ASEAN Macroeconomic Trends: Indonesia Warns Against USA-China Trade War

|

Indonesia: Bank Indonesia Warns Against “USA-China Trade War” |

|

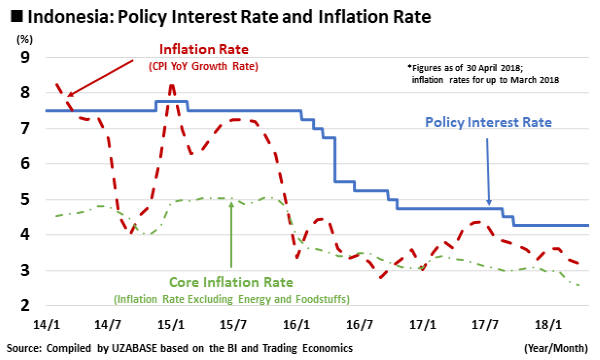

Bank Indonesia (BI) held its regular Board of Governor’s Meeting, and on 19 April, it decided to keep the current policy interest rate at 4.25%. It will also maintain the current deposit interest and loan interest rates at 3.50% and 5.00%, respectively. |

|

|

|

In a statement released after the meeting, the BI shared its understanding that the macroeconomy and financial systems are remaining stable, and that the current interest rate levels are appropriate against the rising external pressure. Compared to previous statements from the BI, the mention of “external pressure”, which was a step further from previous explanations, has garnered attention. Specifically, the external pressure referred to by the BI is a rise in crude petroleum prices and a “USA-China Trade War”. |

|

Should the USA raise its tariffs against China and China take retaliatory measures, global trade may contract, which could result in negative effects on Indonesia’s domestic economy. China and the USA are Indonesia’s top one and two trade partners, respectively, accounting for nearly 25% of the nation’s total export value. It can be inferred that these conditions are in the background behind the BI’s use of the strong phrase “USA-China Trade War”. |

|

While there are some positive contributions from a rise in crude petroleum prices for Indonesia, which has a high amount of exports for resources, the country is also an import destination for resources and has an insufficient supply chain for domestic manufacturing. As such, it has a high amount of imports for intermediate goods, so a rise in crude petroleum prices may have a negative effect by leading to inflation for imports. |

|

Per statistics announced on 30 April, Indonesia’s direct investment for 1Q stood at IDR 185.3 trillion, displaying steady growth at 12.4% YoY. Of this amount, the country’s foreign direct investment (FDI) stood at IDR 108.9 trillion (+12% YoY), while its domestic direct investment (DDI) stood at IDR 76.4 trillion (+11% YoY). The fact that Indonesia does not rely on foreign investment and that its DDI is increasing firmly is likely contributing to healthy and stable growth for its economy. The sectors with the highest amount of FDI were housing, industrial parks, and offices, while construction had the highest amount of DDI. |

|

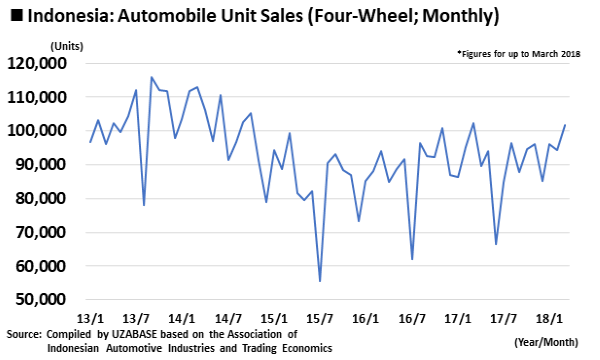

In terms of other indicators for the status of Indonesia’s economy, the country’s Consumer Confidence Index (CCI) for March was 121.6, which was flat from the 122.5 recorded for February. While February retail sales grew by 1.5% YoY, switching to a positive trend after recording -1.8% in January, Asosiasi Pengusaha Retail Indonesia (a retail association) has already expressed its perspective that severe conditions are continuing. Indonesia’s automobile sales for March declined by 0.7% to 101,674 units due to such effects as long holidays like the Chinese New Year. However, these sales grew by 3% YoY in 1Q to 291,920 units, and while this growth rate is small, it is on an upward trend compared to the previous year. |

|

|

|

Thailand: Economy Continues to Improve; High Ratio of Household Debt Calls for Attention |

