Indonesian and Malaysian Palm Oil Industry at Critical Crossroads, given EU Resolution to Ban Palm Oil in Biofuels by 2020?

Tropical deforestation caused by palm oil cultivation has been an area of ongoing tension between palm oil producing nations (such as Malaysia and Indonesia) and legislative bodies in Europe.

In April 2017, the European Union (EU) passed a resolution to ban the use of palm oil in various products such as palm oil-based biofuels by 2020. Simultaneously, the EU is discouraging the use of palm oil in food products through its recently launched (August 2017) “International Palm Oil Free Certification Accreditation Programme” (POFCAP).

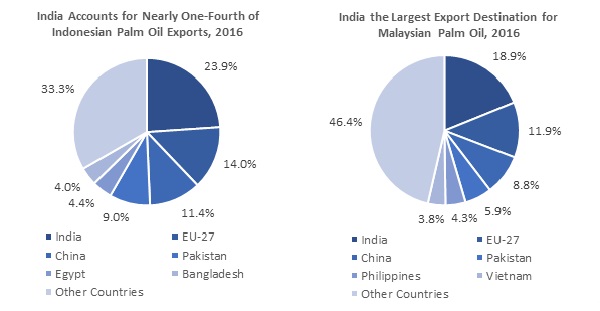

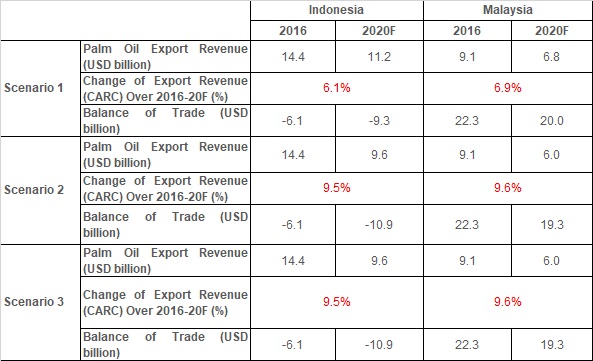

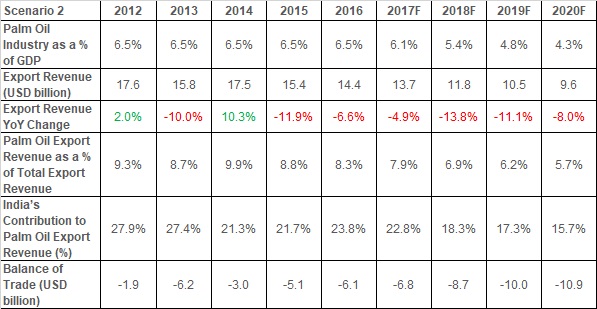

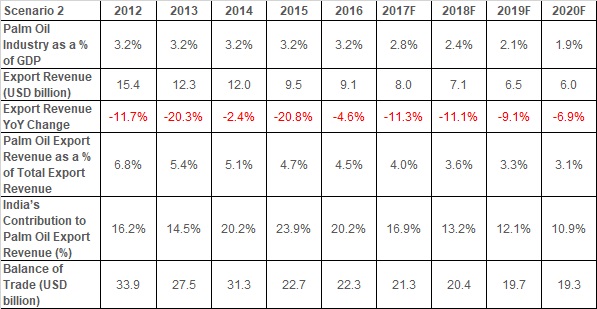

Being amongst the largest palm oil consumers in the world (third-largest in 2015), the EU’s plan to ban palm oil imports by 2020 is likely to exert pressure on major producing economies such as Indonesia and Malaysia. The two countries together contributed around 90% of global palm oil exports in 2016. In our view, given Indonesia’s and Malaysia’s high exposure to the EU market (export market shares were 14.0% and 12.0% respectively in 2016), we expect a notable reduction in palm oil export revenue in the coming period (at a CARC of 6-7% over 2016-20F, both in Indonesia and Malaysia). Consequently, the palm oil ban is likely to be negative for the balance of trade of both Indonesia and Malaysia, given the importance of palm oil as one of their major agricultural commodity exports. The impact is likely to become more severe as India’s import substitution policy on vegetable oil reaches fruition. For instance, considering the worst-case scenario (a reduction in exports to both the EU and India over 2016-20F), we can expect Indonesia’s trade deficit to widen to USD 10.9 billion by 2020F from USD 6.1 billion in 2016. Moreover, in Malaysia, we can anticipate the country’s balance of trade to fall to USD 19.3 billion by 2020F from USD 22.3 billion in 2016. Although the two countries are focusing on increasing domestic consumption of palm oil (through improved palm-based biofuels) to counter the impending slump in international demand, the effectiveness of this strategy is likely to be limited.

