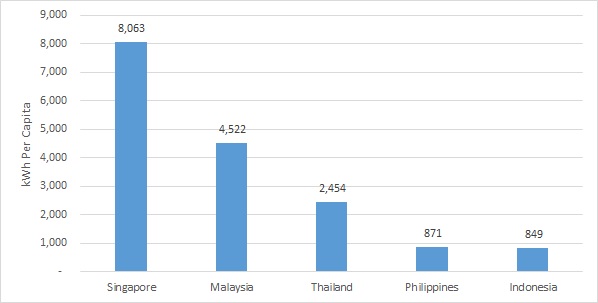

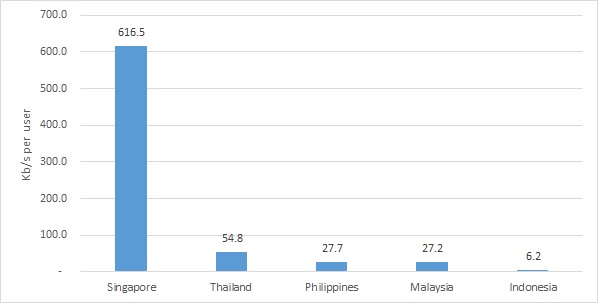

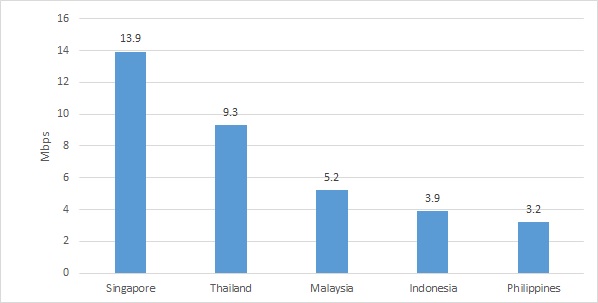

The lower penetration could be attributed to an uneven distribution of power supply and internet connectivity in regions outside Java and Bali islands (60% of commercial DCs are currently located in the Greater Jakarta area, as per CSF Group). Indonesia’s electricity production per capita is currently the lowest among ASEAN-5 countries, based on data from the CIA Factbook. Aside from power issues, the quality of internet in the country is also poor. According to McKinsey & Company, Indonesia’s internet bandwidth of 6.2 kb/s per user in 2015 was the lowest in ASEAN-5; the average connection speed was the second lowest, at 3.9 Mbps. Similar to electricity distribution, fast internet is only available in urban areas on Java and Bali islands (e.g. Jakarta, Bekasi, Tangerang, Bandung, and Surabaya), as per Indonesia-Investments. Hence, when expanding operations, it is not possible for operators to set up DCs (especially higher tier ones) in just any city in Indonesia. |

|

On the demand side, only about 5% of companies in Indonesia outsourced floor space to commercial DCs, which is five times lower than in the more mature market of Singapore (25%), according to PricewaterhouseCoopers’ (PwC’s) ‘Surfing the Data Wave’ report published in January 2017. DCs in Indonesia have been traditionally held in-house, meaning that computer systems are managed on premises by companies’ IT departments. Concern about privacy and security is the main reason companies maintain their servers and other computing hardware on their own premises. As of 2013, there were around 57.8 million micro, small, and medium-sized enterprises (MSMEs) and 5,066 large businesses spread across different regions in Indonesia, accounting for 60.3% and 39.7% of the country’s GDP, respectively. Around 3.8 million of these MSMEs, or 6.4%, have already started to market their products via online platforms, according to CNN Indonesia. The abundance of enterprises indicates considerable untapped demand for commercial DC services. |

|

Indonesia’s Commercial DC Space Smaller than Singapore’s and Malaysia’s |

|

|

|

Source: Singapore and Malaysia’s figures are based on BroadGroup’s data published by Building Industry Consulting Services International (Bicsi) |

|

Note: Indonesia’s data is as of 2017, and Singapore’s and Malaysia’s as of 2015 |