|

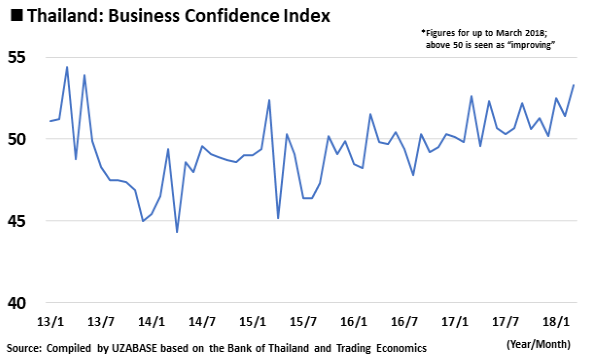

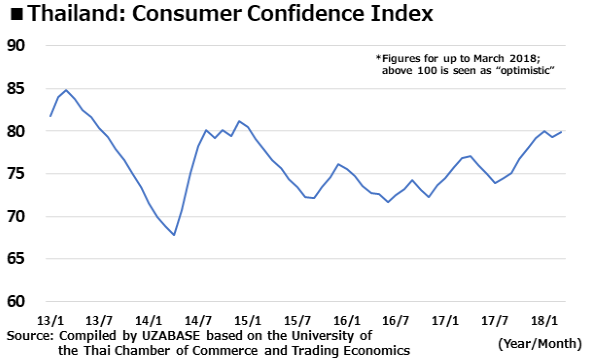

Regarding indicators for economic trends in Thailand, the country’s Business Confidence Index (BCI) for March was 53.3, recording the highest value since June 2013 and maintaining a level above 50, which is considered as “improving”, for 11 consecutive months. Thailand’s CCI for March was 79.9, rising by 0.6 percentage points. Furthermore, the country’s Coincident Index (CI) was recorded at 127.7 for March, which was nearly flat from the 128.1 recorded in February. While confidence in the economy is moving ahead and improving on the business side, the recovery in confidence on the consumer side appears to be lagging behind, albeit demonstrating continuous growth. |

|

|

|

|

|

Thailand’s automobile sales for March amounted to 95,062 units, displaying favourable growth at 12.1% YoY. |

|

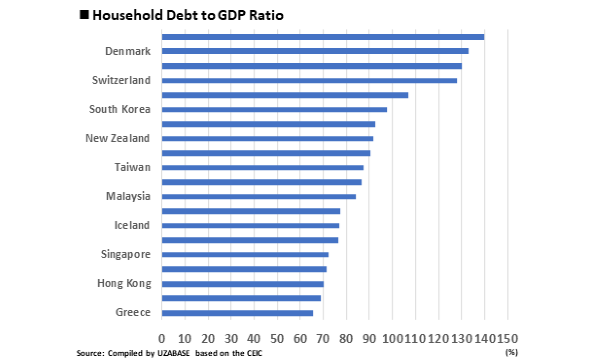

Meanwhile, the Bank of Thailand (BOT) announced that the country’s ratio of household debt in the GDP for 4Q 2017 was 77.5%, rising by 0.2 percentage points from 3Q 2017. While this ratio has been declining from its peak of 80.8% in 4Q 2015, this time marked the first increase in two years. Within the Asia-Pacific region, Thailand’s percentage of household debt ranks 5th, while it ranks 2nd in ASEAN and 13th globally, forming the weak point of the country’s macroeconomy. In emerging countries, it is a common tendency for household loans to increase whenever economic conditions appear to be improving due to expectations for a rise in wages. On the other hand, as these are variable-interest loans, the household economy would sustain major damage if interest rates were raised substantially for whatever reason. |

|

Currently, there is a low risk of Thailand implementing a substantial increase in interest rates over a short period of time. In the long term, however, should an economic crisis occur, inflation accelerate sharply, a significant decline in funds occur, or the Thai baht depreciate, there is a risk that Thailand would be forced to raise interest rates, thus calling for attention. |

|

|

|

Malaysia: General Election Date Announced |

|

Malaysia announced that it will hold its general election for prime minister on 9 May, and a focus point is whether there will be a reversal in the current governing and opposing parties. |

|

*The below analysis is based on available information as 8 May 2018; for more information on the election results, refer to the below link: |

|

The country has carried out 13 general elections since the Malay Peninsula gained independence from the UK as the Federation of Malaya in 1957. However, the Barisan Nasional (BN; “National Front” in English), which is made up of multiple political parties, has consistently governed the nation since, always securing around 70%–80% of the seats in the Lower House of Malaysia’s Parliament. In 2008 and 2013, the opposition party increased its momentum, with the percentage of Lower House seats held by the BN falling to around 60%, while that held by the opposition party leaped to about 40%. |