|

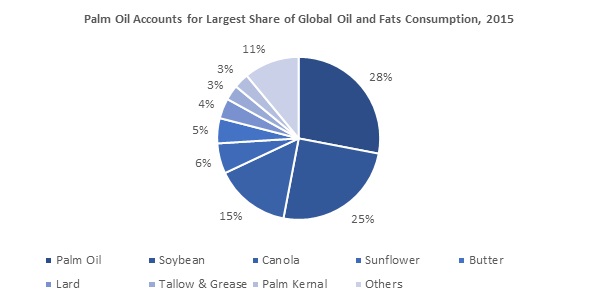

EU to Phase-Out Use of Palm Oil in Biofuels by 2020; EU amongst Largest Palm Oil Consumers On 4 April 2017, the European Parliament (EP) approved a resolution to ban the use of palm oil in biofuels with the intention of alleviating negative environmental impacts such as tropical deforestation and forest degradation. The key points adopted by the resolution include the following: I. Taking measures to phase out the use of vegetable oils that drive deforestation, including palm oil, as a component of biofuels by 2020; II. Applying different customs duty schemes that more accurately reflect the real costs associated with the environmental burden until a single certification scheme is applied; III. Supporting the setting up of a peatland restoration agency for the purpose of restoring 2 million hectares (around 18% of the Indonesia palm oil lands) of fire-hit peatland (a forest fire occurred in Indonesia as a result of forest clearance for palm cultivation in 2015); IV. Imposing a freeze on the area under oil palm cultivation, including the introduction of a moratorium on new concessions; and V. Working closely with other significant consumers of palm oil, such as China and India, and producing countries, in order to raise their awareness and to explore common solutions to the problem of tropical deforestation and forest degradation. In addition to that, a new certification programme, the “International Palm Oil Free Certification Accreditation Programme” (POFCAP), was launched in August 2017 to enable food producers to demonstrate that their products are manufactured without the use of palm oil. The POFCAP trademark will reflect that the products are cruelty-free, certified organic, vegan, and fair trade. The trademark has already been approved by regulators in Australia and the UK. A further 14 EU countries (including France and Italy) have applications pending for POFCAP certification.  Source: Statista; United States Department of Agriculture