|

Indonesia’s Per-Capita Electricity Production the Lowest Among ASEAN-5, 2015 |

|

|

|

Source: Calculated by UZABASE based on CIA World Factbook data |

|

Indonesia’s Internet Bandwidth the Lowest Among ASEAN-5 |

|

|

|

Source: McKinsey & Company, “Unlocking Indonesia’s Digital Opportunity” October 2016 |

|

Indonesia’s Average Connection Speed the Second-Slowest Among ASEAN-5 |

|

|

|

Source: McKinsey & Company, “Unlocking Indonesia’s Digital Opportunity”, October 2016 |

|

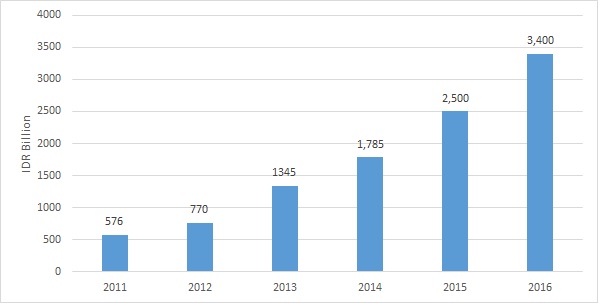

Most Commercial DC Facilities Are Tier III |

|

|

|

Source: Faasri Utama Sakthi |

|

Financial Sector Drives DC Market, Following Enactment of Data Localisation Law; Demand for Commercial DCs to Rise Due to Lower Capital Outlay and Flexible Capacity Expansion |

|

According to DBS Group, Indonesia’s Ministry of Communication and Informatics has stated that the DC market recorded revenue of IDR 4.4 trillion in 2014 (2.1% of IT spend in 2014, as per the EU – Indonesia Business Network), with this figure expected to increase 20% annually until 2017. In recent years, as per PwC, the financial services sector has been the biggest driver of the domestic DC market (accounting for an approximately 30% share of the DC services market) due to several regulations issued by the Indonesian financial services authority (Otoritas Jasa Keuangan/OJK) requiring insurance companies, banks, and others to locate their data centres and disaster recovery data centres in Indonesia by October 2017. According to a survey by International Data Corporation (IDC), Indonesian banks plan to raise their data centre budgets by 5%-10% per year, as they expect data volume to grow by an average of 10%-20% each year. Large banks usually generate large amounts of data, with 10-40 million clients performing hundreds of millions of transactions daily, as per Teradata Indonesia (Jakarta Post). |

|

Many Indonesian enterprises have started to shift to commercial DCs, the initial cost for which is lower than the cost of developing in-house DCs. Moreover, commercial DCs allow enterprises to use their services immediately (without waiting for construction) and on an as-needed basis (e.g. adjusting rack requirements). |

|

Despite the strong demand growth, the domestic commercial DC market appears not to have yet entered an accelerating growth phase. A rapid adoption of commercial DCs might happen only in the medium to long term, in line with improvements in underlying infrastructure. In order to meet growing demand for electricity in the country, the state-owned electricity company (PLN) plans to commission an additional 20 GW of power plants by the end of 2019E (Asian Power), or 33.5% of the current capacity of 59.7 GW, as of July 2017. Moreover, the Indonesian government has also begun the construction of the second phase of the Palapa Ring project. As of March 2018, the west section of the second phase has already reached a 100% completion rate; 72.6% and 35.9% of the central and east sections, respectively, have been completed (Okezone.com). Once the entire Palapa Ring project is completed (no information available on the third phase yet), Indonesia will have fast broadband service coverage across both rural and urban areas. |

|

Enforcement of Data Protection Law to Drive Foreign Investment; Foreign Players Compete by Either Developing Own Fibre Networks or Locating DCs in Area with Improved Power Supply |

