Ebooks: Reading Between the Lines

|

Since the mid-2000s, the ebook industry has grown as a result of the rise in internet and smartphone penetration, with the USA and China becoming the two leading markets collectively accounting for around 38% of the global market as of 2017. Most consumers in the USA and Europe purchase ebooks via Amazon (USA), while in China, QQ Reading (owned by China Literature (CHN)) is the most popular ebook provider of choice. |

|

This growth has brought about an emerging segment of independent writers who choose to self-publish and promote their books in order to maximise their share of total revenue. As of 2017, it is estimated that 35% of all ebooks sold on Amazon (USA) were from independent publishers. |

|

In recent years, there is a widely discussed theme that ebook revenue has been declining, driven by registered publisher statistics in the USA and Europe. However, we conclude that the ebooks industry is still growing and the above declining trend does not entirely depict the correct picture based on the following key three trends which we believe are key growth drivers for the ebooks industry in the near to medium term: |

|

1) Rise in independent publishers– While reported ebook revenue figures for the USA show a declining trend, they do not include non-ISBN books, which represent nearly one third of all ebooks sold in the USA. As such, the reported figures likely understate actual industry revenue by about 50%. |

|

2) Development of an online literature culture in China – The Chinese Market has risen to almost the same size as the US in a short span of time, driven by its unique online literature ecosystem and the emergence of China Literature (CHN) as the second largest player in the global ebook market. The rise in mobile reading in China, with youth preferring to consume digital content on interactive social platforms such as China Reading is another main driver of local revenue. |

|

3) Emergence of audiobooks as a major segment in leading markets – As of 2017, the audiobook market in the USA stood at USD 820 million, which was more than one-third the size of the ebook market. In addition, The Big Five Publishers in the USA claimed that the consistent profit experienced by their digital segments was mainly due to their audiobook business. The Chinese audiobook market is also expected to double over the next two years to USD 901 million by 2019E. |

|

E-books Account for around 10% of Total Book Sales; Historical Growth Driven by Cost Effectiveness and Ease of Use |

|

An ebook can be defined as a book published in digital format (either free or paid) to be read using a computer, tablet, phone or reading device. According to Statista, the ebook market stood at around USD 11.7 billion, accounting for nearly 10% of the global book market as of 2017. Ebooks also formed the biggest part (64% as of 2017) of the broader epublishing industry, which include ePapers and eMagazines as well. |

|

Since 2006, the rise in internet and smartphone penetration across the globe has resulted in a growing demand for ebooks. For example, in the USA, ebook sales accounted for only 0.1% of total book sales back in 2006 but rose to around 8%of total book sales by 2017, as stated by the Association of American Publishers (AAP). The main advantages to consumers are the lower prices of ebooks, portability and the ease of page navigation compared to printed books. |

|

|

|

Global Ebook Publishing Market Led by the US and China in Terms of Revenue and Penetration |

|

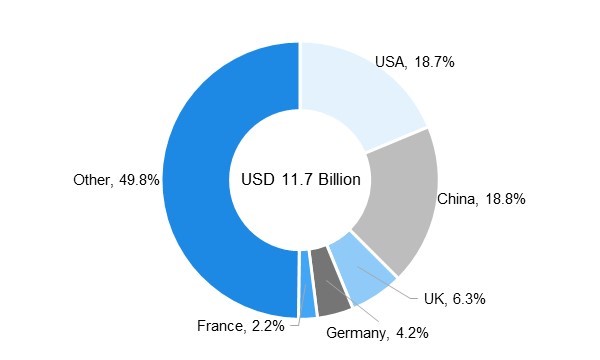

Based on data gathered from various country level sources, we estimate that the US and China were the largest markets for ebooks with similar market shares of around 19 % each as of 2017, in terms of revenue and similar ebook user penetration, at nearly 25%. In the USA, the price ratio of hardcover books to ebooks is high at 1:0.7, while in China, this ratio is much lower at around 1:0.5. As such, the latter is a steadily growing market with high adoption rates. |