Note: Latest data available is for 2015

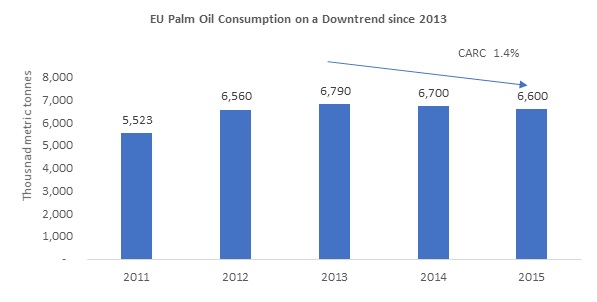

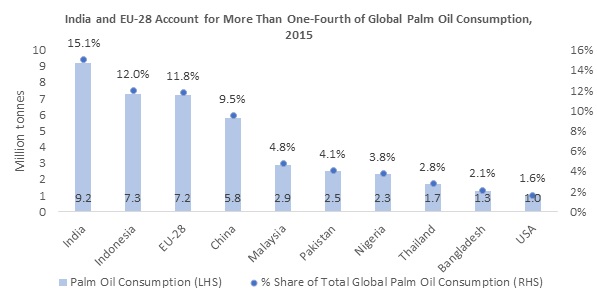

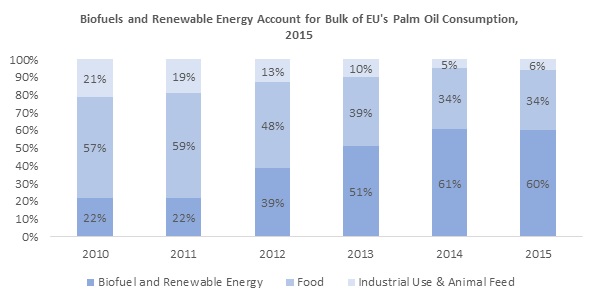

As of 2015, with consumption at 61 million tonnes, palm oil contributed to the bulk of global oil and fats consumption (share of 28%). Furthermore, as of 2015, India accounted for the bulk of world palm oil consumption (share of 15.1%), followed by Indonesia (12.0%) and the EU-28 (11.8%). Moreover, currently, the EU remains the world’s largest palm oil consumer of biofuels. In 2015, the biofuels and renewable energy sector accounted for around 60% of the EU’s palm oil consumption. As such, the EU resolution to ban palm oil on biofuels is likely to have a significant impact on palm oil producing economies.  Source: HIS Markit

Note: Latest data available is for 2015

Source: Greenpalm

Note: Latest data is available for 2015

Source: Malaysian Palm Oil Council

Note: Latest data available is for 2015 |

|

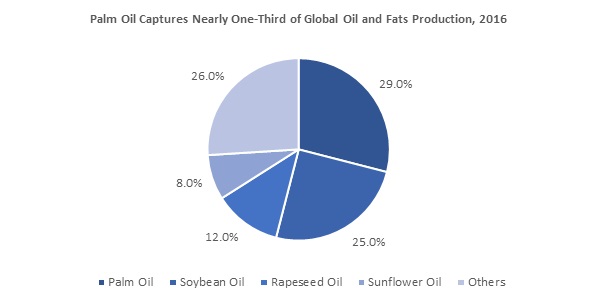

Indonesia and Malaysia Dominate Global Palm Oil Production Presently, palm oil remains a significant contributor to the world market for vegetable oil. With palm oil production at around 66 million tonnes, the industry accounted for around one-third of global oil and fats production in 2016. Source: Malaysian Palm Oil Board (MPOB)/Oil World

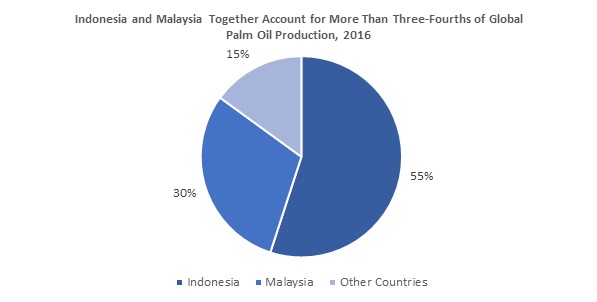

Indonesia and Malaysia continue to dominate the global palm oil market, accounting for more than three-quarters of global production (as of 2016, Indonesia led the market with a production share of 55.0%, followed by Malaysia with 30.0%). At present, palm oil remains an important asset for the major producing countries. In 2015, the palm oil industry accounted for around 6-7% of Indonesia’s GDP (third largest income generating source in Indonesia after oil & gas and industrial manufacturing) and around 3-4% of Malaysia’s GDP (third largest income-generating natural commodity in Malaysia after petroleum oil and timber). Source: Malaysian Palm Oil Board (MPOB)