|

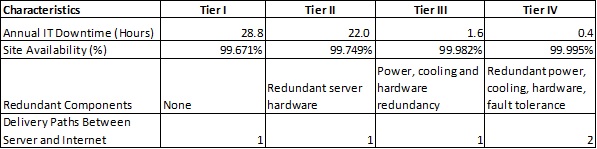

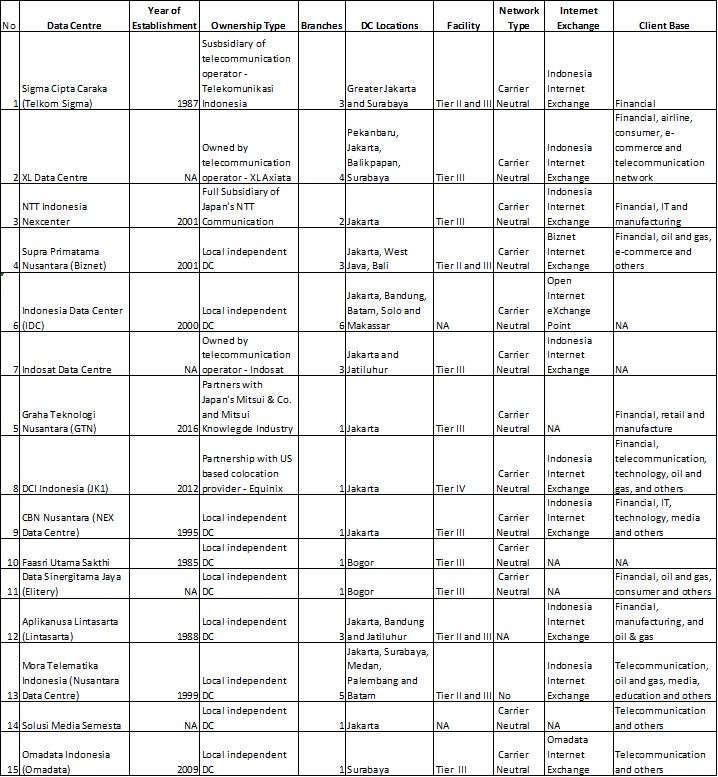

The commercial DC market is characterised by leading domestic telecommunication operators Telkom Sigma (a subsidiary of Telekomunikasi Indonesia), XL Axiata, and Indosat; these currently have a combined market share of 84%, based on DC space. Nevertheless, foreign players such as NTT Communications, Equinix, and Alibaba have also set up facilities in Indonesia through different arrangements. This is in order to capitalise on new growth opportunities arising from 1) low latency requirements, 2) data localisation regulations, and 3) global interconnection (i.e. global strategic positioning to serve multinational companies). Historically, NTT communications and Equnix have expanded into APAC region by either acquiring existing DCs or developing new ones. |

|

Over the next several years, we expect to see foreign investments increase due to further clarifications on how data protection regulation will be implemented, and subsequent enforcement of the law (data protection regulations have given electronic system operators a two-year transitional period until December 2018 to store their data locally, according to Baker Mckenzie). The entry arrangements for foreign players could range from greenfield investments to joint ventures, partnerships and acquisitions, as the country allows for 100% foreign ownership. New local players that plan to compete in this lucrative market are also likely to form partnerships with foreign players in order to benefit from their operational (including staff training) and technology know-how. Forming partnerships with foreign players could also help ease concerns about privacy and security, given foreign players’ perceived sophistication and experience, which in turn could boost demand for their DC services. |

|

Domestic telecommunication operators generally have a competitive edge over independent DC providers due to their underlying network infrastructure; this allows them to provide their clients integrated end-to-end information and communication technology (ICT) solutions (i.e. DC services as part of a broader IT solution). In order to compete with the domestic telecommunication operators, both foreign and domestic independent DC players have also constructed their own fibre optic networks to ensure fast delivery of content to their clients (multinational and local companies). For instance, NTT Nexcenter Indonesia, a subsidiary of Japan’s largest telecommunication company, is currently extending its fibre optic network to allow its DC facility to connect to more industrial parks, office buildings, and other major DC facilities in Jakarta. Moreover, Biznet data centre has expanded its own fibre optic network up to 15,000 kilometres (km). |