|

USA and China Lead Global Ebook Revenue (2017) |

|

|

|

Source: Compiled by UZABASE based on various sources |

|

Ebook User Penetration Highest in the US and China |

|

|

|

Source: Statista |

|

Note: Figures are estimates for 2019E |

|

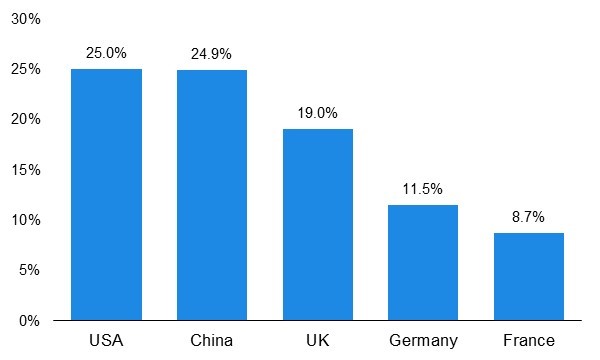

Ebooks Have Brought Notable Changes to the Traditional Book Publishing Value Chain |

|

The digital transformation of the book industry has affected the types and roles of players throughout the value chain. Some key changes include: |

|

(1) The involvement of major internet players: At the publishing stage, apart from traditional publishers such as The Big Five (Hachette, HarperCollins, Macmillan, Penguin Random House and Simon & Schuster), internet companies such as Google and Amazon (USA) have established themselves as providers of online content. |

|

(2) Authors contributing to additional stages in the value chain: Many self-published and independent authors are getting involved in the editing, designing, publishing, promoting and distribution stages as well so they can maximize their earnings by keeping not only the author’s fee but a larger share of the revenue as well. |

|

(3) Distribution intermediaries being replaced by ebook hardware: The e-publishing value chain eliminates the need for distribution intermediaries such as transportation providers, storage services (warehousing) and physical retail stores, replacing them with ebook hardware devices instead. The Big Four ebook market players – Amazon (USA), Barnes and Noble Nook, Apple ibooks and Kobo – have invested in ebook hardware sales (e.g. e-readers such as the Nook and Kindle), thereby diversifying away from their traditional businesses to position and redefine themselves in the ebook industry. |

|

Transformation of the Publishing Value Chain Due to Digitisation |

|

|

|

Source: AT Kearney |

|

Unlike printed books, ebooks have paved the way for publishers to use a variety of distribution models to access consumers of different demographics. These range from e-readers and audio streaming to paid subscription models and package deals to enhance revenue. The unique online literature model exists mainly in China, forming an interactive community between writers and readers (see more details in the key trends section below). |

|

|

|

Amazon is the Pioneer and Global leader in the Ebook Market; Chinese Market Dominated by Local Players |

|

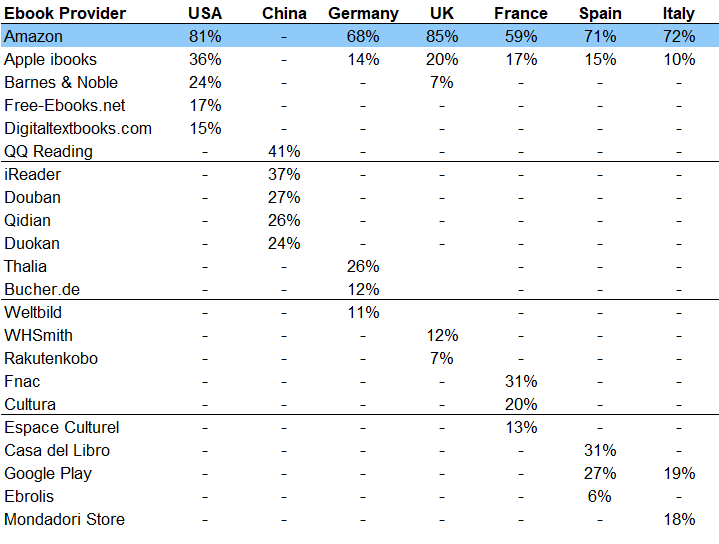

Amazon (USA) is the leading ebook provider in the US and most European markets, with over 60% of consumers purchasing ebooks from their website. However, the Chinese market consists of mostly local players, with QQ Reading (owned by China Literature (CHN), the largest ebook publisher in the country) being the preferred ebook provider by around 41% of consumers. In the tablet market, Apple (USA) dominated with more than 40% market share as of 2016, followed by Samsung (JPN) (25%) and Amazon (USA) (5%). |

|

Amazon is the Leading Ebook Provider in the US and European Markets While QQ Reading Leads in China |

|

|

|

Source: Statista Global Consumer Survey as at November 2018 |

|

Note: Percentages reflect the results of a survey of people who have made online ebook purchases as of the 12 months ended November 2018. As such the totals for each country will exceed 100% as consumers buy from multiple providers. |

|

Independent Self Publishers Dominate Amazon, While the Big Five Publishers Lead Other Ebook Platforms |