In addition, palm oil remains one of the major trading commodities in Indonesia and Malaysia. The two countries together controlled around 90% of global palm oil exports in 2016. Moreover, the contribution of palm oil export revenue to Indonesia’s and Malaysia’s total export revenue remained at 8.3% and 4.6% respectively in 2016. In Malaysia, India dominated the export basket of palm oil, with a share of 18.9% in 2016, followed by the EU-27 (11.9%) and China (8.8%). Similarly, in Indonesia, India contributed nearly one-fourth of palm oil export revenue, followed by the EU-27 (14.0%) and China (11.4%).  Source: UN Comtrade (HS: 1511)

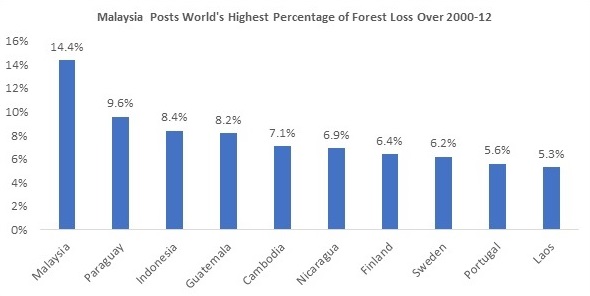

Palm oil producers (such as Indonesia and Malaysia) have been criticised over the past years for failing to prevent rising deforestation due to palm cultivation. Despite growing concerns, in order to meet rising global palm oil demand (which grew at a CAGR of 3.6% over 2012-16), farmers have been increasing palm oil harvesting lands (palm oil harvesting lands in Indonesia and Malaysia together increased 18.4% to 16.7 million hectares during 2011-16, respectively) by clearing biodiversity rich tropical rainforests. During 2000-12 (latest available), Malaysia recorded the world’s highest forest loss (14.4%), followed by Paraguay (9.6%) and Indonesia (8.4%). This rising deforestation has also been leading to increasing carbon dioxide emissions, causing immense environmental and health issues. This has been rallying green activists across the world to fight against unsustainable palm oil cultivation. Source: Google Forest Map/MONGABAY

Note: Latest data is available for 2012

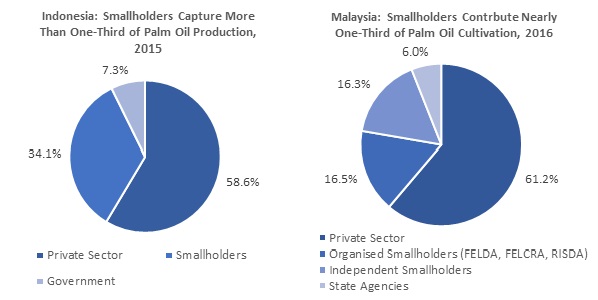

Although major palm oil industry operators (such as Malaysian palm oil producer Felda Global Ventures) have started producing palm oil in an environmentally friendly manner, most smallholders are unable to implement sustainable practices due to a lack of awareness. In the major palm oil economies, around one-third of palm oil production is derived from small farmers. As of 2015, around 3.7 million people (around 3% of the working population) were employed in the Indonesian palm oil industry, with around 34% of palm oil production being generated by smallholders. Meanwhile, in Malaysia, 590,000 direct workers (around 4% of the working population) engaged in palm oil cultivation in 2015, accounting for around 33% of production derived from smallholders. As such, in Malaysia, sustainable oil palm plantations (oil palm cultivation that focuses on reducing the impact on forests, farmers, and communities) accounted for only 4.1% (237,509 hectares) of total palm oil harvesting lands in June 2017.  Source: Indonesian Palm Oil Association (IPOA)/Malaysian Palm Oil Council (MPOC)

Latest data for Indonesia is available for 2015 |

|

Industry in Turmoil; Will Declining International Demand Shake Up Major Palm Oil Economies? Economic Impact of Declining International Demand