|

On the other hand, Data Centre Infrastructure Indonesia (DCI Indonesia), a partner of Equinix (the world’s largest colocation provider) differentiates itself from competitors by locating its Tier IV DC facility, JK1, in Cibitung industrial park (which is supported by two power plants: one operated by the privately owned electricity company Cikarang Listrindo and another by state-owned electricity company Perusahaan Listrik Negara [PLN]). DCI Indonesia claimed that JK1 has never experienced a downtime since it was first launched in 2013. Responding to high demand for its Tier IV facility, in March 2018, DCI Indonesia announced the construction of its second DC facility, JK2. Previously, DCI said it will develop a new DC facility when the occupancy rate of its existing DC reaches 70%. Another large company that uses electricity from Cikarang Listrindo and locates its DC in an industrial park (Cikarang industrial estate) is Graha Teknologi Nusantara (GTN), a joint venture between Multipolar Technology (65%), Mitsui & Co (25%), and Mitsui Knowledge Industry (10%). |

|

Major Foreign DC Players in Indonesia |

|

|

|

Source: Companies’ websites, Data Centre Dynamics, Computer Weekly and “Asia-Pacific Data Center Service Providers, 2017” published by Frost & Sullivan |

|

Large DC Operators in APAC Region That Have Not Entered Indonesia |

|

|

|

Source: “Asia-Pacific Data Center Service Providers, 2017” published by Frost & Sullivan and companies’ websites |

|

Telkom Sigma – Largest Provider in Indonesia in Terms of DC Space |

|

|

|

Source: Compiled by UZABASE based on various materials |

|

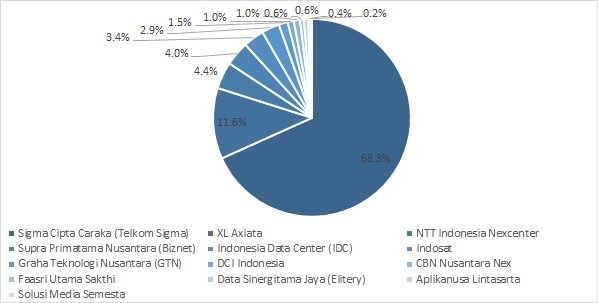

Data Centres and Managed Services Accounted for Half of Telkom Sigma’s Revenue, 2014 |

|

|

|

Source: Company’s magazine |

|

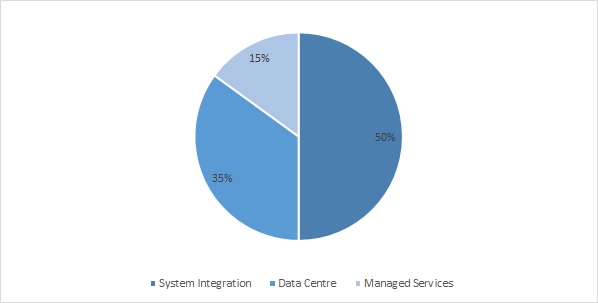

Telkom Sigma’s Revenue Increased More than Fivefold over 2011-16 |

|

|

|

Source: Company’s magazine and Indotelko |

|

At Valuations Above 18x EV/EBITDA, Foreign Players Might Opt to Develop Their Own Data Centres Rather than Acquire Existing Ones |