|

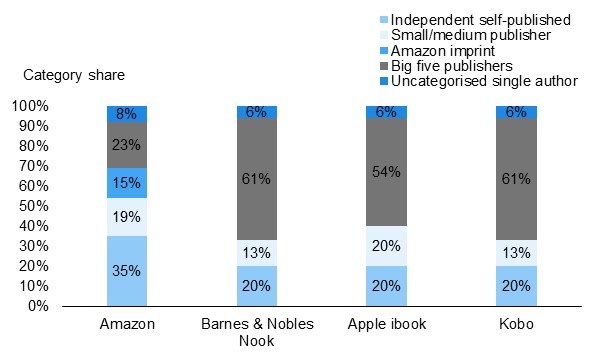

When Amazon (USA) entered the ebook market in 2007, it operated solely as an online bookstore. However, since then it has developed into a global publishing sub market, offering a range of services across the entire value chain. These include editorial services to independent and self-published authors and being a market place to third party sellers. The online platform has over 20 million subscribers, with Kindle Unlimited providing readers access to more than 1 million book titles. As a result, Amazon (USA) dominates the self-publishing ebook segment, particularly throughout the US and Europe. |

|

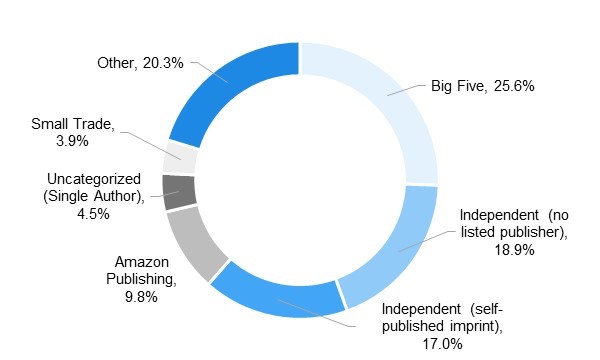

As of 2017, according to data from Amazon (USA) and Author Earnings (a website that tracks the e-book sales by independent authors), Amazon (USA) was the preferred platform for independent, self-published authors as well as small and medium (SME) publishers, with these two segments accounting for about 54% of all ebook unit sales. |

|

Majority of Ebooks on Amazon are from Indie Publishers while the Big Five Dominate Other Retail Platforms (2017) |

|

|

|

Source: Statista based on data from Amazon, AuthorEarnings |

|

Tablets and Readers Most Commonly Used in the USA; While Smartphones are More Preferred in China |

|

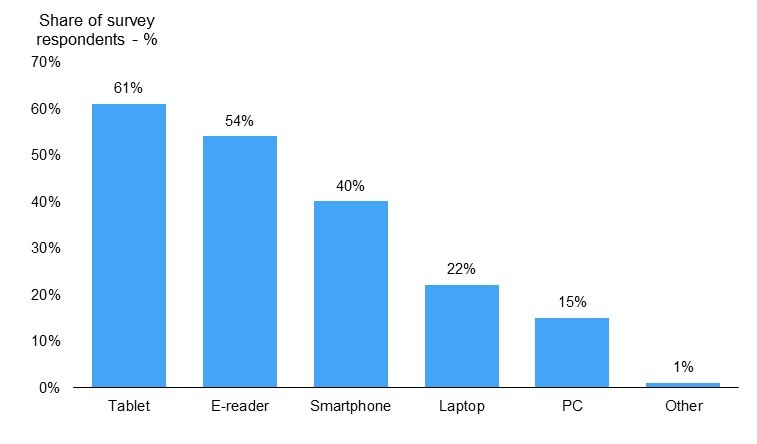

For consumers, ebooks are an addition to the existing spectrum of digital content available such as movies, streaming music, video games and social media. Therefore, it can be assumed that consumers choose to experience digital content as a whole on their preferred screens – be it PCs, tablets or smartphones. |

|

In the USA, as of April 2017, over 50% of ebook consumers used either e-readers or tablets to view their ebooks. In developing countries like China, most people consume ebooks via mobile phones and very rarely use e-readers or tablets. This has resulted in new players from the communications industry entering the ebook market to take advantage of this trend. China Telecom (one of the three leading telecom providers in the country) was able to grow its e-book operations by establishing a subsidiary known as Tianyi Culture Communication which operates three brands – Tianyibook (an e-reader), Oxygen Audiobooks and Zqread.com (its online bookstore). |

|

Tablets and Readers Most Popular Reading Devices in the USA (2017) |

|

|

|

Source: Statista |

|

Reported Revenue for Ebooks in the USA and Europe have Shown Negative Trends; Is That Really the Correct Picture? |