Source: Projected by UZABASE based on UN Comtrade (HS 1511)/MPOB/MPOC/ and IPOA data

Note: Figures from 2016 onwards are forecasts

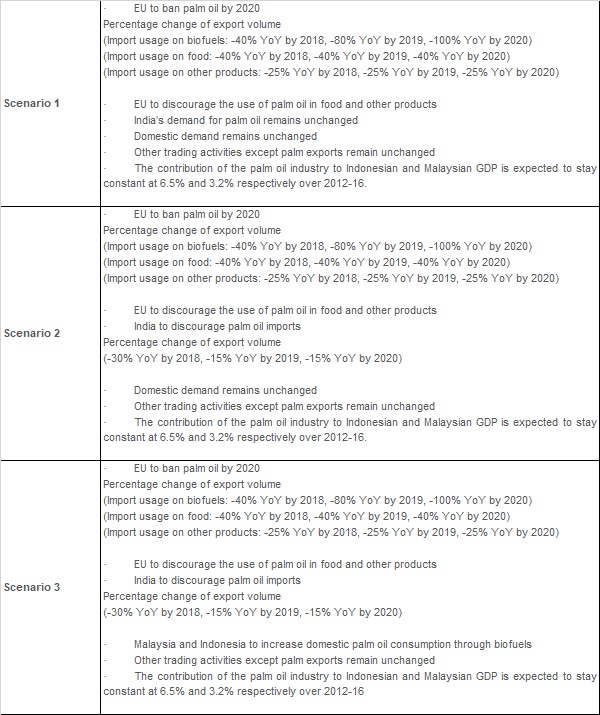

Our Forecasting Assumptions

Source: by UZABASE

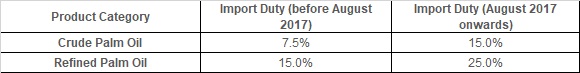

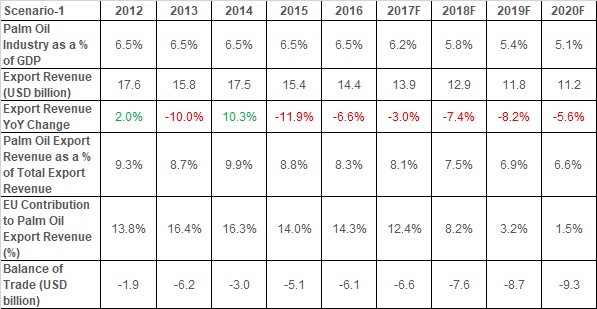

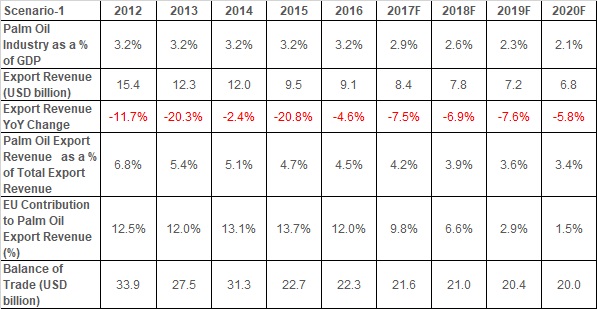

Scenario 1 All other things remaining constant, we estimate the decline in international demand on the back of the EU ban to negatively impact export revenue in both Malaysia and Indonesia, given the significance of palm oil as a major agricultural commodity export. This in turn is likely to adversely affect the two countries’ balance of trade. As such, we expect Indonesia’s export revenue from palm oil to decline at a CARC of 6.1% over 2016-20F and its trade deficit to widen to USD 9.3 billion by 2020F from USD 6.1 billion in 2016. Similarly, we expect Malaysian export revenue from palm oil to decline at a CARC of 6.9% over 2016-20F and its trade surplus to narrow to USD 20.0 billion by 2020F from USD 22.3 billion in 2016. Scenario 2 The impact is likely to be aggravated by India’s renewed commitment to encouraging domestic vegetable oil production by cutting palm oil imports. The world’s largest palm oil buyer, India doubled its import duties on crude and refined edible oil imports in August 2017 with the aim of protecting local oilseed farmers from cheaper vegetable imports. India: Import Duties on Palm Oil