|

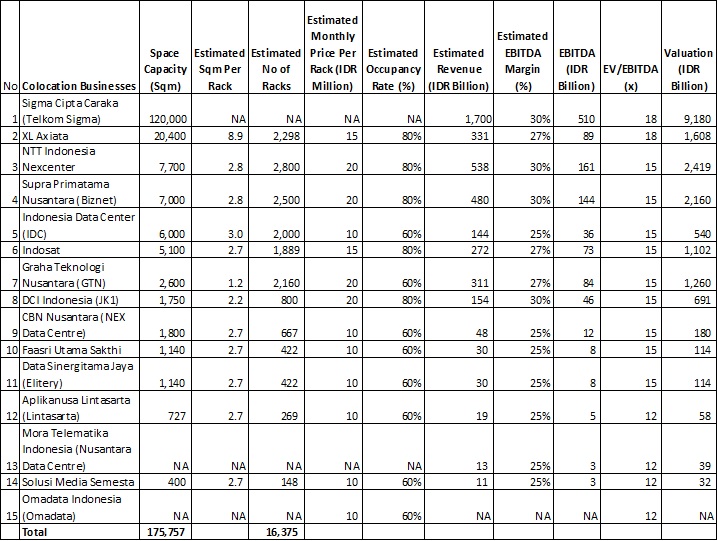

Carrier-neutral facilities and direct connectivity to the Indonesia Internet Exchange (IIX) are the two important factors that foreign players take into consideration when acquiring or partnering with local DC providers. There are at least 12 commercial DC providers that operate carrier neutral facilities in Indonesia (out of 15). Of the 12 carrier neutral facilities, at least eight have direct connections to the IIX. We estimate that the value of colocation businesses of the existing companies should range between IDR 32 billion and IDR 9,180 billion, based on a 25%-30% EBITDA margin and an EV/EBITDA multiple of 12x-18x. This reflects that foreign DC providers and subsidiaries of telecommunication operators have higher pricing power and can generate higher EBITDA margins than other independent DC providers (2%-5% higher). This is a reasonable estimate, given the following: |

|

|

|

We apply a higher EV/EBITDA multiple of 12x-18x (depending on the size) for colocation businesses in Indonesia, given that their growth profile is generally higher than in developed Asian countries. This observation is in line with the valuation multiples of previous acquisitions that took place in the APAC region over 2012-17, where DC businesses in emerging markets such as India commanded a higher valuation (18x) than in developed Asian countries (Hong Kong: 11x; Japan: 10x). However, Indonesia’s DC businesses are unlikely to be valued at higher multiples than India’s, given that Indonesian DC businesses tend to be small on average. Based on past transactions, it appears that larger transactions generally commanded higher valuations. |

|

Moreover, US-based Equinix acquired Australia’s Metronode at a high EV/EBITDA multiple of 31x in 2017, as new institutional players and sovereign wealth funds were competing for the same DC asset, as per Data Center Knowledge. However, the same DC asset would not have invited fierce competition in Indonesia, as foreign players are able to develop their own DCs reasonably fast and at lower cost (no information is available on how difficult it is to obtain direct connections to the IIX). For instance, Alibaba Cloud and DCI Indonesia opened their first DC facilities in March 2018 and May 2013 respectively, following announcements nine months and seven months ahead, respectively, indicating the speed of DC construction in Indonesia (importantly, no information is available on the timeline of the land purchases). DCI Indonesia also stated that the construction of the second DC facility, JK2, will be completed even faster (by August 2018), just five months after its announcement in March 2018. In terms of development cost, the estimated capital expenditure needed to construct a DC in Indonesia is currently between around IDR 40 million/sqm and IDR 70 million/sqm, much cheaper than acquiring DC assets at a 31x multiple. For example, the estimated value of colocation assets for DCI Indonesia is around IDR 816 million/sqm (20-12x higher) based on an EV/EBITDA multiple of 31x. |

|

Valuation of Indonesian Colocation Businesses Could Range Between IDR Around 32 Billion and IDR 9,180 Billion |

|

|

|

Source: Compiled by UZABASE based on various materials; UZABASE estimates |

|

Note 1: Telkom Sigma’s data centre revenue is based on 50% of its revenue in 2016 – IDR 3.4 trillion; DC revenue for Mora Telematika Indonesia is based on the 2017 annual report |

|

Note 2: Estimated colocation revenue for all other companies is based on the estimated average rental price and the number of racks |

|

Note 3: In cases where the number of racks data is unavailable, to determine the number of racks, we used 2.7 sqm per rack as a basis and divided the space capacity by it |

|

Note 4: The average occupancy rate in the commercial DC market was 60% in 2016, according to IDPRO |

|

Note 5: Foreign operators and subsidiaries of telecommunication operators will have higher-than-average occupancy rates |

|

Note 6: Colocation businesses with space capacity above 20,000 sqm, between 1,000-20,000 sqm, and below 1,000 sqm are valued at EV/EBITDA multiples of 18x, 15x, and 12x respectively |

|

Historical Transactions in APAC Region Indicate That Indonesian DC Assets Could Be Valued at EV/EBITDA of 12x-18x, Depending on Size |

|

|

|

Source: “Surfing the Data Wave” report published by PricewaterhouseCoopers (PWC), Credit Suisse, Data Center Knowledge and companies’ presentations |

|

Note: Many of the financial details were not disclosed, despite more than a dozen transactions |

|

Most DC Assets Carrier Neutral and Connected Directly to Indonesian Internet Exchange |

|

|