|

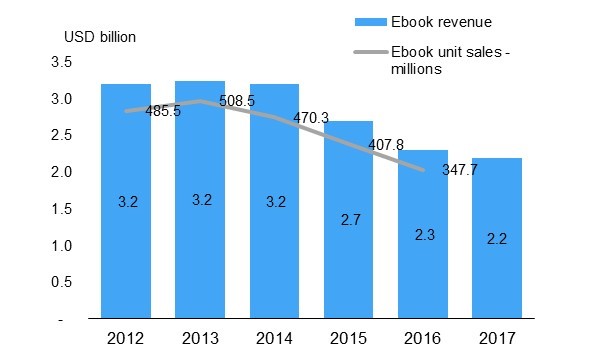

According to AAP, ebook publishing revenue in the USA declined at a five-year CARC of 7.3% over the 2012-17 (latest data available) period to USD 2.2 billion in 2017. Unit sales declined at a similar CARC of 8.0% over the four-year period 2012-16 to 347.7 million units in 2016 (latest data available). The same trend was echoed in the UK data as well, with the ebook revenue reported by Publishers Association UK showing an annual decline of around 2-3% since 2015. This could imply that the demand for ebooks has already matured, despite being a technology-driven industry. |

|

USA’s Ebook Publishing Industry Declining as per AAP |

|

|

|

Source: Association of American Publishers, |

|

Note: Unit sales figures are only available up to 2016 |

|

However, based on our research, we conclude that the above-mentioned declining trend for ebooks does not necessarily depict the correct picture, and in reality, the global ebook market is still growing. Our conclusion is based on the identification of the following three major trends within the industry: (1) Reported data (especially for USA) does not include ebooks sold by independent publishers (2) The emergence of China has a major player in the ebooks market with strong forecasted growth, and (3) Audiobooks gaining traction as a new format of digital book sales. We believe these three trends are likely to be the key growth drivers for the ebooks industry in the short to medium term. |

|

1) USA: Growth in Independent Publishers has Boosted Ebook Sales as Revenue from Traditional Publishers’ Falls |

|

The ebook revenue numbers reported by AAP only take into account ebooks published with an ISBN (International Standard Book Number), which is a unique number assigned to books by the national agencies of each country to identify a specific title, edition or format of a book. It is used by all players along the publishing value chain to record sales and for the purpose of stock control. |

|

All ebooks published by The Big Five have an ISBN. However, many independent self-published books do not usually have an ISBN and are therefore unaccounted for when gathering industry statistics. According to estimates by Author Earnings as of 2017, (1) over 33% of all ebooks sold in the US were non-ISBN (2) On a daily basis, around 37% of ebooks sold on Amazon (USA) do not have ISBN compared to 14-25% on the other four platforms. Taking this into consideration, the actual market for ebooks in the US should be at least 50% bigger than reported ISBN-limited statistics, according to Author Earnings, implying that ebook sales are actually on the rise, contrary to data published by AAP. |

|

As of 2017, independent authors (which are largely non-ISBN) made up the largest component (nearly 36%) of all ebook unit sales, with half of these books being self-published. One of the main reasons for authors seeking independence and self-publishing is the higher profits. While, traditional publishers pass on only about 5-15% of revenue earned from book sales to the writer, independent authors retain a much higher percentage. In 2017, more than a thousand independent authors on Amazon (USA) received over USD 100,000 each in royalties via Kindle Direct Publishing. Amazon (USA) also has a fixed royalty rate of 70% of books sales for its own self-published authors, which is normally the percentage retained by larger publishing agencies. Over the 2012-15 period, figures from Nielsen showed that the ebook market share of The Big Five publishers declined by 12% while that of independent publishers rose by 23%. |

|

Amazon (USA) is also encouraging independent authors to sign up to Kindle Unlimited, which is a subscription-based service that allows consumers to read a wide range of eBooks for a fixed monthly fee, a percentage of which then paid to writers. Kindle Unlimited’s subscriber base grew by 68% over the 2015-17 period, resulting in the monthly payouts to authors rising as well. |

|

Independent Publishers Make up Largest Component of Ebook Unit Sales (2017) |

|

|

|

Source: Statista based on data by Author Earnings |

|

2) Chinese Ebook Market on Par with the US; Driven by Mobile Reading and Interactive Online Culture with China Literature at the Forefront |