Source: Compiled by UZABASE based on various industry sources

The combined market share of India and the EU accounted for around one-third of Malaysian and Indonesian palm oil exports in 2016. Therefore, the negative impact of declining exports to both India and the EU should significantly impact the two countries’ balance of trade. Taking into account the combined effect of the reduction of the EU and Indian palm oil exports, we expect Indonesian and Malaysian export revenue from palm oil to fall at a CARC of around 9-10% over 2016-20F. As a result, we expect Indonesia’s trade deficit to widen to USD 10.9 billion by 2020F from USD 6.1 billion in 2016. We expect the Malaysian trade surplus to narrow to USD 19.3 billion by 2020F from USD 22.3 billion in 2016. |

|

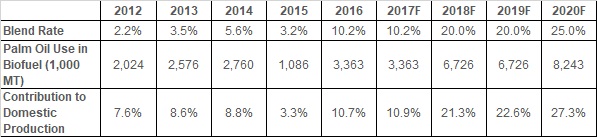

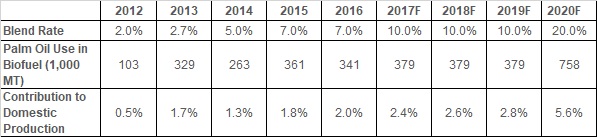

Malaysia and Indonesia to Increase Domestic Consumption to Counter Falling International Demand Scenario 3 In order to mitigate the negative impact of declining international demand, Malaysia and Indonesia are focusing on increasing domestic palm oil consumption through biofuel mandates. Presently, Indonesia and Malaysia follow the B10 biofuel mandate (blends of 90% petroleum diesel with 10% biofuel) in the transportation sector. Indonesia and Malaysia hope to increase their biofuel mandates to B25 and B20 respectively by 2020F. However, the practicality of increasing domestic consumption through biofuels is uncertain, as it takes considerable time and effort to execute the policies within a predefined time frame. For instance, Malaysia’s current B10 policy was initially planned to be implemented by 2015; its actual roll out took place in 1H2017. This was due to increasing concerns from vehicle suppliers on the alleged adverse impact of biofuels on diesel engines. Moreover, in both countries, the contribution of palm oil used in biofuels towards domestic palm oil production remains low (Indonesia: 10.7%; Malaysia: 2.0% in 2016). Therefore, the effectiveness of this strategy to counteract reducing palm oil demand is limited. Indonesia

Source: Projected by UZABASE based on UN Comtrade (HS 1511)/MPOB/MPOC/ and IPOA data

Note: figures from 2016 onwards are forecasted

Malaysia

Source: Projected by UZABASE based on UN Comtrade (HS 1511)/MPOB/MPOC/ and IPOA data

Note: figures from 2016 onwards are forecasted |

|

Annexure 1) Scenario 1 Indonesia

Source: Projected by UZABASE based on UN Comtrade (HS 1511)/MPOB/MPOC/ and IPOA data

Note: figures from 2016 onwards are forecasted

Malaysia

Source: Projected by UZABASE based on UN Comtrade (HS 1511)/MPOB/MPOC/ and IPOA data

Note: figures from 2016 onwards are forecasted

2) Scenario 2 Indonesia

Source: Projected by UZABASE based on UN Comtrade (HS 1511)/MPOB/MPOC/ and IPOA data

Note: figures from 2016 onwards are forecasted

Malaysia

Source: Projected by UZABASE based on UN Comtrade (HS 1511)/MPOB/MPOC/ and IPOA data

Note: figures from 2016 onwards are forecasted |