|

A characteristic of this year’s general election is that the former prime minister Mahathir Mohamad and former deputy prime minister Muhyiddin Yassin are participating in the opposition party against the current Najib administration. There has been mounting distrust for prime minister Najib Razak due to a scandal involving illegal funds from the state-owned investment company 1Malaysia Development Berhad (1MDB). While Najib has claimed innocence and investigations within Malaysia have been completed, the opposition party and NGOs are taking a stance of requesting thorough investigations due to a lack of clarity around the matter. Public opinion within Malaysia also expresses a high level of dissatisfaction towards the 1MDB issue. |

|

Within the opposition party, there has been a confrontation between the radical and moderate factions of the Parti Islam Se-Malaysia (PAS; “Malaysia Islamic Party”), with the moderate faction breaking off to establish the new political party Amanah. The Parti Pribumi Bersatu Malaysia (“Malaysian United Indigenous Party”), which was established by Mahathir, does not yet have a firm foundation for the election. In addition, former deputy prime minister Anwar Ibrahim, who has been a central force for the opposition party, was officially charged for abnormal sexual acts (criminal offense) in 2015, and is currently serving a prison sentence. In other words, the opposition party has not yet reached a state of consistency, with continuous decisive blows of political defeat. |

|

The BN has an abundance of capital power and has maintained an election foundation that is spread across Malaysia. While there has been a rising distrust from the people, the BN still receives support from elderly citizens, those living in rural areas, and those living in the cities of regional areas. |

|

Regarding the outcome of the election, while there are many points of view stating that the BN has the advantage, it would not be strange if the opposition party were to win. There are no expectations for major changes in economic policy if the BN were to win the election. |

|

Even if the opposition party were to win, it is difficult to expect any changes to fundamental economic policies. However, given the opposition party’s probes into the lack of clarity with the BN, it would likely re-examine mega projects set by the Najib administration, which could affect the progress of those projects. |

|

In terms of economic indicators, Malaysia’s retail sales were up by 9.2% YoY in February, continuing on a favourable growth trend. |

|

The Philippines: Industrial Production Is Favourable |

|

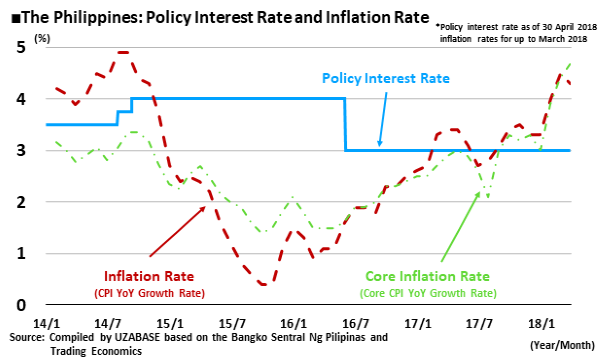

In March, the Philippines experienced a rise in its inflation rate by 4.3% YoY, as well as its core inflation rate by 4.7% YoY, with both figures accelerating for three consecutive months since December 2017. These figures reflect the favourable economy and rising crude petroleum prices. Taking into consideration that the country’s economic growth continues to be above 6%, the current levels do not yet present concerns. |

|

|

|

A look at the supply side shows that the Philippines witnessed high growth in industrial production for February at 23.6% YoY. This represents the infrastructure construction projects being promoted in cooperation with the Duterte administration, as well as increases in internal investment aimed at the domestic market and production by foreign-funded firms alongside the country’s high economic growth. |

|

Vietnam: Number of Foreign Visitor Arrivals Exceeds 1 Million for Seven Consecutive Months |

|

Vietnam’s primary macroeconomic indicators were announced in late April. The number of foreign visitor arrivals into the country for April exhibited high growth at 25.2% YoY to 1.34 million, which was the fourth-highest level achieved and marked the seventh consecutive month above 1 million people. In the backdrop of such favourable conditions are likely effects from vacation seasons in neighbouring countries, such as the Chinese New Year in February and Songkran in Thailand in April. Whether Vietnam can maintain this high level going forward calls for attention. |

|

Vietnam’s retail sales in April maintained a favourable level, rising by 9.5% YoY. Its balance of trade for that month was a surplus of USD 700 million, marking four consecutive months in the black. Although the country’s inflation rate accelerated slightly to 2.8% YoY from the 2.7% recorded for March, it is stable at a low level. |