|

As of 2017, the Chinese ebook market was worth USD 2.2 billion according to China Daily, accounting for 18.8% of the global ebook market. Chinese e-commerce giant Dangdang predicts that the domestic ebook market will rise at a four-year CAGR of 24.6% to USD 5.3 billion by 2020, making it the largest market in the world in terms of both revenue and volume. |

|

A unique feature of China’s ebook market is the online culture, where millions of authors write solely online and publish their novels one chapter at a time, incorporating suggestions and storylines from the online reading community. As of 2016, among the top ten writers in China, six were online writers. According to Chinese research firm Hurun Report Inc, the profile of a typical online writer is a 37-year-old male who spends 8 hours a day on average writing about 20,000 words. The biggest attraction for these online writers is the high return, with China Literature (CHN) (the largest operator in China) having paid over USD 150 million in writers fees in 2016. This relatively unique segment together with regular ebooks (i.e. the electronic versions of the printed books) are known as “online literature” within China. |

|

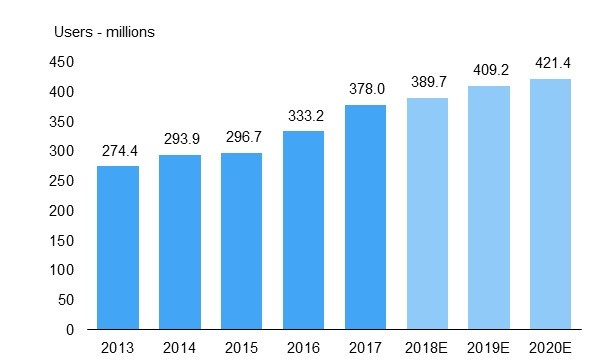

As of 2017, there were 378 million online literature users (recording an 8.3% CAGR during 2013-17) in China, representing 48.9% of the country’s internet population. According to a Frost and Sullivan, this figure is estimated to expand at a CAGR of 3.7% over the 2017-20 period to 421.4 million by 2020. There is also a growing international reader base for Chinese online literature, led mainly by two translation sites – Gravity Tales and Wuxia World. As of 2016, these sites had monthly active users of around 4 million, from over 100 countries, with readers from North America accounting for one third. |

|

Users of Online Literature Rising Steadily |

|

|

|

Source: Frost and Sullivan Report |

|

Note: Figures from 2018 onwards are estimates |

|

The majority of youth in China consume online reading content on China Reading, a digital reading platform run by China Literature (CHN). At present, the company has around 10 million digital works of literature, featuring 200 content types from nearly 4 million authors. |

|

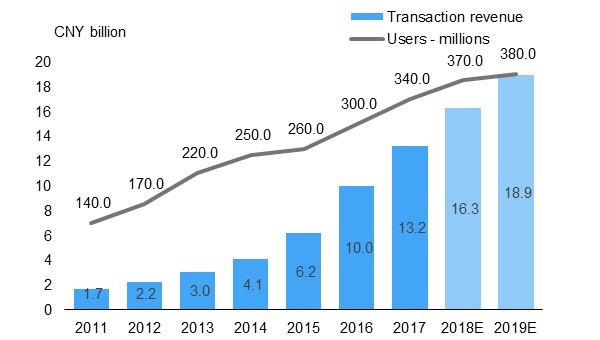

From 2012-17 the number of mobile app readers increased at a CAGR of 14.9% to 340 million in 2017. Walkthechat forecast reader count to record a two-year CAGR of 5.7% totalling 380 million by 2019E. |

|

Mobile Reading App Revenue and Users Rising |

|

|

|

Source: WalktheChat Analysis |

|

China Literature (CHN), the biggest ebook publisher in China, is the second largest global player in the ebook industry, after Amazon (USA). When the company went public in 2017, it was the second largest Chinese IPO in ten years at USD 1.1 billion, after Alibaba. China Literature (CHN) has more than 10 million titles, with 177 million monthly readers. |

|

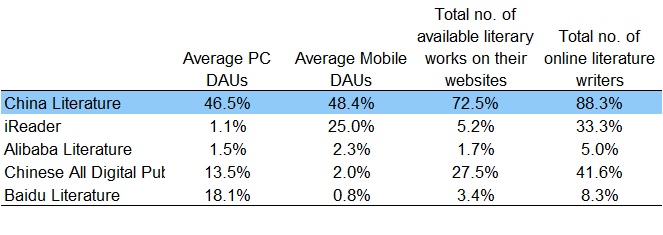

China Literature Leads in Local Online Literature Market on All KPIs (2016) |

|

|

|

Source: Frost and Sullivan |

|

Note: DAU refers to ‘daily average users’ |

|

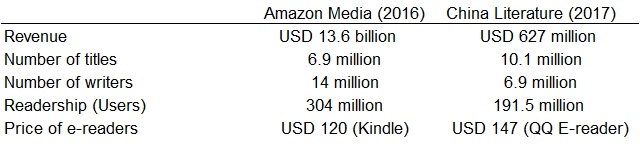

While both operate in the ebook market, we note that Amazon (USA) and China Literature (CHN) have contrasting business models. While Amazon (USA) is essentially an online platform to sell digital versions of traditionally published books, China Literature (CHN) is a virtual social platform where writers, publishers and readers connect and share their views, making this interactive feature of the website its main differentiator. |

|

Comparison of Amazon and China Literature |

|

|

|

Source: Compiled by UZABASE based on various sources |

|

Note: Amazon Media Figures are as of 2016 as the company has stopped reporting the media split from 2017 onwards |

|

3) Audiobooks are Emerging as a Third Major Category Alongside Print books and Ebooks |

|

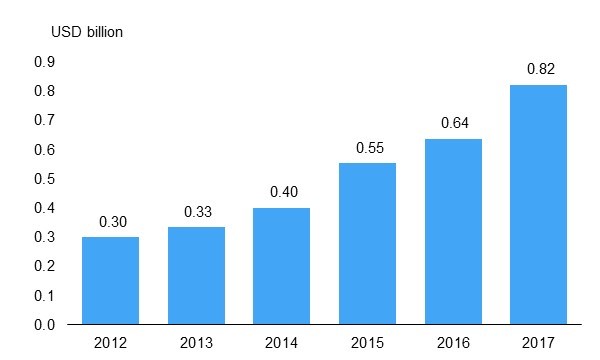

Audiobooks (or downloaded audio) traditionally held a small portion of the total book industry. However, over the last five years this segment has experienced rapid growth. In the USA, audiobook sales accounted for USD 820 million as of 2017 (vs USD 2.2 billion for ebooks), recording a 22.4% CAGR over 2012-17 according to AAP. Four of the The Big Five (i.e all except Macmillan) have experienced consistent profits in their digital book segments, mainly due to audiobooks, despite declining revenue from ebooks. HarperCollins and Penguin were the largest traditional publishers operating in the audiobook space as of 2017. The latter experienced a 20% increase in the number of titles in 2017, bringing the total to 11,000. The sales of downloadable audiobooks for HarperCollins rose by 47% YoY in FY2017 (ending June 2017), while the number of audiobooks issued increased by 20% YoY. |

|

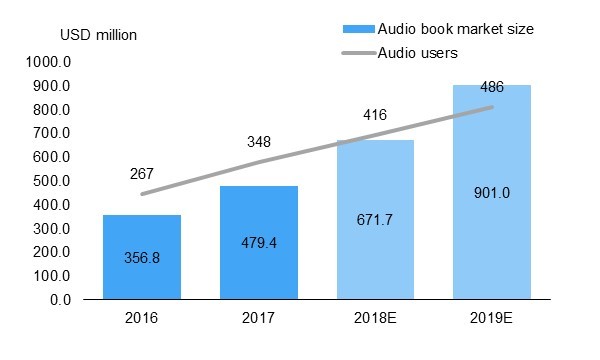

Growth trends were similarly positive for audiobooks in China (2017 growth was 36.7% to RMB 3.24 billion or around 22% of the local ebook market size) and in the UK (26.8% CAGR recorded over 2013-17), indicating that the adoption of audiobooks is a key global trend within the book publishing industry. |

|

USA Audiobook Sales Have Nearly Tripled Over the Past Five Years |

|

|

|

Source: AAP |

|

According to NPD Book (a market trends company), the main reasons for the growing popularity of audiobooks are 1) the ability for listeners to multitask while listening, 2) the portability and accessibility of audiobooks from any location, and 3) the enjoyment of being read to. |

|

In China, iiMedia Research estimates the audiobook market to nearly double, expanding at a two-year CAGR of 37.1% to USD 901.0 million in 2019E., with the number of audiobook users projected to grow at CAGR of 18.2% to 486 million over the same period. However, the biggest challenge for the Chinese market remains the absence of stringent copyright laws, which would need to be improved considerably in order to facilitate this growth. |

|

China’s Audiobook Market is Rapidly Growing |

|

|

|

Source: iiMedia Research, WeChatAnalysis |